Media Update: AI’s Cannes Moment, Google TV Expansion, Search Ad Insights, Federal Behavioral Ad Proposal, and Declining Consumer Sentiment

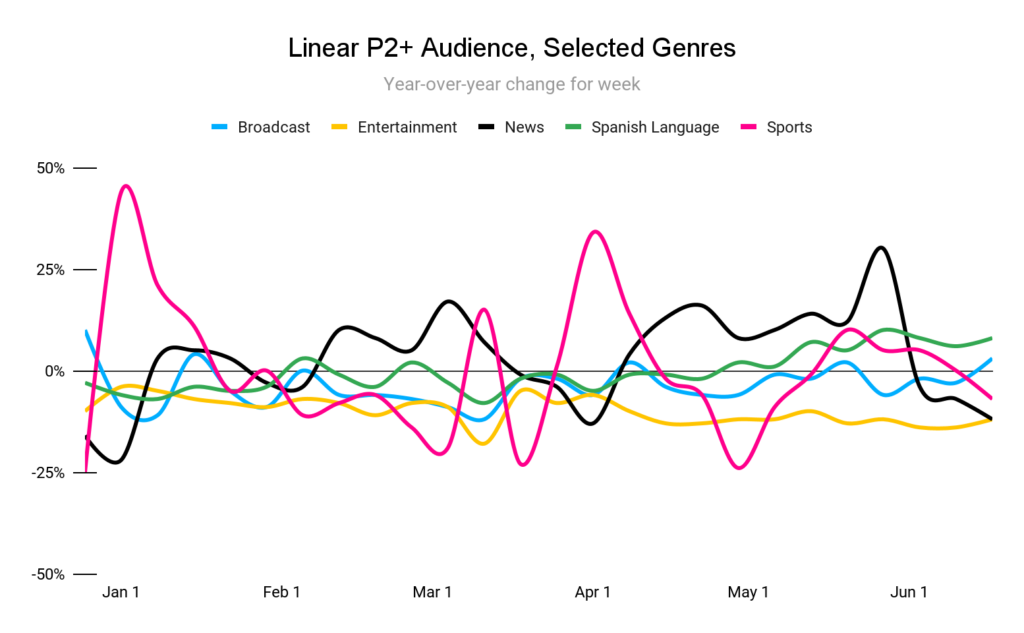

Sports and cable news programming dipped a bit in the last few weeks, while broadcast and Spanish language viewership is seeing year-over-year gains. At the same time, entertainment viewership has been consistently down vs. 2023, reflecting ongoing audience shifts towards streaming platforms. This trend can be seen in the viewership dynamics for the second season of House of the Dragon, which premiered on June 16th. While the show generated Max’s biggest single-day audience ever, total viewership dropped 22% vs. the season one premiere, with 1 million fewer viewers on cable. As further evidence, analysts at MoffettNathanson estimated that pay-TV subscribers fell by 2.4M in the first quarter of 2024, the worst drop in the industry’s history.

“AI” might be the buzziest term in all corners of the business world at the moment, one that can drive excitement, annoyance, anticipation, fear, and every emotion in between. Much of the colloquial discussion of AI centers around chatbot tools, such as ChatGPT, but AI has real power to disrupt the advertising industry on the creative & campaign design sides as well.

The AI evangelists point to the dynamic decision making such tools can provide. These views were well on display last week in Cannes, where AI was the talk of the town. Accenture Song CEO David Droga and OpenAI CTO Mira Murati took the main stage to showcase AI-created video, while Google touted its Gemini AI platform, which PODS used to launch a campaign of 6,000 hyperlocal ads. The campaign used signals including weather, neighborhood, and time to dynamically allocate messaging on the storage business’ roaming trucks. Another major award went to Pedigree, which used AI to take photos of shelter dogs, transform them into “professional-grade” imagery, and promote them on outdoor Pedigree ads.

