Media Update: Netflix's Ad Push, Reddit's Sports Expansion, and Apple’s New Ad Ventures

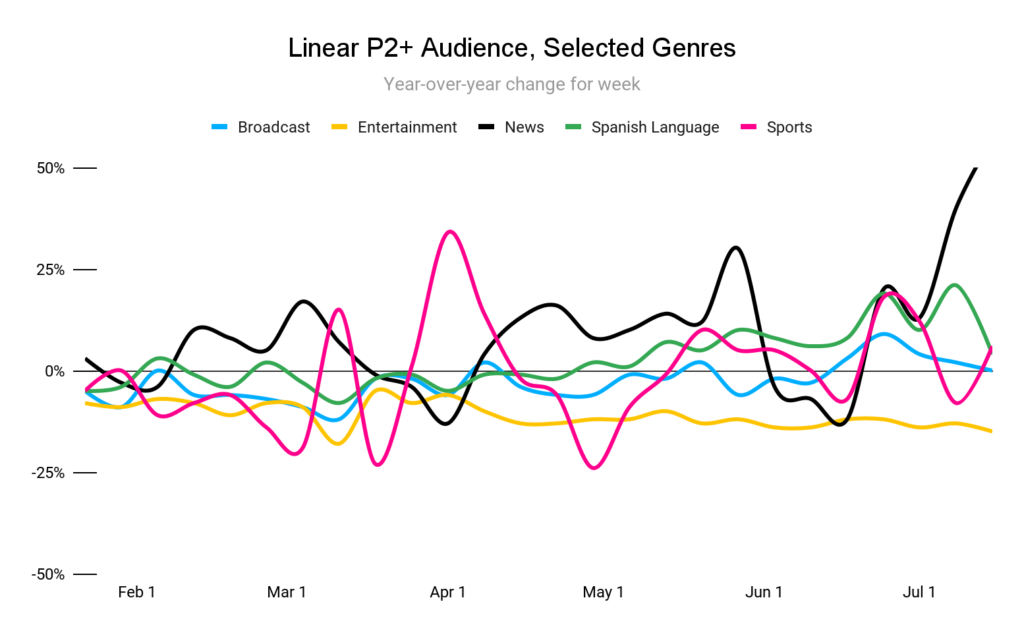

Our readers surely are not surprised to see that news viewership spiked dramatically in recent weeks. Since the last edition of this newsletter on the 12th, a nearly-dormant election cycle has broken open amid an assassination attempt against former President Trump, President Biden’s COVID diagnosis, Trump’s selection of Ohio Senator JD Vance as his running mate, Biden’s decision to drop out of the race, and a groundswell of Democratic enthusiasm for his endorsed replacement, Vice President Kamala Harris. While we at Tinuiti are not Inside-the-Beltway analysts ourselves, we can say with confidence that attention to the race – and news programming more generally – is almost certain to stay very high through Election Day and likely beyond.

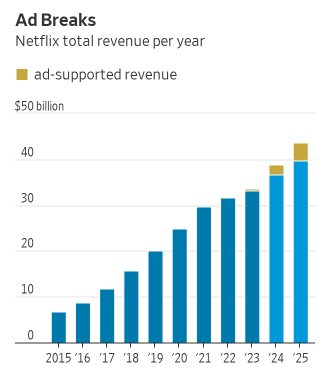

Despite the pressures Netflix is facing from its competition, the streaming giant can boast some solid figures, revealing in its Q2 earnings call that ad-supported memberships were up 34% year-over-year, helping to drive a 17% annual increase in revenue and stronger full-year guidance. While the streamer acknowledged that ad sales will take time to fully underpin the overall revenue picture, the growing emphasis on advertising shows that even Netflix recognizes that ad-free streaming options are becoming less viable.

