Digital Ads Benchmark Report Q3 2025

Quarterly Trends Across Google, Meta, Amazon, and More

Quarterly Trends Across Google, Meta, Amazon, and More

The Tinuiti Digital Ads Benchmark Report is based on anonymized performance data from advertising programs under Tinuiti management, with annual digital ad spend under management totaling over $4 billion. Samples are restricted to those programs that have remained active and maintained a consistent strategy over the time periods studied. Unless otherwise noted, all figures are based on same-client growth. The trends and figures included are not meant to represent the official performance of any advertising platform or the experiences of every advertiser.

Note: The data below is from Q3 2025. Head here to see our most recent report.

Tinuiti is the largest independent performance marketing firm across Streaming TV and the Triopoly of Google, Facebook, and Amazon, with $4 billion in digital media under management and over 1,000 employees.

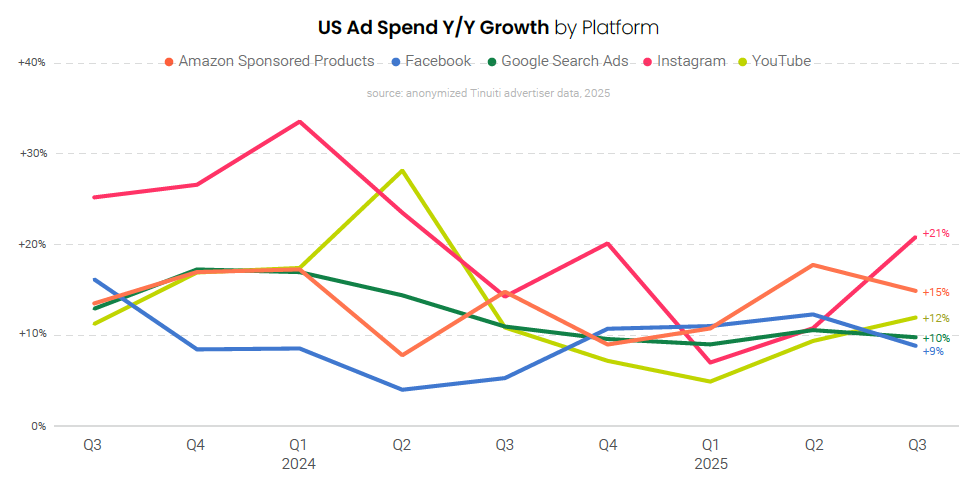

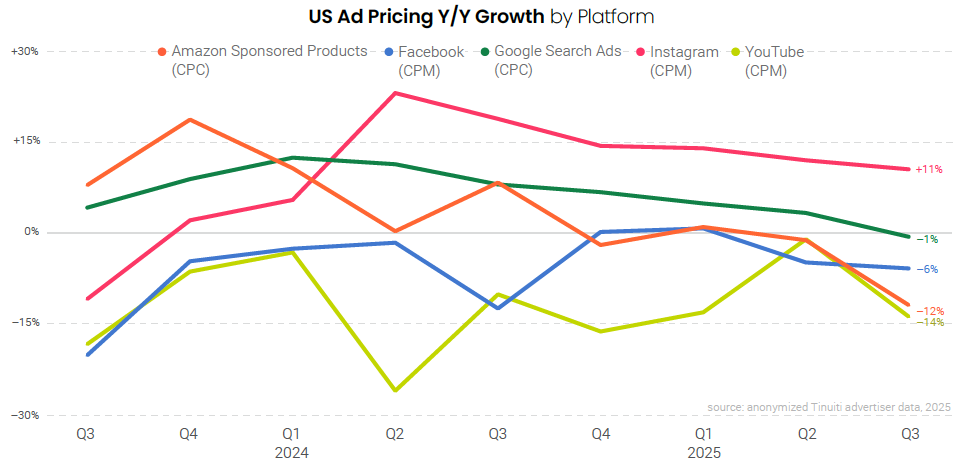

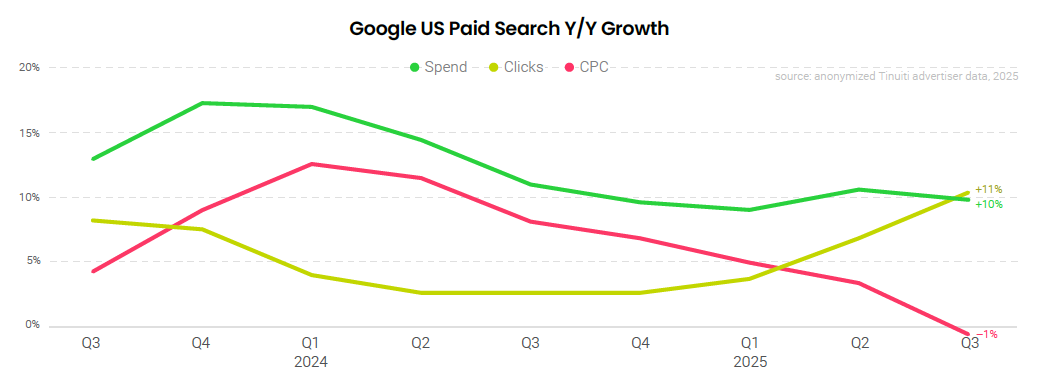

Ad spending growth trends were mixed across the largest US digital ad platforms in Q3 even as Facebook, Instagram, Google search, YouTube, and Amazon Sponsored Products all saw weaker pricing growth. While all but Facebook saw stronger volume growth in the quarter, only Instagram and YouTube were able to deliver an acceleration in spending growth.

While some advertisers have been forced to adjust budgets as a result of higher US tariffs, ad spend on the whole has not been clearly impacted by tariffs specifically to this point.

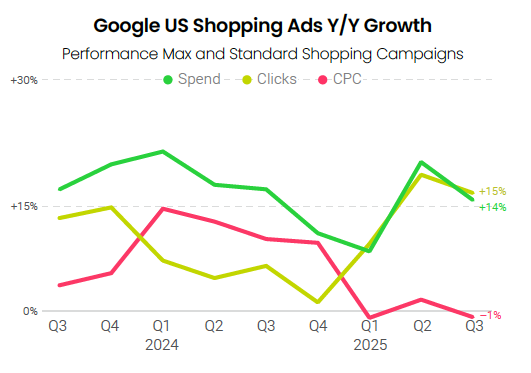

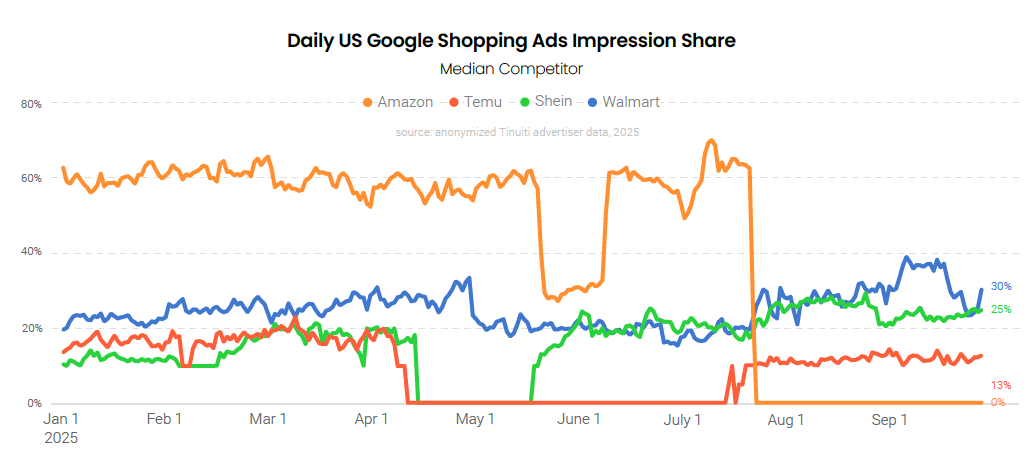

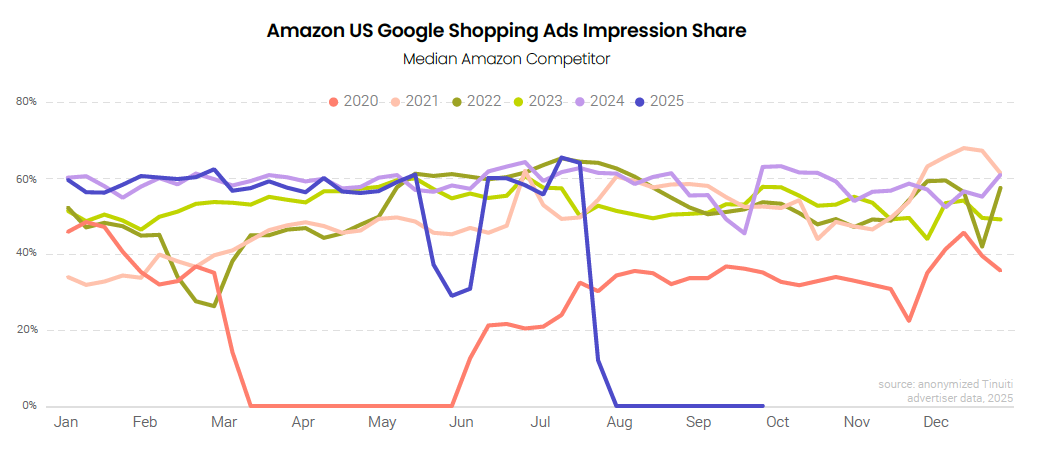

For many Google advertisers, Amazon withdrawing from US Google shopping auctions in late July likely contributed to strengthening click growth and weakening cost-per-click growth trends as the ecommerce giant left a large vacuum for its competitors to fill. While Temu and Shein were back in Google shopping auctions in Q3, after having dropped out for much Q2, Amazon’s competitive presence in Google’s listings has historically been much more significant. Overall, Google search ad spending was up 10%, with click growth rising to 11%, but CPCs down 1%.