Not all uses of AI have been well received. Toys R Us is now facing significant fallout from its use of generative AI (specifically, OpenAI’s Sora tool) to create a brand film about the company’s history. The spot caused backlash due to its avoidance of human creators and its “uncanny valley” imagery. These reactions show the tightrope advertisers and agencies walk when they engage with AI; the tool can be powerful, but missteps can be costly. A recent survey showed that 49% of audiences were comfortable with AI-generated ads as long as it looks authentic. At this time, we at Tinuiti advocate for a middle path when it comes to AI, one of exploration and investigation, but with checks, balances, and validation to ensure that campaigns are always run with a focus on quality. | TVTechnology

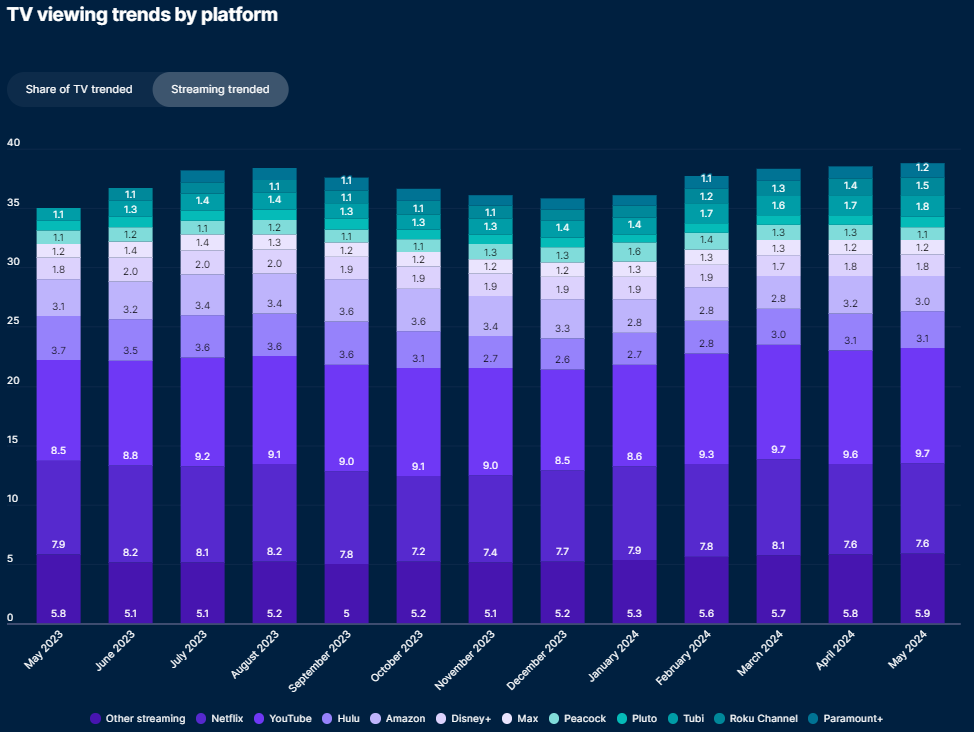

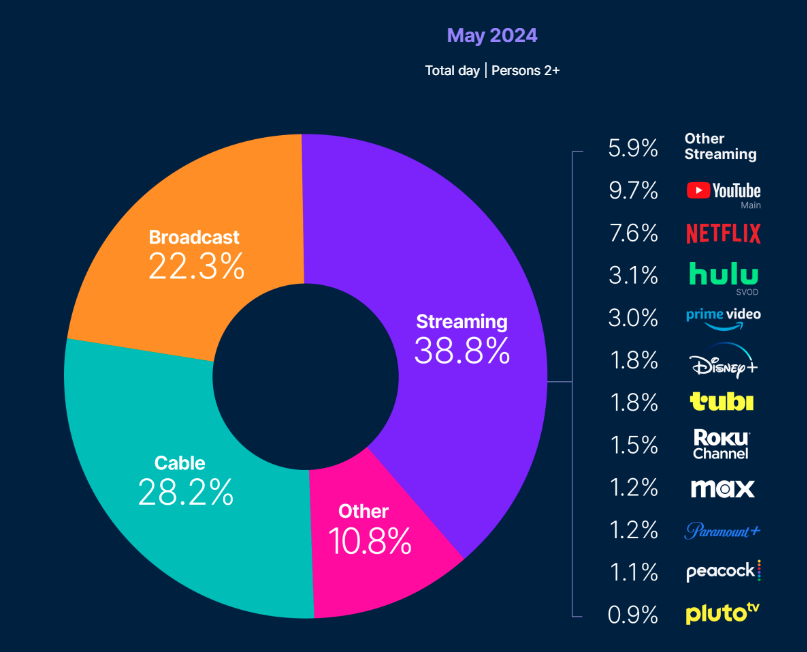

Last month we noted the emphasis publishers were putting on bundled offerings during Upfronts in order to reduce churn. Those efforts now have more supporting data, as a consumer survey from Magid found that churn rates dropped by 16% with bundled plans while customer intent to maintain a subscription rose by 15%. The survey was very positive for AppleTV+ in particular, which saw a 28% churn intent reduction – a particularly helpful development for the streamer, which substantially trails its competitors in viewership. In addition to reducing churn, these bundles help promote streaming viewership overall, with Nielsen’s Gauge showing consistent gains for streaming over broadcast and cable since the start of the year.

