Health & Personal Care Brands' Success on Amazon: Learnings From Advil and Seventh Generation

Shoppers are putting more and more spend toward Amazon for Health and Personal Care: Amazon has a 19% share of wallet in the Health & Personal Care category.

The Health & Personal Care category is also growing on Amazon:

Who is the average Amazon Health & Personal Care shopper?

The average Amazon Health and Personal Care shopper is:

And here’s how their shopping habits compare to the average Amazon shopper:

On the other hand, 21% of people surveyed by Numerator haven’t bought Health & Personal Care products on Amazon yet. There’s still a big opportunity in the Health & Personal Care category, especially in the highest growth categories: Household, Baby, and Vitamins/Supplements.

Why is it so hard to break into Amazon Health and Personal Care?

Subscribe and Save opportunities can help turn customers from brand agnostic to brand loyal.

Here’s how:

With a dedicated Subscribe and Save storefront, you attract engaged shoppers and reliable repeat business.

You can also sell on the Amazon FSA store, which lets you accept FSA (Flexible Spending Account) & Health Savings Account (HSA) payments, opening the door to even more purchases.

To gain an advantage in this competitive category, work on building your brand presence outside of Amazon. Brand isn’t the most important factor to these shoppers, but awareness and credibility do matter! If no one has ever heard of your brand before seeing your listings, you’ll have a difficult time building a customer base.

Amazon has some strict requirements for sellers (and their products) in the Health & Personal Care category. You must be enrolled in the Professional seller plan with these metrics:

And you must provide this documentation from your manufacturer:

Your products must be new and listed under the manufacturer’s UPC, and product listings should include:

You must list all ingredients for over-the-counter medicines and dietary supplements and show the back of the packaging (ingredients and nutritional information) as the second image on product listings.

Here are some tips for complying with Amazon’s strict requirements:

There are four main ways to creatively position your Health & Personal Care products on Amazon:

Check out these examples of brands making the most of their brand presence on Amazon:

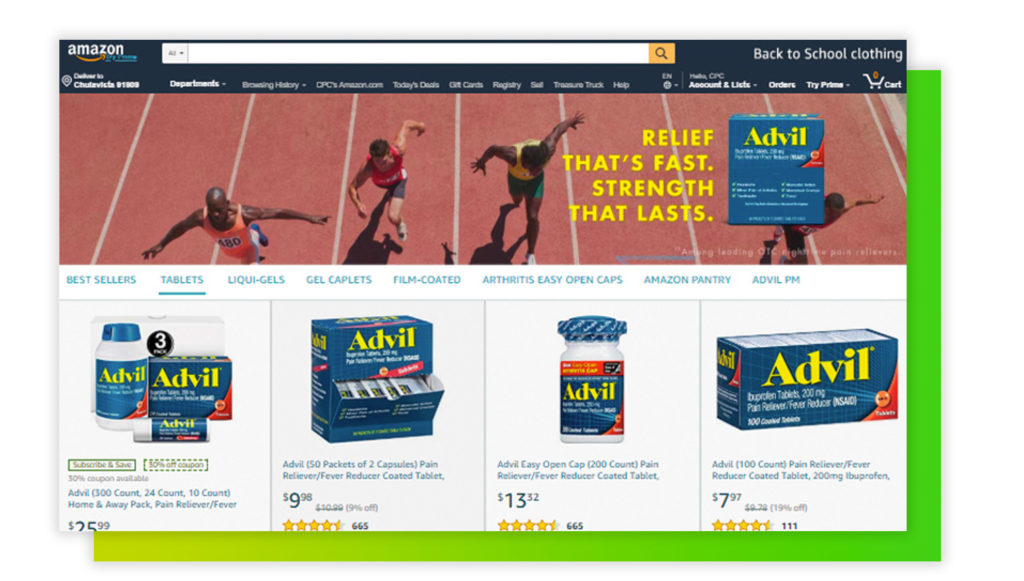

Advil partnered with Tinuiti’s Amazon Creative Team to design, develop, and deploy a customized and responsive Brand Store to promote an immersive shopping experience.

You can view the entire Advil case study here.

Seventh Generation worked with Tinuiti to scale their Amazon Vendor operations. They were able to significantly improve their online advertising efforts through AMS, leading to higher-order volume and lower ACoS. How’d they do it?

For Prime Day, Tinuiti created 55 new campaigns for Seventh Generation to increase brand awareness. The brand saw a 100.55% increase in total sales on Amazon Prime Day in 2017 (compared to the previous week).

You can view the entire Seventh Generation case study here.

Here are three more advertising strategies for Amazon Health & Personal Care Brands.

Your product and brand messaging should stay consistent but serve different purposes.

For your product messaging, communicate the main reasons to buy, describe the product complexities, and address product-related FAQs.

For your brand messaging, communicate the key elements of your brand by telling your brand story, developing your brand tone, and establishing brand equity.

When choosing which ad type to invest in, base your decision off shoppers’ position in the funnel.

Keep ACoS under control by creating separate must-win campaigns for the keywords that are your top priority. These keywords will have higher bids and a higher ACoS. This lets you optimize the non-must-win keywords for lower bids without the risk of losing placement for those high-priority keywords.

To succeed in the Amazon Health & Personal Care category: