2022 Holiday Shopper Study

How Will Economic Uncertainty Impact Consumer Behavior?

How Will Economic Uncertainty Impact Consumer Behavior?

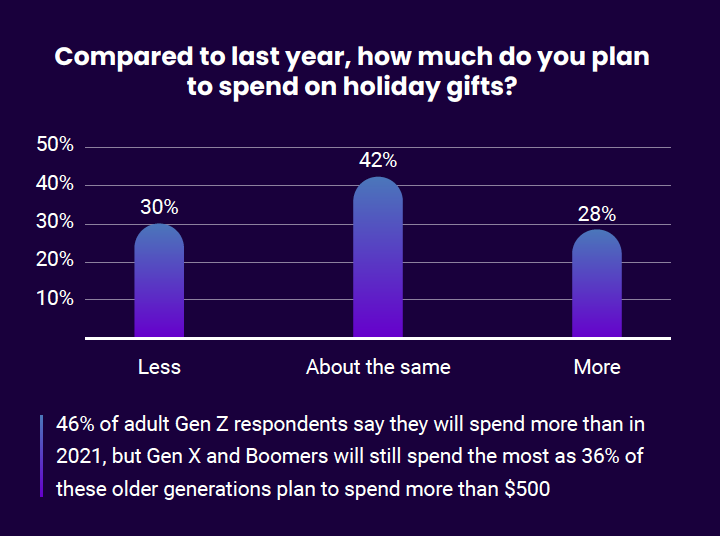

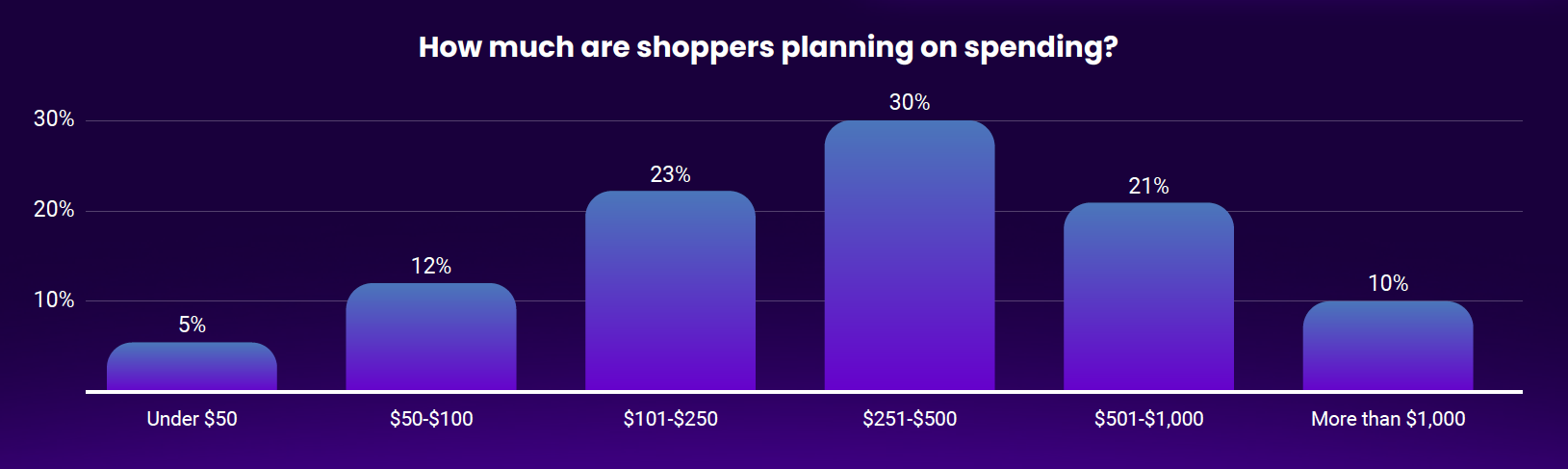

The holiday shopping season is now underway, and many consumers are gearing up for another buying spree. 60% of over 1,000 US holiday shoppers surveyed by Tinuiti in August plan on spending over $250, with 10% expecting to spend more than $1,000. Compared to last year, a plurality of shoppers (42%) expect to spend a similar amount for the holidays in 2022, with the remaining 58% split nearly evenly between those who expect to spend more and those who expect to spend less.

