Amazon’s Pet Supplies category has seen immense growth in recent years.

According to data from One Click Retail, the category brought in almost $800 million in just the first half of 2018 alone. Sales also jumped 30 percent over 2017. Nearly half of those sales come from just pet food — the section’s most popular subcategory by far.

Amazon’s Pet Supplies category is a big one — and one that holds lots of potential. There are tons of competitors, though, both online and in the real-world.

While Amazon has certainly carved out a big share of the nation’s online pet supply sales, data shows that many pet owners just prefer to shop brick-and-mortar when it comes to their furry friends.

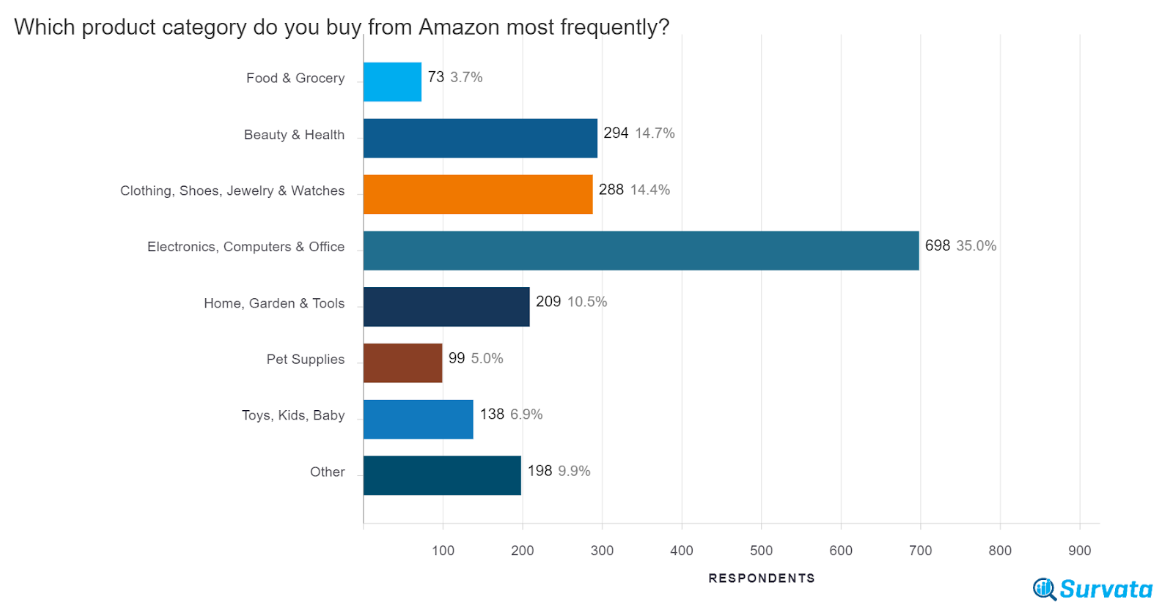

Among all respondents in our “2019 Amazon Consumer Shopping Study“, top categories included “Electronics, Computers & Office” (35%), followed by “Beauty & Health” (14.7%), and “Clothing, Shoes, Jewelry, & Watches (14.4%).

The lowest ranking categories included Food & Grocery (3.7%), as well as Pet Supplies (5%).

Still, it might not be that way for long. With a 30 percent jump in activity last year and more than $800 million in sales, it’s clear Amazon’s pet category isn’t going anywhere anytime soon.

Introduction to Amazon Pet Supplies:

In Q1 and Q2 of 2018, pet food accounted for $360 million of Amazon’s pet category sales, seeing a 34 percent jump over the year.

Though it’s certainly the most successful section, food isn’t the only thing you’ll find in the pet supplies category.

Other sub-sections include:

- Dogs, including apparels, beds, cameras, carriers, collars, crates, doors, flea/tick control, grooming, health supplies, litter, memorials, toys and training

- Cats, including beds, cages, cameras, carriers, collars, flea/tick control, grooming, health supplies, memorials, repellants, toys

- Fish & aquatic pets, including aquariums, aquarium supplies, automatic feeders and health supplies

- Birds, including cages, carriers, health supplies and toys

- Horses, including blankets, boots, farrier supplies, grooming, health supplies, pest control, stable supplies and toys

- Reptiles & amphibians, including habitat supplies and terrariums

- Small animals, including carriers, collars, exercise wheels, grooming, health supplies, houses, odor removers and toys

What Brands Sell Pet Supplies on Amazon?

At the brand level, you’ll find the majority of the pet supply industry present on Amazon, with names like Hill’s Science Diet, K9 Advantix, Frontline, Purina, Fancy Feast, Pedigree, Greenies and Fresh Step all highly visible on the site.