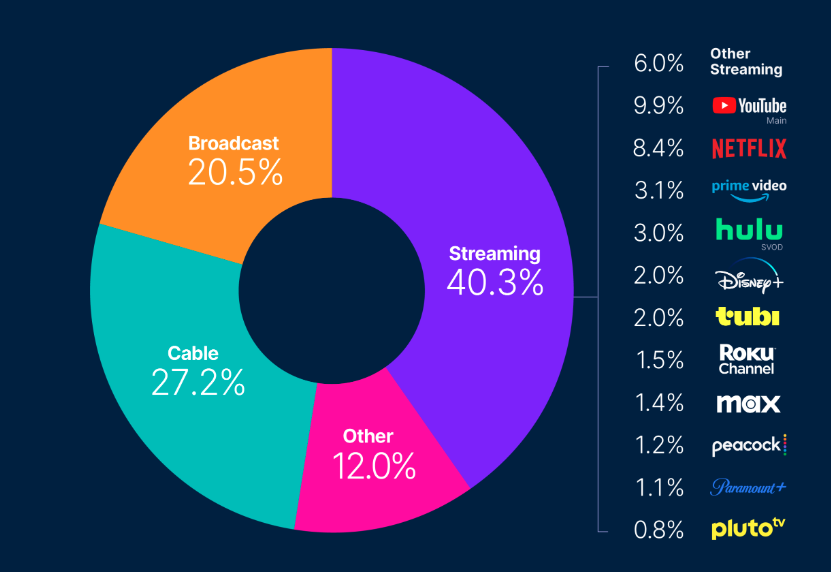

Nielsen’s Gauge shows this dynamic clearly, with the largest streamers maintaining or launching ad-supported options and the major FAST channels (Roku, Tubi, Pluto) now combining to account for more of viewers’ time than any platform other than YouTube or Netflix.

Meanwhile, the other platforms continue to race to stay competitive. Disney is putting a renewed focus on customer stickiness by updating its content-recommendation algorithm and developing “pop-up live channels” (similar to the offerings found on the FAST networks), all in effort to keep viewers around longer and support greater ad sales. At the same time, Paramount is reportedly exploring new ad tech and partnerships to make Paramount+ more appealing to consumers.

Ultimately, these platforms recognize that failing to keep viewers in place is a recipe for losses; whoever can best capture viewers’ long-term attention is likely to be the victor – and perhaps the M&A consolidator. | WSJ, WSJ, Nielsen, Nielsen

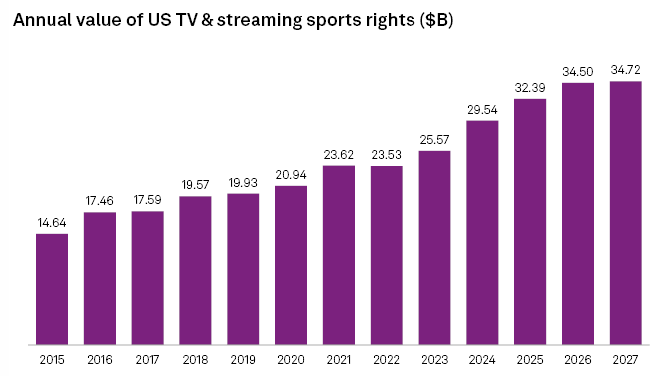

In mid-June, we discussed the status of the NBA’s rights package negotiations, at which point the league was nearing agreement on an 11-year, $76B deal with NBC, ESPN, and Amazon. That deal seemed to leave current partner Warner Bros. Discovery on the outside looking in, but recent developments have shaken up the story. After the NBA and its new partners completed contracts earlier this month, WBD reportedly matched Amazon’s $1.9B per season offer. The matching offer shows a clear understanding of the value of streaming sports, as it reportedly includes provisions to simulcast games on Max (though, notably, it would not include streaming-exclusive games). Just days later, the NBA rejected the matching offer, sticking with the previously announced deal.