Not only did advertisers see strong 15% growth in Google shopping clicks, but text ad click growth also jumped from a 3% decline in Q2 to a 6% increase in Q3. This is particularly interesting because Amazon is still active in text ad auctions, but its retreat from shopping auctions may also be leading more searchers to scroll past product carousels and engage with text ads further down the results page.

The ultimate reasoning behind Amazon’s exit, and what that might mean for the duration of its absence in the US, is difficult to confidently assign for those outside of Amazon. Interestingly, Amazon remains active in Microsoft shopping ad listings, putting questions to speculation that its Google withdrawal centers around concerns over feeding its competitor’s AI algorithms. Further complicating matters is the fact that Amazon reactivated Google shopping ads in international markets in August.

Although YouTube ad inventory is increasingly purchased through other campaign types like Demand Gen and Performance Max, standard YouTube video ad campaign spending was still up 12% year over year in Q3. Shorts have been a significant contributor to YouTube growth, accounting for nearly a quarter of segmented spending in Q3. Although Shorts is a mobile-friendly format, TV screens generated nearly half of Shorts ad spending in the quarter.

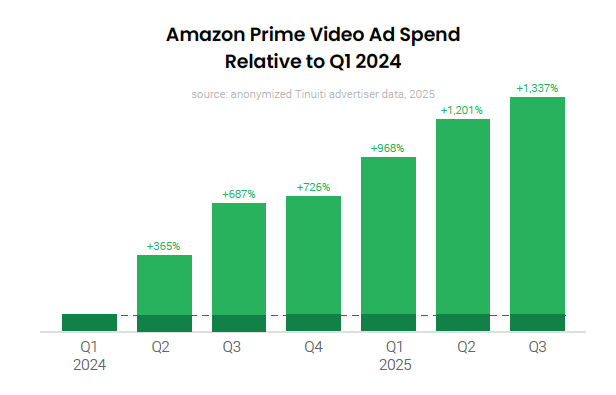

Outside of YouTube, other streaming video platforms saw 11% growth in ad spending, which was slower than growth rates earlier in the year. Launched in Q1 2024, Prime Video ads are still seeing increased investment from advertisers but not contributing as much to growth rates now that early adopters are running up against stronger year-ago comps.

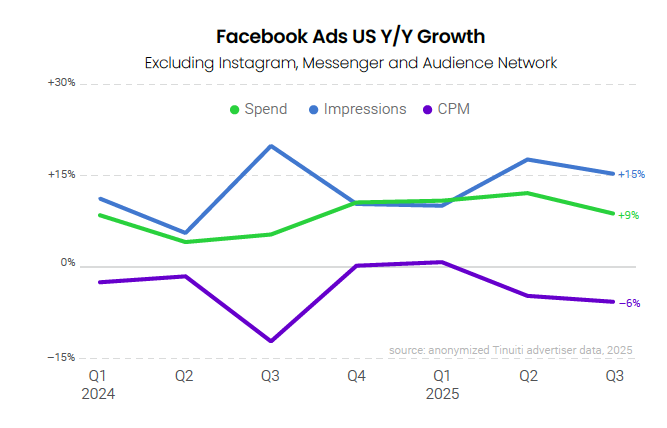

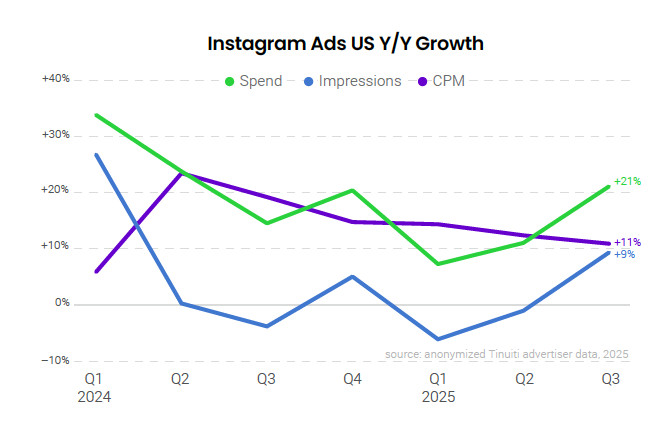

Meta’s Facebook and Instagram have both seen a growing contribution to impressions from Reels inventory, which has helped boost spending growth but put downward pressure on pricing over time. For Facebook, impressions were up 15% in Q3, but that was offset by a 6% decline in CPM, leading to 9% growth in spending. Instagram pricing growth has decelerated each of the last five quarters, but remains positive, and with impression growth accelerating in Q3 to 9% year over year, spending growth improved to 21%.

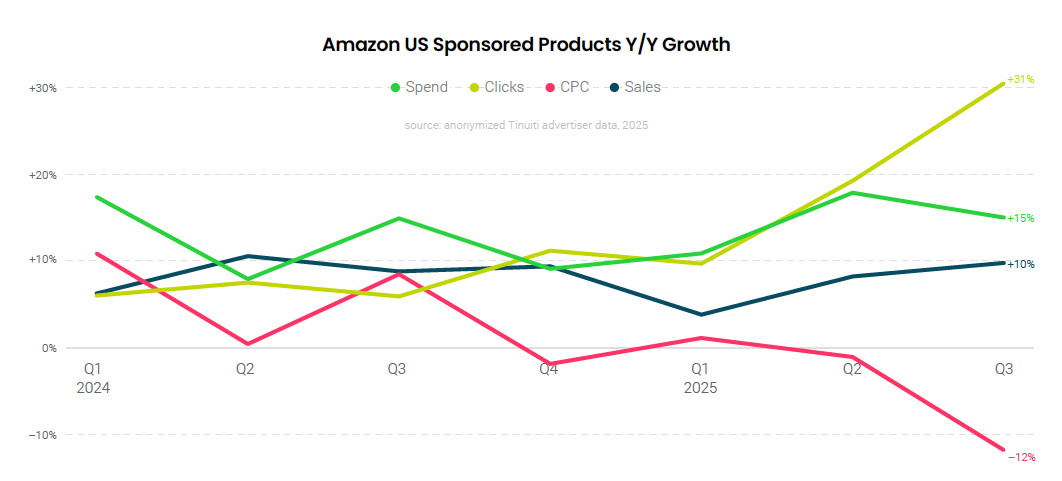

Volume growth for Amazon’s primary Ad Console format, Sponsored Products, did not appear to suffer from Amazon’s absence in Google Shopping auctions. In fact, the format saw click growth spike to 31% year over year, with spend growth decelerating just slightly to 15% on a tougher year-ago comparison. With Amazon out of Google’s listings, users may be conducting more searches on Amazon itself, rather than navigating from Google.

Sponsored Products ads also did well for Walmart in Q3, with spending up 48% year over year. Walmart Sponsored Products were able to buck the trend of weaker pricing growth with average CPC growing 23% year over year, up from 15% a quarter earlier.

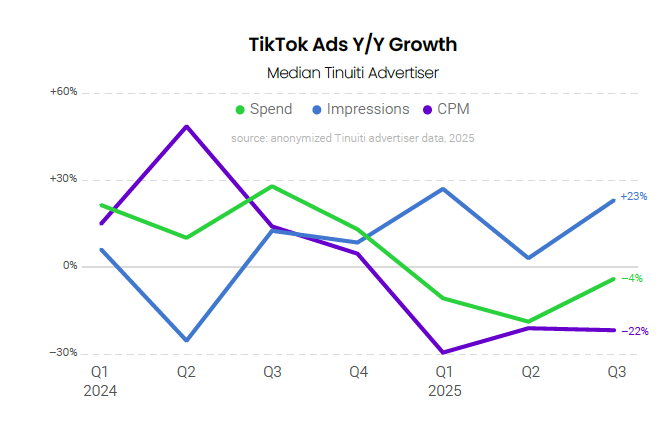

As its future hangs in the balance in the US, TikTok spending continued to lag a year earlier, falling 4% year over year in Q3. With a potential deal to keep it running in the works, however, that did mark an improvement from a 20% decline a quarter earlier. Average CPM continues to track well below last year, coming in at 22% lower in the third quarter.

