From TikTok to Influencers, Social Media's Sprawling Impact on the CPG Customer Journey

Social media is now a crucial part of how consumers discover new CPG products. From brand accounts to online influencers, huge shares of the more than 3,000 CPG shoppers we surveyed in February 2023 said they turn to social along the path to purchase for day-to-day essentials.

Here we’ll unpack just some of the in-depth insights related to social media available in The 2023 CPG Customer Journey.

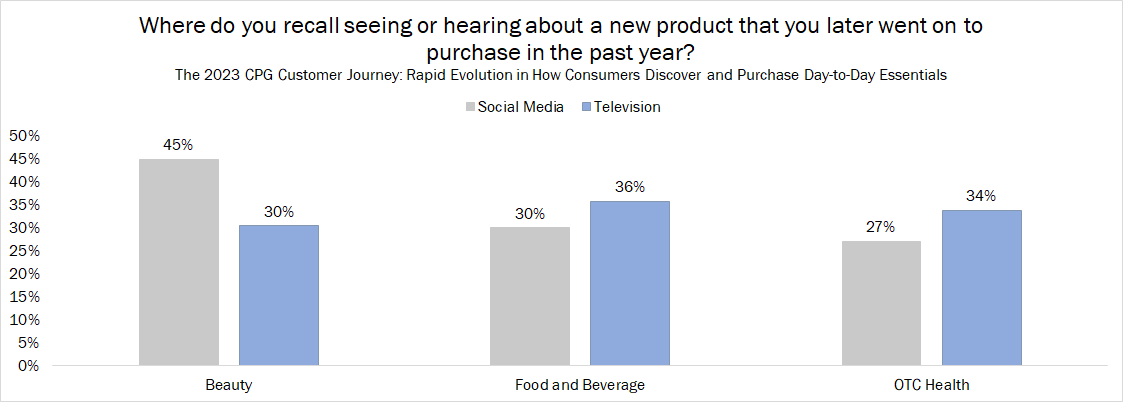

When asked where they had seen or heard about new beauty products that they later went on to purchase, 45% of beauty shoppers chose social media, a higher percentage than television! Television was the top channel for OTC health as well as food and beverage shoppers, but social media still came in second for each.

Social media topped television for product discovery across all three product categories studied for both Gen Z and millennials, highlighting the importance of the channel to younger generations. Incredibly, 65% of Gen Z beauty shoppers recalled seeing or hearing about beauty products on social media that they later went on to purchase.

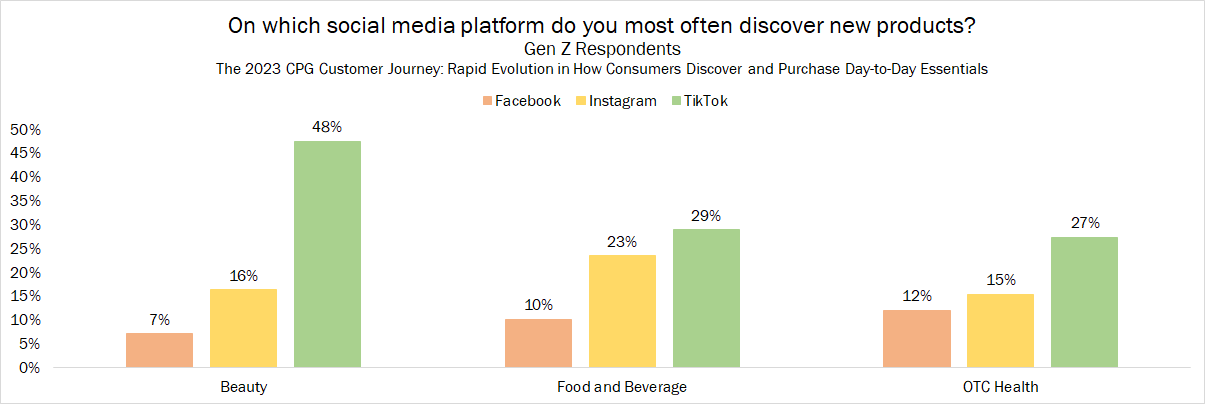

Turning our attention to which social platforms are most influential to product discovery, Facebook won out in every product category studied when looking at all respondents. This is unsurprising given its status as the most used social app in the US.

However, zooming in on Gen Z, TikTok and Instagram outpaced Facebook across all three product categories.

Thus, reaching CPG shoppers effectively is hugely different from one generation to the next when it comes to which platforms are likely to drive product awareness. This is also the case when evaluating the effectiveness of online influencers and brand social accounts.

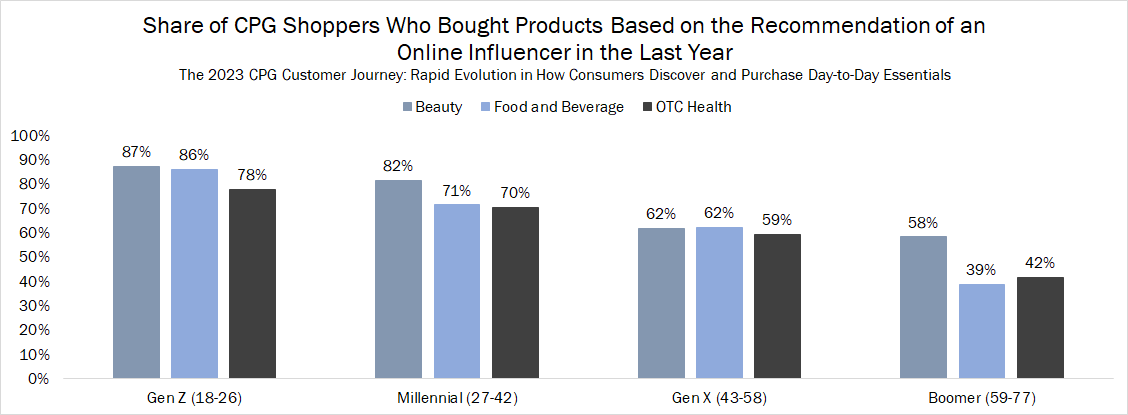

Across beauty, food and beverage, and OTC health products, Gen Z saw the highest share of shoppers who said they had bought a product in the last year based on the recommendation of an online influencer. At least 75% of Gen Zers in each product category bought a product recommended by an influencer. By comparison, less than 60% of Boomer respondents in each category had purchased a product recommended by an online influencer.

