Media Update: New Players in Sports Streaming, Super Bowl Viewership, and Strong Job Growth

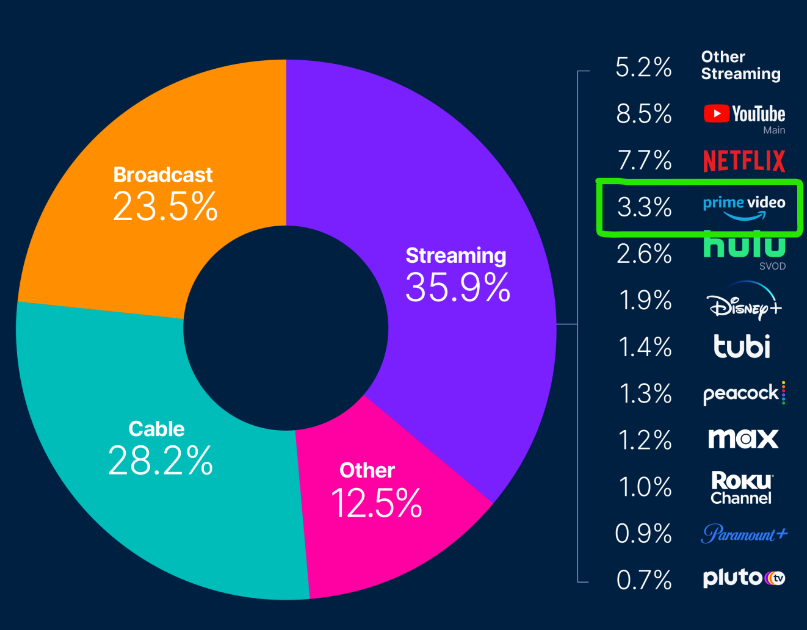

Following a couple of very strong months, ad-supported video supply seems to have reverted to trend. We expect to see this tick up now that college and professional football – which draw tons of eyeballs, and still skew pretty linear – are done for the year.

Industry Notes (Video)

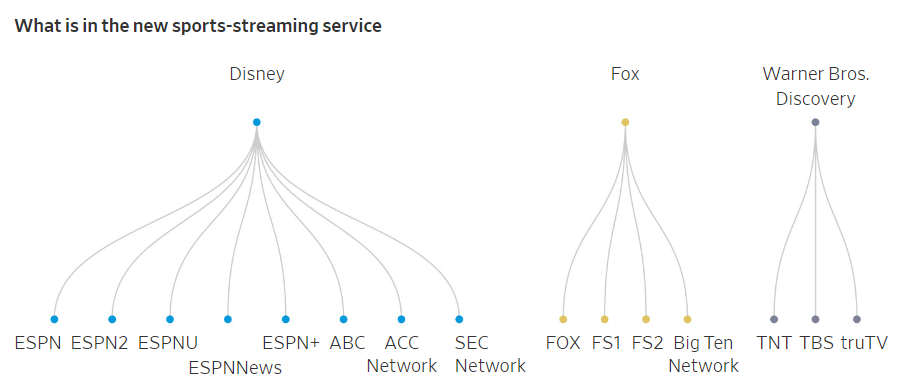

1. The shockwaves are still reverberating from the biggest development in the streaming space in recent memory – Disney, Warner Bros Discovery, and Fox have announced the creation of a joint venture that will offer a streaming sports “skinny bundle” incorporating the complete offerings of all three players. And ‘shock’ is an apt term, as both media buyers and the leagues themselves, traditionally very close partners of the major broadcasters, were completely in the dark until the public announcement was made. The still-to-be-named service will debut in the fall of this year; concrete details remain sparse.

