Cost of Facebook Impressions Down by 50% to End Q1 as Coronavirus Impacts Become Clear

It’s no secret that social media and communication platforms are seeing a huge uptick in usage as the US hunkers down to limit the spread of Coronavirus, and Facebook itself has confirmed as much.

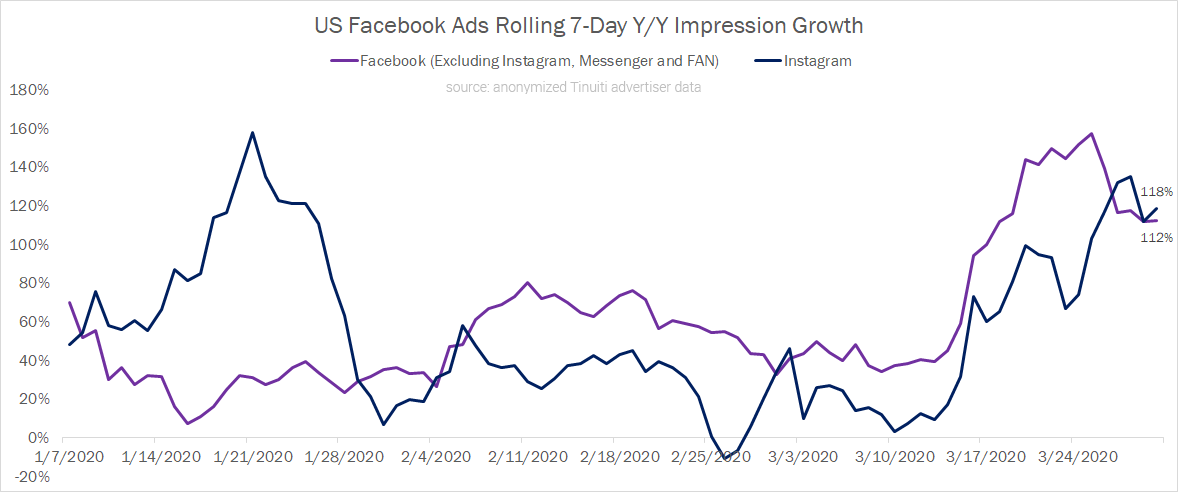

Looking at US advertiser performance for Facebook and Instagram, it’s clear that there’s no shortage of ad placements for advertisers to target as impression growth is soaring. At the same time, CPM is falling precipitously as some advertisers pause campaigns.

The charts and figures below are based on same-store growth figures for advertisers under Tinuiti management, and are trimmed to include only those clients that remained active for the vast majority of Q1 in both 2019 and 2020. As such, the effect of some advertisers pausing campaigns entirely is muted, but these trends are a good indication of how things are trending for those brands that have remained active.

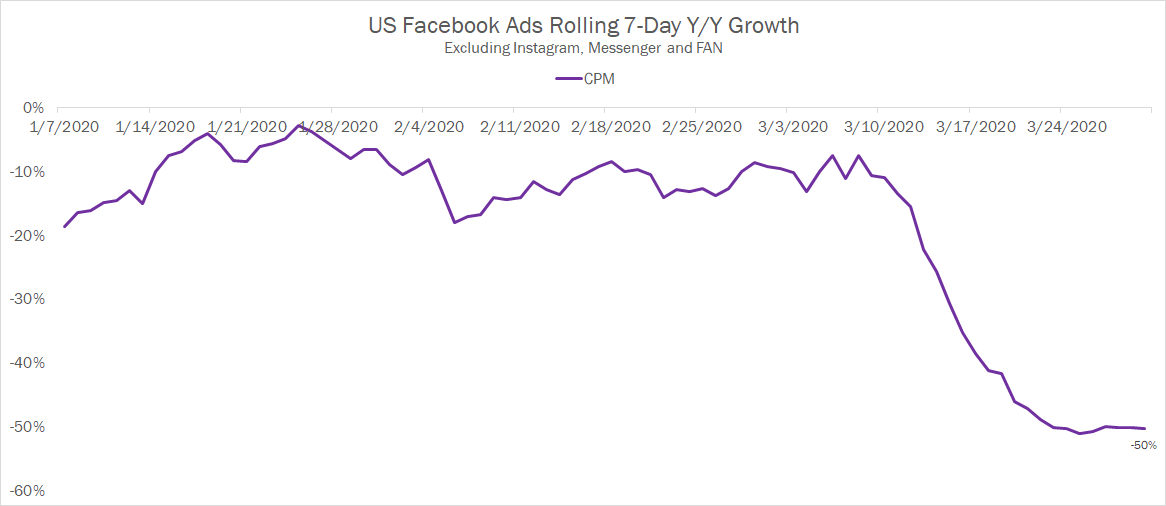

Looking at Facebook proper, excluding Instagram, Messenger and the Facebook Audience Network, CPM was down 50% year over year (Y/Y) for the final week of Q1.

With some advertisers pausing campaigns, the landscape has become more open for those advertisers that remain active, such that there’s less competition to drive up the cost of impressions.

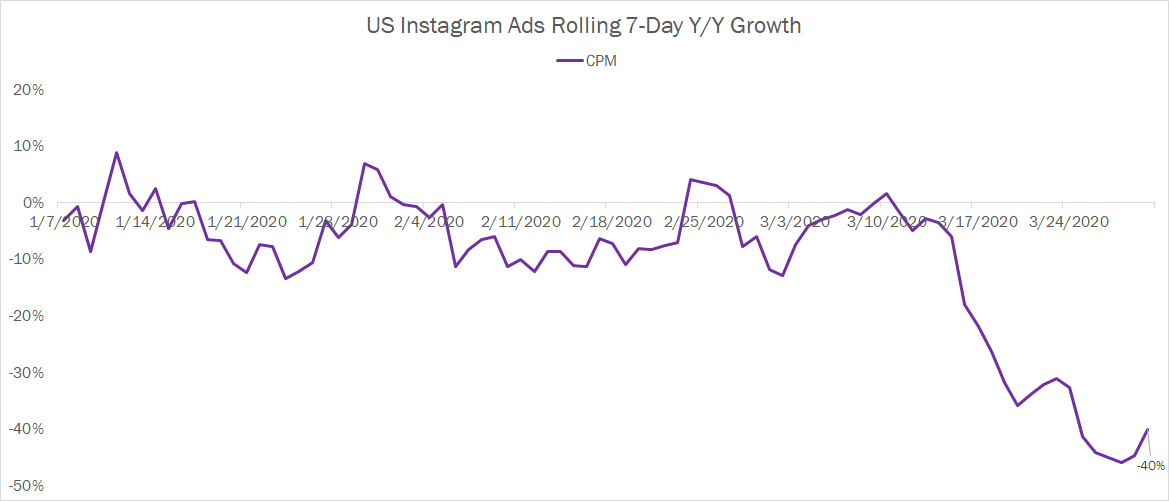

This chart looks very similar when looking over at Instagram, where CPM wrapped up Q1 down 40% Y/Y for the final week.

At the same time that CPM is falling, impressions for both Facebook proper and Instagram are soaring. In the final week of the quarter, impressions for both platforms rose by more than 100%.

While Facebook impression growth seemed to be far outpacing that of Instagram in the early days of the virus’s hold on American activities (or lack thereof), the two were growing at roughly the same pace by the end of the quarter.