It is a bit of an ironic twist to see the streaming industry turn to a legacy cable practice to preserve its competitiveness, even as streaming continues to batter cable viewership. As these bundled offerings lead to new investment options, Tinuiti will be ready to dive into the most promising opportunities for advertisers of all sizes. | Nielsen

Digging deeper into Nielsen’s Gauge, we can see that YouTube continues to lead all streamers with 9.7% of audience’s time. YouTube has stood in top spot every month since February 2023, when it surpassed Netflix.

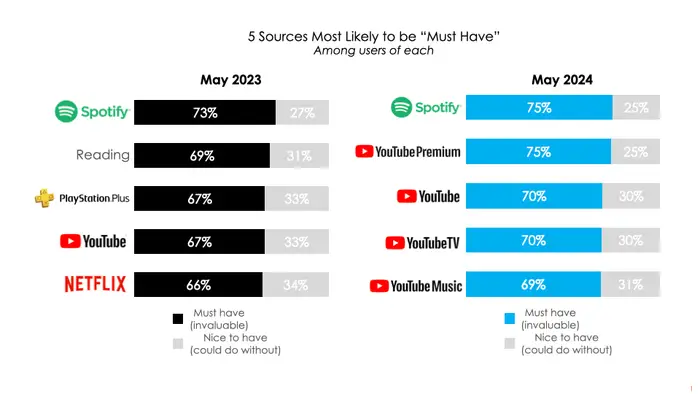

YouTube’s dominance can be seen beyond pure viewing time as well. Hub Entertainment Research polled audiences for their “must-have” entertainment services, with YouTube products taking four of the top five slots (namely, YouTube Premium, YouTube, YouTube TV, and YouTube Music). The remaining slot was held by Spotify, with Netflix leaving the list vs. a year prior.

YouTube’s success makes evident the need for every advertiser to have a strong understanding of how and when to leverage the platform. Tinuiti has focused extensively on our YouTube capabilities in recent years, partnering with Google to leverage ghost bidding technology to bring our best-in-class measurement into the YouTube ecosystem.

Meanwhile, Netflix continues to stagnate, holding at 7.6% of viewer time and down from highs of 8%+ in 2023. On the commercial side, the business is fighting pressure from Prime Video, whose large audience of subscribers has hurt Netflix’s ability to negotiate deals with advertisers for their ad dollars. This has led to significant decreases in Netflix’s CPMs. While this may be an ominous development for the streamer, it does present growing opportunities for advertisers, particularly those looking to make significant brand awareness investments. Interested advertisers should reach out to their Tinuiti client teams to discuss investment strategies and considerations. | Business Insider, Nielsen

We’ve talked quite a bit this year about the rise of the TV screen and the new advertising opportunities that accompany it, particularly within the Google and YouTube universes. The trend continued this month as Google announced the launch of its aptly named Google TV network. The new ad network provides advertisers access to video inventory on over 125 channels built into Google TV, including BBC, NBC News, and Xumo channels.

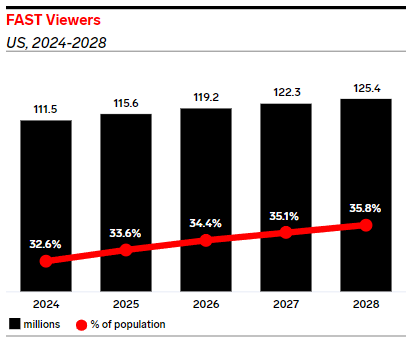

The announcement doesn’t come as a surprise given that viewership of Free Ad-Supported TV (FAST) services are expected to continue to rise, with eMarketer projecting over 125 million FAST viewers by 2028. With the Google TV network reaching over 20 million monthly active devices and YouTube’s 150 million CTV viewers, Google is attempting to position itself as the go-to partner for advertisers looking to engage with TV viewers. To facilitate advertiser adoption of the network, Google made launching ads simple within both Google Ads and DV360. With a simple check of a box, advertisers can extend their YouTube campaigns to the Google TV Network.