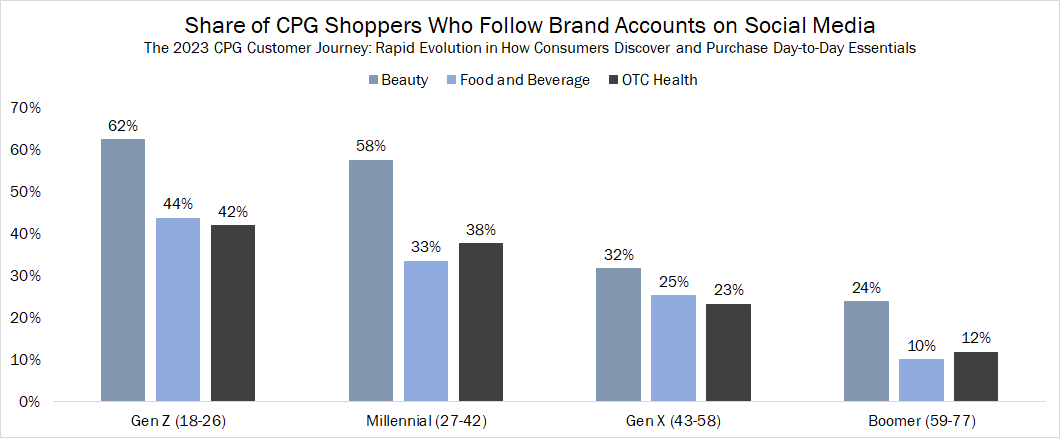

Similarly, younger generations are much more likely to follow brand accounts on social media. Boomers were less than half as likely as Gen Zers to follow brand accounts in each of the product categories studied.

In terms of what brand followers are most looking for from such accounts, the most popular answers were to hear about new products, to hear about promotions/discounts, and for details about the products those brands sell. While entertainment was a reason that many shoppers selected for following brand accounts, it was less important than all other possible reasons presented to respondents across all three surveys.

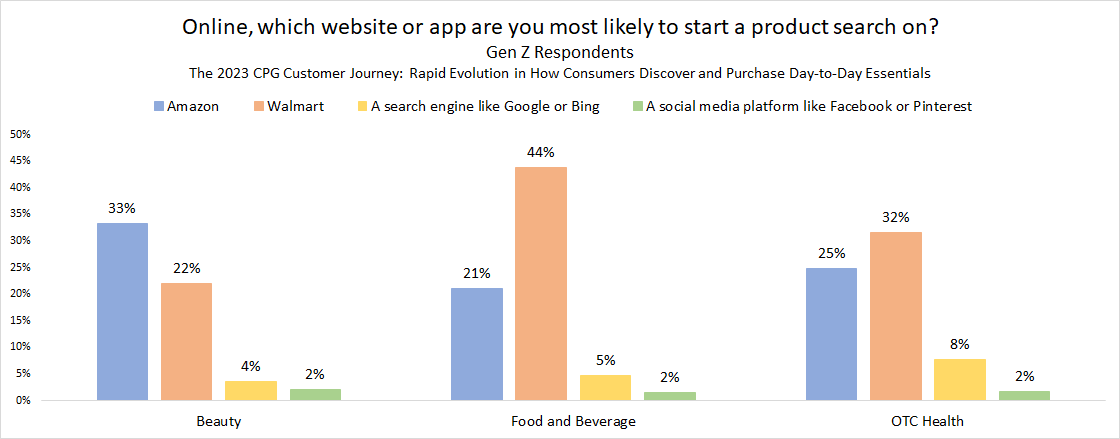

Google data has indicated that about 40% of younger people would go to TikTok or Instagram, rather than Google, when looking for a place for lunch. When it comes to CPGs, however, social media is far down the list of where young people search first, trailing search engines, and particularly large retail sites.

Looking at the share of respondents who first turn to a search engine like Bing or Google for product searches compared to those who would first search on social media, search engines far outpace social platforms across product categories, even for Gen Z respondents. Both social platforms and search engines lag far behind retail sites like Walmart and Amazon when it comes to initial product searches in these categories.

In the case of OTC health products, Gen Z respondents were more than four times as likely to start a search on a search engine than on a social media platform. This will be a trend to keep an eye on as social platforms increasingly provide search advertising capabilities.

Social media is now the most important digital channel for first hearing about or seeing new CPG products across the beauty, food and beverage, and OTC health categories. However, the importance of influencers, brand social accounts, and specific platforms varies significantly by the age of shoppers.

As such, CPG brands need a strong understanding of who they’re aiming to reach through social media, and should create targeted campaigns that provide well-tailored messaging. This is particularly true given that a majority of respondents in each of the three surveys expressed a desire to see ads that are either personalized to them based on past actions or that appeal to groups that share their demographics or general interests. A minority of respondents preferred ads that appeal to the most people.

The importance of social media is likely to grow moving forward. Marketers should make sure they’re putting their best foot forward as its influence balloons across key CPG categories.