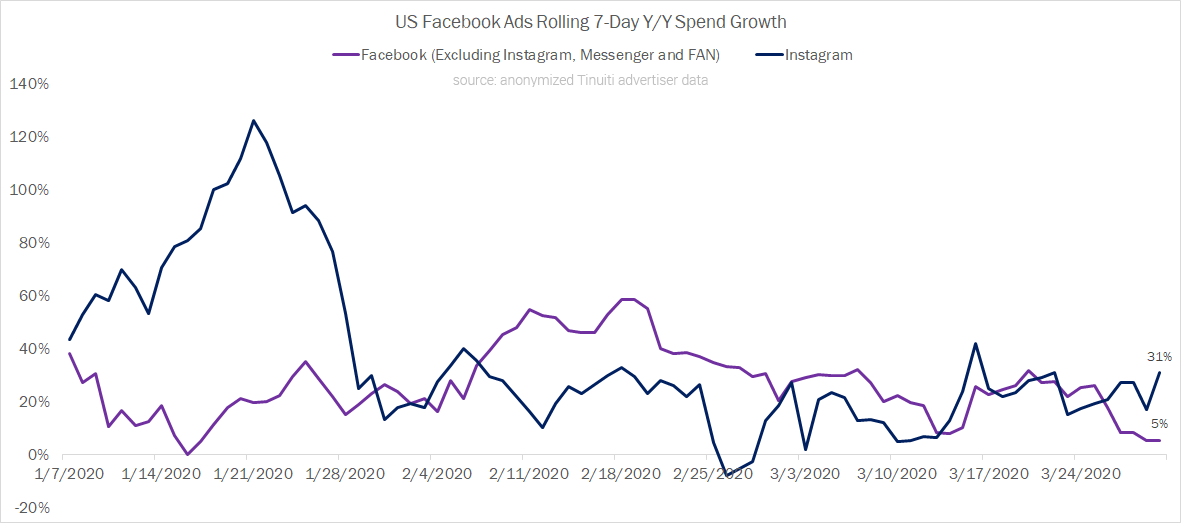

This impressive increase in impressions has helped to keep Y/Y spend growth positive for most advertisers, though this growth did slow towards the end of the quarter for Facebook in particular.

Facebook’s communications touted staggering growth in the use of messaging, which grew 50% in the regions hardest hit by Coronavirus. However, this has not meant that Messenger ads have become more important in the short term for advertisers, as the placement accounted for just 0.06% of spend in Q1 2020.

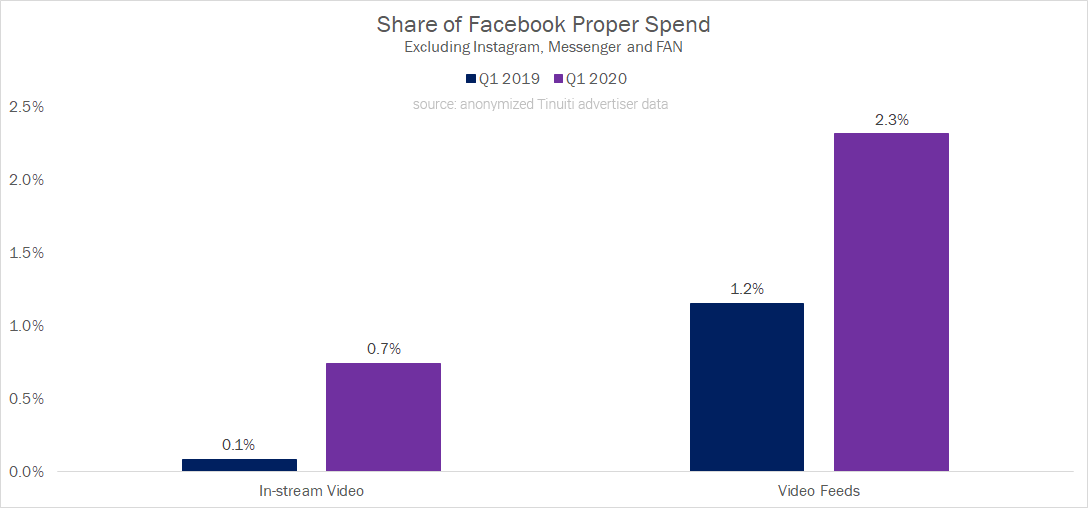

One trend seemingly unrelated to Coronavirus is the rise of video placements in advertiser spend share. The chart below shows the share of Facebook spend, excluding Instagram, Messenger and Facebook Audience Network, coming from in-stream video and video feed ads. In-stream video ads are those that show before, during or after video content, while video feeds let advertisers show video ads between organic videos in video-only environments.

While Y/Y Facebook and Instagram spend growth slowed in the final week of the quarter, Q1 was, overall, a positive in terms of advertiser investment in these platforms, with Facebook spend up 34% and Instagram spend up 37%.

These figures are based on those advertisers that have remained active on the platforms for the vast majority of Q1 2019 and 2020, and as such are not weighed down by those advertisers which might have paused ads in mid-March as events unfolded. While these advertisers certainly exist, particularly in hard-hit industries like travel, most Facebook advertisers at Tinuiti continue to invest in placements across its properties.

CPM is now HALF of what it was last year for Facebook proper and 40% lower for Instagram. There is clear opportunity for brands to gain visibility across these platforms at a price much lower than a few weeks ago, and marketers should take this into consideration in weighing budget adjustments moving forward.

We live in uncertain times, and the current reality has thrown a lot into flux. Digital marketing is certainly not immune, and we’ll be evaluating performance closely to best understand how things are shifting and what advertisers should consider in making adjustments over the coming weeks and months.