YouTube advertisers who are focused on driving reach against the TV viewing audience should see the Google TV Network as a great opportunity to extend their current campaigns. However, for advertisers looking to dive into streaming and want more robust measurement, we recommend focusing efforts on FAST networks such as Tubi, Roku, and Pluto for scale and leveraging Tinuiti’s Bliss Point platform to understand the incremental impact. | Google Blog, Google Help Center, eMarketer

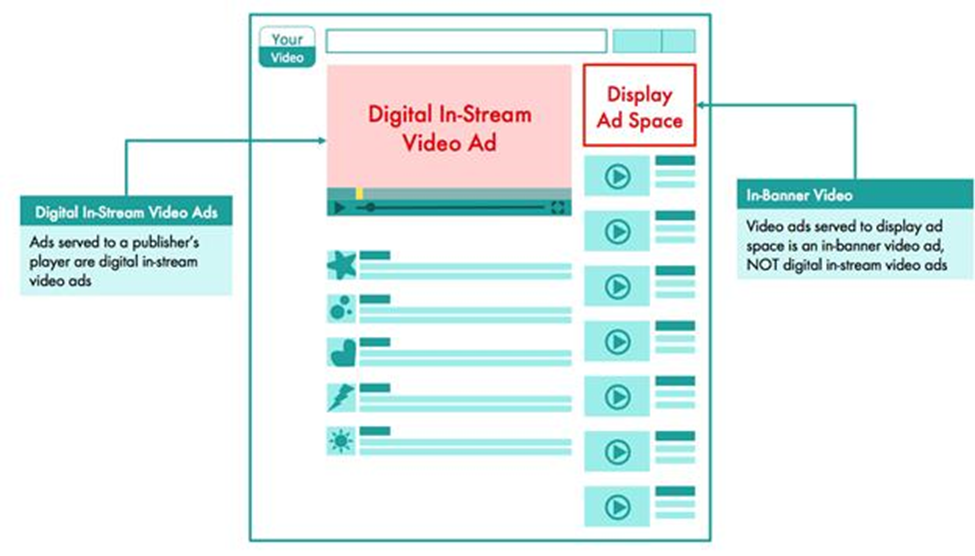

The Trade Desk made headlines last week by announcing the demonetization of Yahoo’s video inventory across the open web. The Trade Desk alleged that the publisher has not adhered to the IAB’s format guidelines for digital video and has consistently misrepresented out-stream video inventory as in-stream. The Trade Desk has also mentioned that it would remove all Yahoo video inventory, including private marketplace (PMP) deals, by July if Yahoo did not rectify the issue.

Misclassification of the inventory presents a few challenges for advertisers. First, there are distinct differences between the two: in-stream inventory is considered more premium as it is the focus of the site visit and plays with “sound on” by default. Out-stream inventory is usually served in a display placement on a webpage, is not the intended reason for a user’s visit, and does not play with “sound on” by default. These delivery distinctions are important when developing a video strategy. For example, out-stream inventory can be quite impactful when strategically used as a complement to content that is on the page; however if an advertiser wants to have their video front-and-center, in-stream would be the more impactful placement.

The lack of transparency can also cause buying and optimization challenges. Given the premium nature of in-stream inventory, CPMs are usually higher. If out-stream inventory is misclassified as in-stream, advertisers may be overpaying for those impressions. Lastly, if an advertiser runs a video where sound is an important element to the viewing experience, that video may not have the same impact when shown in an out-stream unit, misrepresenting its performance. So when a publisher mis-classifies their inventory, the digital video strategy is compromised, leading to inefficiencies and misguided insights.

The Trade Desk and Yahoo are currently re-engaging in negotiations, and we are keeping an eye on the outcome. This move by The Trade Desk marks the beginning of the DSPs cracking down on publishers and enforcing the IAB’s Ad Format guidelines. While a solution is being discussed, advertisers can mitigate some of the challenges of serving on unviewable, sound-off video inventory by leaning into direct deals with the publishers. | AdExchanger, IAB Tech Lab

Generative AI is continuing to evolve the way people search online. As discussed in our last update, searchers on Google have been seeing AI Overviews on certain results pages for some time now, and advertisers remain uncertain about how to measure the impact of ads from these new search result formats. Other AI enabled platforms, like Bing’s CoPilot and Perplexity, are arguably ahead of the game compared to Google in terms of making the shift from providing “results” to providing “answers.”

