Amazon Regains Dominant Google Shopping Visibility Following Prime Day Disappearing Act

Leading up to this year’s two-day Prime Day event we reported that Amazon’s Google Shopping impression share skyrocketed as a result of Amazon aggressively ramping up its Product Listing Ads (PLA) presence. This seemed like a logical strategy to build visibility ahead of the big sales ‘holiday,’ but could have been unrelated to the event specifically.

Come Prime Day, however, Amazon seemed to vanish entirely from Google Shopping auctions in the U.S. How should advertisers think about this in light of Amazon’s turbulent Google Shopping history?

Huge thanks to Tinuiti Senior Specialist Alison Nguyen for her contributions to this post.

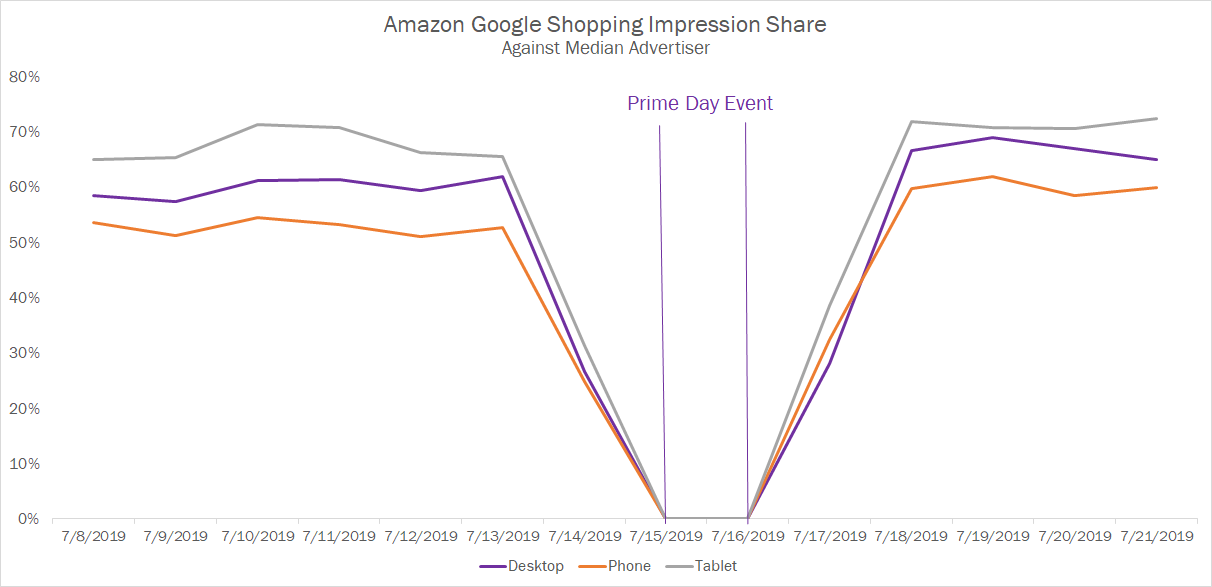

Taking a look at a number of U.S. retailers that compete against Amazon in Google Shopping across multiple product categories, the eCommerce giant completely vanished from Google Auction Insights reports across all three device types for the entirety of both July 15 and 16.

By July 18, it was right back to the impression share observed prior to its Prime Day hiatus and has remained there to this day. Amazon appeared to mostly hold steady against advertisers in terms of text ad impression share, though did vanish from auctions against some retailers coinciding with Prime Day.

It’s difficult to definitively say why Amazon went completely dark during its big clearance event, but given its expansive Shopping presence both before and after, it seems unlikely that the price tag of ad clicks was what turned it away. My hunch is that it decided it wasn’t willing to share product info with Google during such a sensitive time, but there could be other explanations as well.

Amazon only started bidding on Google PLAs at the very end of 2016, following several years in which it refused to pay for Google’s product ad format despite PLAs accounting for a huge share of retail paid search growth during that time. While its visibility in the early goings was limited and seemed mostly centered on home goods products, Amazon’s presence has grown over time, albeit with some fits and starts.

For example, Amazon’s U.S. Shopping campaigns went totally dark for two weeks last year between late April and early May. Its Shopping ads were up again by late May and active going into Prime Day, but with impression share roughly equal to what was observed prior to the campaign pause. There was nothing similar to this year’s June surge, and while Amazon’s impression share did decline during the course of Prime Day 2018, it was still active to an extent and did not appear to turn U.S. ads off entirely like this year.