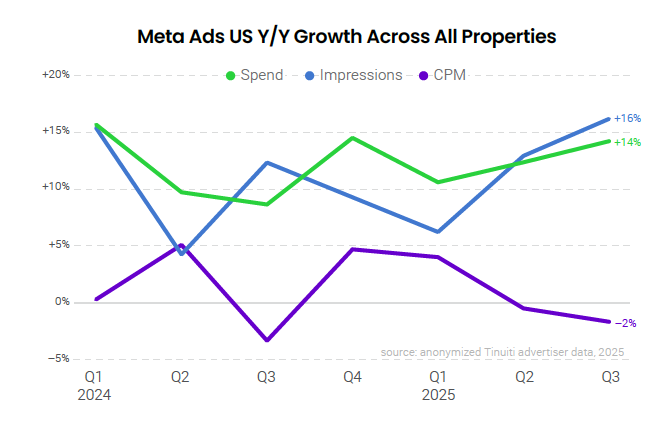

Advertisers ramped up investment across Meta properties 14% year over year in Q3, up from 12% growth in Q2. This was the second straight quarter of spend growth acceleration as year-ago comparisons grew softer through the first three quarters of the year. Meta impressions rose 16% year over year in the third quarter, the strongest growth since Q4 2023, while CPM fell 2%. Threads ads, expanded to all advertisers globally in April, currently only account for 0.04% of Meta ad spend.

Ad impressions on Meta’s flagship app rose 15% year over year, driving a 9% increase in spend even as CPM fell 6%. This marks the second straight quarter that CPM declined on Facebook, as well as the eleventh time in the last 13 quarters that pricing has declined year over year as growth in inventory sources like Reels has put downward pressure on Facebook CPM.

Advertisers increased investment in Instagram by 21% year over year in Q3, nearly double the 11% growth observed in Q2. The acceleration can largely be attributed to an easier year-ago comparison, as spend growth slowed from 24% in Q2 2024 to 14% in Q3 2024. Instagram CPM rose by double digits for the sixth straight quarter, while impressions jumped 9% year over year, which was the strongest growth observed since Q1 2024.

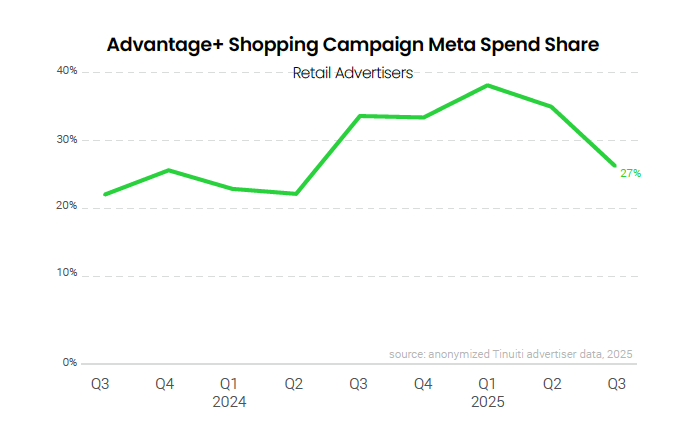

Q3 marked the second straight quarter that the share of total retail and ecommerce Meta ad spend going to Advantage+ shopping campaigns slipped, dipping to 27% after accounting for 35% in Q2 and 38% in Q1. While still clearly a meaningful part of advertiser campaign strategy, Meta’s AI-powered campaign type usage continues to lag that of Google’s Performance Max campaigns.

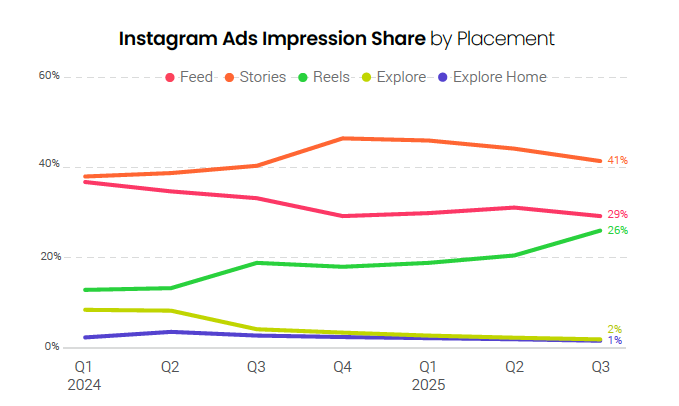

Fully 26% of Instagram ad impressions in Q3 2025 were attributed to Reels ads, up from the 19% share these placements accounted for in Q3 2024 as well as the 21% share observed in Q2 2025. The rise of Reels ads, which carry a lower CPM than Feed and Stories ads, is putting downward pressure on pricing over time, with Instagram year-over-year CPM growth slowing from 19% year over year in Q3 2024 to 11% in Q3 2025.

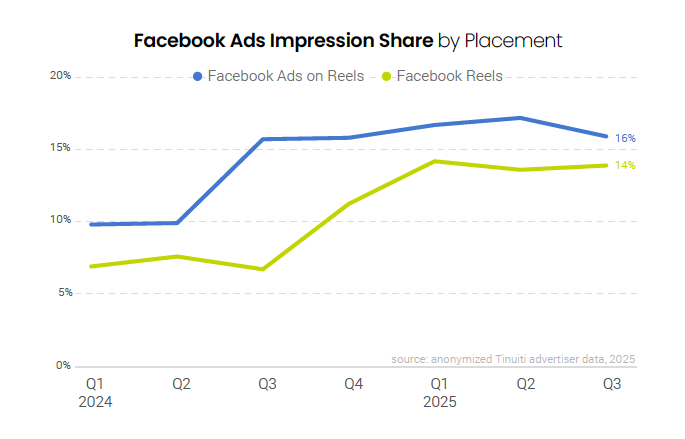

The share of Facebook ad impressions attributed to Reels video ads rose from 7% in Q3 2024 to 14% in Q3 2025. Ads on Reels, formerly known as Reels Overlay ads, accounted for 16% of impressions, the same share observed last year. Given the significance of Ads on Reels on Facebook, it remains unclear why these banner ads featured on top of Reels videos have not been similarly rolled out on Instagram.

The median TikTok advertiser active on the platform since at least Q3 2024 reduced investment by 4% year over year, a much smaller decline than the 20% drop observed in Q2. While TikTok advertisers sought to diversify social investment earlier in the year on fears that the platform might ultimately be banned in the US, continued delays and a recent agreement on a possible sale have given advertisers reason to feel more confident about its future moving forward.

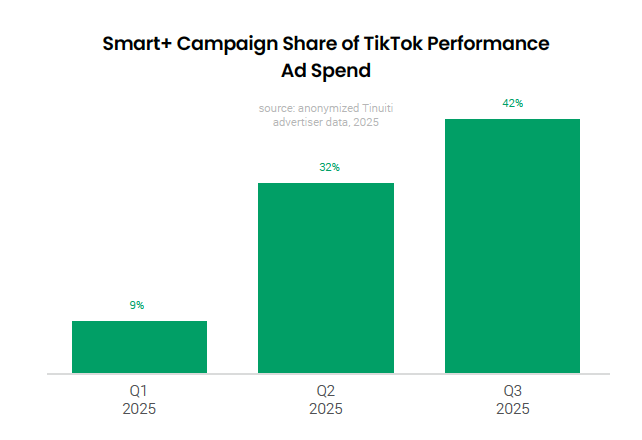

The share of TikTok performance ad spend, meaning investment aimed at driving a specific action/goal such as a purchase or sign-up, attributed to TikTok Smart+ campaigns rose from 9% in the first quarter of 2025 all the way up to 42% by Q3. Only just announced in Q4 2024, Smart+ campaigns provide automated targeting, bidding, and creative to streamline management for advertisers and improve performance.

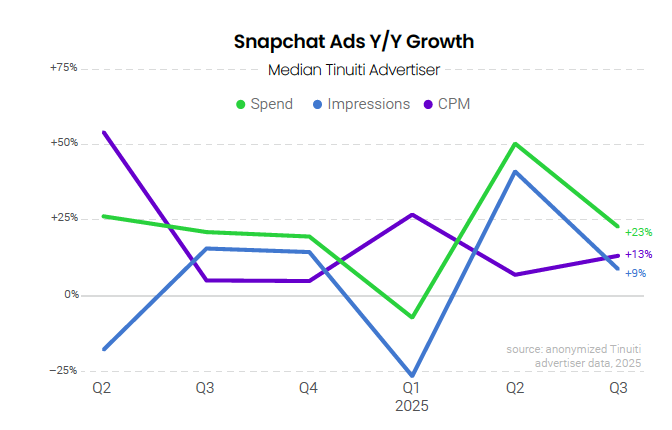

The median Snapchat advertiser active on the platform since at least Q3 2024 increased spend 23% compared to a year prior, with a 9% increase in impressions and 13% growth in average CPM. Spend growth has now topped 20% in five of the last six quarters. One newer source of inventory for advertisers has been Sponsored Snaps, which were announced in October 2024 and allow brands to send Snaps that appear in the Chat tab.