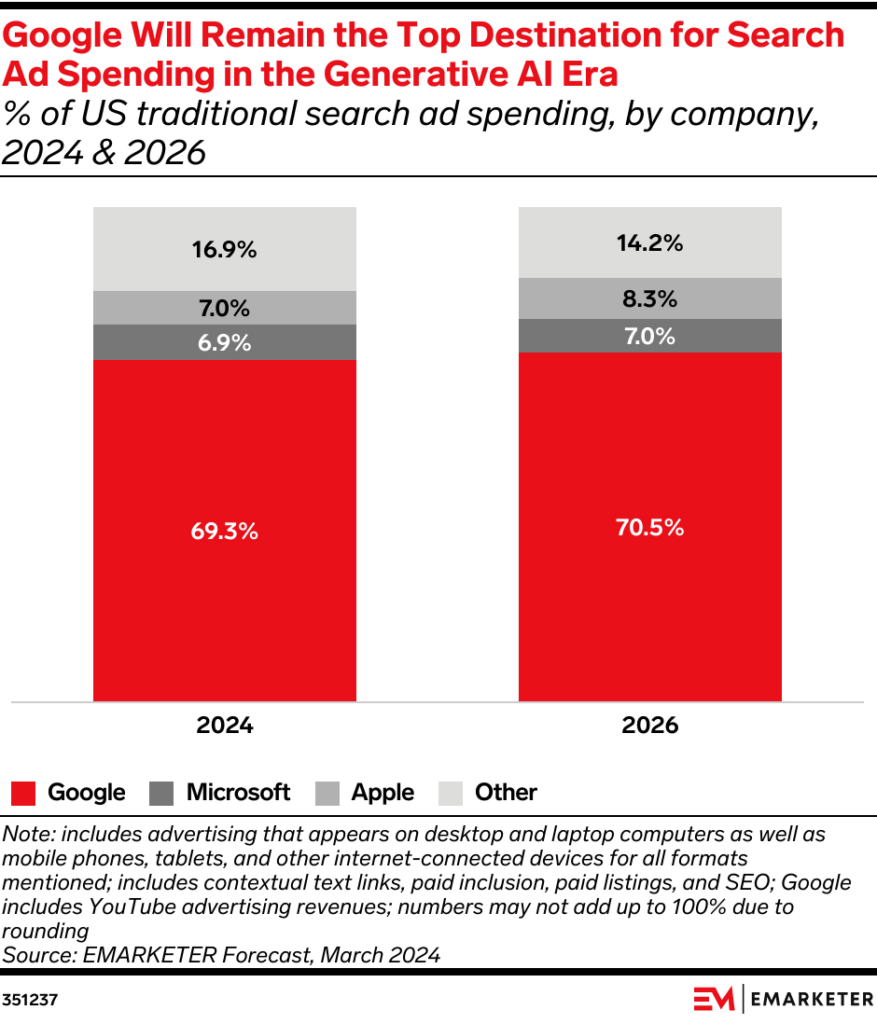

We expect each of these platforms to continue evolving and iterating ways in which AI powers search results, especially Google. Recent studies indicate that Google is showing AI Overview results even less frequently now (only 7-9% of queries, down from previous estimates of ~15%), supporting the idea of the more deliberate, gradual rollout. Despite momentum in the Generative AI space from competitors, a recent eMarketer forecast projects that Google will remain the clear leader for the foreseeable future, at roughly 70% of US advertising share.

That said, it’s important to note that the prevalence of this SERP experience varies by industry, and currently Google’s AI Overviews more often seem to be triggered by “long tail” searches than by shorter, more direct searches.

