Media Update: DirecTV-Disney Dispute, Snapchat Sponsored Snaps, and Google's Video Action Campaign Deprecation

News viewership remained high in late August amid strong ratings for the Democratic National Convention, which pulled in ~22M viewers per day and peaked at ~29M during Vice President Harris’ acceptance speech. With just two months to go until Election Day, expect interest to stay elevated, especially next Tuesday when Harris and former President Trump square off in their first prime-time debate in Philadelphia.

1. Long-simmering tensions in linear TV boiled over into the public sphere this past weekend, as Disney pulled its properties from DirecTV on Sunday. Viewers tuning in ahead of the USC-LSU primetime game were met with a short message:

The TV provider has been in a heated conflict with Disney regarding the carriage fees it pays to broadcast Disney-owned properties. These fees have become a thorny issue due to “minimum penetration” requirements that result in many DirecTV customers paying high rates for programming they watch infrequently – costs that DirecTV frames as unnecessary. These bundles that can put less popular channels on a customer’s bill have been a catalyst for linear cord cutting, which has severely punished cable and satellite providers. Figures from Leichtman Research below show how quickly these providers are hemorrhaging subscribers.

For the Disney-DirecTV dispute, we’ll need to wait for a resolution; Disney and Charter’s 2023 impasse lasted 12 days, but there is no indication yet on how long DirecTV and Disney will remain at odds. Some major programming is at risk for DirecTV customers in the near term, including Monday Night Football, the US Open, and ABC’s coverage of the upcoming presidential debate (though other news networks will be simulcasting). Advertisers looking to air in this linear programming should monitor the situation closely, as viewership could be depressed. More broadly, however, this story is just the latest milestone on the long road of linear’s decline. The latest reporting from Nielsen showed continued growth for streaming viewership and ongoing declines for linear, as streaming reached over 41% of viewers’ time in July, the largest share of any format since Nielsen launched the Gauge in 2021.

The writing has been on the wall for a long time, and these public disputes certainly do nothing to slow linear’s decline. To be clear, linear is not – and may never be – fully “going away” for advertisers, as there remain audiences who subscribe and tune in and thus opportunities for strategic brands looking to access these viewers. But the growth trend is inexorably toward streaming, across ages and demographics. If the figures from Nielsen and LRG were not enough, consider this unsolicited anecdote from an unimpeachable source – my own father:

With Disney and ESPN holding a massive block of premium sports inventory, he and other sports fans may see this as the push needed to cut the cord. | Forbes

2. Netflix is accelerating its advertising options to stay competitive in the increasingly crowded streaming space. The network announced new buying methodologies including PMP deals with major DSPs; measurement partnerships with NielsenOne, Cint, EDO, and Kantar; and clean room integrations with Snowflake, InfoSum, and LiveRamp. These offerings are designed to help Netflix catch up to its competitors, many of whom had an advertising head-start on the largest streamer, which only began supporting ads in 2022. On the other side of the coin, Netflix announced it was deprecating its “Basic” ad-free plan and automatically putting those subscribers on an ad-supported tier.

The situation remains complex for Netflix, as its late entry into the ad-supported space, coupled with competition from Prime Video and the rise of the FAST networks, have left it a bit behind the eight ball and have led to major CPM decreases since ads were initially launched. Still, opportunities abound, particularly in live sports. The network will be broadcasting two Christmas Day NFL games this year (and even offered a live hot dog eating contest on Labor Day between Joey Chestnut and Takeru Kobayashi). We have yet to see an undisputed leader in streaming sports emerge, especially after an injunction blocked the launch of Venu Sports, the planned joint venture from WBD, Fox, and Disney, on antitrust grounds. As such, the door remains open for essentially all of the major players – Netflix, Amazon, Disney, WBD, NBCU. As live sports remain one of the last areas of mass, synchronized viewing, advertisers should continue to pursue a diversified strategy across these platforms and take advantage of the growing inventory. | Netflix, WSJ, eMarketer

1. Snapchat is expanding its advertising options by introducing “Sponsored Snaps,” a new feature that allows businesses to pay for the placement of their content within users’ chat inbox without a notification. While Snapchat is already natively using a similar forum to share platform updates and fun seasonal messages with users, this is notable as the first time that advertisers will have the opportunity to tap into this sort of inventory. This addition introduces a new way to engage with Snapchat’s audience alongside organic peer-to-peer messaging content.

