What Is Retail Media? Benefits, Challenges, & Best Practices

Retail media isn’t a new concept – but as with commerce overall, it’s been reimagined for the digital age. The immediacy and contextual relevance of those promotions such as those you might see in a grocery store have been translated into new online formats representing big business opportunities for brands. With careful planning, execution, and management, brands can leverage the visibility and targeting capabilities of retail media networks to reach new audiences and enhance every stage of the buying journey.

Retail media is a form of advertising intended to capture consumers’ attention when they’re nearly ready to buy – at or near the point on the path to purchase when they make a selection from among competing brands and products.

Online, retail media is far more sophisticated than a decorative end cap at the grocery store. Retailers offer digital ads on their own ecommerce websites and apps to boost visibility of products to relevant audiences. In addition to the online shopping cart, these ads can be placed on the home page, search results pages, category and seasonal pages, and more. Retailers are even expanding beyond their own web properties to offer partner brands exposure via off-site advertising and social media placements.

“To be frank, the industry’s revenue has exploded in terms of growth over the past several years, with the gains originally expected for a two-year period being crammed into mere months. This push was partially due to the COVID-19 pandemic and the need for contactless payments and delivery, but it’s also thanks to advancement by major big-box retailers like Walmart and Target following in the footsteps of Amazon.”

– Elizabeth Marsten, Group Director, Marketplace Strategic Services

For growing brands, digital retail media offers a number of potential benefits. Through targeted placements, brands can leverage the existing online presence of larger retailers to gain new visibility and connect with highly relevant consumers who are actively looking for products to purchase. Specifically, through retail media, brands can:

The pandemic fundamentally shifted digital to the center of retail: online sales now account for 1 of every 5 retail dollars spent, and the majority of offline purchases are influenced by online research. For brands that sell in brick-and-mortar stores but are still newer to the web, retail media represents a chance to make quick gains. Retail media can also help build awareness in new global markets where brands have yet to launch robust localized web offerings.

“Retail media is definitely playing a crucial role as ecommerce becomes a bigger piece of the retailer’s pie. I remember being part of retailers where ecommerce was such a tiny percent of the total business. As the years went on, it was still relatively small but growing exponentially. We’ve seen ecommerce become a much bigger piece of retailers’ total business throughout the years, and we tend to see higher year-over-year growth rates in ecommerce vs. the more established store business for omnichannel retailers. I expect retail media to continue to grow as ecommerce grows, and as brands realize the importance to invest in media to stay competitive online.”

–Scott Glaser, Associate Director of Marketplace Strategic Services at Tinuiti

Shoppers browsing retailer websites and apps are purposely seeking to buy. Retail media gives brands the ability to influence decisions when consumers are in active research mode and weighing purchase decisions.

Consumers widely expect shopping experiences to be personalized, but it’s harder than ever for sellers to deliver, thanks to a growing number of regulations and recent decisions by major tech players ending or limiting the use of third-party tracking cookies.

As a result, first-party data consumers directly share is now at a premium – and retailers have it in abundance, in the form of item data and purchase histories. On retail media networks, brands can target shoppers effectively by category, price point, and even SKU attributes such as clothing size.

“It’s all about the audiences. Retailers have amassed years of loyalty data through programs with perks, points, and personal information. While previously leveraged in a slow-to-scale (and rather impersonal) way, retailers can harness “people as data sets” with considerably greater relevance, and higher-quality targeting, to appeal to brands looking to generate new-to-brand buyers, foster loyalty buyers, and close the proverbial loop.”

– Elizabeth Marsten, Group Director, Marketplace Strategic Services

Because retail media placements are positioned within a shopping environment on the host ecommerce site or app and leverage existing customer data, brands can easily track the impact of their investments. They can see which products sell, which customers are buying, and confidently calculate return on investment (ROI).

Not only do more consumers see retail media than might expressly visit an unknown brand’s site, but they’re more likely to trust products they see on a large merchant site or app. A recent Amazon Prime Member Study by Tinuiti found that 6 in 10 Prime members had tried new categories or brands on Amazon during the pandemic; willingness to experiment correlated with loyalty to Amazon, suggesting trust in the platform helped nudge shoppers to try new offerings found there.

Multiple entities contribute to the growing popularity of retail media, and each partner can potentially reap positive outcomes. The key roles in the ecosystem:

While the best-known providers of retail media networks are mass merchants such as Amazon, Walmart, and Target, recently bargain warehouse Costco and category leaders such as Best Buy and Home Depot have launched their own retail media offerings. The sites needn’t be bricks-and-mortar retailers; in addition to Amazon, delivery services Instacart and DoorDash and online auction site eBay are among the sites hosting ad networks of their own.

These companies benefit from a new advertising revenue stream that offers much higher margins than traditional retail, giving them more budget to reinvest in digital initiatives. They can also leverage their retail media networks to solidify brand partnerships and better track and anticipate inventory demand.

Buyers of retail media advertising can be brand manufacturers or dealers seeking improved visibility on existing retail partner websites, or they can be companies looking to target potential affinity groups. For example, airlines may opt to invest in retail media ads on sites offering paid placements in luggage and travel accessories categories; financial services companies may want to advertise home equity loans to shoppers looking at DIY renovation supplies on a hardware and home goods site.

With retail media network hosts offering both onsite and offsite ad buys with different audiences and degrees of effectiveness, it’s no wonder brands turn to agencies such as Tinuiti to help direct their retail ad spend. Acting as a proxy for the retail media buyers, agencies offer strategic advice, expertise, and day-to-day management of retail media initiatives.

Seven in 10 consumers now expect interactions with brands to be personalized – an achievable feat thanks to retail media’s superior targeting abilities and contextual placement in the shopping environment. The result is a higher than average return on ad spend (ROAS) that’s among the top reasons brands opt to invest in retail media.

Because retail media networks deliver benefits across the ecosystem, they’re quickly becoming big business. After jumping a whopping 50% in 2020, annual sales growth has continued at above 20% and is forecast to total $41 billion by 2030 – that’s nearly 15% of all digital ad spending, according to eMarketer.

The boost retail media network owners receive from this spending will help propel spending across the ecosystem, with an estimated $1.3 trillion potentially generated in enterprise value by 2026 as retail and traditional media capabilities combine, McKinsey predicts. The effectiveness of retail media ads is set to contribute to continued growth in the ecommerce sector overall: online retail sales are forecast to top $7 trillion globally by 2025, to more than 23% of all retail sales, eMarketer says.

Even with a number of potential benefits incentivizing brands to start their retail media journey, the prospect can be daunting. After all, each retail media network has its own customer data, advertising mechanisms, ad formats, and channels, making scheduling alone – not to mention tracking and reporting – a resource-intensive endeavor. But with focused investments in data, talent, and technology, brands can maximize ROI in record time.

The more data brands have at their disposal when planning and placing retail media ad buys, the better they’ll be able to target spending to relevant audiences. Tools for gathering first-party data such as email subscription offers, interactive profile builders that collect information on preferred styles or solutions, loyalty programs, feedback surveys, and customer service interactions can all help brands enhance existing customer records.

As they face increasingly complex digital ad spending options, brands need to recruit media buyers with the expertise to take a holistic approach to campaigns based on their goals and their target audience – without being siloed in one particular network or channel. The optimal strategy may mean using one retail media network to place ads on the retailer’s ecommerce site and another for offsite social media plays. People management skills also come into play to align campaigns with merchandisers’ and product managers’ priorities so the right categories and items are being promoted.

To select the right retail media mix, knowledge of brands’ target audience is key. While it’s tempting to default to Amazon, the dominant retail media network for sheer reach, category-specific retail media networks may be a better option if they can provide more precise targeting and ad relevance. While traffic scale ranked first in importance of retail media network attributes, traffic quality – defined as “reaching the right audience” – and targeting capabilities came in second and third in an eMarketer survey, suggesting that a combination of healthy audience size combined with niche relevance is the optimal combination.

Managing retail media campaigns requires more than manual updates to a spreadsheet. Monitoring and bidding engines can identify high-intent audiences to target and optimize spending across retail media networks, while real-time reporting tools can track results and issue alerts when adjustments to campaigns are needed. While large brands may attempt to build these capabilities in-house, others may require more sophisticated ad agency solutions.