While this likely is the final nail in the coffin for WBD (though legal action could follow), it shows that the publisher – as well as WBD’s competitors, the league, and audiences – recognizes the value of sports in the current media landscape. Sports streaming viewership is growing dramatically, such content is becoming more expensive for publishers, and in an ever more fractured content landscape, the ability to capture millions of viewers simultaneously is paramount to publishers’ success. In the coming years, we will see negotiations for the MLB, NHL, and major soccer tournaments; we should expect to see significant sums traded in these deals, especially from the major streaming players. | S&P Global

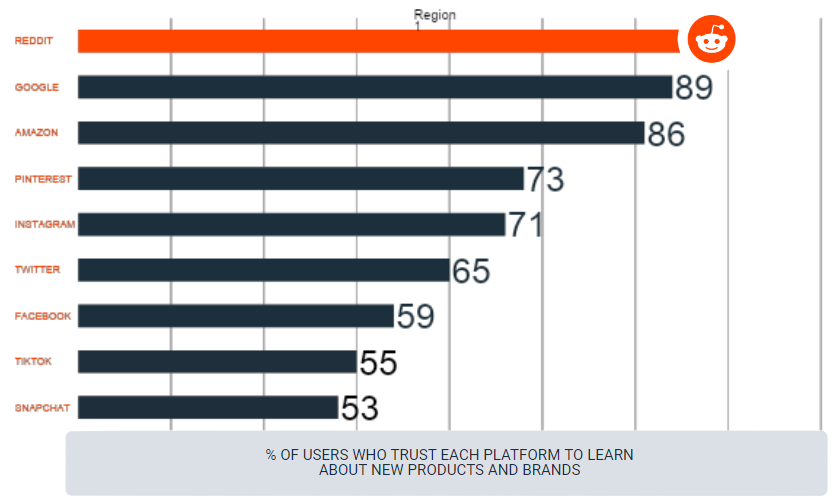

Reddit announced this week that it is rolling out a new sports partnership program on the platform. This is a big opportunity to accelerate growth for Reddit, as it is the 11th most visited website in the world and the 6th most visited in the US. Moreover, a 2021 YPulse study ranked Reddit as the #1 place for trusted product and brand recommendations, ahead of Google, Amazon, Pinterest, and Meta.

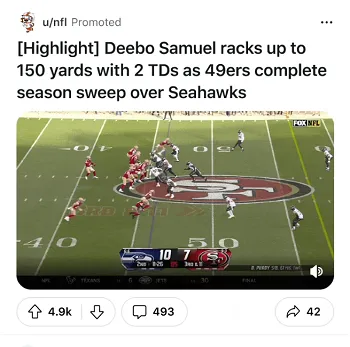

The nature of Reddit is that there are no influencers or single people that move the needle, but instead the entire platform is centered around communities. As such, these communities are the influencers for brands to tap into. On Reddit, sport communities make up a large portion of communities, and have continued to grow at a rate of +26% YoY. Reddit’s new partnership will open up more official content on the platform coming from the NFL, NBA, MLB, PGA Tour, and NASCAR. Other platforms like TikTok and Snapchat, which have publisher deals with some of these partners, allow advertisers to buy ad inventory against this content, but Reddit appears to be focusing on its users for the time being.

These new partnerships give Reddit users access to exclusive AMA’s, behind the scenes content, highlights and more. This is all designed to increase engagement for these communities and further deepen Reddit’s roots as a trusted forum for users to engage and share their opinions and passions. For advertisers, there is still an upside – with the sports community growing, the addressable audience for sports category takeovers, sports interest and keyword targeting, and alignment with sports-adjacent brands will continue to grow. This is also most likely just the tip of the iceberg, and success with these partnerships will pave the way for additional ones in new categories, all bringing new users to the platform and ripening the ecosystem. | Social Media Today, Reddit