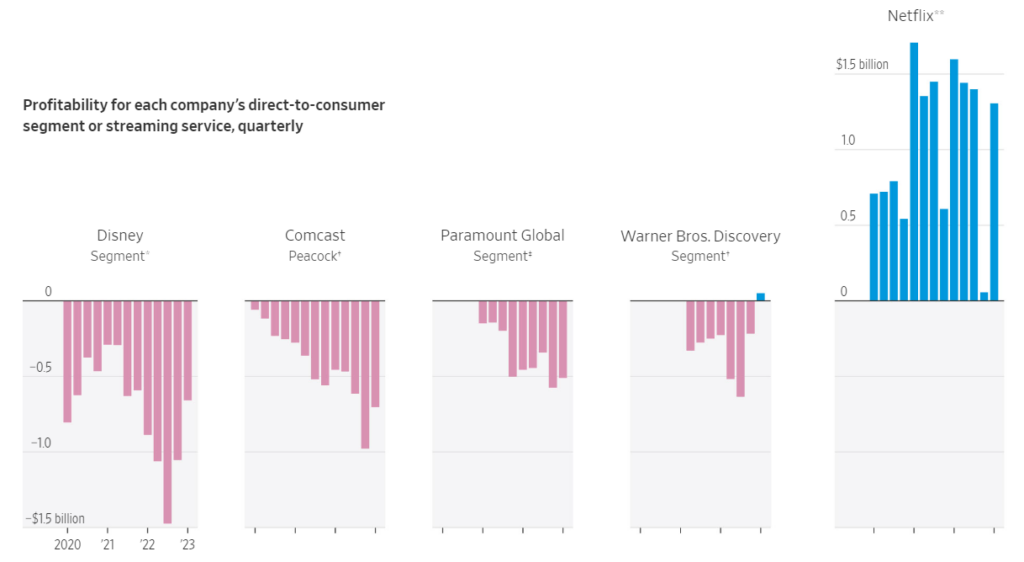

A natural question to ask might be, Is this something consumers want? In one sense, yes – 97 of the top 100 telecasts in 2023 were sporting events, and there is abundant evidence that consumer demand for sports programming is insatiable. But as to whether this particular offering will resonate with consumers, it’s much less clear. For one thing, the new service will have about 55% of U.S. sports rights, so it will by no means be a one-stop-shop for sports fans. Just taking the NFL, America’s favorite sports, a fan would additionally need a Peacock subscription, a Paramount+ subscription, an Amazon Prime subscription, and potentially a YouTubeTV subscription add-on for content completeness. Then there is the question of relevant alternatives – while pricing has not been announced, most expect it to be at least $50/month. A YouTube TV subscription costs about $73, includes everything this new service offers, and has CBS and NBC (other major NFL rights holders), plus all the rest of cable TV. So the question becomes, How large is the market of consumers who want a partial sports package for $50, but aren’t willing to pay an additional $20 for a more or less complete sports package? Billions of dollars are riding on this question.The other major question is, Why would the major networks make this move now? There are at least a few answers to this question. First, the traditional cable bundle, which has been so profitable for these companies for many years, is disintegrating faster than they expected. There are now about 73m households subscribed to any form of pay TV, down from about 100m a decade ago, and the rate of cord cutting continues to accelerate. Meanwhile, these companies so far have only figured out how to lose money in streaming:

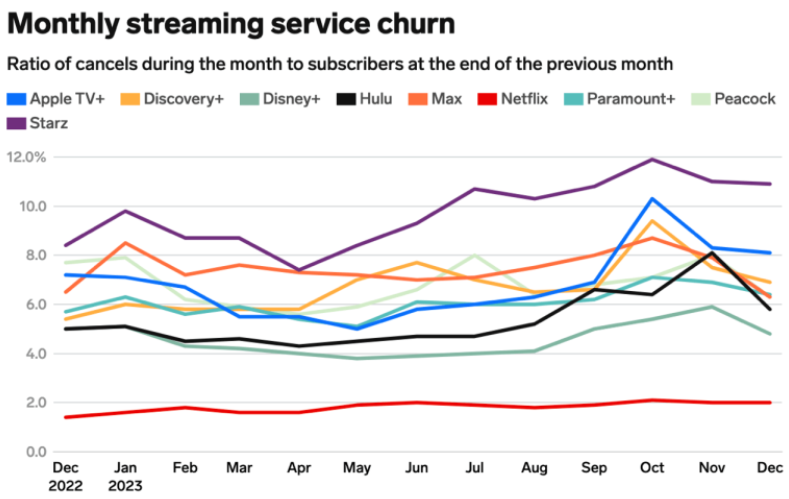

By bundling, the companies presumably hope to address their collective Achilles’ heel, churn. Here is the monthly churn rate for several major streaming services:

In the words of the estimable Ben Thompson, “I can’t overstate what a disaster this chart is for everyone other than Netflix.” (and do note what an outlier Netflix is in the above profitability chart!) Disney, WBD, and Fox are presumably expecting that a more comprehensive sports bundle that satisfies a greater breadth of consumer needs and embeds greater promises of future value will be more churn resistant and, by extension, more profitable.