Note: The data below is from 2022. Head here to see our most recent report.

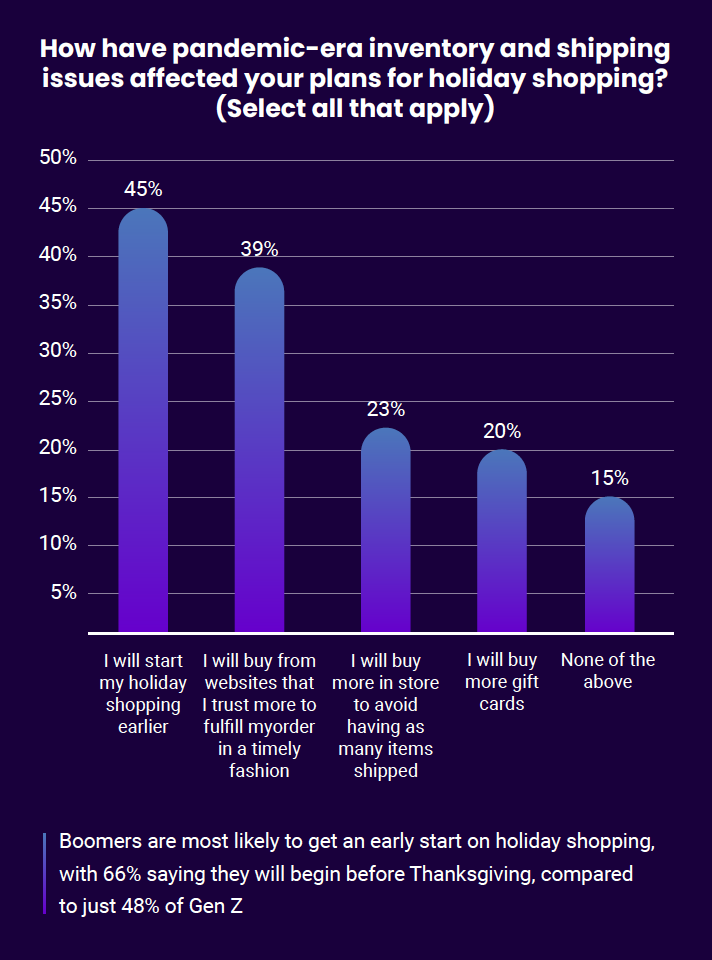

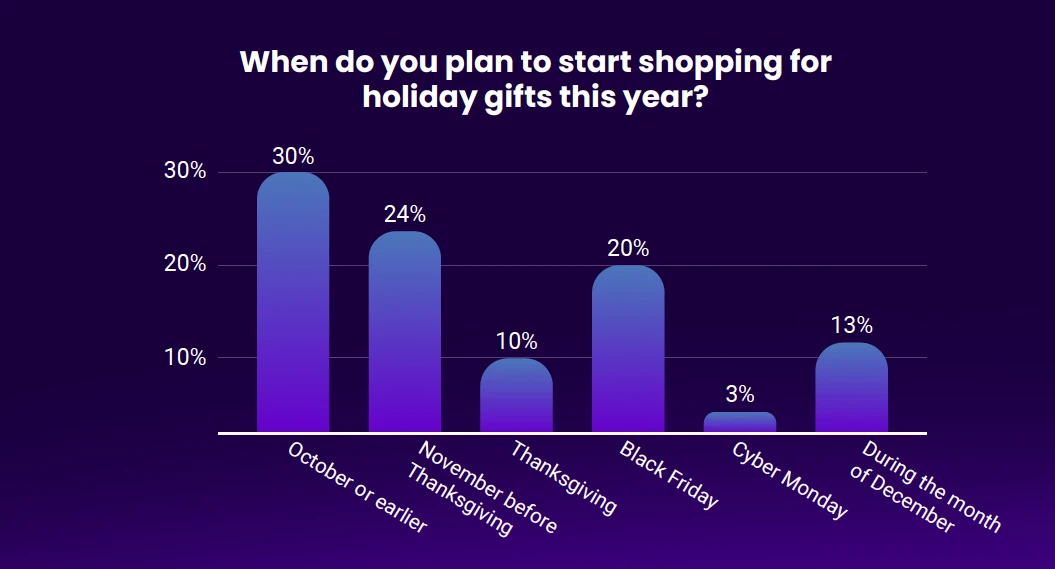

Asked when they would start shopping for the holidays this year, 30% of all respondents said October or earlier. Combined with 24% who expected to start in November before Thanksgiving, over half of US consumers expect to have made at least some holiday-related purchases by the time they carve the turkey. Many respondents attributed at least some of the desire to shop earlier to pandemic-era shipping and inventory issues, with 46% saying these issues would cause them to start shopping earlier.

