2024 Cyber Five Ad Trends: Black Friday and Cyber Monday Stats Across Google, Amazon, and Meta

The period between Thanksgiving and Cyber Monday, known as the Cyber Five, is a clear mile marker to start holiday shopping for many consumers, and, as such, is a pivotal stretch for many marketers. Here we’ll take a look at some of the key trends that emerged from this year’s Cyber Five for Tinuiti clients under management, including how the shift in the timing of Thanksgiving impacted sales and ad pricing.

The following charts and figures are based on same-store growth for longstanding Tinuiti advertisers.

This post was coauthored by Mark Ballard and Andy Taylor.

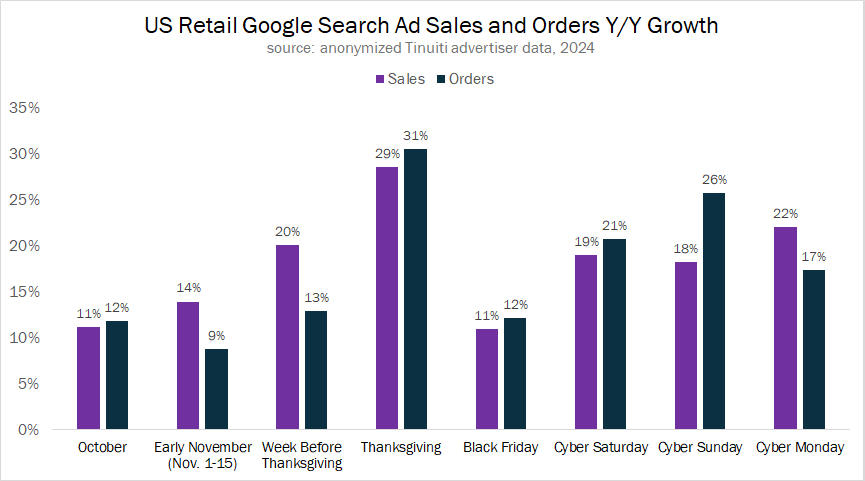

With Thanksgiving coming a full five days later in 2024 than in 2023, consumers were less inclined to wait around until Black Friday to begin making a large share of their holiday purchases. Looking at retail purchases generated by Google search ads, sales growth jumped from 11% Y/Y in October to 20% Y/Y over the seven days before Thanksgiving. The median retailer then saw sales growth hit 29% on Thanksgiving Day itself, before returning to October levels on Black Friday.

While Black Friday and Cyber Monday are still significantly bigger sales days than the rest of Cyber Week, consumers have been spreading their Google-driven purchases out more in recent years. In 2023, order growth from Google search ads was strongest over Cyber Saturday and Sunday, while in 2024, those days were beaten only by the relatively late Thanksgiving Day. Cyber Monday sales growth did outpace the preceding weekend, however, due to stronger average order value (AOV) growth.

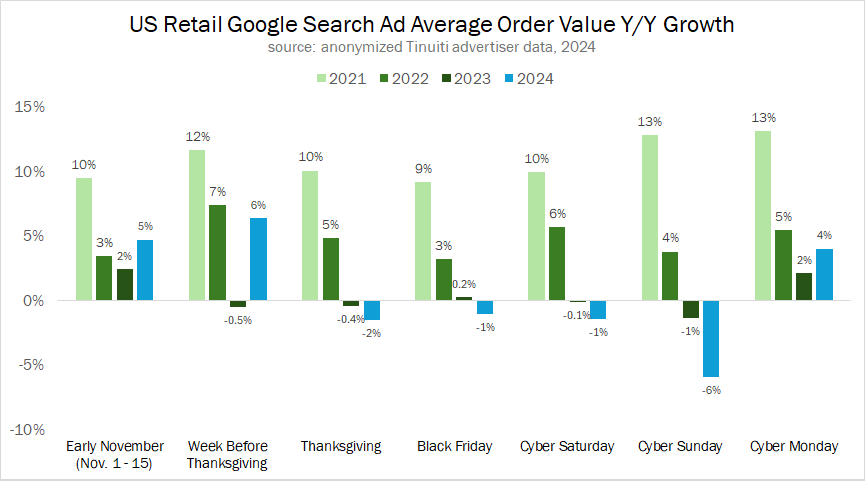

Again looking at performance from Google search ads, retailer sales growth over Cyber Week came despite modest declines in AOV on all days except for Cyber Monday.

Over early November and through the week before Thanksgiving retailers had seen AOV rise by a little under 6% Y/Y, which was up from an average of 3% growth in Q3. On Thanksgiving Day, though, AOV growth turned negative with Cyber Sunday seeing the largest decline of the week.

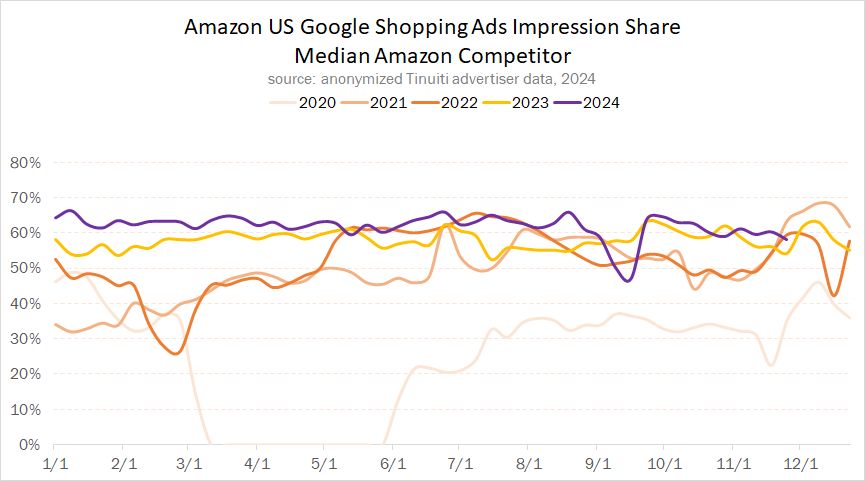

Looking at the presence of Amazon and Temu in Google Shopping ad auctions, it appears that the competitive landscape for the rest of Google’s retail advertising base may have been a bit more favorable this year than last.

Amazon’s average share of Google Shopping impressions took a big hit toward the end of Q3 but recovered at the beginning of Q4. In the weeks since, though, Amazon’s impression share has generally declined, including during the week of Thanksgiving.

This trend largely mirrors what Amazon’s competitors saw in 2023, but in 2021 and 2022, Amazon’s share of Google Shopping impressions was on the rise ahead of Thanksgiving as the retail giant got more aggressive in its stance in Google’s auctions at those times.

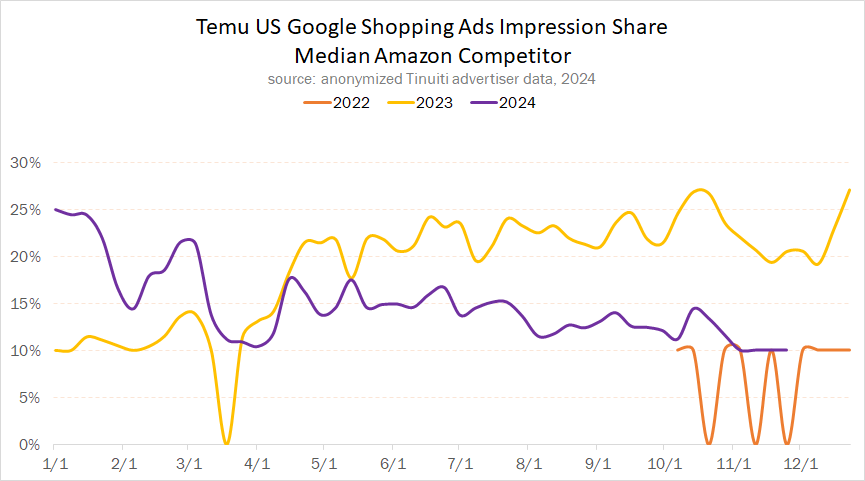

Maybe more significant than Amazon failing to make a big push in Google Shopping auctions yet has been Temu’s sharp decline as a competitor for Shopping impressions. At points in Q4 2023, Temu was second only to Amazon in the share of retailers seeing it as a competitor for Shopping impressions (as determined by Google’s Auction Insights Reports).

Over 2024, however, fewer brands are seeing Temu as a competitor for Google Shopping impressions and those that still do are seeing Temu at a minimal presence. The minimum impression share in Google’s Auction Insight reports is listed as “< 10%”, which is where the median Temu competitor sees Temu now.

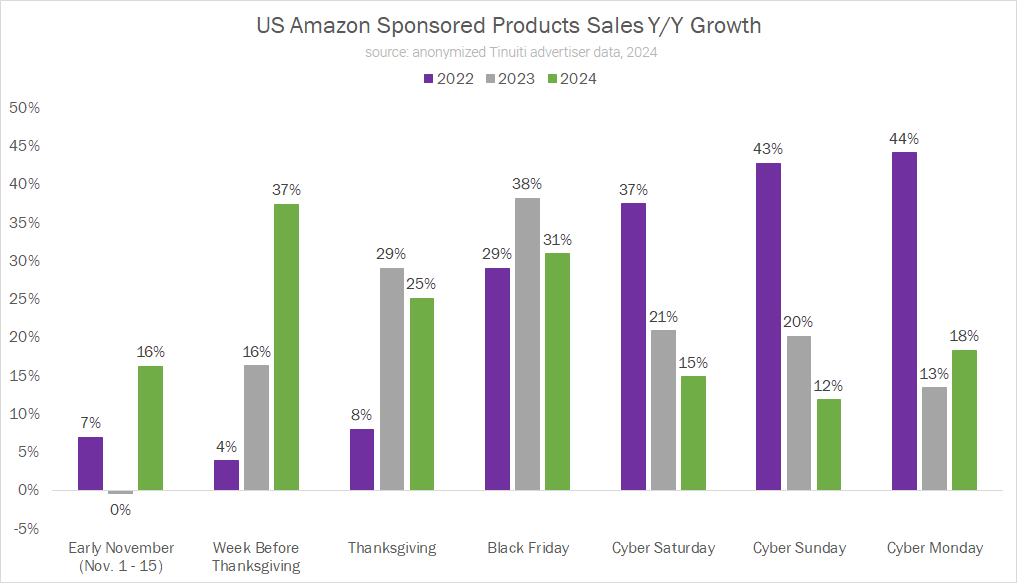

Amazon now promotes Black Friday deals a week before the big day, and growth in sales attributed to ads during the seven days before Thanksgiving has accelerated each of the last two years. In 2024, sales attributed to Sponsored Products were up 37% year over year for the week before Thanksgiving, topping growth on key days like Black Friday and Cyber Monday. This is at least partially a result of the change in how the calendar year fell in 2024, with the Cyber Five taking place nearly a week later than in 2023.

Advertisers also saw strong growth throughout the Cyber Five, with sales up 31% on Black Friday and 18% on Cyber Monday. The weakest growth came over the weekend, though Sponsored Products advertisers still averaged 13% sales growth over the course of Saturday and Sunday.

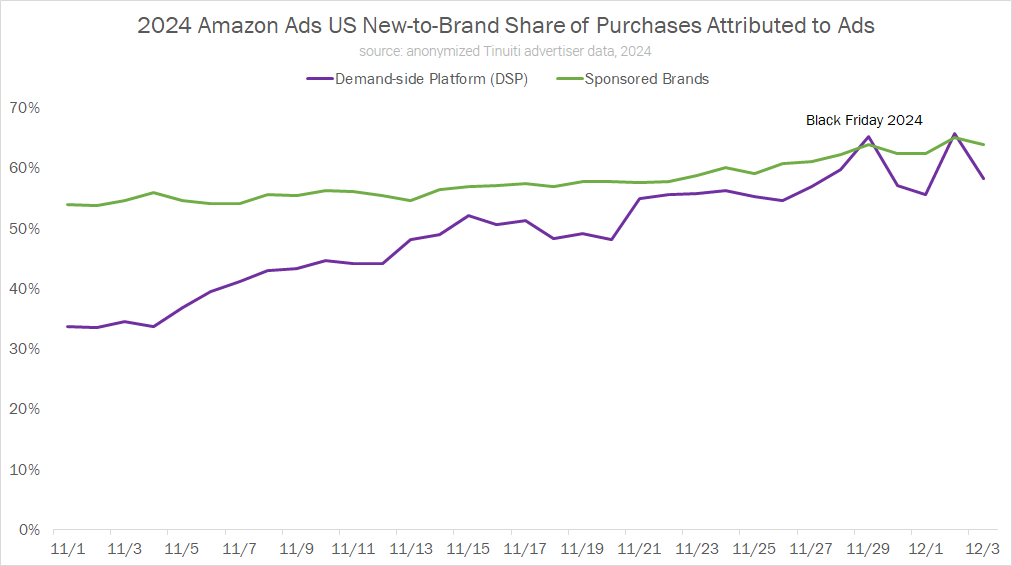

Across both the Amazon Demand-side Platform (DSP) and Amazon Sponsored Brands, the share of purchases attributed to ads as new-to-brand rose throughout the month of November, and was significantly higher during the Cyber Five than earlier in the month. This is especially true for the DSP, which saw new-to-brand purchase share rise from 34% at the start of November to 65% on each of Black Friday and Cyber Monday.

New-to-brand customers are defined by Amazon as those shoppers who have not purchased from the advertiser in at least twelve months. Marketers typically see new-to-brand customer share rise during key events like the Cyber Five and Prime Day, as well as in the final lead up to shipping cutoffs for Christmas delivery when shoppers increasingly purchase from new brands to get presents in time.

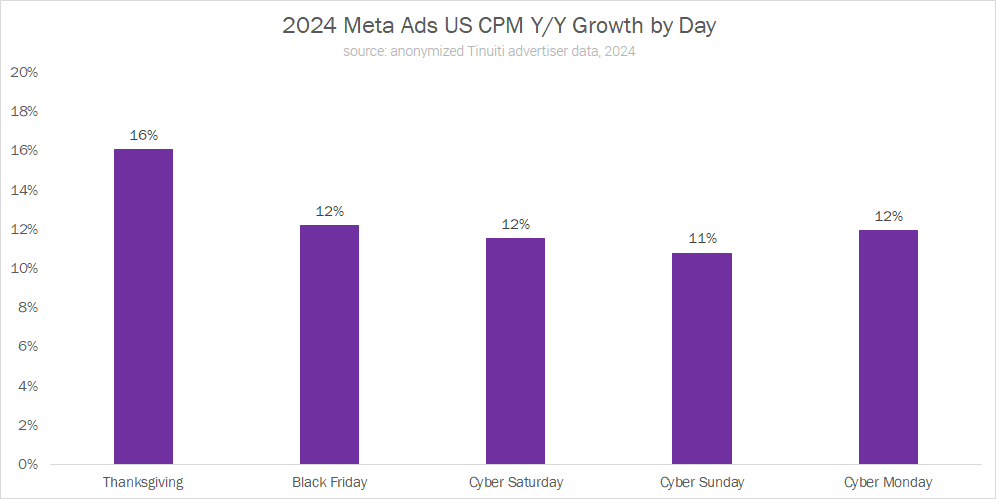

Tinuiti Meta advertisers, most of which are retail/ecommerce brands, saw CPM climb by at least 11% on each day from Thanksgiving through Cyber Monday, with the biggest growth coming on Thanksgiving Day at 16%. For the full five-day period, CPM rose 12% year over year, far eclipsing the 3% CPM growth observed over the entirety of the Cyber Five last year.

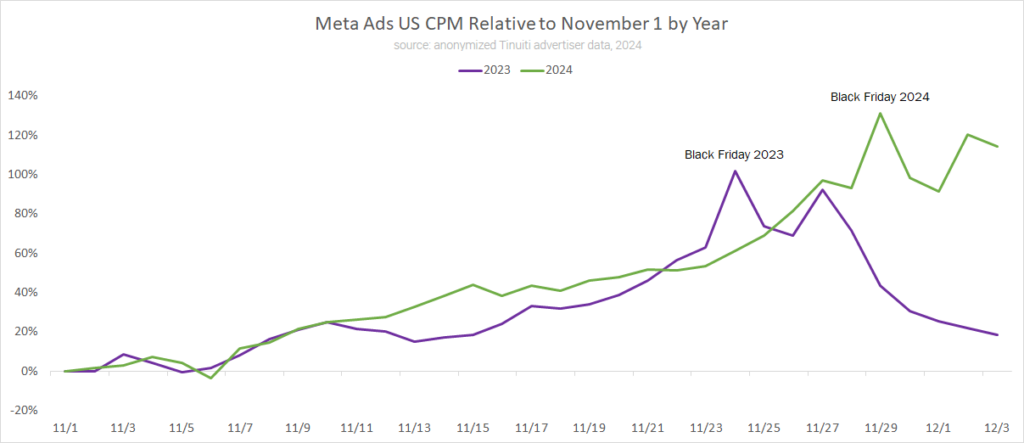

Over the course of the first ten days of November, the ramp in Meta CPM compared to November 1 observed in 2024 was remarkably similar to that of 2023. However, CPM picked up more steam in the middle of the month in 2024 than in 2023, and advertisers saw CPM continue to climb for nearly a full extra week before Thanksgiving thanks to how the holiday fell this year compared to last.

Advertisers should expect pricing to come back closer to mid-November levels in the coming days.