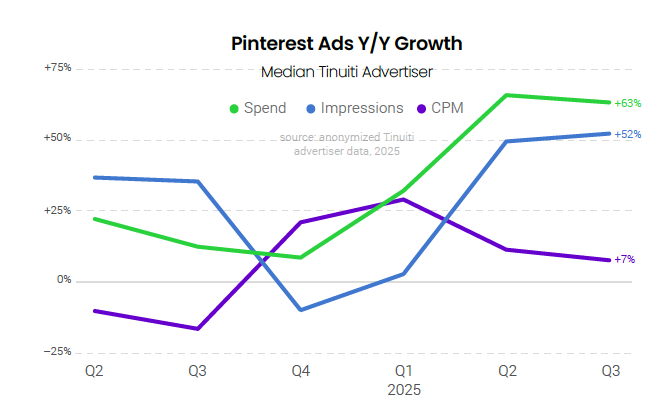

Pinterest investment jumped 63% year over year in Q3 for the median advertiser after rising 66% in the second quarter. Once again, impressions drove much of the growth in spend with a 52% increase compared to last Q3, compared to just 7% CPM growth. Increased investment has been helped along by Pinterest’s Performance+ tools, with features like the Performance+ ROAS bidding tool and Performance+ creative helping early adopters drive results.

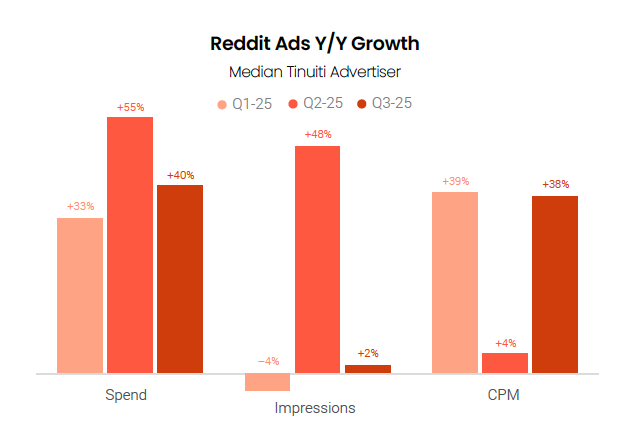

Spend on Reddit advertising rose 40% year over year in the third quarter, after rising 33% in Q1 and 55% in Q2, as advertisers continue to ramp up investment to reach the valuable Reddit audience. Much like other social platforms, Reddit is leaning into AI-powered tools with its recently released Reddit Insights and Conversation Summary Add-ons features, together branded as Reddit Community Intelligence.

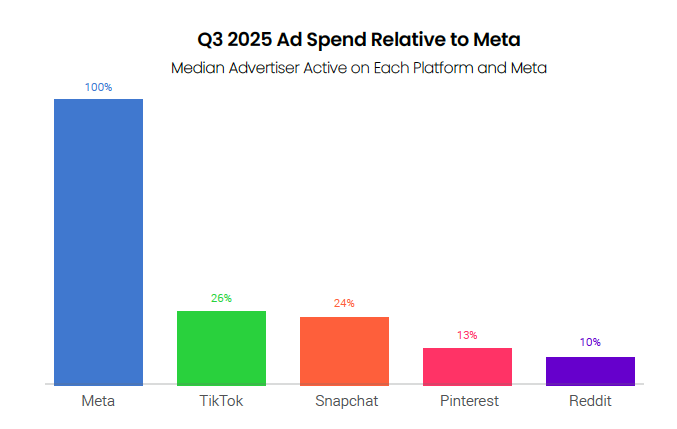

Advertisers active on both Meta and TikTok spent 26% as much on the latter as on the former in the third quarter, as TikTok has quickly become an important part of the social mix for brands. Snapchat advertisers spent 24% as much on the platform as on Meta, nearly matching the relative spend of TikTok, though more than three times as many Tinuiti advertisers are actively spending on TikTok as on Snapchat.

Advertiser spending on Google paid search ads was up 10% year over year in Q3 2025, which was down a point from a quarter earlier. Click growth accelerated for the fifth straight quarter, reaching 11%, but average cost per click fell 1%, which was down from 3% growth in Q2. While Temu and Shein were back in Google shopping ad auctions in Q3 after sitting out large portions of Q2, Amazon dropped out of US Google shopping auctions entirely on July 23. Amazon’s absence helped drive strong click growth for other retailers, while removing some pressure on CPCs.

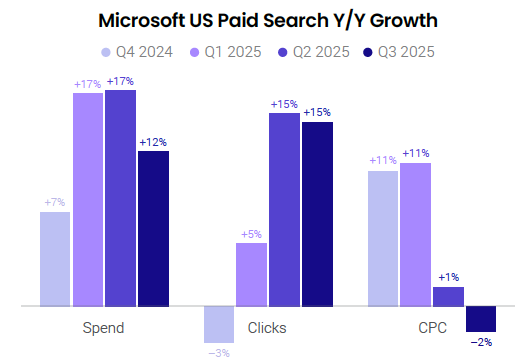

Spending on Microsoft paid search ads was up 12% year over year In Q3 2025, down from 17% growth a quarter earlier. Click growth for Microsoft search ads – including text, shopping, and Performance Max campaigns – was down slightly to just under 15% in Q3. Advertisers saw greater deceleration on the pricing side with average CPC down 2% year over year, compared to a 1% increase a quarter earlier. Importantly, Amazon has remained active in Microsoft shopping ad auctions, even as it has paused its Google shopping program.

Google shopping ad spending was up 14% year over year in Q3 2025 across standard Shopping and Performance Max campaigns as clicks grew 15% and CPCs fell 1%. Click growth decelerated slightly against stronger year-ago comps, while CPC growth slowed even against weaker comps. Amazon withdrawing from Google shopping auctions in July was partially offset by the return of Temu and Shein to auctions, along with Walmart picking up a larger share of shopping impressions than it did earlier in the year.

With the end of the de minimis tariff exemption for Chinese goods looming in the weeks ahead, Temu and Shein paused their Google shopping ads in mid-April 2025. Shein resumed its ads after a little over a month, while Temu remained on the sidelines until mid-July. Shortly after, on July 23, Amazon paused its Google shopping ads entirely. Amazon had previously pulled back sharply but remained active in auctions over late May and early June, before returning to prominence ahead of Prime Day. While Amazon has returned to international Google shopping auctions, it remains to be seen whether it will resume its US program before the Q4 holiday shopping peak.

While Amazon was a relative latecomer to Google shopping ads – it didn’t participate for nearly five years after Google moved to a paid model in 2012 – it has been a consistent presence in the years since, with very few exceptions. Amazon paused its shopping ad program for about three weeks in 2018, over the Prime Day event in 2019, and for about three months during the early days of the pandemic. Amazon’s current break is now approaching that 2020 pause in duration, but without a clear causal backdrop.

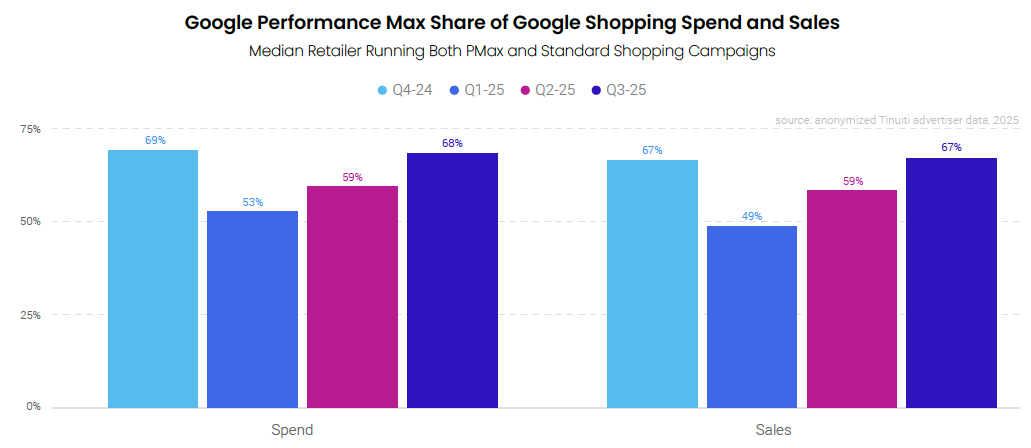

Among retailers running both Performance Max and standard Google Shopping campaigns, spend share continued to shift back to Performance Max in Q3, following a significant decline to start the year. PMax campaigns account for 68% of spending on Google shopping ad listings in Q3, up from 59% a quarter earlier and 53% in Q1. With PMax generating 67% of Google shopping ad sales in Q3, it did produce a slightly lower ROAS than standard Shopping campaigns, but that gap has narrowed since Q1.

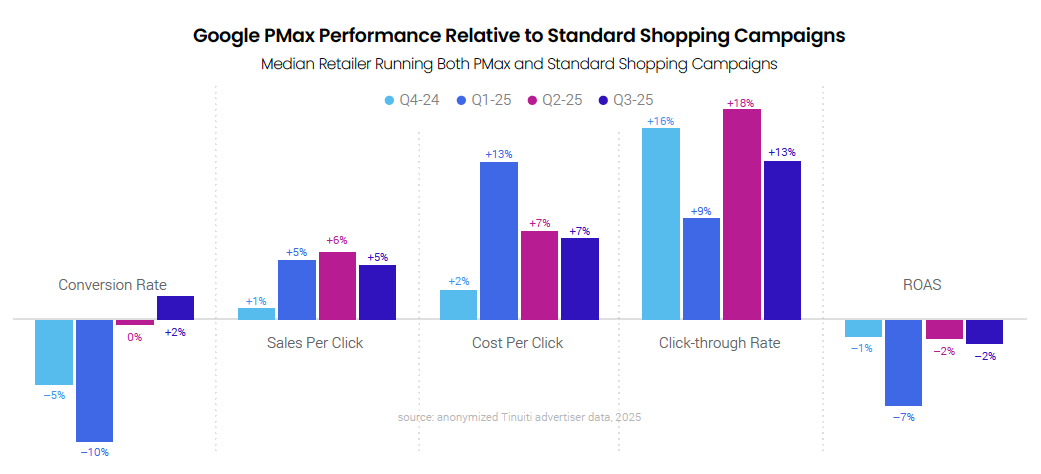

For brands running both campaign types, Performance Max conversion rates were 2% higher than standard Shopping campaign conversion rates in Q3 2025, which was a stark improvement from a 10% deficit in Q1. Sales per click for PMax was 5% higher than it was for standard Shopping campaigns in Q3, though with CPCs running 7% higher for PMax, advertisers did see a 2% lower ROAS for PMax.

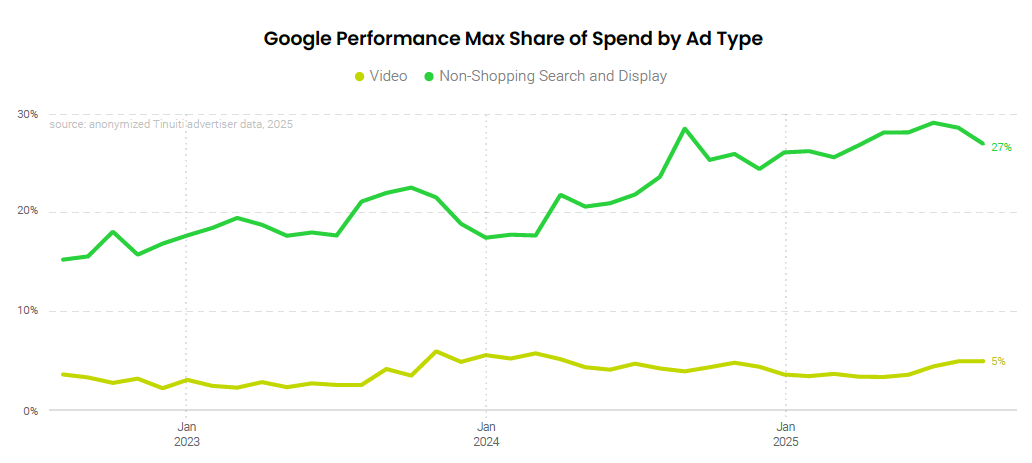

Video and non-shopping search and display inventory accounted for an average of 33% of Google Performance Max spending in Q3 2025, which was up two points from a quarter earlier and four points from Q3 2024. Video provided the uptick between Q2 and Q3 2025, with its share of Performance Max spend increasing from 3% to 5%.

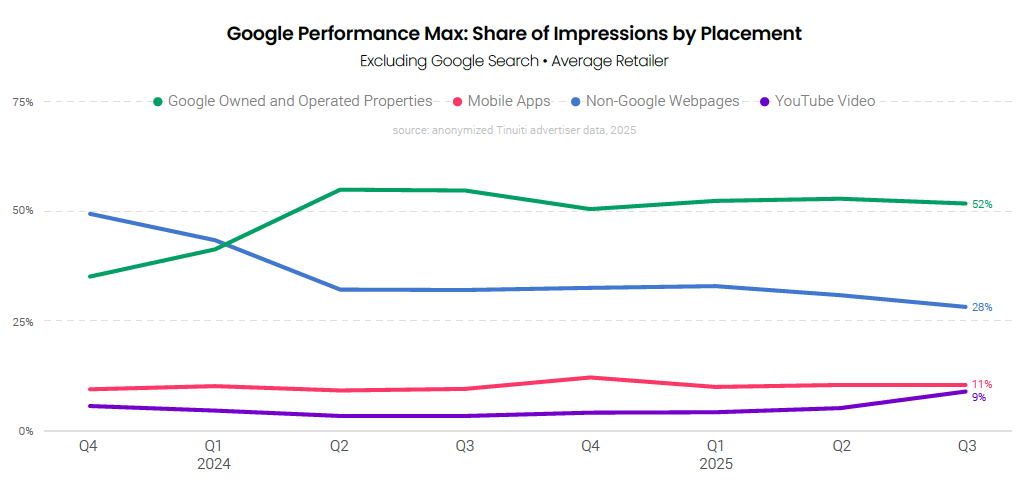

The increase in Performance Max spend share attributed to video was reflected in a significant uptick in the share of non-search PMax impressions generated by YouTube. YouTube video accounted for 9% of PMax placement impressions in Q3 2025, up from 5% in Q2. Other Google owned and operated properties continued to generate a majority of PMax placement impressions, while non-Google webpage impression share has trended lower since Google began applying account-level placement exclusions to its Search partner network.

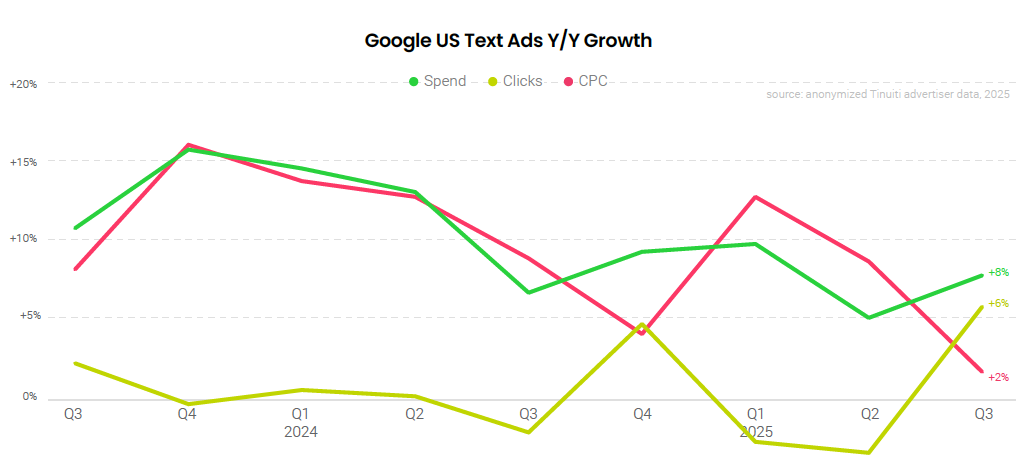

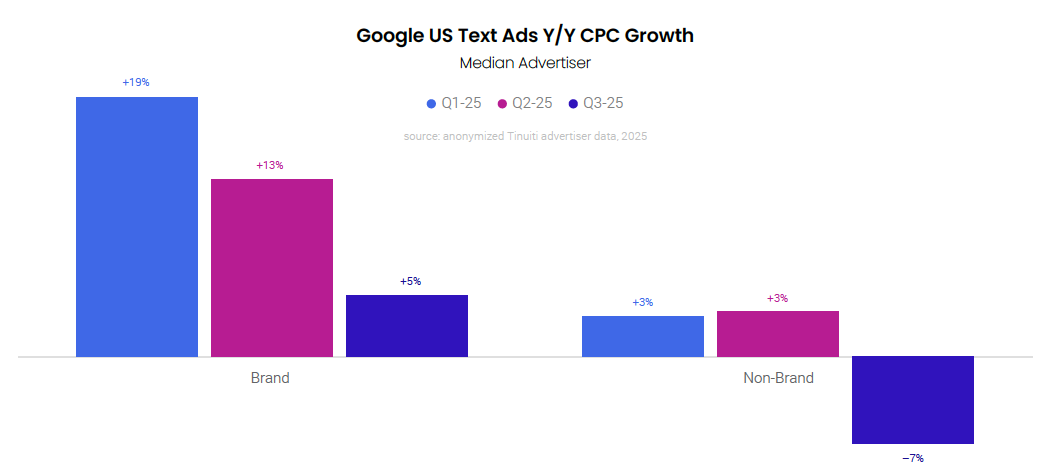

Spending growth for Google search text ads was 8% year over year in Q3 2025, up from 5% growth a quarter earlier. Against weak year-ago comps, advertisers saw positive click volume growth for the first quarter since Q4 2024. At the same time, CPC growth continued to decelerate after it had jumped to 13% year over year in Q1 2025, primarily due to a spike in pricing for advertiser brand keywords. While brands are testing AI Max campaigns as a supplement to other text-based Google search ad campaigns, they have not been a significant contributor to overall text ad trending to date.

After spiking 19% year over year in Q1 2025, CPC growth for advertiser brand keywords has come down sharply over the last two quarters reaching just 5% growth in Q3 2025. On the non-brand side, CPCs saw much more modest growth of 3% to start the year, which carried over to Q2. In Q3, however, non-brand CPCs fell 7%. While Amazon withdrew from Google shopping listings in the US, it has remained active in the text listings.

Amazon Sponsored Products advertisers saw the strongest click growth on the format since Q2 2020 when the pandemic sent millions of shoppers online, driving spend up 15% even as CPC fell 12%, the largest pricing decline since Q2 2020. Amazon exited US Google Shopping auctions in July, but the reduction in spend on Google does not appear to be hurting search volume on Amazon as evidenced by the strong click growth of its flagship search ad format.

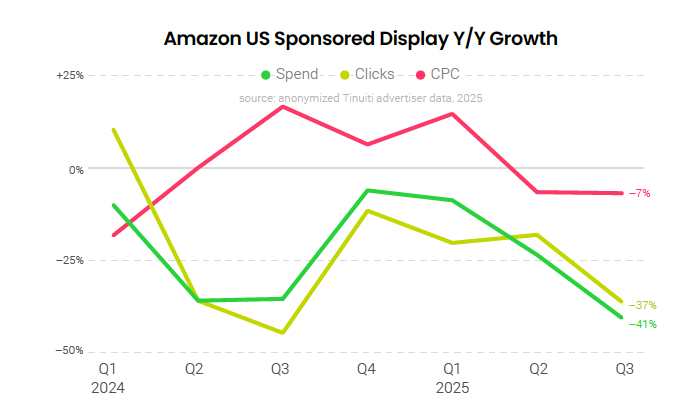

For the seventh straight quarter investment in Amazon Sponsored Display fell year over year, with a 37% decline in clicks and 7% decline in CPC resulting in a 41% drop in spend from the same quarter last year. Advertisers looking to increase spend on Amazon display placements have increasingly done so through the Amazon DSP over the last couple of years.

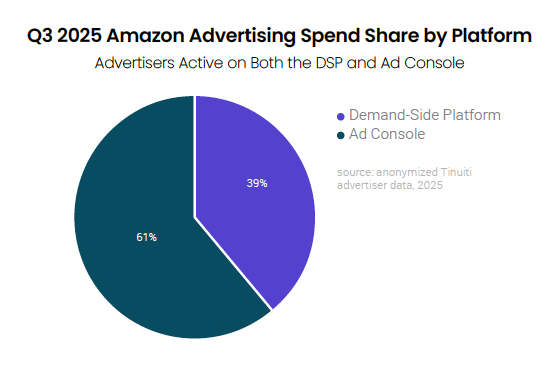

Fully 39% of all Amazon spend was attributed to the DSP in Q3 among endemic advertisers that are active through the Amazon DSP, up from 37% in Q2. DSP spend growth has regularly outpaced that of search ad formats for endemic advertisers — those that sell products directly on Amazon — with recent DSP growth buoyed by the continued adoption and growth of Prime Video advertising.

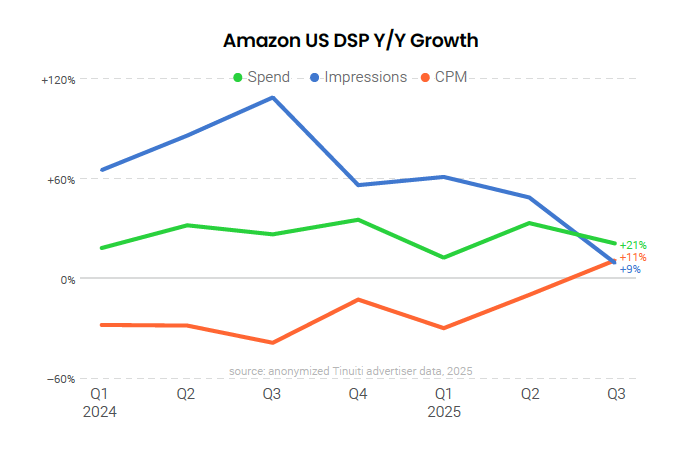

Investment in the Amazon DSP rose 21% year over year in Q3, outpacing growth for Amazon Sponsored Products once again. Average CPM increased 11% year over year, the first quarter of positive pricing growth since Q3 2023, while impressions rose 9%. Recent DSP growth has been helped along by growing investment in Prime Video advertising since ads were introduced to the platform in the first quarter last year.

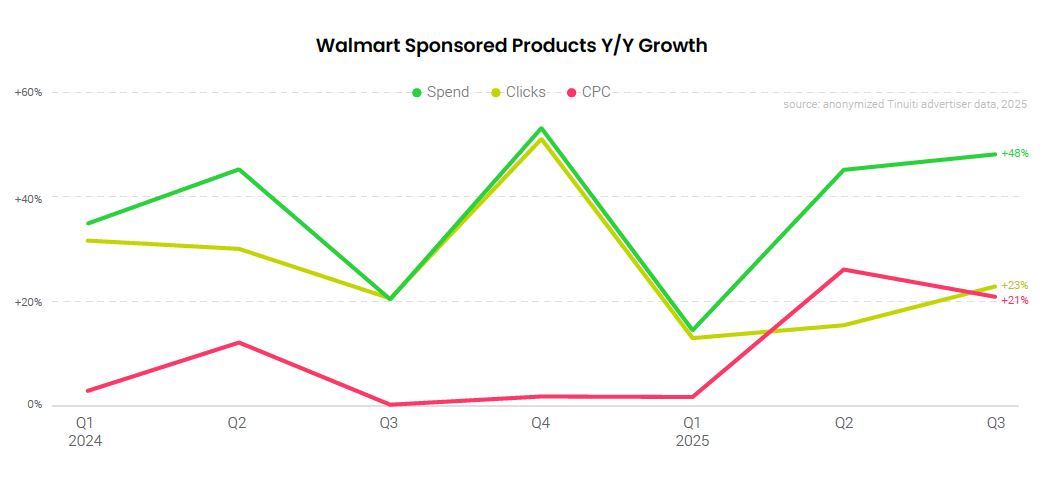

Walmart Sponsored Products advertisers ramped up spend on the format by 48% year over year in Q3, stronger than the 45% growth observed in Q2. Both click and CPC growth rose more than 20% year over year, as both pricing and volume have seen strong increases over the last two quarters. While some Walmart Sponsored Products advertisers are finding that CPC increases outpace growth in the sales per click, the median advertiser saw ROAS rise 10% year over year.

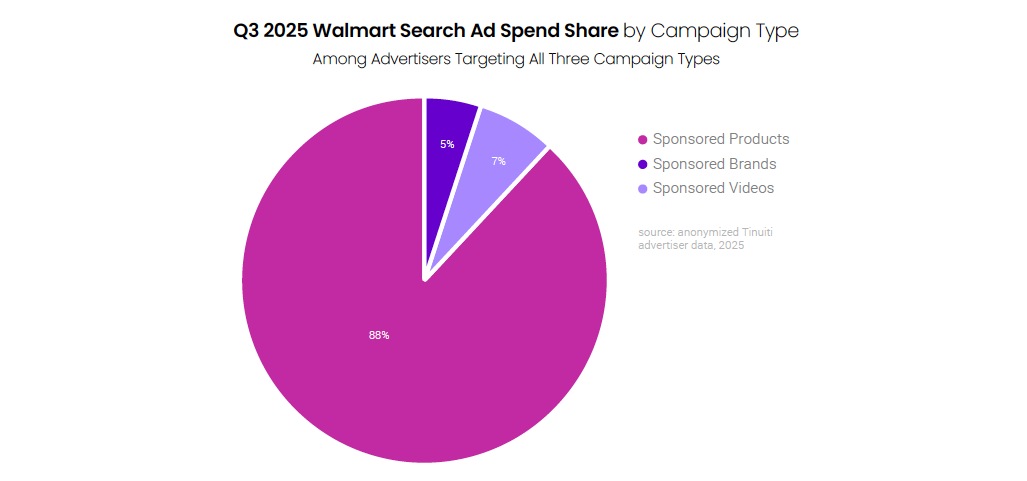

Fully 88% of all Walmart search ad spend went to Sponsored Products in Q3, as the format dominates Walmart spend in much the same way it does for Amazon advertisers, even for advertisers targeting all three Walmart search campaign types. Sponsored Videos accounted for 7% of spend in the third quarter, with the remaining 5% of spend going to Sponsored Brands. While not all Walmart search advertisers invest in all three formats, the share that do is growing over time.