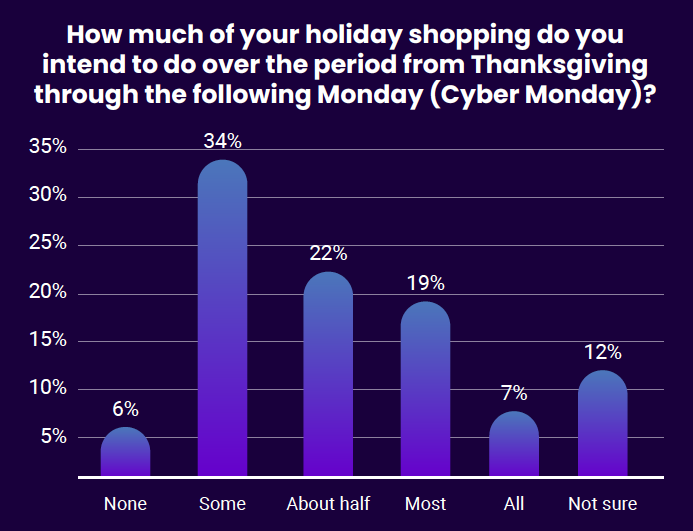

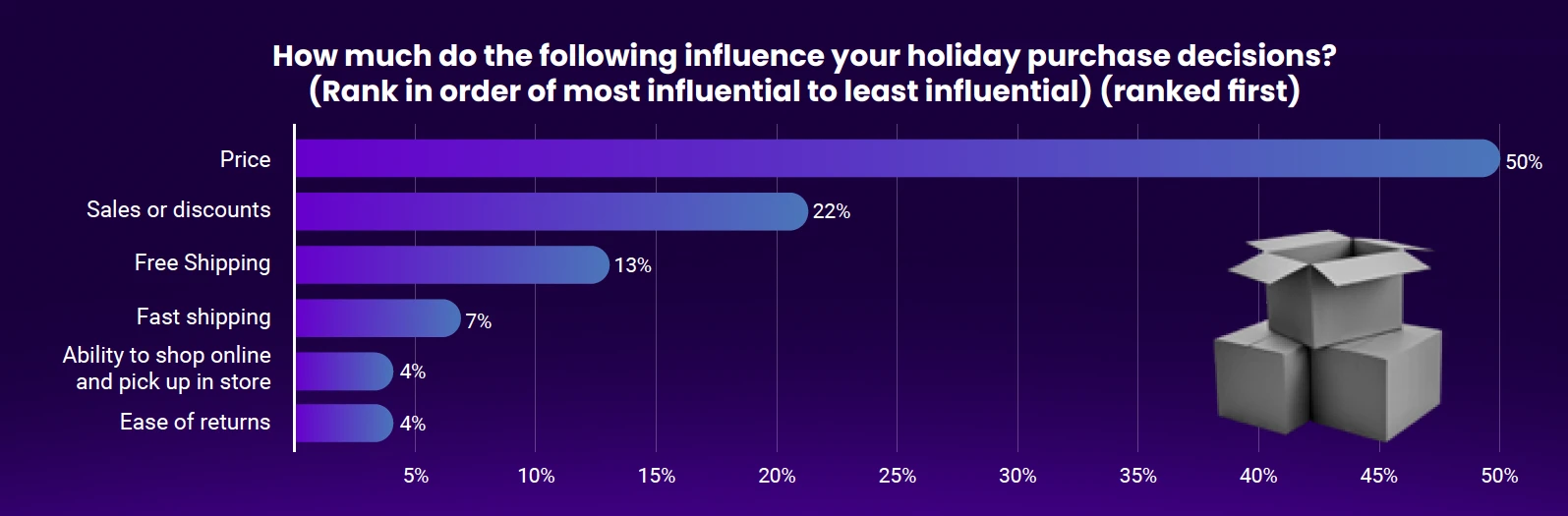

The Cyber Five period from Thanksgiving through the following Monday (Cyber Monday), continues to be a significant stretch for many US shoppers, as 48% of those surveyed expect to complete at least half of their total holiday shopping over these days. Combined with the fact that 30% of all respondents plan to kick off holiday shopping on either Thanksgiving or Black Friday, it’s clear the period around Turkey Day continues to be a mile marker for many American consumers, despite recent holiday promotions kicking off earlier than in years past. Fully 22% of shoppers cite sales or discounts as the factor most influencing their holiday shopping.

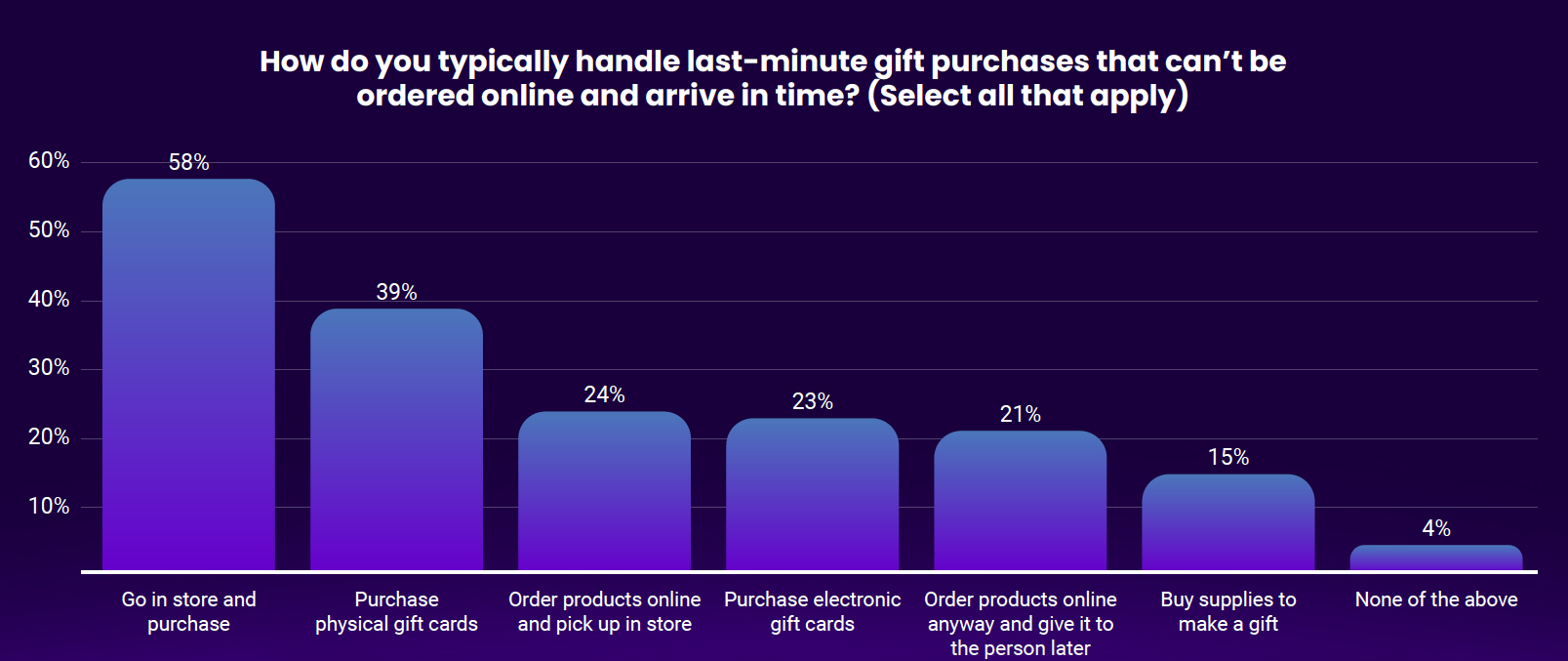

While many respondents expect to have shopping underway before Thanksgiving, 13% don’t plan on starting before December. When buying last-minute gifts, 58% say they typically go in store to purchase, but online channels still stand to play a meaningful role in the homestretch. 24% of respondents say they typically order last-minute gifts online and pickup in-store, and 23% buy electronic gift cards.

Rising product prices have been a major concern for many shoppers over the past year, and survey respondents expect inflation to have a meaningful impact on how they approach the holidays. Half expect to shop around more in light of inflation, and 30% expect to cut back on non-holiday expenses. Interestingly, 13% plan on using buy now, pay later services to allow them to delay payment, and 11% believe they will need to run a higher balance on credit cards.

