Amazon Growing Its Impression Share in Google Shopping Auctions

If you read our recent Google Ads Benchmark Report for Q2 2020, you know all about the significant year-over-year drop in average cost per click (CPC) many advertisers saw last quarter. Part of the drop in CPC can be attributed to Amazon exiting the auction for Shopping and text ads, a story we broke back in March and followed up on in June when Amazon started reactivating ads on Google.

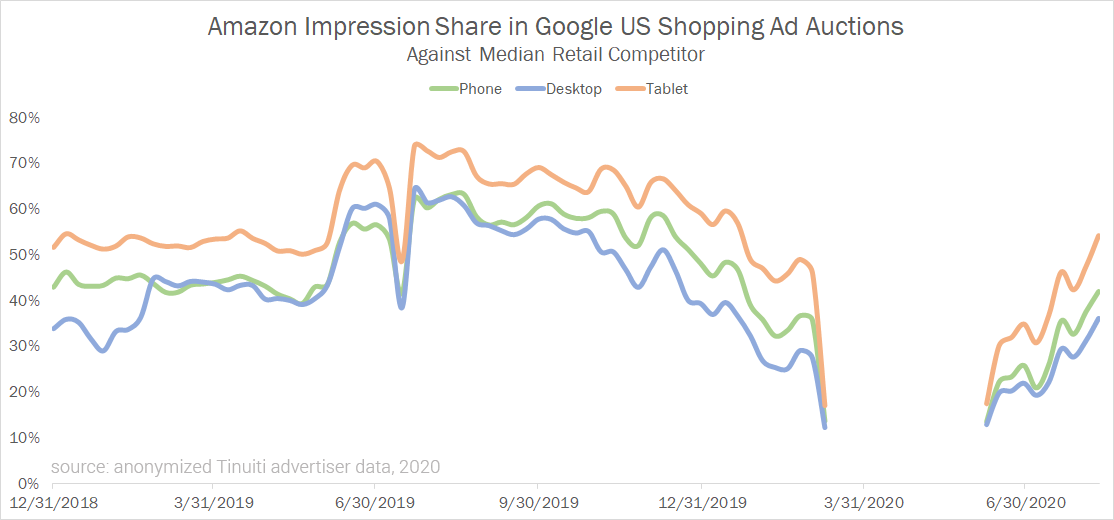

Since its reemergence, Amazon’s paid search presence has picked up across device types and is nearly in line with its early-2020 highs for Shopping. However, its impression share remains well below the highs seen last July and August for Shopping and continues to lag early-2020 levels for text ads.

Across desktop, phones and tablets, Amazon’s Shopping ads impression share against the median Tinuiti retail competitor in the US has grown rapidly over the last several weeks. By the second week of August, Amazon was back to at least 85% as high of an impression share as the highest figures observed in 2020 prior to its extended pause beginning in March across device types.

It’s important to note that, for reasons unclear, Amazon’s impression share was already trending down beginning in the first half of last December and into the start of the year. Still, Amazon’s January 2020 impression share was roughly equal to its January 2019 impression share, as 2019 saw Amazon become much more prevalent starting in the middle of the year prior to trailing off in December.

While in the early goings of its June 2020 return to Google Shopping auctions Amazon appeared to be only very lightly visible in some product categories like CPG and health supplies which have seen huge surges in online demand during the pandemic, it’s quickly becoming more prevalent against Shopping advertisers in these categories as well.

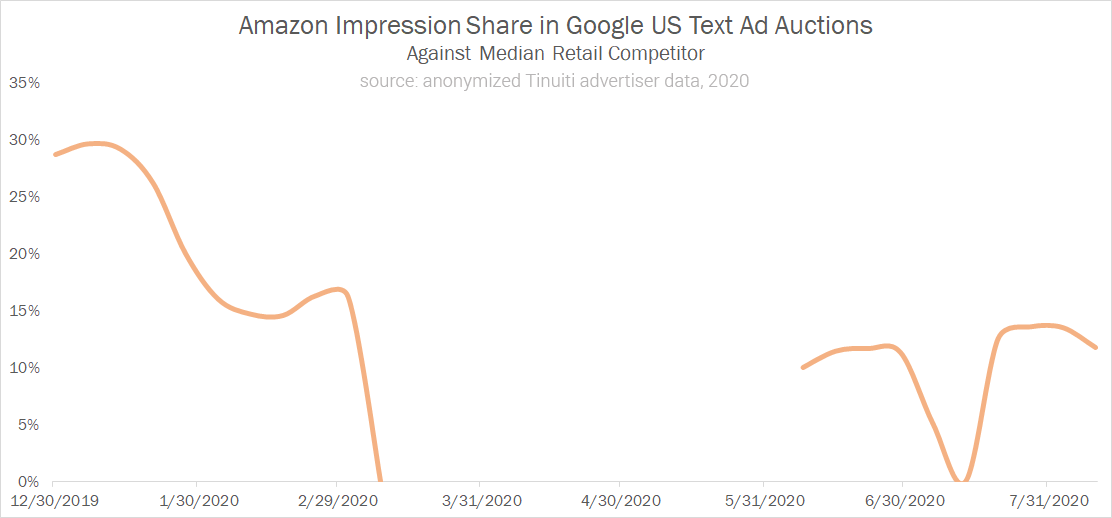

Of course, what made Amazon’s pause in March even more meaningful was that it also extended the pause to text ads, for which it is now also buying up ad real estate once again. However, Amazon’s impression share hasn’t picked up in text ads to the same extent that it has for Shopping so far.

In addition to the median impression share coming in well below what was seen in early January, it’s important to note that about 20% of the advertisers that saw Amazon as a text ad competitor in the first four weeks of the year aren’t currently seeing Amazon as a text ad competitor.

All of these trends bleed into perhaps one of the biggest questions for retailers in paid search…

Q4 is right around the corner, and this year’s holiday shopping season is likely to produce some interesting trends with all of the unique variables affecting 2020.

For one, it’s reported that Amazon is likely to hold its Prime Day event in October. Last year, Amazon pulled out of Google Shopping auctions during the core two days of the event. Will the same happen this year? I’d predict yes.

It will also be interesting to see how Amazon’s paid search strategy changes around the Cyber Five period between Thanksgiving Day and Cyber Monday. Last year, its impression share appeared to hold roughly steady through this period but picked up about a week into December, and it’s possible that that holds true once again.

However, with many large stores closing for Thanksgiving Day and the very real possibility that shoppers will think twice about heading to brick-and-mortar stores for Black Friday deals during a pandemic, online demand will likely soar. Will Amazon, and perhaps the big-box retailers that are closing for Thanksgiving Day, lean into paid search to capture as much online demand as possible? Advertisers should brace for a potentially very competitive environment heading into the winter months.

This year has already been a wild ride in many ways, and Amazon’s moves in Google search auctions have been no exception. Particularly given the fact that the pandemic is still hugely affecting everyday lives and the potential for a tough resurgence this Fall, its tough to guess whether or not Amazon may find itself refocusing on essential products once again or if it will be in a position to ramp up advertising spend.

As always, Google advertisers should focus on getting the most out of their campaigns by embracing the fundamentals of management, regardless of what Amazon and other major players are forced to do this winter. That said, performance will almost certainly be significantly impacted by what Amazon does end up doing.