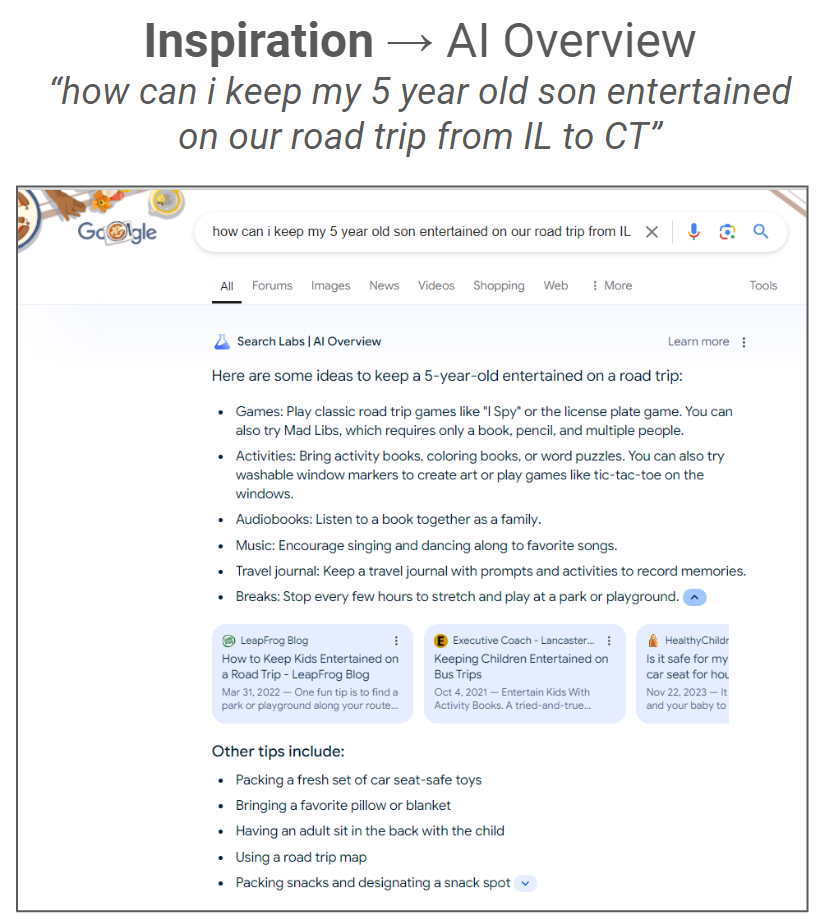

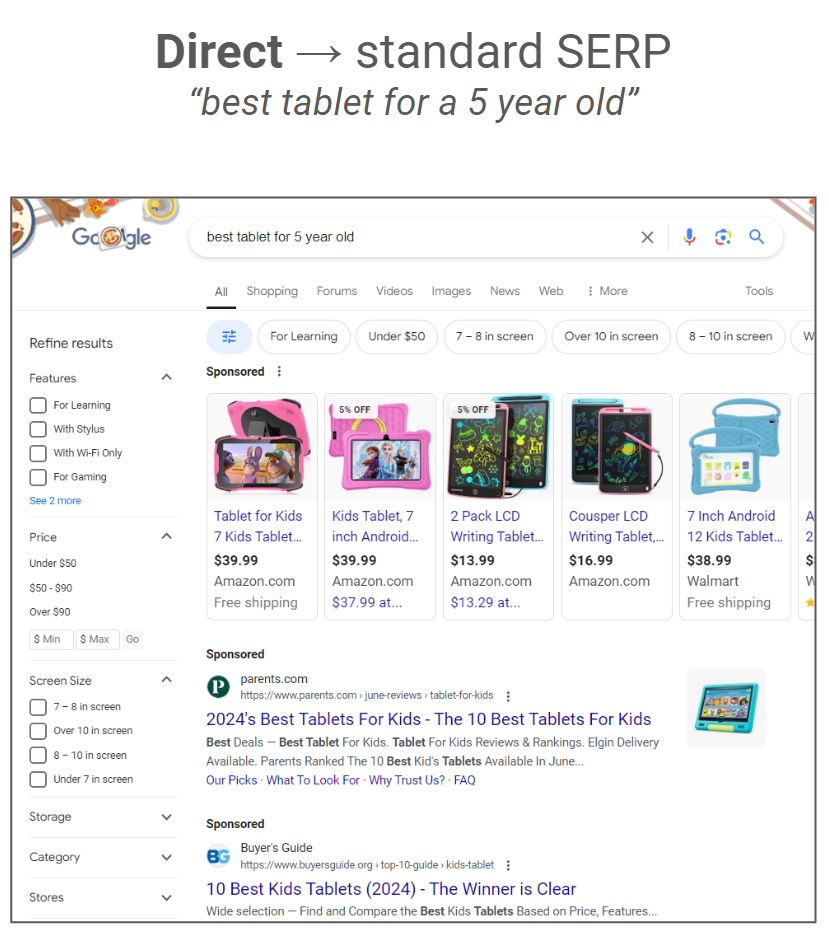

For example, searching on Google for inspiration with a query like “how can i keep my 5 year old son entertained on our road trip from IL to CT” results in an AI Overview that gives a bulleted list of ideas, along with links to related blog posts, and some additional “tips.” Ads are sometimes, but not always, included.