This new update is very similar to LinkedIn’s Sponsored InMail, and Snapchat is already using this forum to send out fun holiday messages and themes to users, like the Team Snapchat message in the screenshot above. Snapchat would do well to tread cautiously here, given Meta has learned in the past that advertising in users’ DMs is generally not welcome, making Snapchat’s move all the more intriguing for advertisers. For advertisers interested in tapping into the new Sponsored Snaps, a select number of advertisers are expected to initially get access over the coming months, with plans to expand as the feature develops. | SocialMediaToday, The Verge, Snapchat

2. After teasing the new platform for months, X, aka Twitter, has officially launched the beta version of its new Connected TV app, X TV. This app allows users to access X’s content directly on their TV screens, providing a larger and more immersive way to engage with video posts, and even exclusive content to the platform, including live events. For X, this is a step forward in its evolution into a video-first platform; this move also presents new opportunities for advertisers and content creators to reach users in a more dynamic and visually impactful way, potentially boosting the platform’s ad revenue and user engagement.

With CTV rapidly growing, there is a clear opportunity for X TV to capitalize on this demand. While advertising on X TV is not available yet, X reports that it will be coming soon, including new ad options incremental to what is currently available on their desktop and mobile platforms. So far, X has already signed content deals with celebrities including Khloe Kardashian, Paris Hilton, Tucker Carlson, Don Lemon, WWE, and others. In 2016, Twitter (now X) was able to sign deals with the MLB, NFL, and NBA to broadcast games directly in the app. While these deals have since been dropped, X TV presents a new medium for this type of content. As a popular second screen, there is a very unique opportunity for X to crack the code of merging these two attention streams, potentially allowing advertisers a lucrative ad placement; but before this can come to life, X will need to establish X TV’s product-market fit and scale usage meaningfully. | SocialMediaToday, X

1. The long-awaited answer concerning the future of YouTube’s Video Action Campaigns (VAC) has been revealed. This week, Google announced plans to deprecate VAC in favor of its newest AI-driven campaign type, Demand Gen.

Speculation around the future of VAC started to rise in June of last year when Google announced the launch of Demand Gen, which merges features and inventory from VACs, Discover campaigns, and Gmail campaigns, allowing advertisers to drive performance by leveraging video and image assets in a single, automated campaign type. While Demand Gen features consolidated campaigns, advertisers can separate video-only from image-only campaigns.

The deprecation process will be slow with VACs available through March 2025, when the ability to create new campaigns will sunset. All remaining VACs will auto-migrate throughout Q2 of 2025. The extended migration period allows advertisers to test and optimize Demand Gen before its full rollout.

Overall, we see this announcement as an upgrade for advertisers looking to drive action from their video campaigns. Demand Gen provides access to the same core functionality as VAC but also provides added features not available in VAC, including:

We strongly encourage advertisers currently not utilizing Demand Gen to start testing the campaign type to understand the migration’s impact on performance. Advertisers running Demand Gen and VACs should audit both campaign types to identify potential campaign setting gaps and targeting inconsistencies to ensure parity. | Google Blog, Google Help Center

2. YouTube’s rising viewership on TV screens has been a consistent theme in 2024. As Harry showcased in the July Nielsen Gauge data above, YouTube made up 10.4% of viewers’ streaming time, becoming the first streaming platform to crack 10%. We don’t expect to see YouTube’s streaming prominence slowing down anytime soon – according to eMarketer, connected TVs will grow to make up ~50% of the time spent with YouTube by 2026. This trend has prompted YouTube to focus on enhancing the user experience.

Back in March, we shared YouTube’s plan to design a richer TV viewing experience that was “uniquely YouTube,” introducing interactive features, such as shopping directly from the videos. Now, YouTube aims to enhance the connected TV experience with longer, uninterrupted viewing blocks. This is a welcome change for YouTube CTV viewers who have voiced frustration over the current ad break frequency. By consolidating ads into longer breaks, YouTube offers a more familiar experience akin to traditional streaming platforms. Google estimates this will extend viewing sessions by up to 50% before the next ad break, boosting overall watch time.

While this update benefits viewers, advertisers should monitor device performance trends, including view-through rates, average watch time per impression, and brand lift results to gauge if there is a shift in user behavior and the impact on YouTube’s CTV ad performance. | Nielsen, YouTube Blog, Google Help Center

1. Major search engines are expecting this holiday shopping season to look considerably different than years past, with a variety of factors contributing to these expectations.