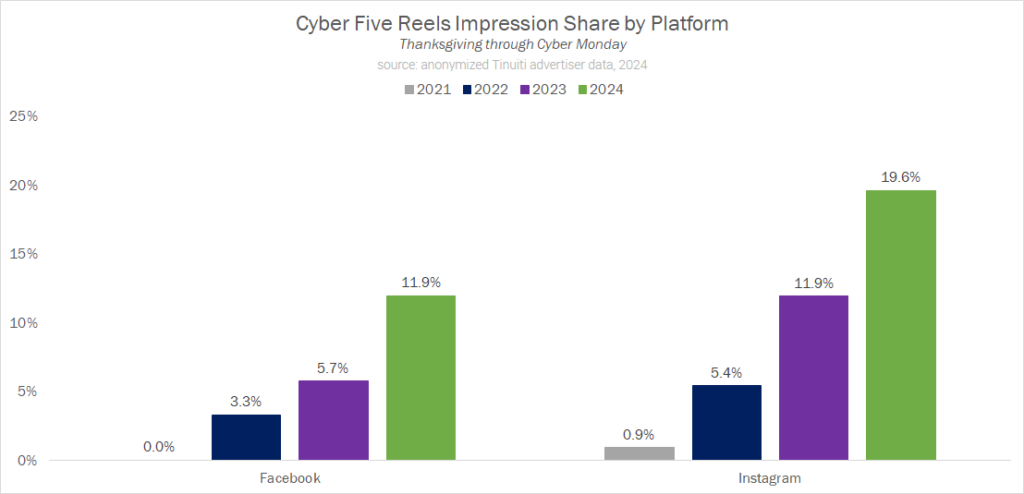

Reels video ads continue to grow in importance for Meta advertisers across both Facebook and Instagram, and this was certainly clear when looking at how impression share for Reels has risen during the Cyber Five. Reels video ads share of Facebook impressions during the Cyber Five more than doubled from 2023 to 2024, while their share of Instagram impressions nearly topped 20% in 2024.

Combined with the fact that Reels overlay ads accounted for an additional 13.8% of Cyber Five Facebook ad impressions, it’s clear that Reels has become a crucial part of how marketers are reaching potential customers this holiday shopping season.

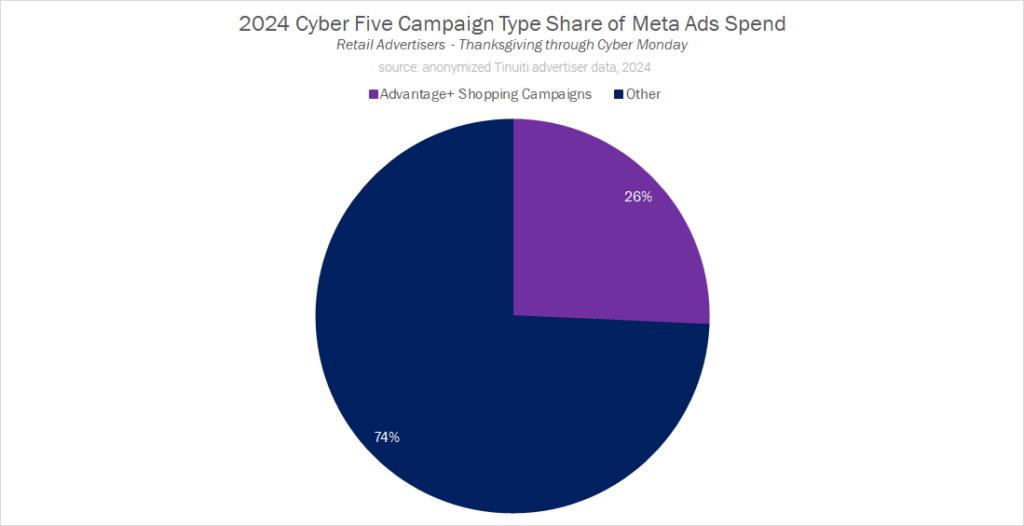

Retail advertisers spent 26% of all Meta investment on Advantage+ shopping campaigns (ASCs) between Thanksgiving and Cyber Monday. Much like with Google Performance Max campaigns, ASCs are AI-powered campaigns which streamline some aspects of optimization.

While the 26% Cyber Five figure is a decline from the 34% spend share the campaign type held for the full third quarter, ASCs are still a substantial portion of many advertisers’ investment in Meta properties this holiday shopping season.

Thanks to the late timing of Thanksgiving, we’re already less than three weeks away from Christmas. Keep a look out for the Tinuiti Q4 2024 Digital Ads Benchmark Report in January to get a full accounting of how the holiday season shakes out for advertisers from here.