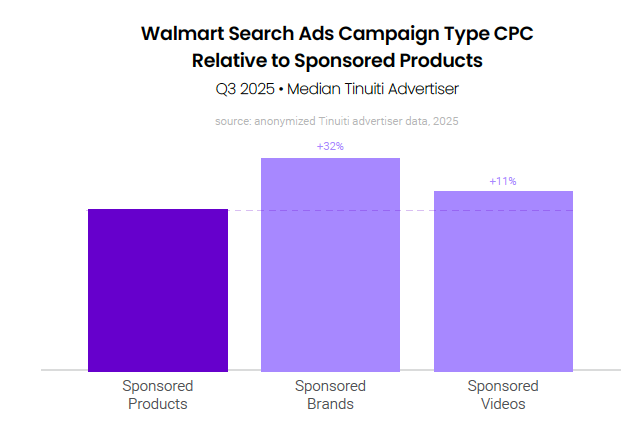

Sponsored Brands ads were 32% more expensive than Sponsored Products for Walmart advertisers in Q3, down from 43% more expensive in Q2. Sponsored Videos CPC relative to Sponsored Products also fell, dropping from 16% higher in Q2 to 11% higher in Q3. For Sponsored Videos specifically, Walmart reduced its former $1.30 minimum bid to participate in auctions to $0.80 in November 2024, and the CPC gap has grown narrower ever since.

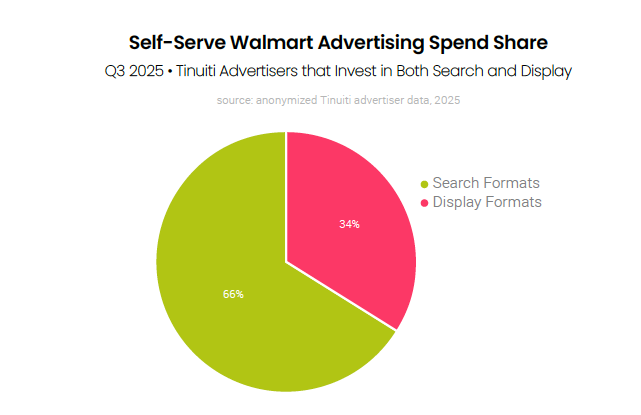

For advertisers actively investing in self-serve Walmart display ads, the share of total self-serve spend going to display placements both on and off of Walmart’s app and website was 34% in the third quarter. The remaining 66% was attributed to search advertising formats including Sponsored Products, Sponsored Brands, and Sponsored Videos. Some managed-serve onsite auction campaigns were sunset in Q3, making self-serve more important for advertisers.

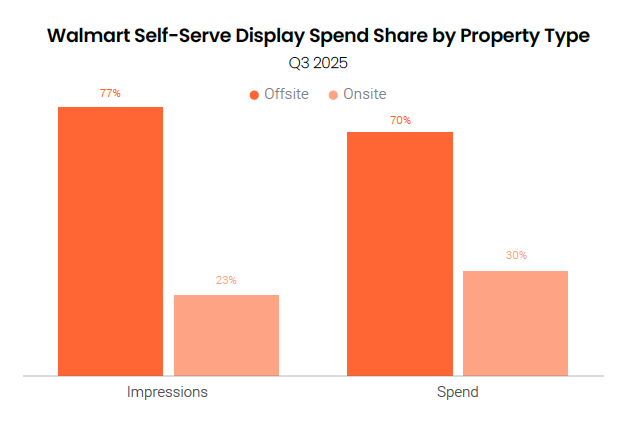

More than two out of every three ad dollars spent through the self-serve Walmart DSP went to inventory off of Walmart’s website and app, as many advertisers use Walmart’s targeting to reach customers across the web. Similar to Amazon and its DSP, Walmart onsite inventory does come at a higher CPM than offsite inventory, with onsite accounting for 30% of spend on just 23% of impressions.

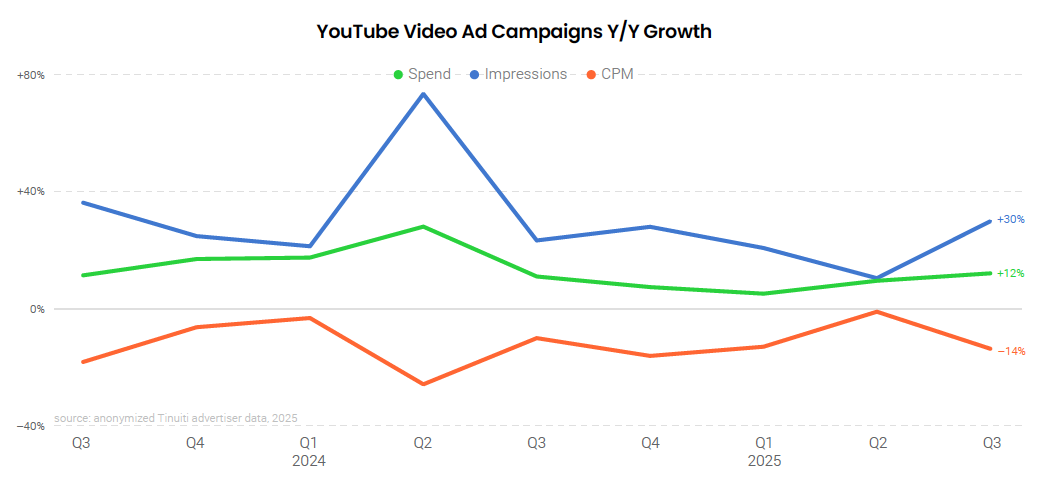

For brands active on YouTube video ad campaigns in Q3 2024 and Q3 2025, spending was up 12% year over year, up from 9% same-site growth a quarter earlier. While YouTube CPMs fell 14% year over year in Q3, impression growth improved to 30%. In July, Google began transitioning Video Action Campaigns to Demand Gen campaigns automatically, but other YouTube video campaigns continue to see strength from Shorts and TV screens.

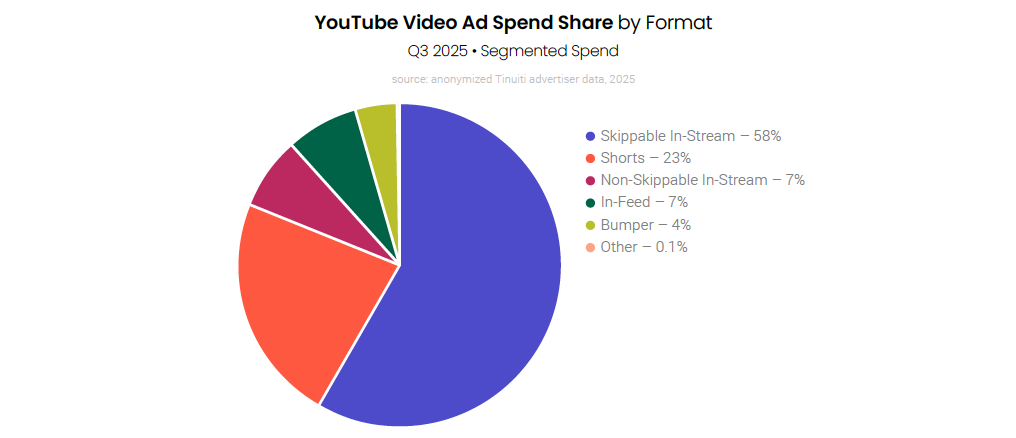

YouTube Shorts ads accounted for 23% of segmented YouTube video ad spending on average in Q3 2025, making it the second-largest segment after the skippable in-stream format at a share of 58%. While the vertical Shorts format may have its roots in mobile devices, TV screens accounted for nearly half of Shorts ad spending for the average brand in Q3, while mobile phones accounted for just a little under a third of spending.

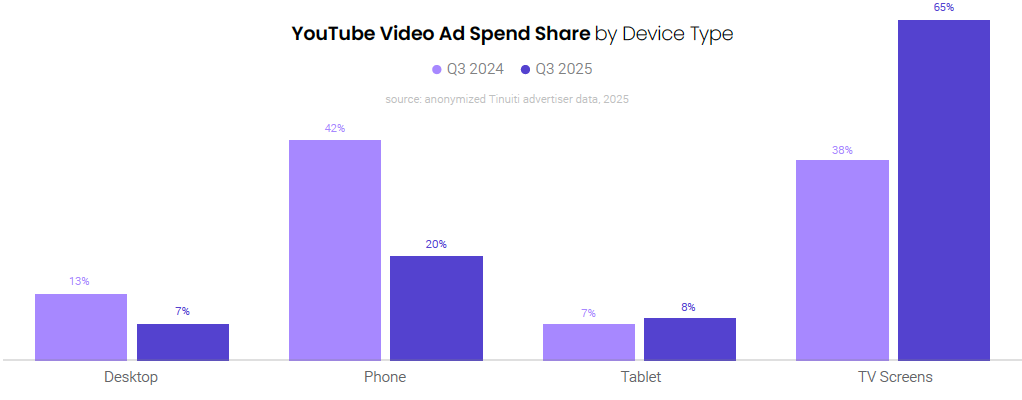

TV screens accounted for 65% of YouTube video ad campaign spend in Q3 2025, a significant jump from 38% a year earlier. Most of those gains came at the expense of phones, where spend share fell from 42% in Q3 2024 to 20% in Q3 2025. While TVs are generating a larger share of YouTube volume over time, much of this particular shift in spend share is due to the migration of Video Action Campaigns to Demand Gen campaigns. Demand Gen campaign spending on YouTube inventory was approximately 80% on phones in Q3 2025.