Compared with other types of advertising, retail media promises access to an unprecedented level of data both for targeting campaigns and measuring their success. But transforming that vision into reality requires overcoming a series of unique hurdles. Among them:

In theory, retail media networks offer a trove of first-party data to help target offers, but brands should investigate what specific types of data are on offer. Do retailers leverage data from stores to inform their ad ecosystem? How do they integrate social media and search intent signals with their first-party customer data?

Data clean rooms enable advertisers to leverage the valuable first-party data retail media networks offer while complying with privacy regulations and standards. Data from different sources is securely synced, then stripped of identifiers and aggregated into groups or cohorts to inform targeting and personalization. While the concept has received plenty of hype, not all data clean rooms are built to the same standard; review policies thoroughly before initiating campaigns to avoid a costly privacy breach. What controls and permissions exist for each party, how is brand data imported into the clean room, and how quickly can results be extracted at scale?

Retail media networks can provide concrete measurement of ads’ impact on sales – but only if analytics tools move well beyond impressions, clicks, and conversions. Incremental ROAS is just the start; the ability to compare results for new versus returning customers, to track performance by category, and to engagement metrics for a fuller picture of retail media impact.

Brands also need to be able to compare performance of campaigns across different retail media networks – a challenging feat, given that analytics and data practices vary from platform to platform. The ability to knit together disparate information can help brands holistically target audiences, rather than isolated segments within a single network’s system.

Once accurate data has been collected, brands need to be able to translate it into actionable insights that can optimize campaigns and drive sales. Data can also be used to refine marketing initiatives in other channels, and attach concrete value to relationships with individual retail partners. Retail media performance data can even inform product design and pricing strategy.

Retail media can be a powerful means to reach active shoppers – and not just to trigger purchases of individual products. Companies are using retail media networks at every stage of the customer lifecycle, from introducing their brands to re-engaging lapsed customers. Among the types of retail media to consider:

Social media placements via retail media networks leverage the visibility and advertising budgets of larger players to spotlight brands in news and video feeds. While these audiences aren’t necessarily looking to buy, relevant finds can convince them to switch into shopping mode. This sponsored promotion by Home Depot on Facebook features Delta bathroom fixtures – potentially relevant for a viewer who’d been reading reviews of local contractors on the platform earlier.

Up-and-coming brands can introduce themselves to active shoppers by targeting audiences browsing ecommerce sites at the category level or using on-site search for generic terms. Prebiotic brand Poppi drove 86% sales growth quarter over quarter and 106% growth in new user acquisition with streaming advertising in Amazon’s Upper Funnel program. The ads express the brand’s playful identity and eye-popping design with bright colors and peppy music, with information about health benefits integrated in the messaging. Adjacent Amazon product listings enable purchase.