First: the compressed peak period (the days after Cyber / before Christmas). This year there are five fewer days after the Cyber period, not to mention a major US election earlier in November that could distract consumers and temporarily delay holiday shopping. This means shoppers could be scrambling later in the season to purchase their gifts, and advertisers may feel the crunch with tougher competition during the shorter peak period.

Second: the post-COVID economic squeeze. Many consumers this holiday season may not be just price conscious (like in 2023), but price vigilant. According to Microsoft, there is a gap between inflation and disposable income, with credit card debt replacing COVID savings that have run dry, as we’ve noted in recent editions. This means advertisers will need to focus their messaging on creating value for consumers, beyond touting mere cost savings.

Third: Microsoft started to see a shift in seasonality of holiday search volume in 2023 that could repeat itself this Q4. There was more YoY growth in retail-related searches happening in October followed by a YoY decline in December.

Microsoft also reports that large portions of holiday conversions stem from clicks that happen earlier in the season, specifically in October (67% of Nov ‘23 conversions, and 49% of December ‘23 conversions came from October ‘23 clicks).

So while nailing the Cyber 5 period is still critical, it’s important to recognize that ~90% of holiday conversions happen outside this short promotional window. Knowing this, search advertisers should invest early in the lead-up to this holiday season while shoppers are starting to plan their purchases, especially since paid search & shopping CPCs can be more affordable prior to highly competitive peak periods. This strategy can also serve to fuel the funnel by building up remarketing lists for holiday prioritization. | Microsoft Advertising, “Retail: Holiday 2024 Expectations”

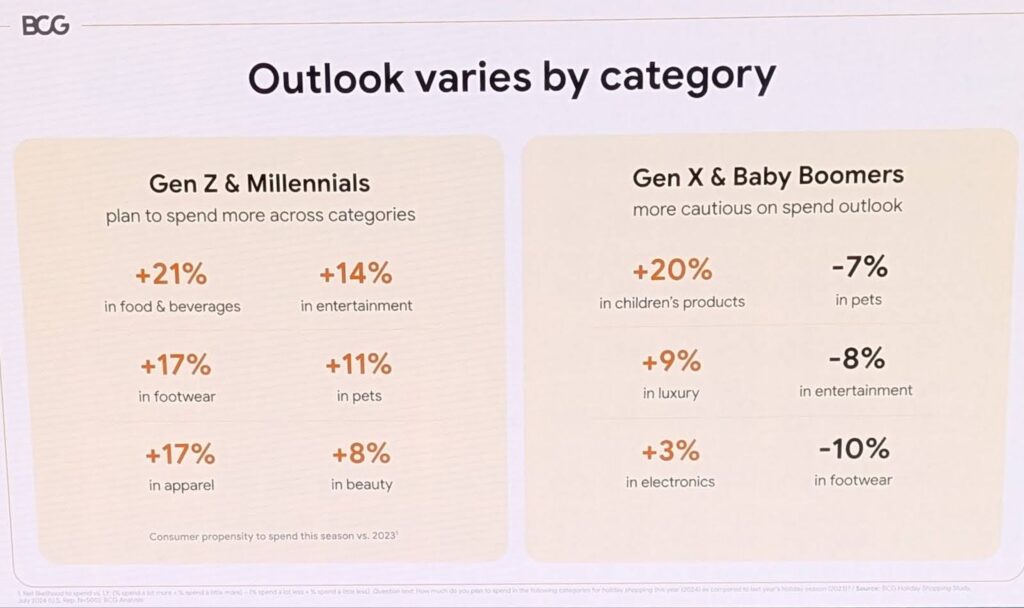

2. Lastly, at its annual Think Retail event, Google shared that, per BCG research, the outlook of holiday spending behaviors varies based on age group and category. Young generations (Gen Z & Millennials) reported planning to spend more across categories, while older generations (Gen X & Boomers) say they will be more cautious. For example, in the entertainment category, Gen Z & Millennials plan to spend 14% more YoY, whereas Gen X & Boomers say they will spend 8% less.