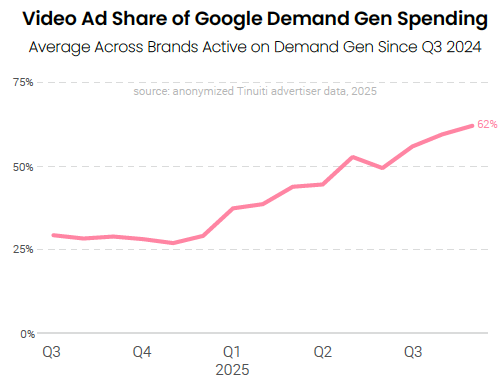

Video ads generated 62% of Demand Gen campaign spending in September 2025, over double the rate of a year earlier. In September 2024, Google announced that they would transition Video Action Campaigns to Demand Gen campaigns in 2025 and recommended advertisers start running Demand Gen campaigns in preparation. In April 2025, Google removed the ability to create new Video Action Campaigns, while in July 2025, it began transitioning Video Action Campaigns to Demand Gen automatically.

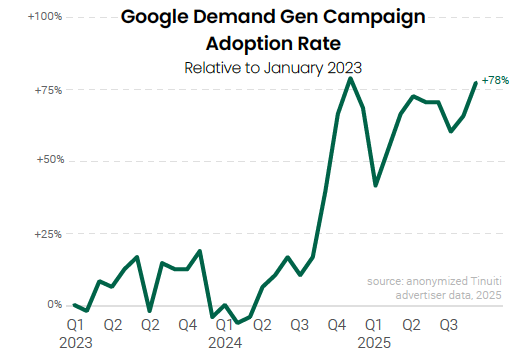

After languishing over 2023 and most of 2024, adoption rates for Google Demand Gen campaigns spiked in September 2024 after Google announced the upcoming transition of Video Action Campaigns to Demand Gen campaigns over the following year. Demand Gen campaign adoption peaked during the height of the Q4 2024 holiday shopping season, before retreating in Q1 2025. Entering Q4 2025, Demand Gen adoption rates are back near all-time highs with nearly 80% more Google advertisers running Demand Gen campaigns than in January 2023.

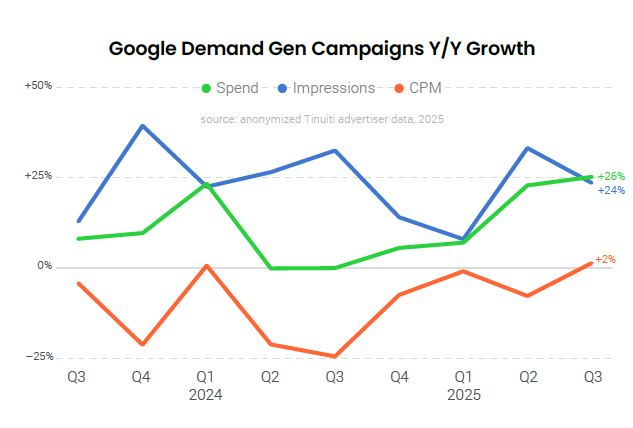

Google Demand Gen campaigns are not only seeing strong growth in adoption rates, but also strong spending growth among brands that have been active with the campaign type since Q3 2024. Same-site spending growth for Demand Gen campaigns was up 26% year over year in Q3 2025, up from 0% growth a year earlier. Demand Gen impressions were up 24% in Q3 2025, while average CPM was up 2%.

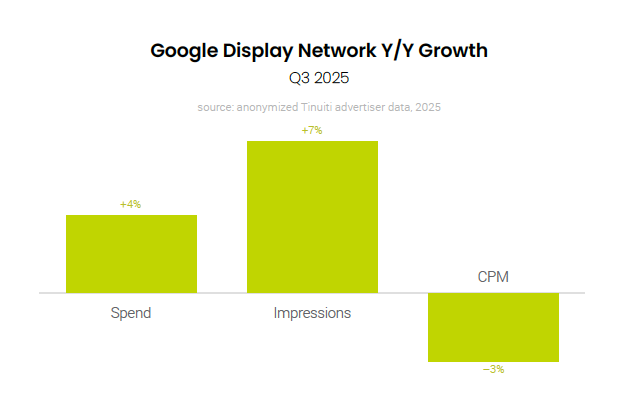

Spending on the Google Display Network (GDN), primarily from Google display campaigns, but including impressions from app, Demand Gen, video, and other campaign types, was up 4% year over year in Q3 2025, which was down from 6% growth a quarter earlier. GDN impressions were up 7%, but average CPM fell 3% year over year. Google has officially reported single-digit revenue declines for 12 straight quarters for its “Other” ad revenues outside of Google search and YouTube.

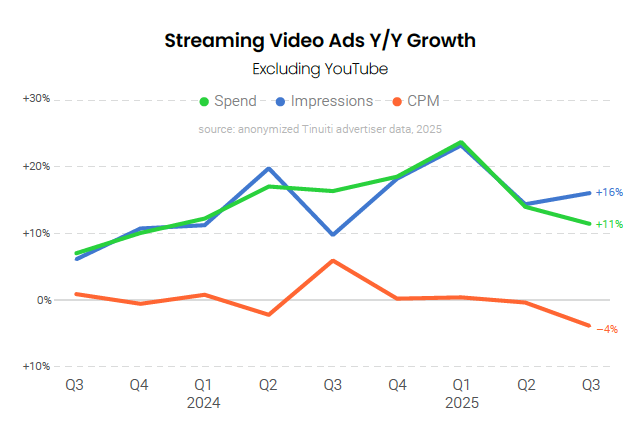

Same-site spending on streaming video ads outside of YouTube was up 11% year over year in Q3 2025, down from 14% growth a quarter. Spending growth had accelerated with the launch of Prime Video ads in Q1 2024, but growth rates are now decelerating against those stronger comps. Streaming ad impressions grew 16% year over year in Q3, but average CPM fell 4% as platforms continued to feel pressure to be more competitive in their pricing.

Including both new and existing advertisers, spending on Prime Video ads was up a little over 10% from Q2 to Q3, which was down from 22% quarter-to-quarter growth in Q2. Compared to Q3 2024, Prime Video spending was up 82%, but that was down from nearly 180% year-over-year growth in Q2. Although it has already become one of the better established streaming ad platforms, Prime Video is still benefiting from new advertiser adoption.

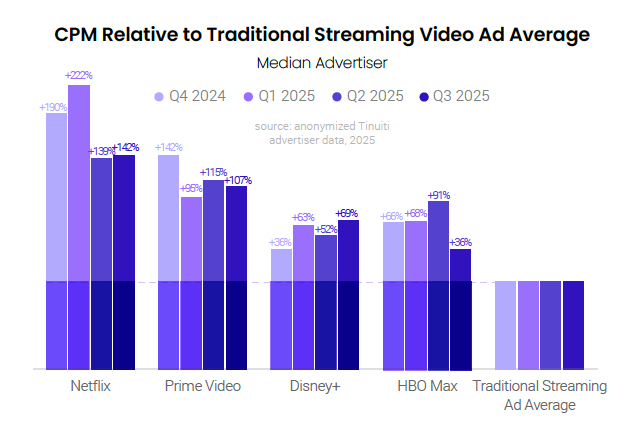

Across four of the largest US streamers — Netflix, Prime Video, Disney+, and HBO Max — Netflix continued to enjoy the highest average CPM in Q3 2025, although that advantage has narrowed considerably over the last two quarters. Netflix CPMs were 2.4X that of the traditional streaming ad average in Q3, which was down from 3.2X average in Q1. Prime Video saw the next highest CPMs at 2X the streaming average in Q3, which was followed by Disney+ at 1.7X average and HBO Max at 1.4X average.

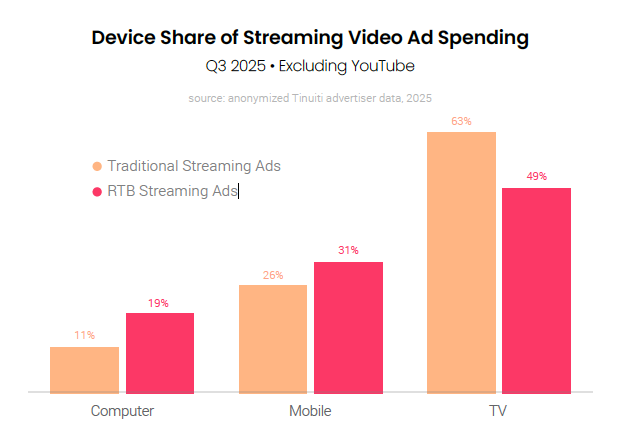

In Q3 2025, 63% of spending on traditionally-purchased streaming video ad inventory was devoted to TV screens, which was roughly steady with a quarter earlier. Mobile devices, including both phones and tablets, accounted for 26% of traditional streaming ad spending in Q3, while computers contributed 11% of spending. Mobile devices and computers played a larger role for RTB-purchased streaming ad inventory, combining for just over half of spending.

Check out our most recent Digital Ads Benchmark Report for more exclusive insights.