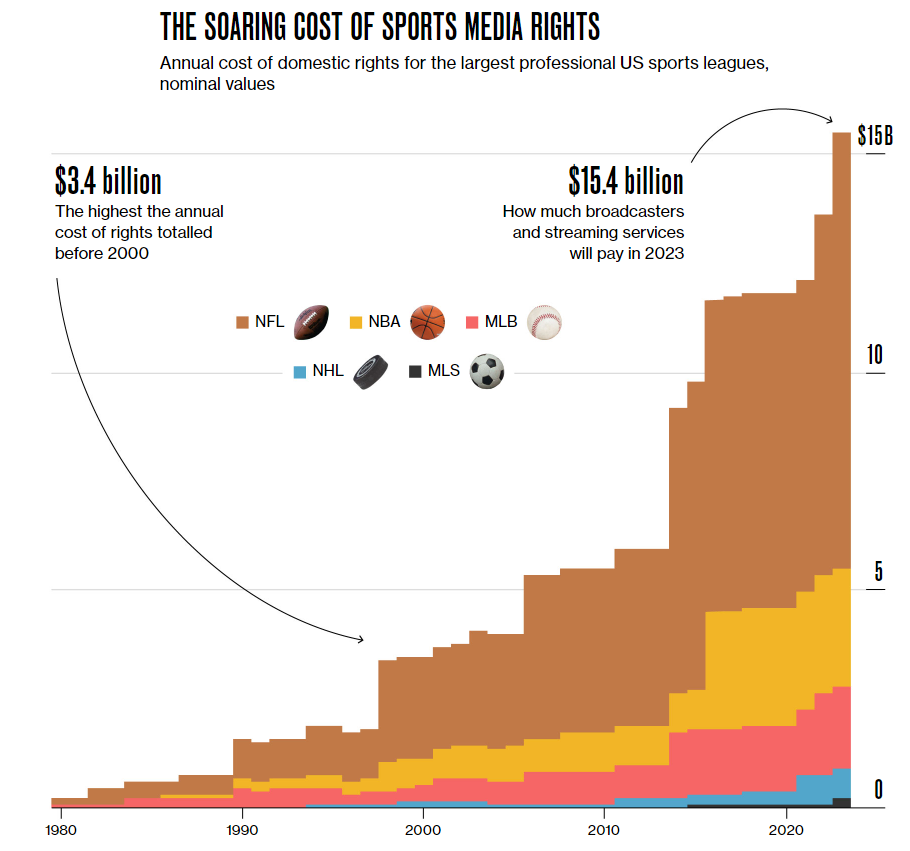

The second major rationale for this move by the networks is a fortification of their position in upcoming rights negotiations. Some of you may recall this chart, reflecting the spiraling cost of broadcast rights to major sports properties:

The NFL, in particular, has been absolutely surgical in parceling out rights among several distribution partners (Disney, Paramount, Fox, NBCU, Amazon), which results in very little negotiating leverage for any one of those partners. Meanwhile, the current NBA rights deal expires in 2025, and the league is looking for triple its current money in its next renewal. With in-demand leagues extracting every cent they can, and with deep-pocketed tech firms newly interested in sports rights, it is reasonable that individual media companies may see going it alone as a suicide mission.

We’ve barely scratched the surface of the many complications to this arrangement (antitrust, incentive conflicts with the JV structure, ad sales, etc), but there is one more we want to highlight. Back in December ‘22, we quoted a MoffettNathanson analyst discussing the relatively orderly demise of traditional pay TV:

The market seems resigned to a steady deterioration…But there is clearly a risk that the declines become disorderly. All it would take is one major player — ESPN is the obvious candidate — to decide that the future demands a bolder shift in their best programming to DTC, or, alternatively, that their entire suite of programming should be simultaneously available DTC … and the Jenga tower would collapse.