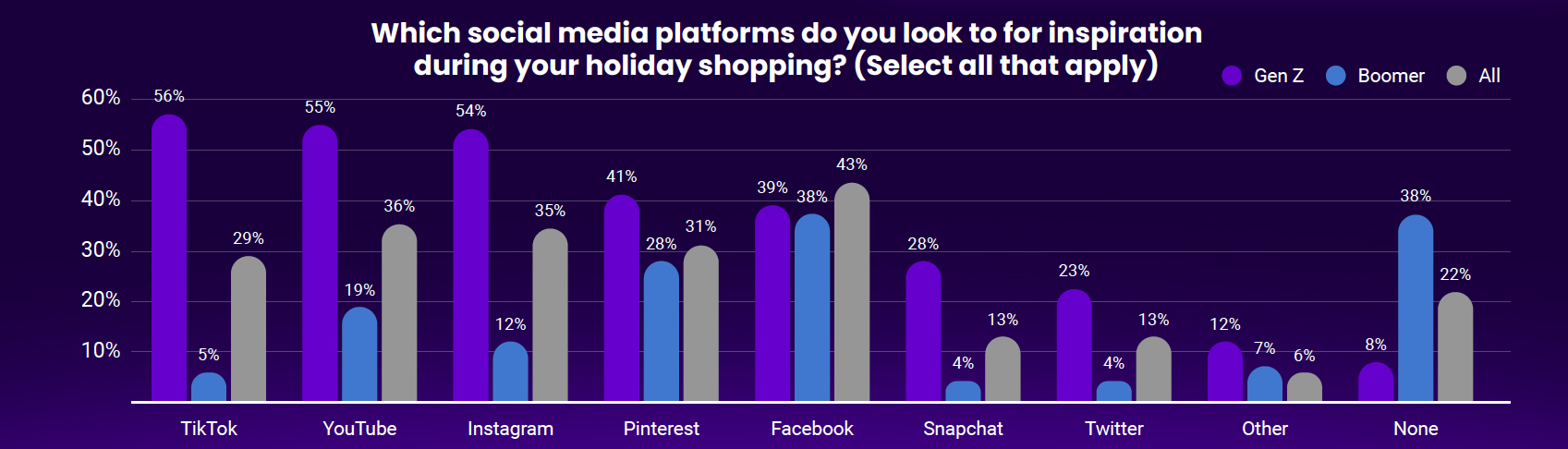

When asked which social media platforms they look to for inspiration during holiday shopping, respondents most frequently chose Facebook, followed by YouTube and then Instagram. Only 22% of those surveyed did not expect to look to social media platforms for gift ideas, as these networks help with product discovery for many consumers.

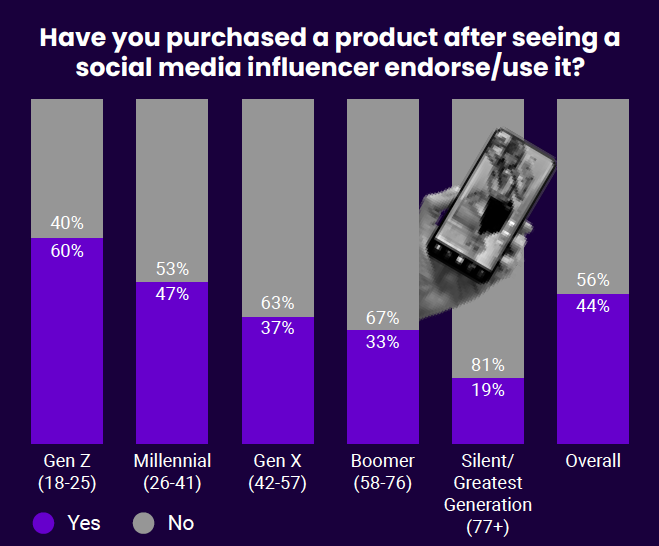

Influencers on these networks will also likely be important this holiday season, with 44% of holiday shoppers saying they’ve purchased a product after seeing a social media influencer use or endorse it. Brands should seek out well-positioned influencers to help enhance their product placement across social platforms this winter.