Amazon also offers its own white-labeled pet supplies via its AmazonBasics and Wag lines.

AmazonBasics boasts things like puppy pads, dog crates, food bowls, cat trees, leashes and pet beds, while Wag offers only dog food — both wet and dry. Wag also offers dog treats.

Amazon Pet Supplies: The Competitive Landscape

The Amazon Pet Supply landscape is a competitive one — and not just because there are big-name players and Amazon itself with skin in the game.

According to Statista, online sales of pet supplies are just a small blip on the radar, accounting for only 17 percent of all pet supply sales in the United States. People are far more likely to buy pet supplies at supermarkets, Petsmart, Petco or discount stores before heading online to do so.

Still, Amazon makes up a big share of that 17 percent.

Data from American Pet Products shows that of the consumers who purchased pet supplies online in 2017, 54 percent shopped on Amazon. That’s nearly twice the amount that shopped on Petsmart.com, Walmart.com and SamClub.com, the next-highest shareholders in the online sales category. Other competitors include Target, eBay and Chewy.com.

What Do Shoppers Value?

When people do buy their pet supplies online, they’re doing so for convenience and access to competitive pricing and a more varied product selection. They also like the ability to price-shop and find discounts and promotions — both of which are inevitably more difficult in a brick-and-mortar store.

Generally, pet owners are most likely to purchase food, treats, and medications online. For dog owners specifically, they’re buying:

- Dry dog food

- Pet treats and chews

- Flea and tick medication

- Pet grooming supplies

- Pet vitamins and supplements

- Heartworm medication

- Pet oral care

- Wet pet food

Cat owners, on the other hand, are looking for:

- Dry pet food

- Cat litter

- Cat litter boxes

- Pet treats and chews

- Flea and tick medication

- Wet pet food

- Pet grooming supplies

- Pet clean-up and odor control

- Flea and tick collars

Who Buys Pet Supplies Online?

Overall, dog owners are more likely to purchase pet supplies online than cat owners.

Childless, married pet owners are also highly likely to order pet supplies online — and that demographic is slowly growing in the U.S., especially as Millennials delay having families or decide to forego it altogether.

Successful Brands Selling Pet Supplies on Amazon

Here’s a closer look at two pet supplies brands who are successfully scaling their business on Amazon today.

Oxyfresh Teams Up With CPC Strategy, Amazon Sales Jump 110%

From mouthwash to toothpaste and nutritional smoothies, Oxyfresh is rooted in all things that make you (and your pets) happy and healthy.

Judging by their community of loyal customers – from athletes to superhero parents and pet lovers, they’ve gone above and beyond to prove the brand’s worth.

But a few years ago, one of the biggest hurdles for the Idaho-based company was how to tackle the Amazon Marketplace.

“Amazon is its own animal. Sometimes people make the mistake of thinking what they do for their Google advertising will work on Amazon too – but that’s just not the case. You have to look at it with fresh eyes.”

– Melissa Gulbranson, Vice President of Marketing at Oxyfresh

“We are really good at creating phenomenal products and developing community. But when we started to look at how to manage our Amazon advertising efforts, we knew we needed someone that not only had a proven track record of helping other companies but could ensure Amazon advertising would be the focus.”

In the following interview, Gulbranson shares Oxyfresh’s experience on the Marketplace, how they increased sales 110% in one year and what they are working on now.

MidWest Homes for Pets™ Increases AMS Sales 231.11%

Founded in 1921, MidWest Homes for Pets™ is the largest U.S. headquartered home builder for pets. Today, they offer a complete line of standard-setting Dog Crates, Small Animal Modular Habitat Systems, Birdcages, Pet Enclosure Furniture, and an ever-growing array of Pet Bedding and related Accessories.

MidWest Homes for Pets teamed up with CPC Strategy to gain a better understanding of the Marketplace, improve efficiency, and scale their Amazon Vendor operations. They also wanted to increase exposure and generate more sales for products in their catalog (outside of their typical best sellers).

“The e-commerce platform is growing fast and always changing. Working with CPC Strategy has allowed us to stay ahead of our competitors and excel in this evolving environment. With AMS spend comprising a large amount of any vendor’s budget, it was important to us that we worked with an agency we could trust and rely on. We have constant access to our CPC Representative and often use CPC as a sounding board for our other e-commerce initiatives as well. I am very happy with our decision to use CPC Strategy.”

– Neil Smith, Director of E-commerce, MidWest Homes for Pets

In the following case study, you can read all about MidWest Homes for Pets™ experience on the Marketplace and how they increased revenue by 231% in less than a year.

For more on selling pet supplies on Amazon, email [email protected]

You Might Be Interested In