The 7 Biggest Online Grocery Shopping Trends & Tactics for Brands

The online grocery shopping industry has evolved rapidly to meet an almost overnight change in consumer demands.

Improvements in digital technology and new restrictions from the COVID-19 pandemic have forced brands to innovate, including new methods for selling directly to customers, online ordering, last-mile delivery, click and collect, and other changing consumer appetites.

Here are seven of the biggest online grocery shopping industry trends and opportunities that brands are capitalizing on in 2021.

Following COVID-19, Amazon and Walmart have leveraged the changing grocery shopping landscape. These leaders will capitalize on changes in consumer behavior, emerging channels, and the advent of smaller customer-centric digital brands that are taking over the online grocery industry.

Though online grocery sales are still on track to make up 20% of all grocery sales, becoming a $100b market by 2022, consumer behaviors in the time of COVID-19 change depending on multiple variables: stay-at-home orders, mask regulations, and rapidly changing consumer preferences.

In fact, in the four weeks leading up to March 12, 2020, ACOSTA – CPG industry sales and marketing research firm – reported that:

Despite complications from COVID-19, Amazon and Walmart will continue to lead online grocery through 2021 and beyond. CPG industry research firm eMarketer states that 37% of US digital shoppers most recently purchased groceries from Walmart, compared with 29% who used Amazon.

“New CPG brands are entering markets dominated by big-box retailers and selling similar products in a way that addresses the exact pain points of their niche target market. They’ve given a fresh take on an old product and can project themselves as something new and worth trying.”

— Ben Whitrock, Senior Growth Media Manager at Tinuiti

While Walmart has an advantage over Amazon in the marketplace, Amazon’s free, fast shipping could carry the company over the finish line with shoppers. Many changes in Amazon’s business model, like eliminating Amazon Fresh’s monthly fee for Prime members and expanding for the third time, have made their presence significantly impactful in all major US markets.

Similar to how companies like UberEats and DoorDash changed the delivery landscape, so too is ecommerce reshaping grocery platforms.

Aided by the pandemic, more than 40% of Americans who ordered grocery delivery during the week ending in March 13th also tried it for the very first time in 2020. Even more interesting is that many consumers report they’d like to continue their behavior, post-pandemic.

According to a study by Mercatus/Incisiv, 90% of e-grocery customers are expected to continue shopping online. Once more drastic shelter-in-place orders are lifted, only 7% of online grocery shoppers said they will return to brick-and-mortar stores.

As COVID-19 has brought new regulations and consumer concerns to light, ecommerce and grocery retailers have been tested to the limit. While pushing the envelope on what is expected of a digital retail business in 2020, some major models have emerged for brands to use as a reference point in determining which offering their customers might prefer.

Elizabeth Bennet, VP Global eCommerce at the Kraft Heinz Company recently posted three different digital grocery models. These models are as follows:

1. Pure-play, Ship-to-home – In this model, customers complete all stages of purchasing digitally: discovery, transaction, and in-home delivery. Amazon and some of Walmart fit in this category.

2. Last Mile – In this model, shoppers complete the discovery and purchasing portion of the journey, but businesses, like Instacart, complete in-home delivery.

3. Click and collect, or BOPIS – In this model, consumers buy online, and pick up in-store (or, outside the store), collecting their order from the retailer.

Keep in mind that consumer attitudes during the pandemic are changing according to ongoing decrees by local and state governments. The best strategy is one that includes current consumer preferences but can adapt or scale as necessary when faced with major change.

In addition to the pandemic, protests in the United States brought a newfound focus to black- and minority-owned businesses across the country. The growing economic strife brought on by COVID-19 also highlighted the importance of supporting small and locally-owned brands. Selectivity about stores and brands has been top-of-mind for many in recent months.

In fact, a quarter of Americans (23%) have researched brands that are locally run or owned this year. Interest in women- and BIPOC-owned brands is on-the-rise. More than 28% of Americans have researched brands run or owned by women and BIPOC-run or owned brands in 2020, using that information to make purchasing decisions.

About 23% of survey respondents researched brands that are locally run or owned in 2020, and 14% said they’ve researched brands run or owned by women and by BIPOC. Even beyond 2021, consumers will trend in-favor of being selective about the stores and brands they support.

Here’s a list of five of the fastest-growing and high-performing women- and minority-owned businesses frequented by Instacart users in North America.

Among all of the burgeoning delivery services, Instacart remains the most popular in North America. Instacart shoppers offer same-day delivery and pickup services to bring fresh groceries and everyday essentials to busy people and families across the U.S. and Canada.

