COVID-19 Fallout: Key Performance Shifts Across Google, Facebook and Amazon Ads

It should come as no surprise that recent events have had a huge impact on advertiser performance across the digital marketing spectrum. Here we’ve assembled some of the most important shifts we’ve identified across a sample of Tinuiti’s advertiser base, which spends more than $1.5 billion annually on advertising across Google, Facebook and Amazon platforms.

As a new state of reality sets in across the country, more social media users than ever are remaining at home for vast majorities of the day, with many possessing significantly more free time due to work interruptions. Facebook itself has confirmed that usage is soaring across its properties.

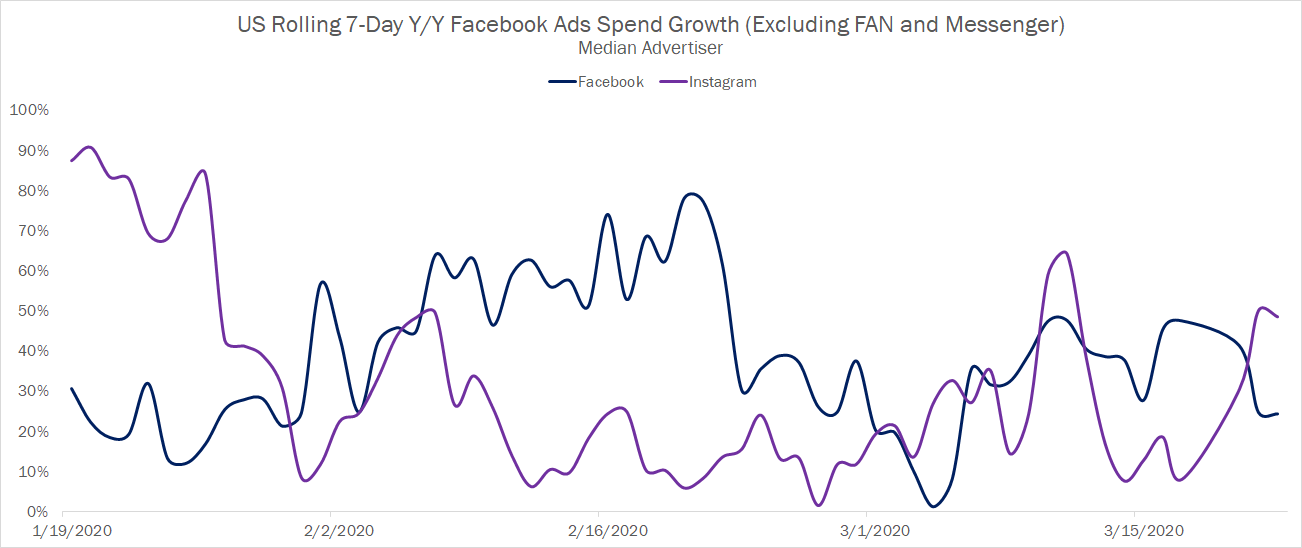

While advertisers in some industries, particularly those centered around travel, have been forced to temporarily cut off ads if recent events rendered them irrelevant, most Facebook advertisers continue to invest in the platform, though meaningful shifts are occurring.

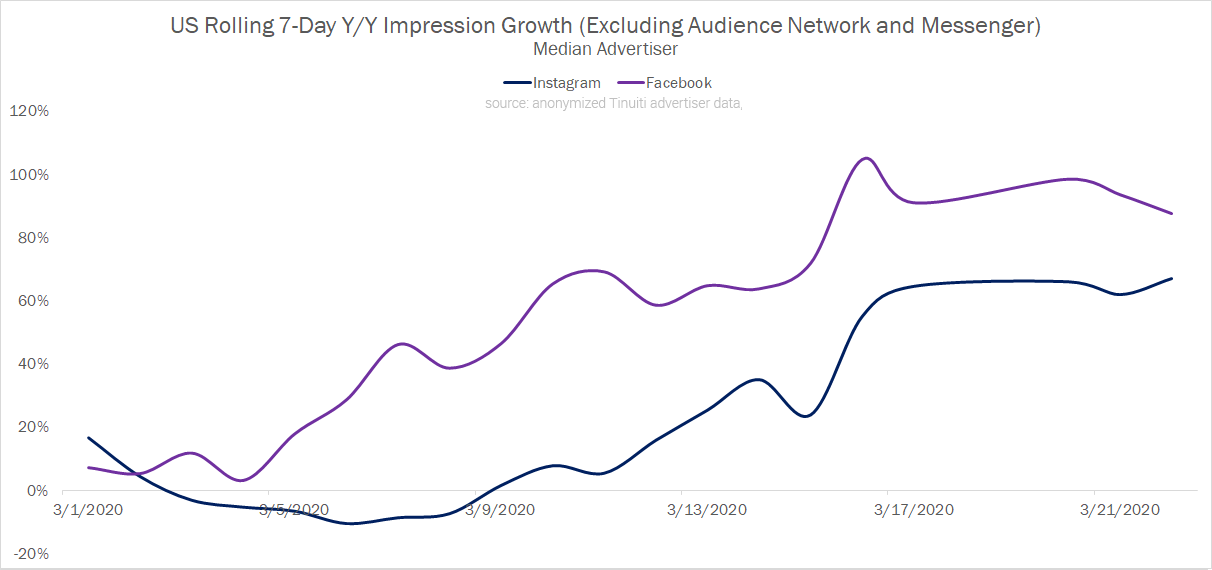

Digging into ad performance, we find that year-over-year impression growth on Facebook and Instagram soared over the last two weeks for many advertisers.

This trend has been accompanied by a decline in CPM, which has dropped meaningfully for both Instagram and Facebook. This comes as some categories of advertisers affected by Coronavirus have paused campaigns, freeing up available inventory and reducing competition.

All in all, most US advertisers are still growing spend on the platform year over year for both Facebook and Instagram. These trends are likely quite different in the regions that have imposed more stringent restrictions, as Facebook itself confirmed lagging ad sales in such markets.

Amazon is one of the businesses best positioned to benefit from the current reality in which consumers are attempting to complete as many of their purchases as possible online to avoid heading outside. This has resulted in a push to hire 100,00 workers to help with shipping and fulfillment, as well as the suspension of many of its advertising efforts on Google and a refocus on essential products given the strain of attending to the overwhelming demand.

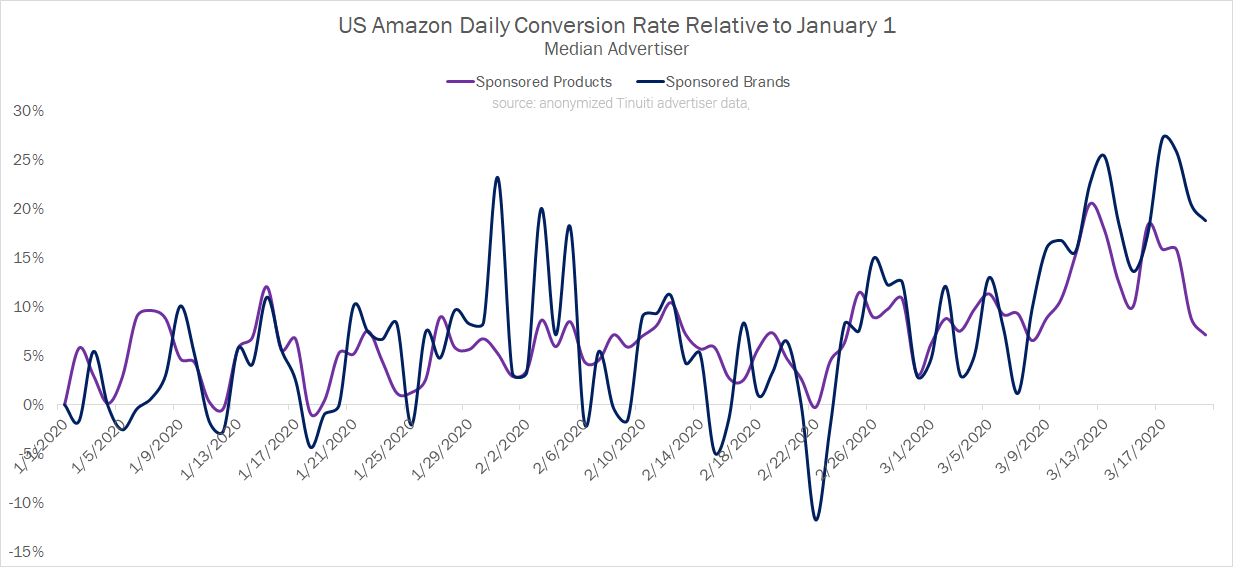

The strength of demand is obvious when looking at conversion rate for Sponsored Brands and Sponsored Products ads, which has been notably elevated for the past two weeks relative to earlier in the quarter.

However, while demand for products on Amazon is clearly soaring, advertisers are finding it more difficult of late to continue growing ad investment at the same rates observed earlier in Q1. Contributing to this slowdown are shifts in demand away from some types of products, supply chain issues resulting in low inventory/out of stock products, as well as Amazon’s move to restrict Fulfilled by Amazon (FBA) to only those products deemed essential, thereby forcing some sellers to find alternative options.

For Sponsored Products and Sponsored Brands ads, this has resulted in year-over-year spend growth for US advertisers slowing considerably from the weeks prior.

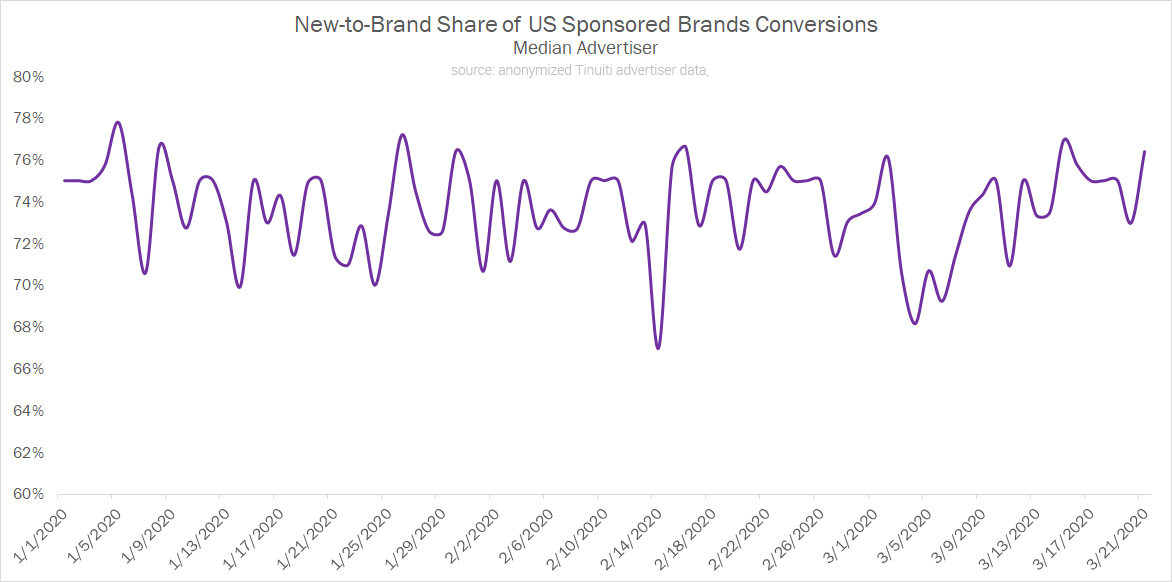

While consumption habits have certainly shifted significantly for many over the last few weeks, the share of Sponsored Brands conversions attributed as new to brand has remained relatively stable. New-to-brand conversions are those purchases attributed to Amazon shoppers that have not purchased from the advertiser in the past twelve months.

This indicates shoppers are not becoming significantly more likely to purchase from new brands, despite inventory issues affecting product availability.