Advertisers will need to take these unique desires and expectations across generations into account when developing ad targeting strategies and messaging this holiday season. | BCG Holiday Shopping study presented at Google Think Retail

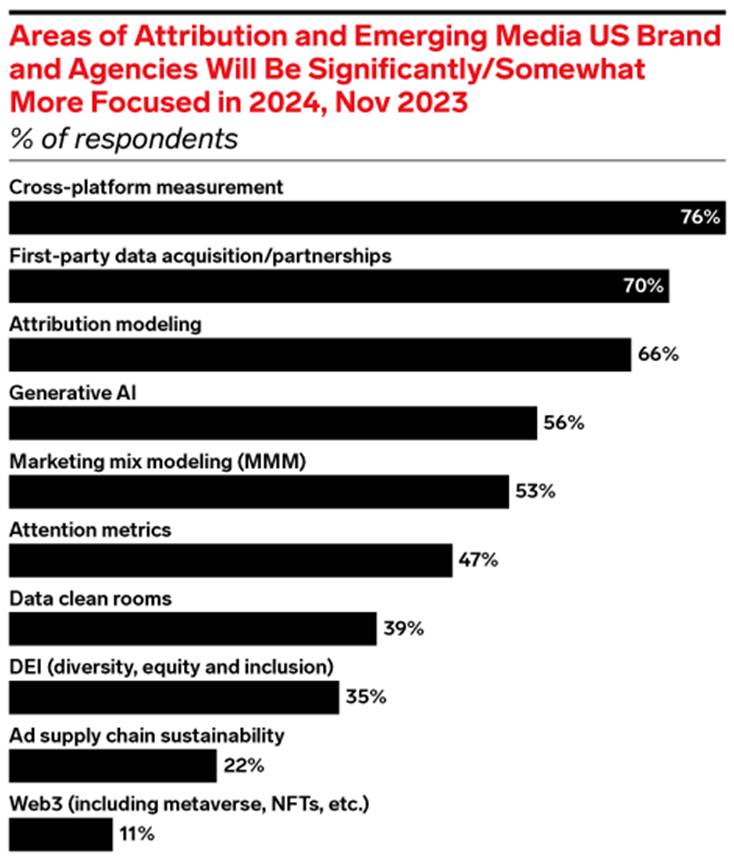

1. Viewability: the metric that hasn’t realized the party’s over and it’s time to go home. While you’re unlikely to meet many enthusiastic advocates for viewability, it still plays an important role at the intersection of delivery and observability. The role of viewability has shifted somewhat in recent years as marketers have come to realize its fallibility highlighted in the era of Made-For-Arbitrage (MFA) websites. An ad being viewable does not inherently mean it was observed, nor, critically was it was comprehended. While the comprehension metric may be a pipedream for the moment, the focus on attention as an industry standard is finally, well, getting the attention it deserves. Notably, an IAB survey conducted in November of 2023 found that 47% of US brands and agencies would be somewhat more focused on attention metrics compared to the prior year.

Attention is a complicated metric, and in lieu of invasive biometric tracking solutions, will largely remain inferred. The fact it is inferred inhibits standardization across networks and is a key limiting factor to adoption by marketers. As reported by Digiday, the Interactive Advertising Bureau (IAB) and the Media Rating Council (MRC) are teaming up to form an Attention Task Force with their eyes on standardization. The team is reportedly focused on both the standardization of approaches used by various platforms, as well as the initial certification of pioneering solutions providers such as DoubleVerify and IAS.

While the push toward standardizing attention is logical for the future of cross-surface advertising, this isn’t a universally agreed upon metric. Some detractors, such as marketing professor Byron Sharp, argue that attention metrics are not all that valuable, and only serve as a proxy metric that marketers may over-optimize toward in lieu of actual metrics that move the needle. While this may have some merits (and an overindulgence on any hero metric should be challenged) it’s a better proxy for advertising efficacy when compared to viewability for in-platform optimizations. | Digiday, Forbes

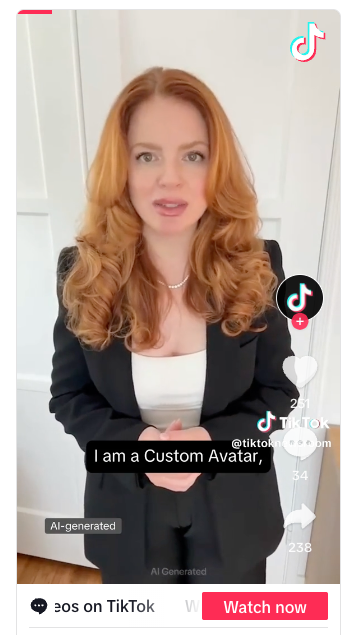

2. As investment continues to pour into AI, the questions of regulation continue to mount. Regulation is always challenging in fast-moving emergent industries; too much and you threaten to kill off innovation, too little and you allow for bad actors or nefarious use cases to proliferate. There are, of course, concerns that require immediate regulation, such as deep fakes or the exploitation of minors. But what about scenarios where humans are replicated, either visually or audibly? It’s complicated.