Concurrent with the announcement of the new sports streaming bundle coming in the fall of this year, Disney confirmed that a standalone DTC ESPN app is coming in the fall of 2025. With that, the final element holding the cable bundle together, however tenuously, will shake loose. And the orderly decline will likely become a freefall. | WSJ, WSJ, Stratechery, Digiday

UPDATE: Right on cue, the DOJ has said it is planning an antitrust review of the new platform. | Bloomberg

2. We told you last time about Peacock’s streaming exclusive NFL Playoff game, which became the largest event ever for internet usage in the US and made the Saturday it streamed the heaviest internet usage day in US history. For the privilege, NBCU paid the princely sum of $110m.

Having seen the insatiable demand for the playoff football, and viewers’ demonstrated willingness to subscribe in order to watch, Amazon will follow the Peacock template by offering a streaming-only NFL Playoff game next season on its Prime Video platform, which is already the exclusive home of NFL Thursday Night Football. NBCU apparently sought to keep the streaming-only game next season, but Amazon has a clause in its deal with the NFL that gives it first refusal.

Last time, in the context of Amazon’s investment in Diamond Sports, we discussed the possibility of Amazon building a sports aggregator app; Disney, WBD, and Fox have certainly changed the math since we wrote that! (see above) Thus we shouldn’t view the NFL Playoff game as another step in that direction – instead, it says more about the ways Amazon Prime is evolving now that it’s an advertising platform. Pre-ads, Prime Video was best understood as an anti-churn mechanism – the goal was simply to make Prime subscribers stickier. As a new advertising surface, Prime now has to concern itself much more with both audience size and time spent; reach and engagement are what major advertisers care most about, and Amazon is not a leader in its share of consumer attention.

Peacock’s experiment shows that high-profile NFL games can be potent acquisition drivers; to drive any meaningful change in time spent on the platform, Amazon will have to develop substantial content outside of live sports. | WSJ

Industry Notes (Audio)

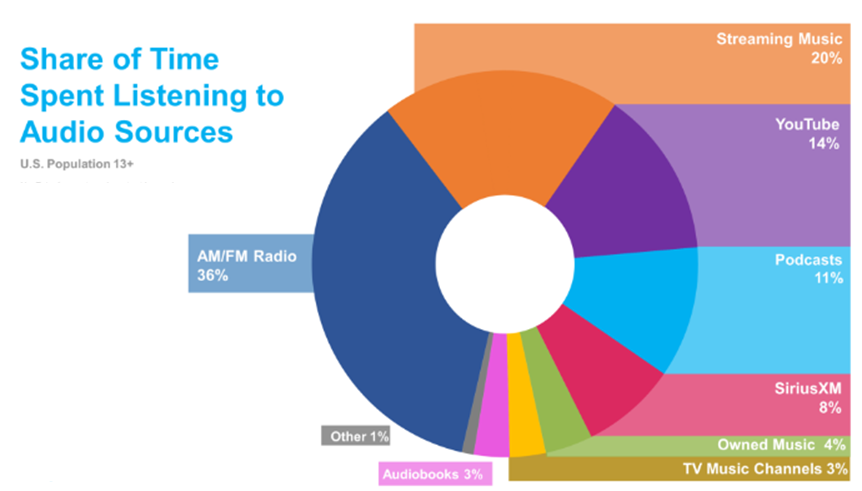

1. Edison Research has released its latest ‘Share of Ear’ report for Q3, which shows terrestrial radio maintaining the plurality of listenership with 37% of total listening time. YouTube, which most of us don’t primarily think of as an audio platform, has a whopping 14%.

Since the last Share of Ear report in Q2,

As the inexorable trend from owned to rented music continues, owned (people listening to their own CDs, vinyl, mp3’s, etc) is down to 4%. | Edison Research

2. Spotify held its quarterly earnings call earlier this month and revealed that over 600m users are now active on the Spotify platform each month. This threshold was crossed due to a gain of 28m users in the quarter, which was the second-largest quarterly gain in the company’s history. Of the 602m MAUs, 236m pay to use the service, with the remainder on the free, ad-supported tier.