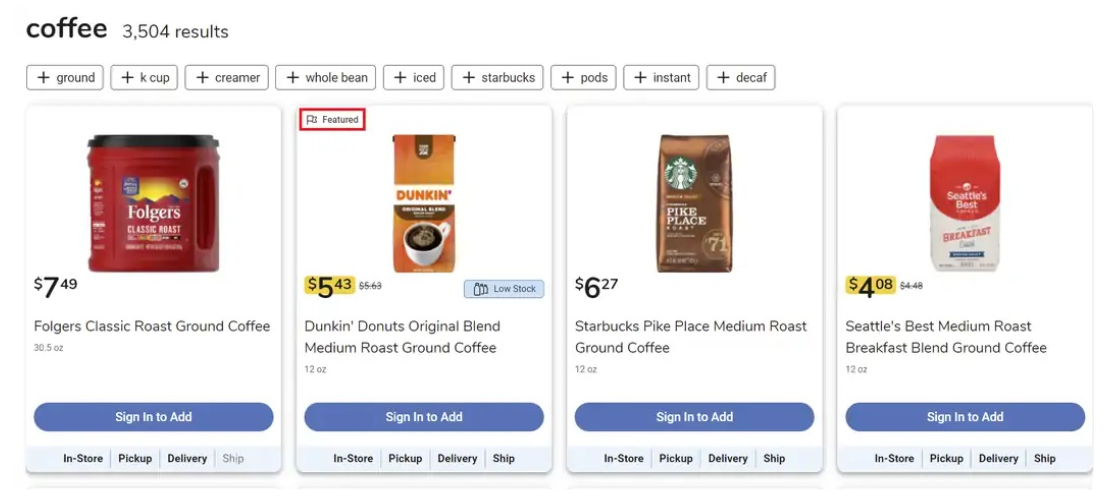

Once shoppers begin hunting for products in earnest, individual product listing ads on retail media networks within on-site search results and in cross-sell positions on the ecommerce page – as well as offsite on search engines – can help brands boost visibility. Dunkin’ Donuts ensured their Original Blend coffee earned a highly visible placement amongst thousands of returned results for an internal “coffee” search with a Featured product listing on the Kroger website.

Brands can position themselves within retail media networks’ local search advertising to drive in-store purchasing. This Target Roundel placement highlights nearby availability for a specific brand and product keyword term.

“The next rabbit hole of retail media is: How do you connect an in-store transaction to an online ad on a regular basis? The answer tends to be an investment and structural change that can handle this audience-based approach over individual retailers or channels and their ROI/ROAS.”

– Elizabeth Marsten, Group Director, Marketplace Strategic Services

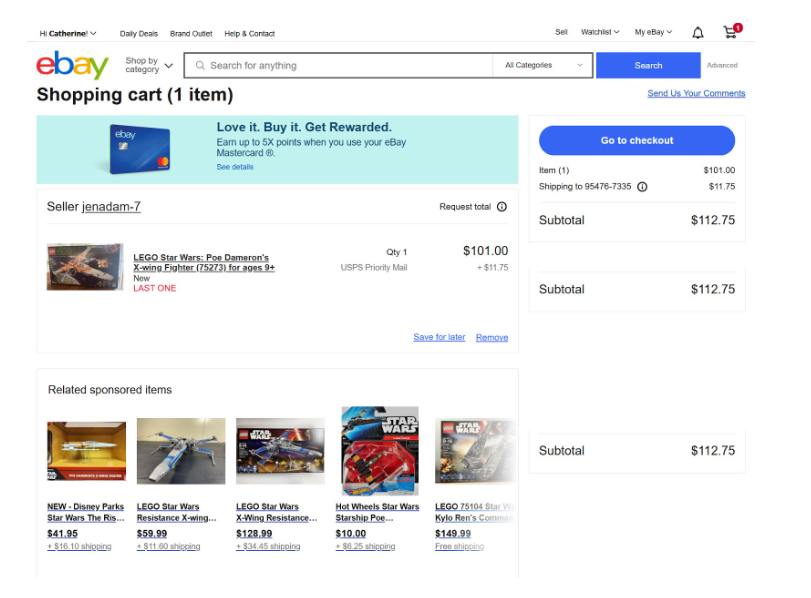

Ad placements in the shopping cart can capture the attention of shoppers who are edging toward a purchase commitment and give them alternatives, add-ons, or discount savings. eBay’s shopping cart features a carousel of products to accompany or replace the item in the cart; in addition, a credit card offer promises rewards points for purchases – a timely offer to go with a relatively high-priced item for the platform.

Retail media has come a long way since the days of store cardboard cutouts.

“One of the benefits of ecommerce is that it’s an endless aisle that isn’t limited by floor space in a store. In some situations, brands have the ability to upload entire product catalogs online, which is a great way to offer your product line to customers around the world. That said, more products and unlimited space leads to more competition. It’s increasingly important that brands invest in retail media to ensure that their products are visible and being shown to the right consumers. The hard part is that there are so many advertising options across different retailers. It can be intimidating and overwhelming to think about how to spend budgets by retailer, let alone by ad type by retailer. That’s where Tinuiti comes in, as we take a holistic approach to retail media and allocate budget by retailer based on goals and our industry expertise.”

– Scott Glaser, Associate Director of Marketplace Strategic Services at Tinuiti

With unprecedented capabilities to target relevant audiences and deliver measurable ROI, retail media can boost visibility and sales for brands on the rise. To learn more, check out Tinuiti’s “Retail Media Masterclass” available on-demand.