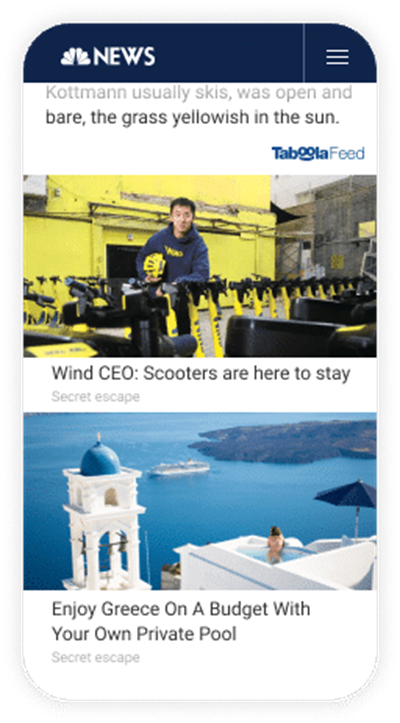

Apple made waves last week by expanding its partnership with Taboola, enabling the ad tech company to power native ads within the Apple News and Apple Stocks apps in the U.S. and the U.K. The move opens up new, premium inventory for advertisers and underscores Apple’s commitment to diversifying and expanding its ad revenue streams. While Apple doesn’t disclose specific revenue figures, eMarketer estimates its ad revenues to reach $10.58 billion globally this year and grow to $14.31 billion by 2026.

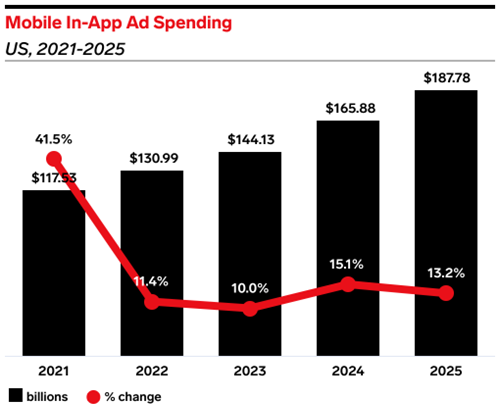

The expanded partnership is a strategic move for Apple on two fronts. First, mobile in-app ad spending is projected to eclipse $187 billion in 2025, providing a sizable revenue opportunity. Second, Taboola’s rapid business growth allows Apple to capitalize on Taboola’s success, offering the premium Apple inventory to a broad array of high-quality advertisers without the need for an internal ad platform buildout.

This partnership is also crucial for Taboola. With the launch of Taboola Select, its new premium inventory offering, and teaming up with Apple, this year marks a strategic shift for the company, signifying Taboola’s evolution from the click-bait “chum box” ads we’re all familiar with (and fall victim to daily) towards delivering a more premium advertising experience.

This could be a very successful partnership; however, that success largely hinges on Taboola’s ability to satisfy Apple’s and its users’ demands by providing a premium and non-intrusive ad experience. Given the partnership’s prominence, we expect Taboola’s ad moderation team to be busy ensuring they deliver on those expectations.

While we are not bullish on this being an evergreen tactic today, advertisers should consider testing the offering. With over 125 million monthly active users in the US, the UK, Australia, and Canada, the News app alone provides a sizable opportunity for brands to engage with desirable iOS users. | AdAge, eMarketer, Taboola

In news that may come as a surprise, recent survey results indicate that the public’s satisfaction with Google has improved over the last year, increasing from an index score of 80 in 2023 to 81 in 2024.

This was largely unexpected, given other survey results from late February ‘24 which suggested users were feeling frustrated, reportedly having to look through more search results and spend more time searching now vs. 5 years ago.

Perhaps a cause for this shift in public perception can be linked to gradual changes in users’ search behaviors as Google’s AI Overview results become more familiar to the masses.

Google’s recent evolutions of its search results pages have been met with mixed reactions from both industry experts and the public. As machine learning continues to power more and more of the search ecosystem, there has been plenty of negative sentiment around some of the misses coming out of AI Overviews immediately following its wider-scale US rollout in Q2. But we saw Google pivot accordingly, acknowledging the imperfections and announcing a shift in focus, placing more emphasis on high quality outputs.

While we’ve seen prevalence of AI Overviews drop significantly following some of the early criticisms about accuracy in search results, in Alphabet’s Q2 ‘24 earnings call we heard CEO Sundar Pichai mention how Google is “scaling it back up”, and “innovating at every layer of the AI stack.” He also mentioned that Google would be testing new ad formats in AI Overviews later this year. Relatedly, in Alphabet’s earnings, we saw Google’s Search revenue surpass expectations, and officials nodded to the improvements in AI Overviews.

eMarketer had already been predicting that Google would remain the clear winner in the Search advertising space for years to come. And this apparent improvement in public sentiment may support that hypothesis.