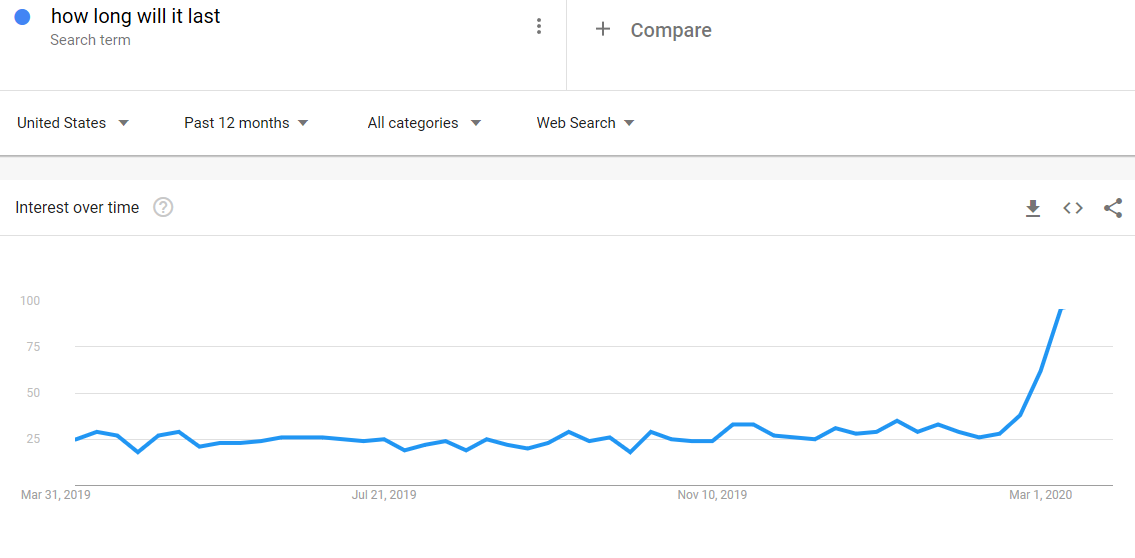

People are naturally searching very differently than they were two weeks ago, with different needs and different questions. For example, the last two weeks have seen about four times the search interest for ‘how long will it last’ compared to the average week over the last year, according to Google Trends.

How users behave after clicking through search ads is also changing, and demand for many products and services have gone down for most advertisers.

In turn, advertisers haven’t been able to grow investment in Google ads at the same rates observed earlier in the quarter for both Google Shopping and text ads, with spend down recently for both formats for most advertisers.

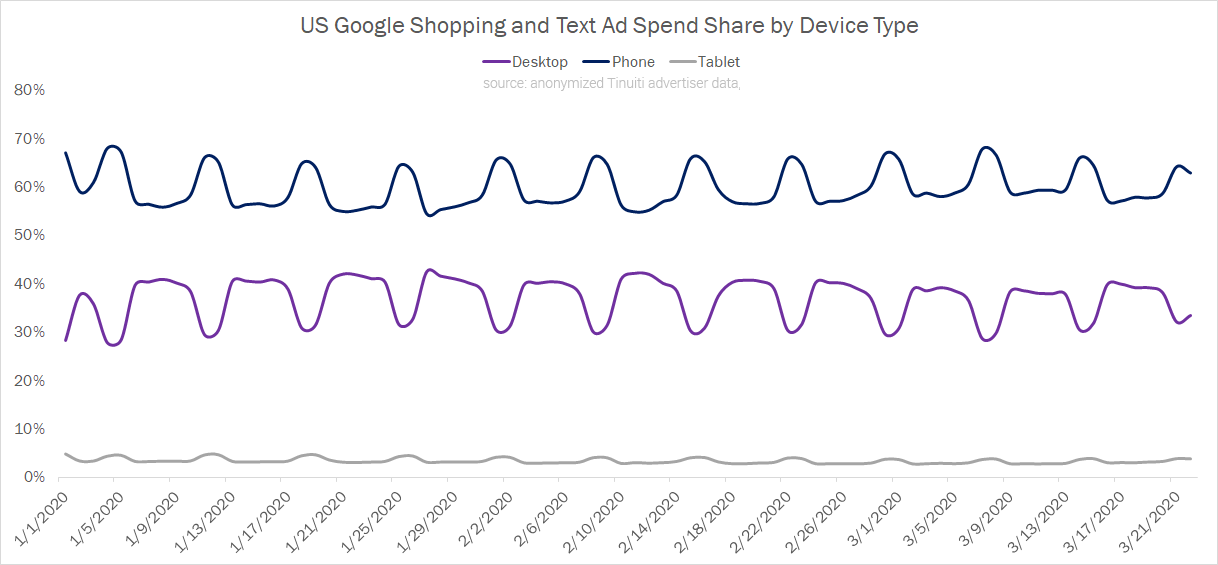

Device type spend share across the ad formats has remained essentially the same over the course of the last three months, indicating that the transition to working from home for many has not yet significantly impacted device type usage across all advertisers, at least as it pertains to search.

Consumers have had to adjust behavior as a result of both changes in day-to-day life, which seem to be increasing social media usage, as well as the economic stress of mass business closure.

With a massive stimulus bill primed to ease investor and consumer concerns, these trends could well reverse over the course of the next couple of weeks. The picture of how long Americans will have to restrict movement also stands to become much clearer, further impacting digital advertising performance in ways yet unclear.

We’ll continue evaluating advertiser performance across Tinuiti’s client base to understand how things are changing. As always, stay tuned to our blog for updates to these and other trends.