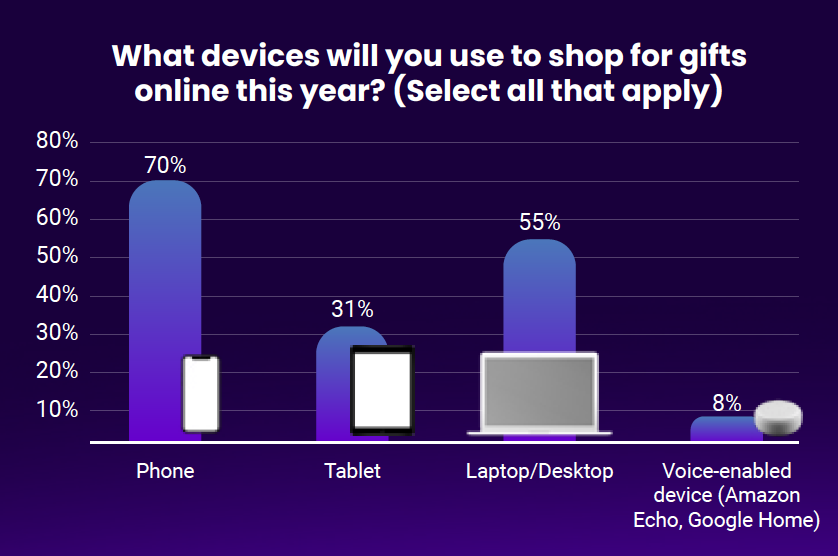

Just under 14% of surveyed consumers expect to shop for holiday gifts solely online this year, compared to just 8% who plan on shopping only in stores. More than three quarters of holiday shoppers intend to do at least half of their shopping online. When asked which devices they intend to use to shop for gifts, phones were the most popular at 71% of respondents, followed by desktops/laptops at 55%. Just 8% plan on using voice-enabled devices, such as Amazon Echo and Google Home, as these devices continue to play only a minor role in product discovery for most consumers.