With AI developments and innovations showing no signs of slowing down, brands should continue testing and learning, evolving their search strategies to embrace evolutions in the AI search space. | Search Engine Land, Search Engine Land, Google’s The Keyword Blog, Search Engine Land, Alphabet Q2 2024 Earnings Report, eMarketer

We told you in May that Google’s Privacy Sandbox Proposal and plan to deprecate 3rd party cookies within Chrome had hit a major roadblock in the form of a report from UK Competition & Markets Authority. At the time, Google stated that it was still committed to moving forward with its proposal, albeit absent of any firm timeline. Despite the original announcement of the plans happening back in August of 2019, now, almost five years later, Google has made a major announcement that Chrome will not be deprecating 3rd party cookies at all.

Instead of deprecating third-party cookies, we would introduce a new experience in Chrome that lets people make an informed choice that applies across their web browsing, and they’d be able to adjust that choice at any time.

-Anthony Chavez, Google’s VP of Privacy Sandbox

While this specific announcement was not anticipated, we had previously shared with you that the path forward for Google was opaque following the challenges issued by the UK CMA; it was clear that a fundamental change in Google’s approach was required in order to see the Privacy Sandbox come to life. What has followed since can be described as a mix of excitement, confusion, and concern from industry talking heads and beyond. Many mass media outlets, such as the Daily Mail, have provided a perspective that lacks nuance, or a fundamental understanding of what exactly is happening. Cut from the same cloth of those championing the phrase “Cookiepocalypse,” this type of content isn’t helpful and only distorts the narrative as to what this announcement means. Fortunately, many industry publications have accounted for this nuance, and showcase a prevailing sentiment that this announcement doesn’t change guidance for advertisers and publishers that 3rd party cookies are not long for this world.

This saga has been a long and complex one, with multiple parties bringing unique concerns to the table. You have no doubt read an array of perspectives this week, and while the purpose of this article is not to cover all possible outcomes, marketers will be wise to consider the following aspects of this announcement:

It would be fair to frame this announcement as a moment for Google to have its cake and eat it. We are going to continue tracking this story, as the means of opt-out mechanism will be critical. While it’s unlikely we will see a consent cliff, what we are essentially looking at are 3rd party cookies making their move to the retirement home and, while they will not be deprecated, they will go away – likely before 2026 if not sooner.

As you process the announcement from Google, we would recommend you keep the following facts in mind:

| Privacy Sandbox, Daily Mail, DigiDay, MediaPost, Apple, Cory Underwood

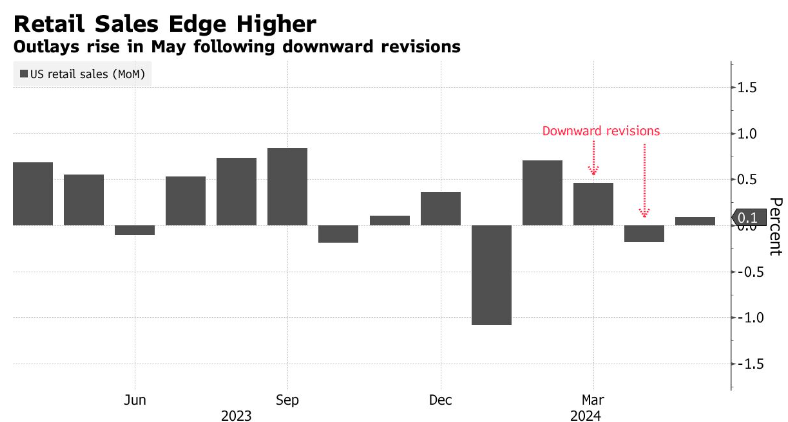

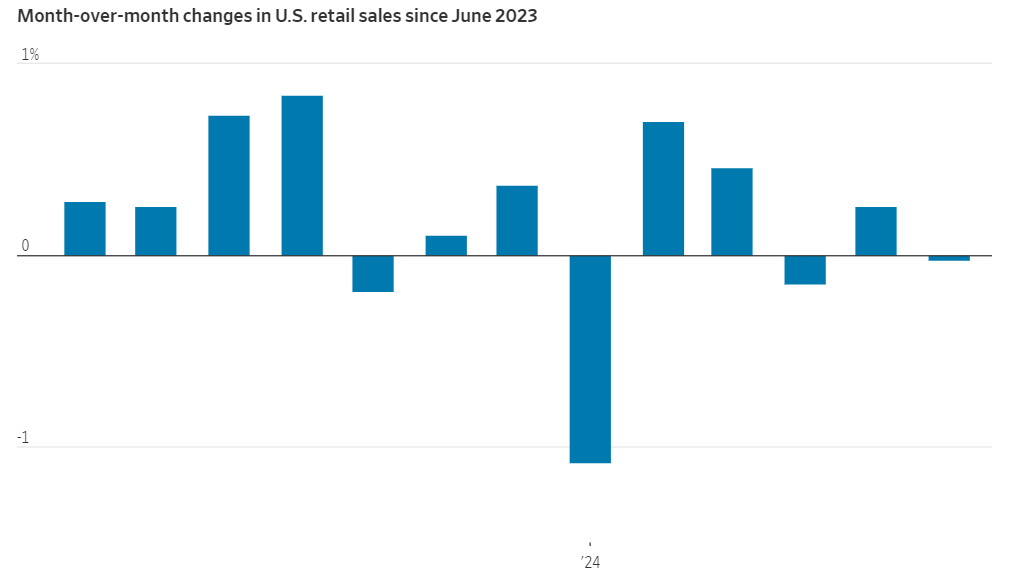

We told you last month that retail sales were soft in the month of May, rising just 0.1% MoM:

The Census Department has just released new figures revising the May retail sales figure upward to 0.3%, painting a considerably strong picture of underlying consumer demand heading into the summer.

Figures for last month have been released as well, showing June retail spending flat to May, surpassing economists’ expectations for a 0.4% contraction. (please note that these figures are seasonally adjusted, so this does not simply reflect seasonal spending patterns)

Excluding the automotive category, retail sales rose 0.4% in June; excluding automotive might be sensible in light of a large cyberattack that crippled auto dealers’ systems for much of June. This gradual deceleration in spending, combined with disinflationary trends in the price level, are raising optimism for rate cuts this fall. | WSJ, Yahoo Finance

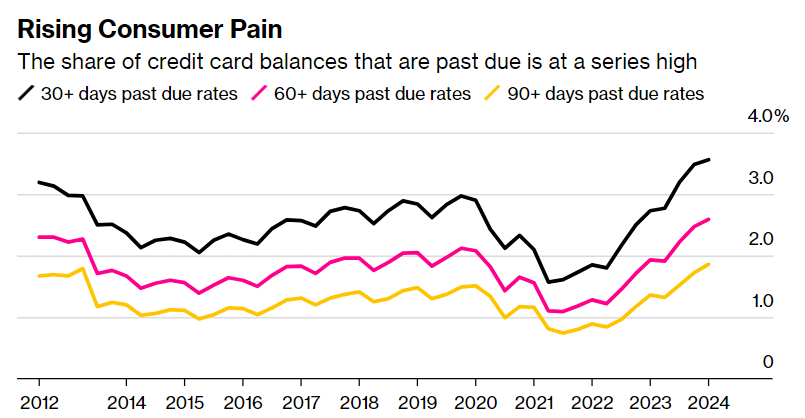

Back in April we told you about credit card delinquencies having risen substantially toward the end of last year, suggesting growing pressure on consumer finances as substantial pandemic-era savings were fully drawn down. New data from the Philadelphia Fed reveal that the share of credit card balances past due reached a series high data back to 2012, reinforcing the picture of stress on consumers’ wallets. Delinquency rates are now more than double what they were in late 2021, when US households were flush with pandemic support funds.

Coupled with the labor market cooling we’ve covered in recent months, this suggests a period of consumer belt-tightening is already underway and is likely to continue for a little longer at least. | Bloomberg