The scope of AI regulation is broad, from proposals that seek to require businesses to disclose all elements of AI-powered content on their websites to limits applied to the way AI can replace humans. You are likely aware of the AI-enabled creative solutions coming from Meta, Google, TikTok and the other major platforms. These solutions show incredible promise for augmenting product imagery and democratizing access to high quality product photoshoots, but there is a big problem – the imitation of humans. You may recall that TikTok earlier this year announced the launch of Symphony Digital Avatars, essentially a replacement for human influencers. Not too long after release, one of these avatars was co-opted to quote Hitler, and instructed people to drink bleach. There are, of course, plenty of non-AI humans that would willingly say such things, but it does present a core problem – and one that will impact advertisers’ use of creative solutions tied to trust.

The reality is that we’re currently operating in a world without guardrails, and while many marketers may experience a FOMO-fueled desire to go all-in on human clones, there are risk migration & ethics factors to consider here before taking the leap. While not explicitly focused on AI-generated avatars, California has recently proposed several bills addressing the replacement of human roles with AI – from potentially creating penalties for the digital clones of the deceased without consent from their estates to blocking the digital replication of actors’ likenesses. While the advent of AI creative has great potential, it is critical that advertisers take a cautious, measure-twice-cut-once approach to the use of AI-generated humans to avoid any potential for embarrassing brand experiences, or the inherent risks associated with impersonation of real people. | The Verge, AP News

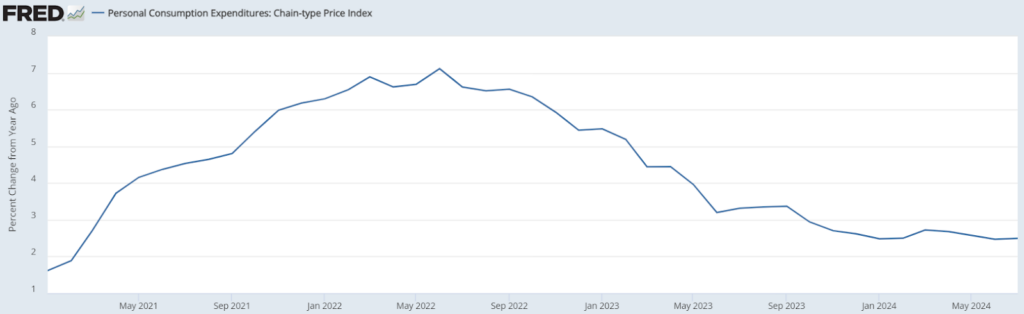

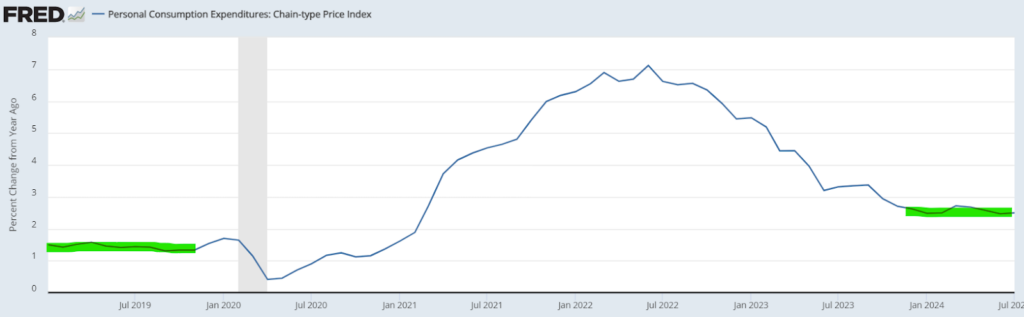

1. We told you last time about an encouraging inflation print for the month of July, which showed the Consumer Price Index (CPI) rising by 2.9% YoY. Last week brought us new data reinforcing that picture, as the Fed’s preferred PCE gauge of inflation showed a 2.5% rise YoY in July, all but cementing a reduction in the Fed’s benchmark interest rate at its next meeting in mid-September. Markets are already anticipating the reduction, particularly following Fed Chairman Powell’s declaration on August 23rd that “the time has come” to begin a process of rate lowering.