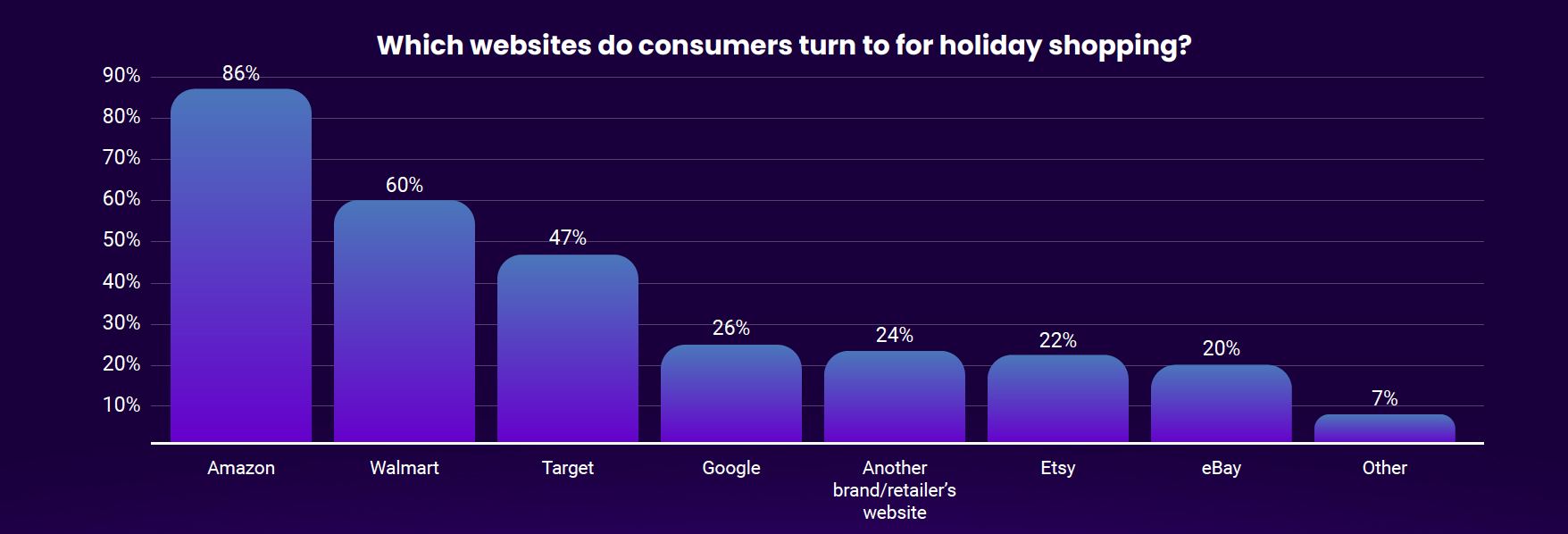

Fully 86% of holiday shoppers expect to visit Amazon when shopping online for gifts, by far the highest share among retail websites, as the ecommerce giant remains the first online stop for many US consumers. Walmart came in a distant second at 60%, followed by Target at 47%. Interestingly, just 26% of those surveyed expect to head to Google when shopping online for gifts, though this share varies significantly by age group.

Tinuiti surveyed 1,053 online respondents ages 18 and older between August 25, 2022 and August 26, 2022, via the Pure Spectrum Insights platform. All respondents were screened with the question, “Are you going to shop for holiday gifts this year?” and those who are not going to shop for holiday gifts did not participate.

This survey was commissioned by Tinuiti and conducted by Pure Spectrum, which uses PureCore, proprietary technology for gathering quality responses. Consumers receive no monetary payment for their participation. More information on Pure Spectrum’s methodology can be found at https://www.purespectrum.com/insights/.

Check out our most recent Holiday Shopping Trends Report for more exclusive insights.