Despite this impressive user growth, it has been difficult for Spotify to generate consistent profitability. Revenue of €3.7b in the quarter represented 16% YoY growth, but it still lost €75m in the quarter. This is largely due to the low operating leverage in its core business, which entails paying royalties to music rights holders on virtually all of its content. Spotify’s plan for getting out of this trap is to become an ad network, and its ad revenue did grow 12% YoY to €501m. But it has pivoted a couple of times in order to figure out an ad model that truly works at scale. Business model and profitability issues aside, Spotify is continuing to cement its position with users as their preferred audio destination. | TechCrunch

Despite the Super Bowl’s record audience, broadcast TV as a whole last week was only up fractionally on a YoY basis. Entertainment, news, and sports networks were all down YoY.

Industry Notes

1. No points for guessing what we’re writing about this week. Last time, we projected very healthy viewing numbers for this year’s Super Bowl based on strong viewership growth of 7% for the NFL’s regular season and record breaking audiences of 55m+ for the conference championship games. That intuition proved correct, as Super Bowl LVIII was the most-watched telecast in U.S. history, drawing 123.4m viewers across linear and streaming platforms; the audience was up 7% from last year’s edition of the Big Game. Viewing broke down as 120m on CBS or Paramount+, 2.3m on the Spanish-language broadcast on Univision, and 1.2m on the kid-friendly Nickelodeon broadcast.

(Note that this infographic likely contains an untruth: according to Nielsen, about 53.5m households tuned into the Apollo moon landing. But given the US was a much smaller country in 1969, it is probably the most watched telecast by share of audience.)

The game had just about everything going for it to net a big audience. The first Super Bowl held in Las Vegas; a matchup between a modern dynasty and a traditional powerhouse; an era-defining quarterback; a very close and dramatic game that went into overtime, only the second time ever in a Super Bowl; and, to state the obvious, the Taylor Swift effect. According to TVision, among both men and women, attention was nearly 8% higher when Swift was pictured versus when she wasn’t.

The Super Bowl isn’t just about the football, of course – it’s also the Super Bowl of advertising, and brands went all out to put their best feet forward. There are many, many measures of ad success in the Super Bowl, so we’ll just mention just two. First one of the most traditional yardsticks, the USA Today Ad Meter; according to users who responded to the Ad Meter, the top ads were:

A very different approach is taken by EDO, which, rather than asking viewers how much they like ads, attempts to measure digital engagement immediately following ad airings. According to EDO, the top ads were:

Finally, there was speculation ahead of the game as to whether Twitter would remain the primary second screen for digital conversation about the year’s biggest sporting event. Based on the numbers, it seems safe to say Twitter remains the focal platform for second screen conversation: the game generated 10.5b impressions, over 19m posts and 4.8m unique users posting on the subject. All those metrics were up by double digits on the previous year, and video views around the game increased by 75% over the 2023 total. | AdAge, Bloomberg, WSJ

1. Many have argued that Google was baited into third-party cookie deprecation by Apple; no law or regulation is compelling Google to kill off cookies, but Apple did it and Google felt it had to do it too. Google may now be wishing it had been a lot less like Apple, by sticking with 3P cookies; or a lot more like Apple, by killing them arbitrarily and with little debate.

Instead, we’ve had a multi-year process of industry consultation, preparation of post-cookie technologies, and endless fighting over the details. With for real, no-kidding-this-time cookie deprecation coming in the second half of this year, the latest contretemps is a daming new report front the IAB that says, in essence, that the Chrome Privacy Sandbox will break real-time bidding, and that the majority of advertising uses cases are “explicitly not supported or have been degraded to the point of being untenable.”

The IAB is a non-profit consortium that collaborates on the development of standards and practices across the digital media ecosystem. The specific task force that prepared this report is composed of 65 participants, from companies like Criteo, PubMatic, Amazon Ads, The Trade Desk, etc. The point being, while some of these companies may be Google competitors, it does represent a very broad swath of the ad tech industry.

The task force assessed the Privacy Sandbox’s ability to support online advertising use cases across five categories:

The conclusion – full details available here – is that most of these use cases will not be supported, either at all or anywhere close to the level advertisers have been accustomed to. Examples include:

Naturally, Google – which was not a participant on the taskforce that conducted the analysis – vehemently disagrees with the IAB’s report. Feel free to read Google’s rebuttal in full, but much of it boils down to, “Ad tech is going to have to do something totally new – we’re not trying to whitewash that at all. But these are companies whose job it is to provide the infrastructure that makes the ad ecosystem work.” Expect more shouting in the months to come, but Google does seem fully committed to killing cookies this time. | AdExchanger

2. We first wrote about Threads, Meta’s X killer, last July, when over 70m people signed up in the first 48 hours. We followed up in August, with news that, a month since its launch, Threads’ DAUs had declined by 80%. In essence, it appeared to be a story of lots of initial interest (aided by Instagram’s massive install base), followed by very few reasons for users to stick around.

In its most recent earnings call, Meta announced that Threads has now grown to 130m MAUs, though it conspicuously did not provide any detail on DAUs, which it does for other Meta apps. Some analysts remain bullish on Threads – Mike Proulx of Forrester said, “Threads continues to show promise as the leading X/Twitter alternative. It now has more people using it today than it did during its original launch peak. As X continues to degrade, Threads continues to benefit.”

Back in that July note, we highlighted three factors working in Meta’s favor: the already massive reach of Instagram, upon which Threads is built; Meta’s unsurpassed capabilities in ad targeting and optimization; Meta’s explicit de-emphasis on political content on Threads, which pushes the platform in a more brand safe environment. Meta has not yet brought ads to the Threads surface, but when that day inevitably comes, it seems a safe bet that it will quickly surpass competing sub-scale social media platforms. | AdAge

3. It hasn’t garnered much attention, but there was a potentially significant development for DTC marketers last week as Shopify announced a new program where it will buy Meta and Google ads on behalf of its merchants.

The program, dubbed Shop Campaigns, is an evolution of Shop Cash. The way Shop Cash worked is that consumers would use Shop Pay at checkout from a Shopify merchant, thereby earning rewards to spend on the Shop app; Shopify merchants could then target these consumers, specifying a maximum willingness to pay, and Shopify would then handle the intermediation of audience targeting and promotion to deliver new customers to its merchants. Shop Campaigns scales this up off-platform, specifically to Meta and Google.

There are some similarities here with Shopify Audiences, which uses pooled first-party data across Shopify merchants to create targetable segments on platforms like Meta, Google, Pinterest, Snap, etc. The critical difference here is that Shopify will actually buy the ads for its merchants, and it will do some de-risking by allowing merchants to specify a maximum willingness to pay. In this sense, Shop Campaigns is taking a page from the Performance Max and Advantage+ playbooks by abstracting away all of the annoying campaign management; indeed, it seems likely Shopify will just be using those products under the hood! This does raise the question of why a merchant would want Shopify to handle this for them, the most obvious answer being the long tail of small merchants who don’t receive meaningful customer support from Google and Meta and lack internal resources to operate within those platforms. In other words, the “thin wrapper” model of a source of supply plus a Shopify account, squeezing out other forms of overhead.

This interpretation is supported by there being no minimum spend requirements for Shop Campaigns. With the kind of scale this could enable, Shopify could in short order become one of the larger Google/Meta agencies on the planet. | Business Insider

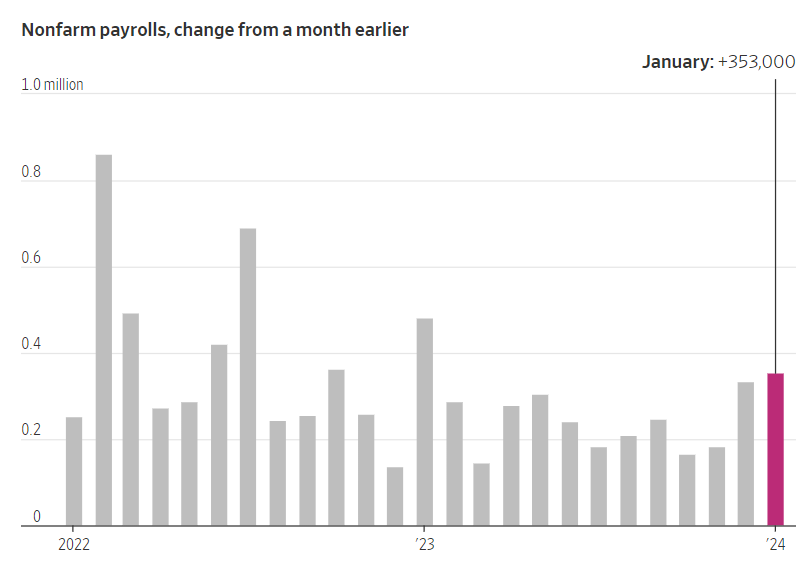

1. We wrote last time that basically all economic indicators are pointing in the right direction: consumer confidence is rising steeply, GDP growth is strong, and the labor market is in historically rude health. The latest macroeconomic data points are somewhat more mixed:

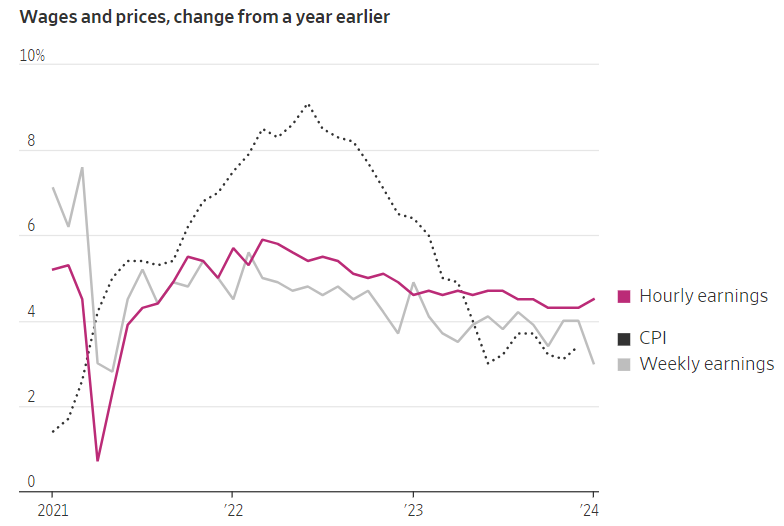

Unemployment remained at 3.7%, which is extremely low by historical standards. Wage growth also ticked up, notching 4.5% growth over the prior year.

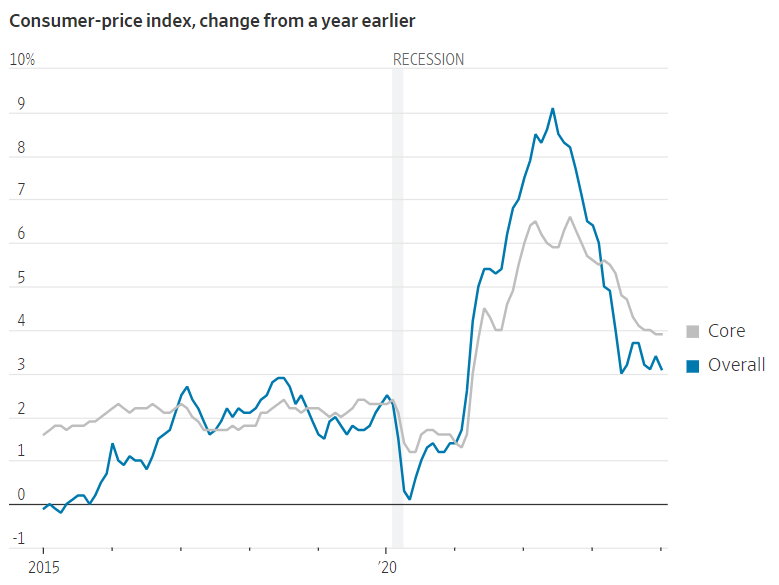

The less rosy indicator for the economy is inflation – Labor Department data for January have consumer prices up 3.1% in January from a year earlier, above consensus estimates for 2.9% and still materially above the Fed’s official target of 2%. The higher-than-expected reading caused a significant decline in the stock market, which had been pricing in expectations of Fed rate cuts that now appear less likely.

While emphasizing that monthly CPI data are noisy and we should resist over-interpretation, it may not be surprising that inflation remains well above target. While interest rates have of course risen significantly, macroeconomists generally agree that interest rates are not a reliable indicator of the stance of monetary policy; if high interest rates indicated tight money, Argentina should have extremely low inflation! Instead, we can look at NGDP growth, which remains well above the ~4% it average for the first couple decades of the century:

As some of these economists put it, “Wake me up when the tight money begins.”

While the latest inflation numbers are not what everyone was hoping for, the overall picture continues to look promising, underpinned by the extreme resilience of the US labor market. | WSJ, WSJ