On the other hand, a more direct, “typical” search query like “best tablets for a 5 year old” triggers a traditional SERP with shopping ads, at the top, followed by a section of text ads, then some organic results below the fold.

In most cases, modern internet users are accustomed to searching in this more “direct” manner, which typically means they then need to parse through suggested content on a traditional SERP. The beauty of continually evolving technology like AI in search results is that we should expect the results to get better and better as time goes on. As that happens, we also expect that the behavior of searchers will evolve. We may see a mindset shift with searchers starting to ask more complex, nuanced questions, expecting the search engine to understand their intent and provide not just some suggested results, but THE answer to their query.

More advanced searchers will start changing their behavior by adding terms like “which” to the beginning of queries (for example, “which is the best XYZ for XYZ” rather than simply querying “best XYZ for XYZ”), gradually shifting to a more “intelligent search” model (an idea explored by Avinash Kaushik, a former Googler). Realistically though, we think it could be years before the average, non-tech savvy searcher makes that pivot. | Emarketer, Search Engine Land, LinkedIn

At the heart of modern, deterministic advertising has long been a tension between privacy and value. While we have seen technical privacy shifts come by way of Apple’s Intelligent Tracking Prevention & App Tracking Transparency initiatives, as well as the unending saga we detailed last month pertaining to Google’s plan to deprecate 3rd party cookies in Chrome, these are not statutory laws and are subject to all kinds of workarounds limiting their efficacy in protecting consumers’ privacy. It is clear that, in lieu of laws, the identity arms race will continue.

Despite the prognostications of industry leaders for years that legislation will come, the US has remained neutral on digital privacy at the federal level, instead leaving it to the states to adopt a patchwork of privacy laws such as California’s CPRA. Notably, Texas, Florida & Oregon have consumer privacy laws coming into effect on July 1, 2024, with a total of 19 states slated to have similar laws by January 1, 2026. The burden of compliance associated with unique regulations by state is likely to be untenable for the majority of advertisers. It’s an open secret, but without federal-level action, death by a thousand regulations seems like an almost inevitable fate given our current trajectory.

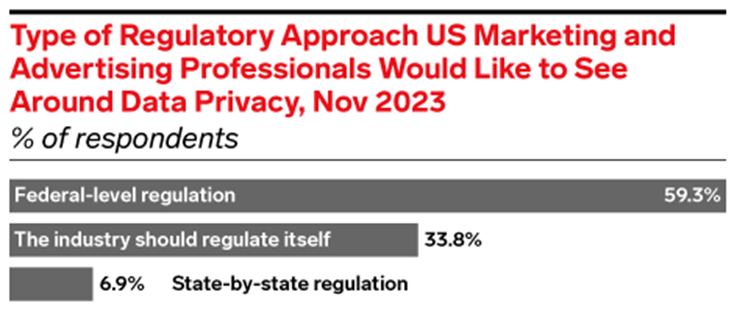

Not all is lost though. There is hope in the form of a bipartisan bill initiated earlier this year called the American Privacy Rights Act. While commentators had suspected this may come in the form of a watered down version of CCPA (California’s privacy law), the latest draft makes for concerning reading in its heavy-handed proposal to ban behavioral advertising. Of course, there is a dance to these things, and the current text of the bill is unlikely to reflect its final form. It is troubling by way of the inherent disregard for the thousands of businesses (of all sizes) to take on a form of prohibition, but we won’t read too much into this until we see some further traction. Emarketer & Basis recently found that the majority of US advertising professionals state that they would like to see federal regulation – but if we continue down this path, we may just see a more impassioned movement towards self-regulation.

Say it with me folks…

What do we want? Federal level privacy regulation that takes a balanced approach to consumer privacy and the ability of businesses to grow through behavioral advertising!