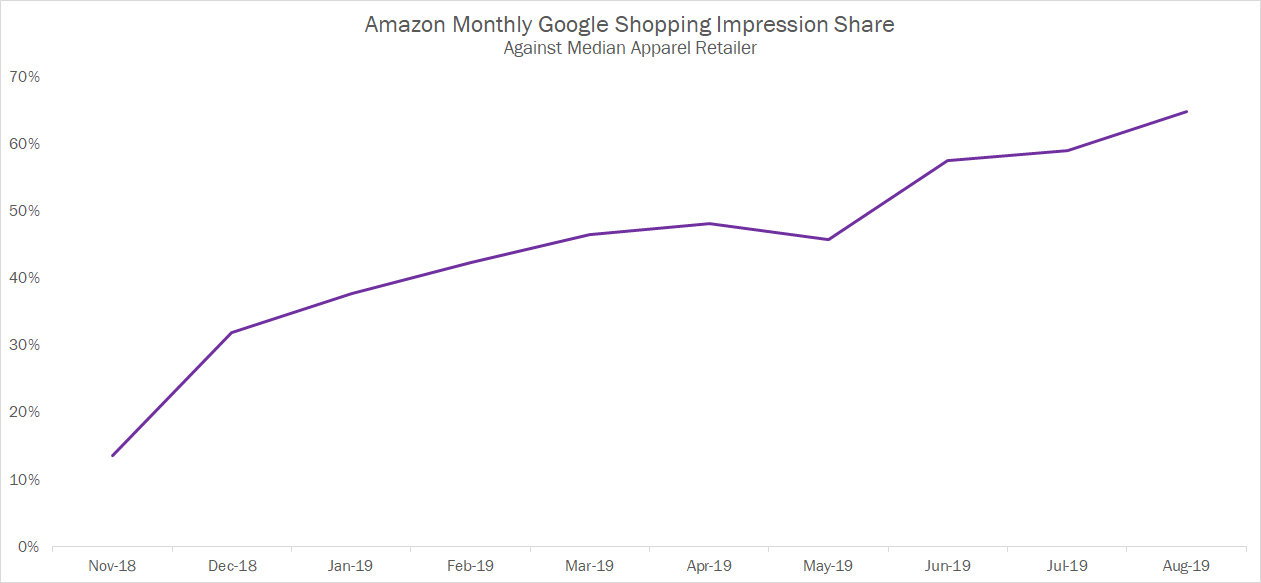

Amazon has also branched out over time in terms of the product categories it goes after in Google Shopping. The most notable example of the past year is apparel, where it went from virtually non-existent through November 2018 to its current station as the number one competitor for essentially all apparel advertisers studied in less than a year.

If last year’s stint away from Google Shopping indicated that Amazon was second-guessing its investment in the format, all of the evidence since then has indicated that Amazon is now fully leaning into Shopping and expanding its presence.

The most common response from retailers in light of this information is to ask how they can go about competing with Amazon, but the answers typically look a lot like how retailers should go about optimizing Shopping campaigns in general.

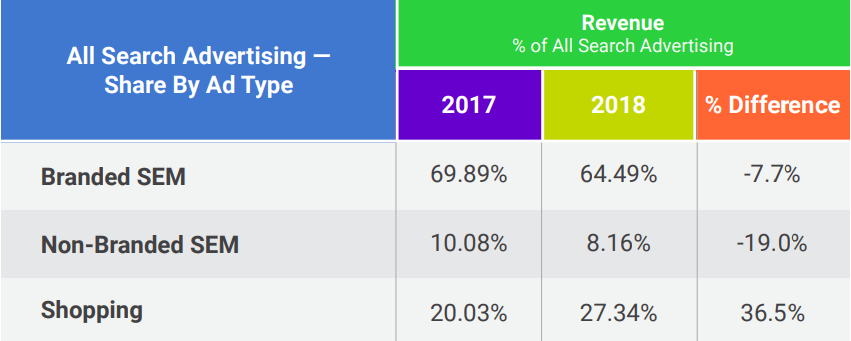

The first is to acknowledge that the paid search landscape has changed dramatically over the past few years, with Google Shopping Ads now dominating paid search growth and click share for retailers, often at the expense of text ads. The chart below from Tinuiti’s 2019 Mobile Momentum Report demonstrates this dynamic, as Shopping’s share of paid search-driven revenue grew significantly Y/Y while both branded and non-branded text ads fell – particularly non-branded.

It’s likely no coincidence that Amazon is ramping up (Prime Day vacation excluded) in Google Shopping after Google rapidly expanded the presence of Shopping units towards the end of last year. Almost no retailer, even one as big as Amazon, can truly compete in paid search in 2019 without a robust Google Shopping program. That means:

The last point is particularly important to keep in mind for retailers with a brick-and-mortar presence, given Amazon and other eCommerce pure plays do not have physical stores. For queries which carry clear local intent, such as those that include ‘near me’ or other cues, Google is very likely to feature LIAs in prominent positions in the Shopping carousel.

It’s common for brick-and-mortar advertisers to achieve LIA impression shares that are consistently at least 50% higher than their impression shares for other Google Shopping campaign types. Of note, however, is that Amazon’s impression share is still typically very strong even against LIA campaigns.

Heading into the holiday season this year, it’s tough to know how Amazon’s Shopping strategy might shift. While Amazon did make its first significant move into apparel last November, its presence remained relatively stable throughout the winter against some advertisers that have long seen it as a competitor in Shopping.

It’s also difficult to definitively quantify the effects of Amazon’s presence in Shopping Auctions. For Google, it’s certainly a benefit to have such a large advertiser bidding on these ads, and it should help to drive up the cost of traffic for the auction-based format when Amazon impression share rises. Amazon ads may also pull some incremental traffic that would otherwise not have gone to a Google Shopping ad at all if Amazon were not present in the carousel, owing to its significant brand recognition and legions of Prime subscribers that might seek it out.

For advertisers, surges in Amazon spend likely put upward pressure on CPC growth and downward pressure on click and revenue growth. However, with regular shifts in competition, device usage, SERP layout, and other important variables, no time period is really clean enough to get a read on exactly what Amazon does to the performance of its competitors in the auctions it enters. It’s safe to assume that increases in Amazon presence are not good for its Google Shopping competitors.

Still, as mentioned earlier, advertisers saw ad revenue driven by Google Shopping rise 37% Y/Y in 2018, and many have seen significant growth in 2019 as well even with Amazon’s strong presence. There is still huge opportunity in Google Shopping, despite Amazon’s growing shadow.