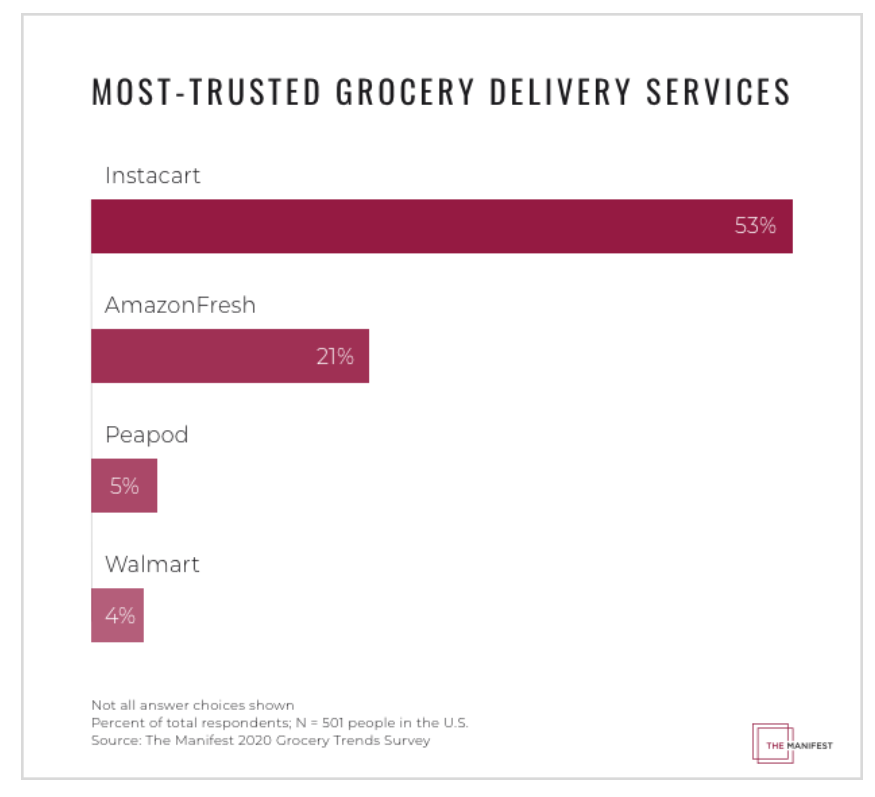

More than half of Americans say that they trust Instacart more than Amazon Fresh and Walmart.

In 2020 alone, Instacart consumed 57% of the grocery ecommerce market and increased their order volume by 500%. Instacart is an undisputed opportunity for brands to acquire and retain online grocery shoppers.

Work-from-home flexibility dramatically increased consumer grocery shopping schedules as well. Instacart reports that the “numbers of orders placed between 9 AM and 5 PM during the workweek rose by 32%.” Instacart also reports that almost a quarter of Americans are doing more shopping during the week, with orders placed on weekdays growing by 8%.

As America’s shopping habits continue to change after COVID-19, an Instacart advertising strategy should be top of mind–if you’re in-store as a participating retailer. Learn more about the top trends dominating Instacart advertising and unpack the latest insights across our digital aisles here.

“Instacart’s marketplace is becoming an enormous opportunity for brands that can get on the platform early. High conversion rates, average order values, repeat purchases, and lower CPCs are all positive signals for brands, in addition to reaching shopper households all across the US.”

— Elizabeth Marsten, Senior Director of Strategic Marketplace Services

“Customers are also moving rapidly from thinking just perishable staples to adding shelf-stables and other CPG products like cosmetics, health, and of course, alcohol. If you are in-store at a participating retailer, then an Instacart ads program should be part of your media strategy.”

Supermarkets with limited online offerings were severely affected by the pandemic. With the growing innovations. Perhaps not surprisingly, brick-and-mortar stores are forecasted to fall at -1% CAGR when compared to the overall grocery industry growth.

Despite the growing adoption of online-ordering and grocery delivery platforms, consumers still bring some worries with them. Addressing these concerns is crucial for any online-grocery provider and/or brick-and-mortar store.

The following findings were first reported by financial firm UBS, taking data from their Evidence Lab respondents. From the study, these were the most frequently cited reasons for not spending more on grocery online:

To really master both brick-and-mortar and online grocery spheres, brands will need to offer more diverse items, increase their online SKU counts, and offer more flexible shipping options.

In addition to the pandemic changing major consumer businesses, COVID-19 also changed the items that online shoppers prefer to purchase. During the midst of the first wave of the pandemic, consumer attitudes focused heavily on purchasing personal health products. In fact, according to Accenture, 34% of consumers are increasing their purchase of personal hygiene products while cutting back on more discretionary categories.

These changes in spending habits extended well beyond the first wave of the pandemic, as lockdowns increased all over the world. With the rise of these lockdowns, came a rise and a focus on consumer health. Online grocery brands should note these changes, and prioritize the ways they can support healthy lifestyles for consumers, shoppers, and employees.

For instance, consumers are modifying their personal habits such as cleaning more surfaces, increasing their handwashing, and more than 85% of consumers plan to continue these habits following COVID-19. Such changes present opportunities for new personal hygiene offerings within any company’s portfolio. Even virtual tools, such as mediation apps, or anything poised to focus on self-care and mental well-being can be a positive influence not only on consumers but also on overall brand perception in the marketplace.

Online grocery companies cannot overlook or underestimate the impact their spend has on the bottom line. Focusing on consumer behaviors, food trends, and breakthrough technologies is the key to success for digital retailers in the online grocery industry.