When do we want it? Before we have to deal with 19 independent state laws come Jan 1st, 2026! | Apple Webkit ITP, DataGuidance, Emarketer

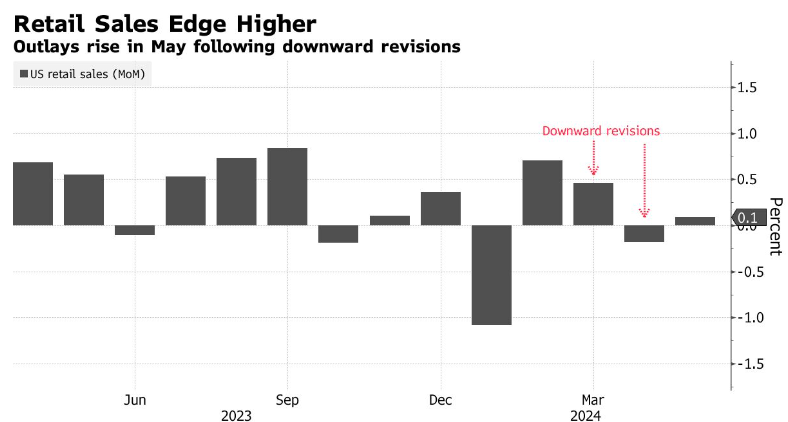

US retail sales rose just 0.1% MoM in May, a significant slowdown from earlier this year; and March and April were both revised downward, painting a picture of overall softer consumption from American consumers.

note: the large January drop is a seasonal effect of December holiday shopping)

Retail spending excludes most services, so this is not necessarily a comprehensive picture. The one service sector that is included in these figures, spending at restaurants & bars, declined by 0.4%, the largest drop since January. Data on goods & services combined for May will be available later this month, but this leading indicator suggests total consumer spending will be soft. | Bloomberg

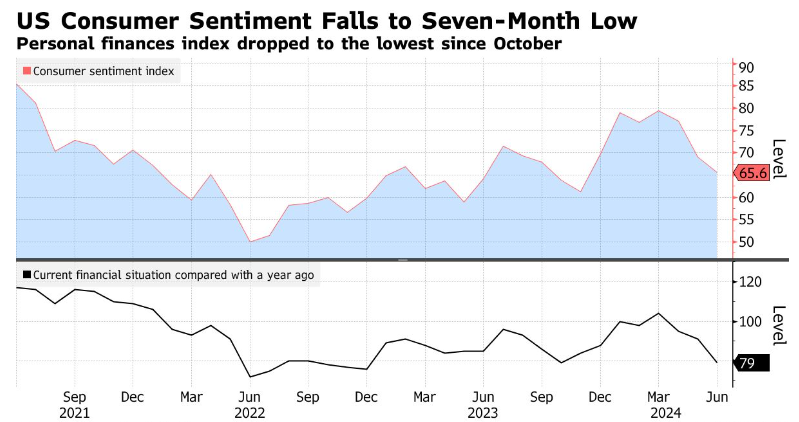

Consistent with the above picture of soft consumer spending, US consumer sentiment fell to a seven-month low in early June, as consumers’ assessment of their personal finances fell precipitously.

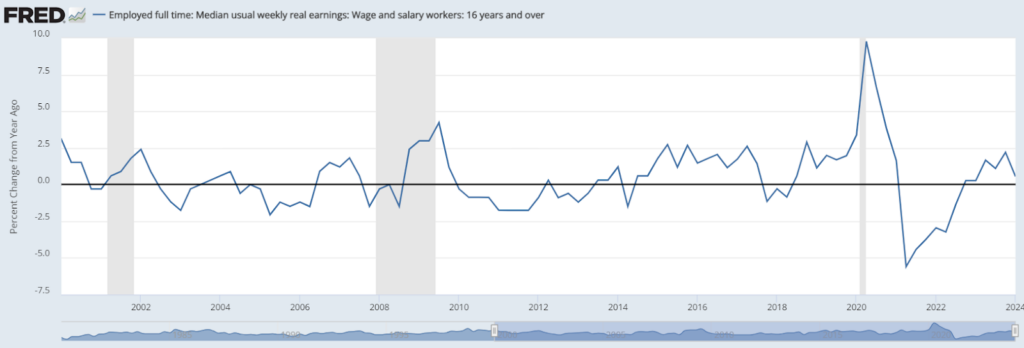

Consumers’ views about economic conditions dropped to the weakest since the end of 2022, despite the significant disinflation over the past 18 months. For all the talk of a vibecession, a dour consumer outlook is not surprising from the perspective of real (inflation-adjusted) wage growth. In the years leading up to the pandemic, ~2% annual real wage gains had been the norm (although this was not the norm during the first decade of the century):

Real wages post-pandemic have not reverted to that trend, undermining the real and perceived purchasing power of the median consumer. Until real wage growth gets back to where it was in the 2010’s, consumer spending cannot grow much faster than it is at present. | Bloomberg, FRED