While the inflation picture is generally encouraging, it’s probably too soon to say we’re “back to normal.” PCE inflation, for all that it has come down over the past 24 months, remains a full percentage point above where it was pre-pandemic.

The reality that inflation is not quite licked is unsurprising when considering the truly extraordinary extent of monetary expansion in response to the pandemic:

The U.S. has not seen an expansion of M2 (a measure of the money supply) like we had in 2020 in at least 60 years, and it is taking time to re-anchor inflation expectations at 2%. | Bloomberg

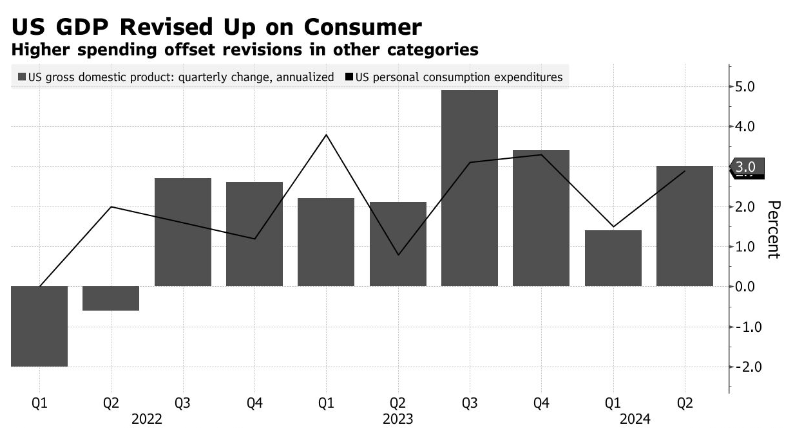

2. In more positive macroeconomic news, U.S. GDP grew at an upwardly revised 3% annualized rate in Q2, a significant jump from Q1.

A major driver of GDP is personal spending, which grew at a rate of 2.9%. The leading sectors for personal consumption were health care, housing and utilities and recreation. | Bloomberg

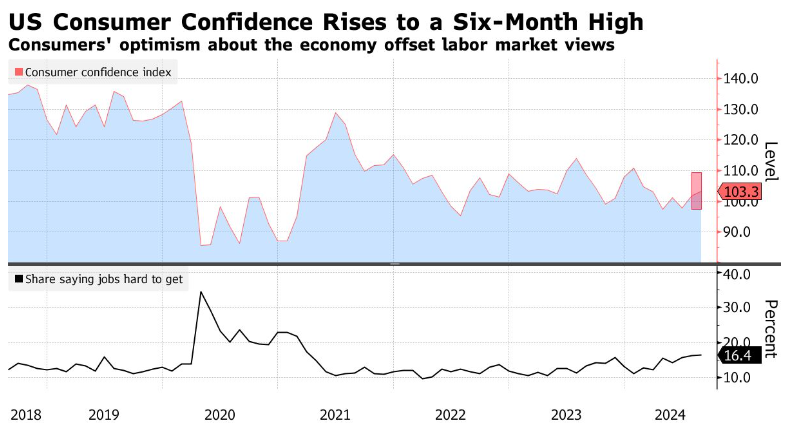

3. In line with strong GDP growth, US consumer confidence rose to a six-month high in August as more upbeat views of the economy and inflation offset waning optimism about the labor market.

As we’ve emphasized before, such short-term upticks should not obscure the fact that consumer confidence remains well below its pre-pandemic level. Despite an amazingly resilient labor market, the combination of the pandemic itself, the disruption to work patterns, and the worst inflation in many Americans’ living memory has induced a hangover that consumers have not shaken off.

As we’ve been telling you in recent months, the labor market is finally beginning to show some cracks; and it’s being noticed, with just 33% of consumers this month saying jobs are plentiful, the smallest share since March 2021 and the sixth straight decline. The share saying jobs were hard to get edged higher. | Bloomberg