2020 Holiday Consumer Trends Report

The holiday season has always been crucial for retailers, and in the age of COVID-19 2020, that’s more true than ever. Retailers must navigate their traditional peak selling period amidst fast-changing local conditions, even as they hope to recoup sales lost during store closures in the spring and summer.

Sellers that can address consumers’ changing priorities and pivot to meet new needs can emerge from the season as survivors of an unprecedented challenge. We built this comprehensive report to illuminate holiday shoppers’ intentions and attitudes in a tumultuous season so you can stay ahead of the curve.

Note: The data below is from 2020. Head here to see our most recent report.

As retailers attempt to cope with fundamentally new realities, they’ll do so alongside traditional competitive and seasonal challenges that promise to make 2020 a year like no other. Four major trends are combining to impact the holiday season.

As the Coronavirus made its way to the U.S. in March, widespread store closures sped a shift to online shopping that is likely here to stay. Despite the loosening of stay-at-home restrictions from state to state, consumers are still wary of in-store shopping, and 60% plan to venture into stores less over the holidays due to fear of COVID-19 exposure, according to a survey from Radial.

The pandemic also accelerated growth of mobile commerce, as consumers at home were cut off from workplace computer access—as of late April, 76% of consumers reported increasing use of smartphones or mobile phones compared with earlier in the year, according to The Next Web, while 51% said they had bought something online using their phone.

Offline operations have also been impacted. Retailers have expanded and pivoted their existing store pickup services to introduce curbside offerings in keeping with local public health regulations, and 30% of consumers surveyed by Salesforce report using store pickup more than usual.

Shoppers are also spending intentionally in their local communities, hoping to save small retail operations and shore up local economies amidst the continuing COVID-19 crisis. Internet Retailer reported that 38% of shoppers were interested in shopping local to help businesses survive.

Pandemic-induced shutdowns are having ripple effects throughout the economy, impacting consumer confidence and budgets. Overall, unemployment has reached historic highs, with broad swaths of the economy still largely closed down, including the retail sector itself. The pandemic has caused dozens of brands to file for bankruptcy, and millions have been laid off or furloughed due to temporary store closures.

As a result, disposable personal income has steadily decreased since the beginning of the year, with a drop of 1.4% month over month in June following a 5% drop in May. Consumer confidence has dropped steeply since the start of the pandemic, and forecasters predict continuing instability will lead shoppers to boost their savings.

The economic stress triggered by the global pandemic has exposed the schism between haves and have-nots in the U.S. Furthermore, nationwide protests in the wake of George Floyd’s death and Jacob Blake’s shooting at the hands of police have prompted a fresh reckoning with the country’s history of racial inequality.

In response, a growing number of consumers are seeking to right past wrongs, including through their spending habits. As the Black Lives Matter movement continues to gain steam and protests continue, activists are calling for shoppers to spend dollars at Black-owned businesses.

Retailers face a short peak season, with just 29 days between Thanksgiving on November 27 and Christmas. That’s one more day than in 2019, but forecasts predict consumers’ timing will be much the same as last year, when 50% of the season’s online holiday sales were transacted by December 3, according to Salesforce. The picture is complicated by the growing number of retail stores announcing they’ll stay closed on Thanksgiving Day in the hopes of avoiding large crowds that could raise the risk for transmission of COVID-19.

Amazon’s Prime Day, which offers steep discounts to the more than 110 million U.S. members, is typically held in July but has been postponed this year due to the pandemic. Forecasters predict Prime Day will take place in early October to avoid conflicts with holiday promotions.

When that happens, spending could shift seismically, as the online giant claims 44% of U.S. eCommerce sales overall. Last year, Amazon boasted of record-setting holiday sales—including millions of new Prime signups—and its revenues for the quarter rose 21% year over year.

Our survey revealed that these factors will combine to exert significant influence over how consumers shop for the holidays. The report will explore three major themes:

More than 45% of consumers say they’ll shop more online for the holidays as a direct result of the pandemic. Overall, nearly half of respondents, 48.5%, will shop entirely or mostly online, with another 22.3% saying they’ll shop equally online and in stores. The majority of shoppers, 51.7%, will use in-store pickup, an increase of 20% year over year.

When asked how the pandemic would impact their holidays, respondents’ answers vary depending on where they live. The highest percentage of those saying COVID-19 would have no impact on their plans were in the Midwest, while the highest percentage curtailing air travel hail from the West.

More than 8 in 10 consumers (81.3%) said they plan to spend about the same or more on holiday gifts—the highest level in the past three years.

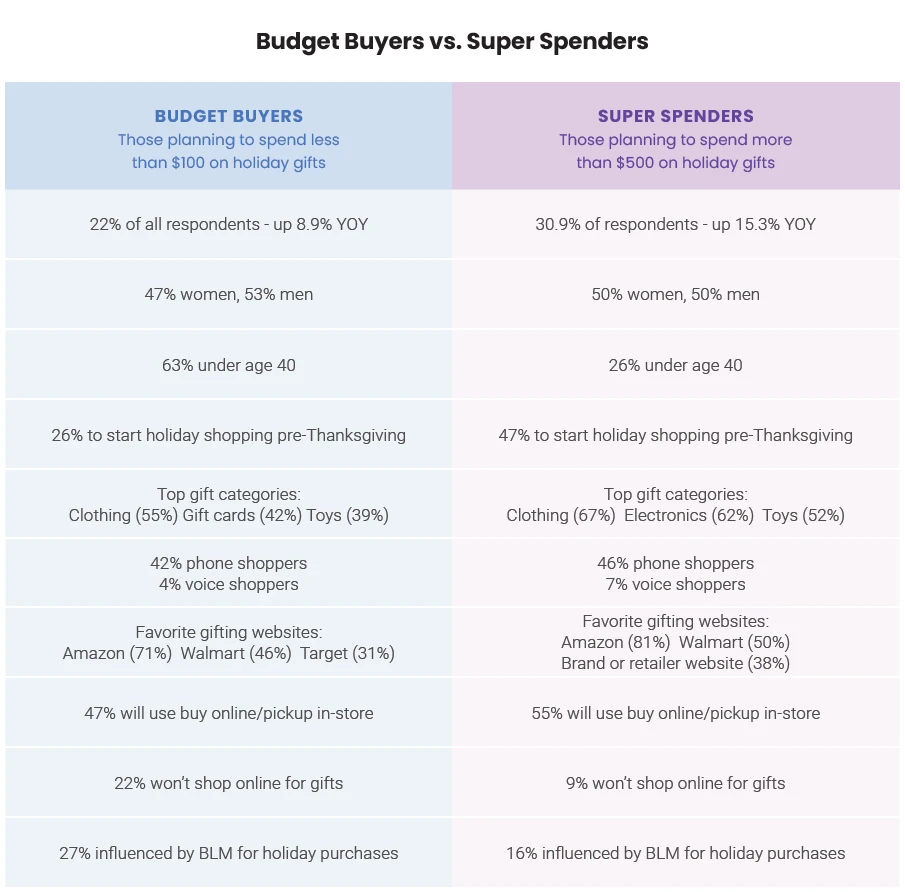

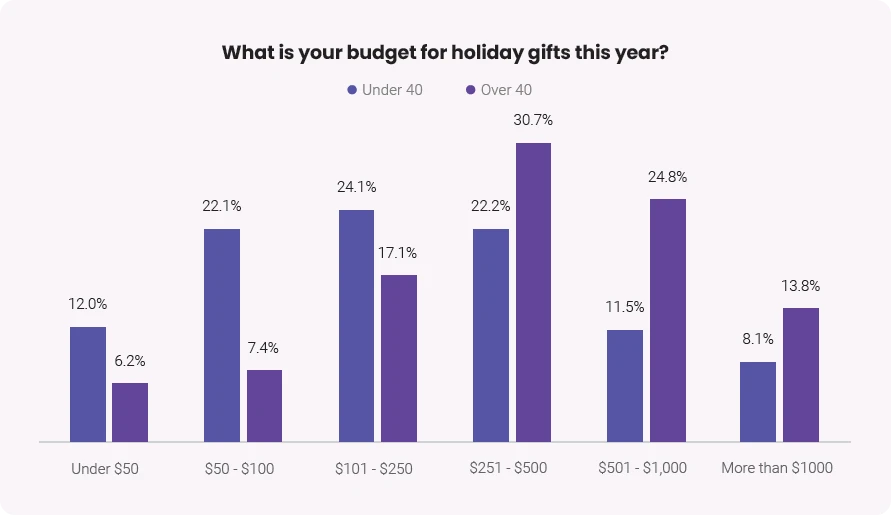

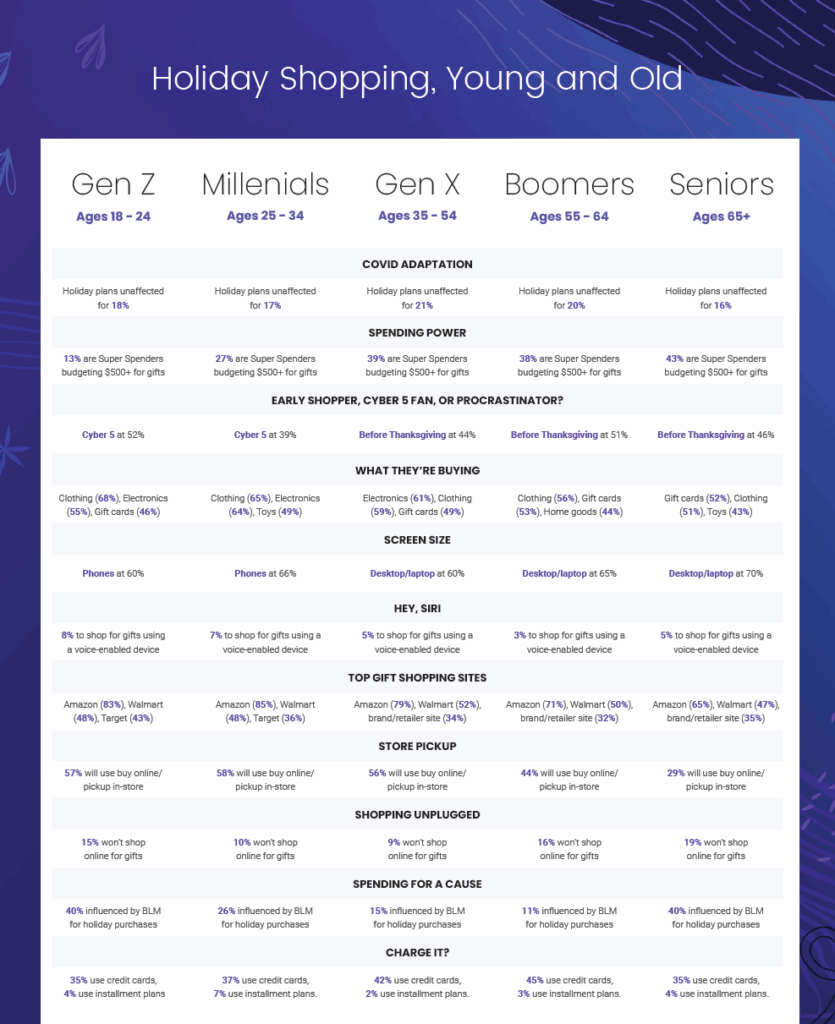

More than 3 in 10 respondents are “Super Spenders” (shoppers budgeting $500 or more for gifts), a 15.3% increase from 2019. But the percentage of those spending $100 or less also grew, by 8.9%, to 22%. This split occurs largely on generational lines, with those under 40 more likely to spend under $100 and those over 40 dominating the ranks of Super Spenders.

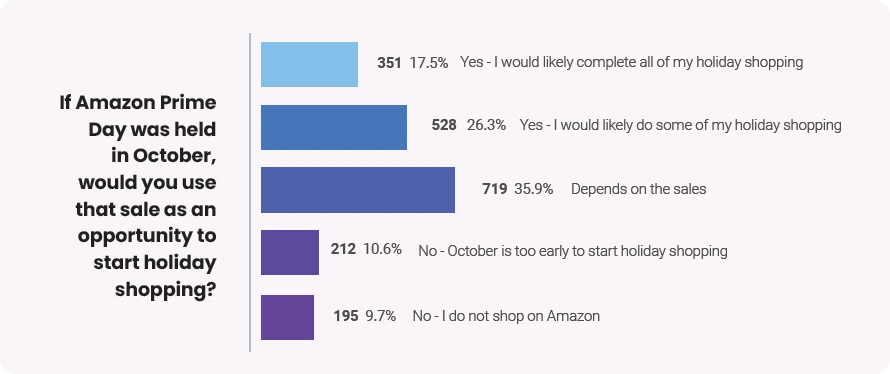

The largest percentage of shoppers, 37.8%, will start gift shopping before Thanksgiving, but the “Cyber 5” holiday weekend is also popular, with 34.2%of respondents saying that’s when they’ll kick off the season. The calendar will be upended when Amazon holds Prime Day in October: 43.8% of consumers will take advantage of the event to do some or all of their holiday shopping, while another 35.9% say whether they’d do so depends on what deals were offered.

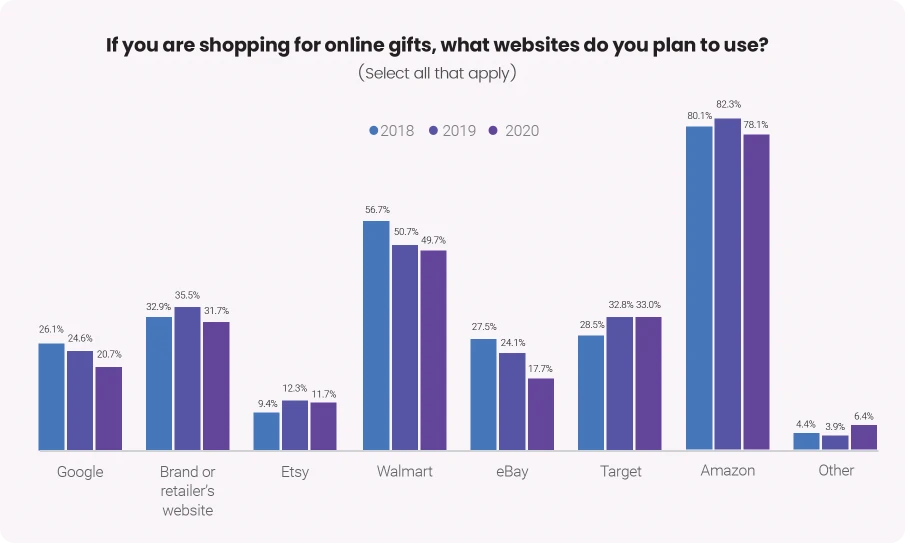

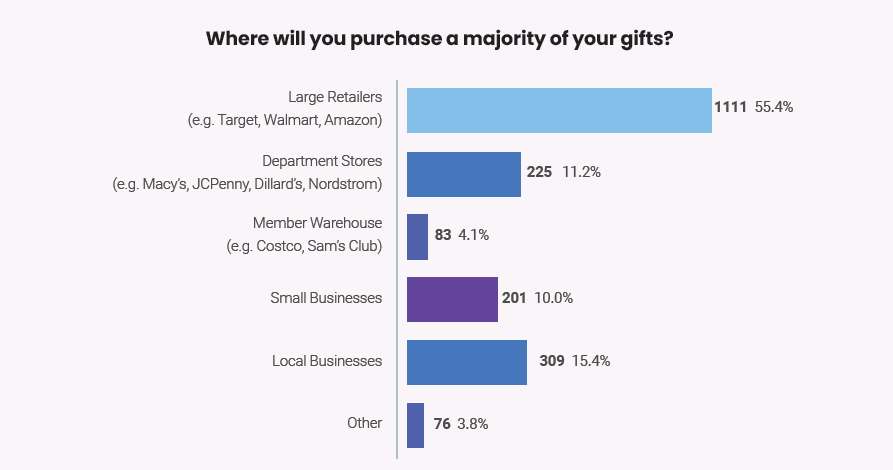

While mass merchants and Amazon will earn the majority of holiday purchases, at 55.4%, a quarter of respondents will buy the majority of their gifts from small and local businesses. Online, Amazon dominates, with more than three quarters (78.1%) of shoppers planning to shop there during the holidays; Walmart and Target are also popular, with individual retailer and brand sites taking fourth place.

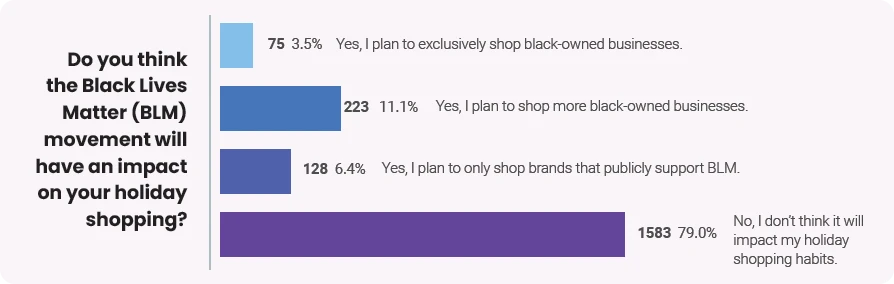

More than 1 in 5 shoppers (21%) will patronize Black-owned businesses or brands that have expressed support for the Black Lives Matter movement. Younger shoppers are more likely to take up this cause, with nearly 4 in 10 (39.6%) of Gen Z shoppers saying their holiday spending would be impacted; specifically, 27.9% will shop with more or only Black-owned businesses.

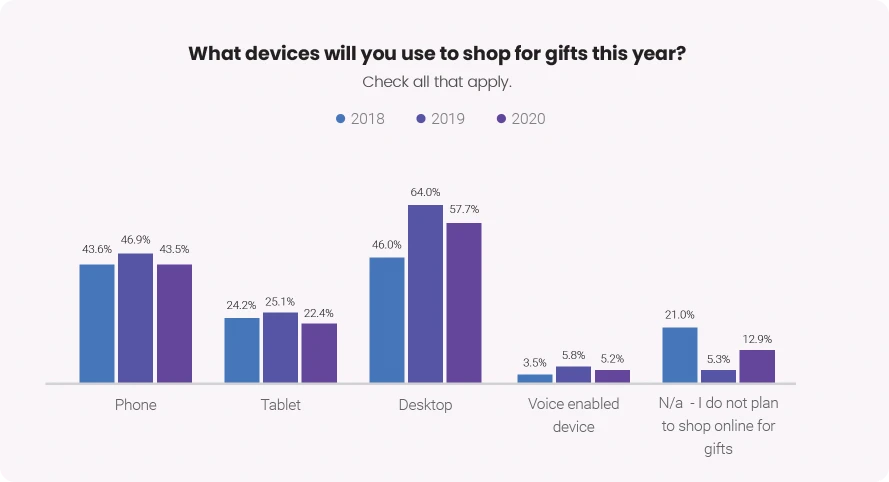

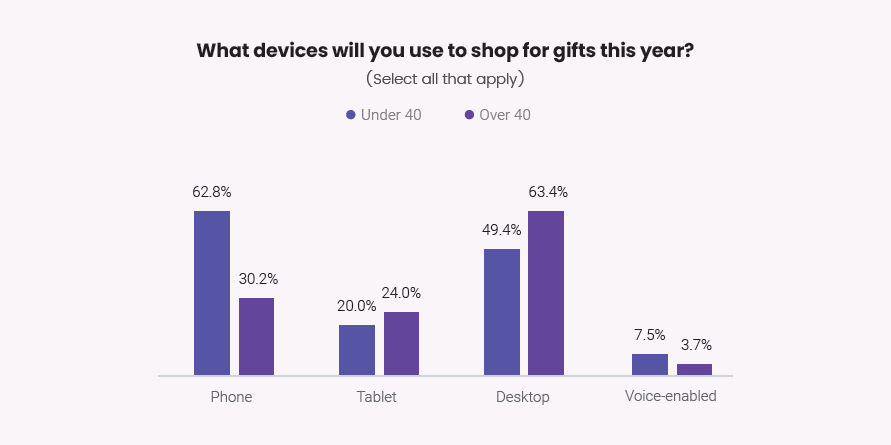

For those under 40 years old, 62.4% will use phones to shop for gifts, while 63.4% of those over 40 will use their computer’s web browser. Use of voice-enabled devices for holiday shopping remains relatively small, at 5% of all consumers—though more than 7% of both under-40 respondents and Super Spenders plan to use their “smart speakers” for gift finds.

Electronics are men’s top gift pick overall, but both Gen Z and Boomer men prefer clothing. Apparel is women’s number one gift purchase and the top pick for survey respondents overall.

More than 7 in 10 (72%) respondents will use cash or debit cards, which only allow spending funds already in hand. Usage of credit is split along the age divide, with 43.6% of those over 40 planning to use credit cards and 35.9% of those under 40.

While the web has been growing in importance as a shopping resource for decades, the past six months have accelerated the shift toward eCommerce and hybrid forms of online/offline shopping like never before, pushing retailers to speed omnichannel innovation and remove organizational barriers that inhibit unified messaging and customer profiling.

Even as they gravitate online and take advantage of the web’s price transparency, consumers are more aware than ever of the social and economic impact of their choices. While the lure of bargains makes mass merchants and Amazon nearly irresistible, for a segment of respondents,

it’s increasingly important to use their spending power to support social and economic causes.

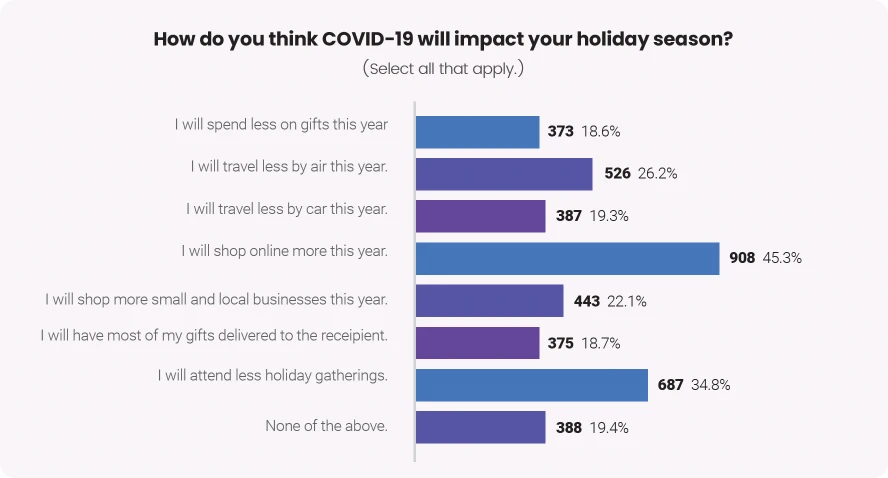

Although by now many physical store outlets have reopened, COVID-19 is having lasting effects on shopping habits, starting with the holiday season. Shopping more online is the top way respondents’ holiday plans will change as a direct result of COVID-19, with 45.3% saying they’ll turn more often to the web for gift picks.

More than 1 in 3 consumers (34.8%) plan to attend fewer holiday gatherings, and fewer will travel: 26.2% will cut back on air travel and 19.3% say they’ll venture out less by car. With fewer opportunities to see friends and family face to face, 18.2% plan to have gifts delivered.

As a result, disposable personal income has steadily decreased since the beginning of the year, with a drop of 1.4% month over month in June following a 5% drop in May. Consumer confidence has dropped steeply since the start of the pandemic, and forecasters predict continuing instability will lead shoppers to boost their savings.

Not surprisingly, those over the age of 55, who are at an elevated risk for contracting COVID-19, are more likely to anticipate restricted movement over the holidays. Nearly 40% are planning to limit holiday socializing, 28.2% are planning to travel less by air, and 24.5% are traveling less by car.

Notably, however, older shoppers make up a slightly higher percentage of the nearly 1 in 5 respondents (19.4%) who predict COVID-19 will have no impact on their holiday season. More than half of these holdouts (53.6%) are 45 or older, 6% higher than the survey average. Likewise, 27.3% of those who say the pandemic won’t affect their holidays are from the Midwest, nearly 19% higher than the survey’s overall demographic profile.

Regional differences are pronounced when it comes to how respondents predict the global pandemic will affect their holiday plans. The rankings below show which concerns top the list for each region.

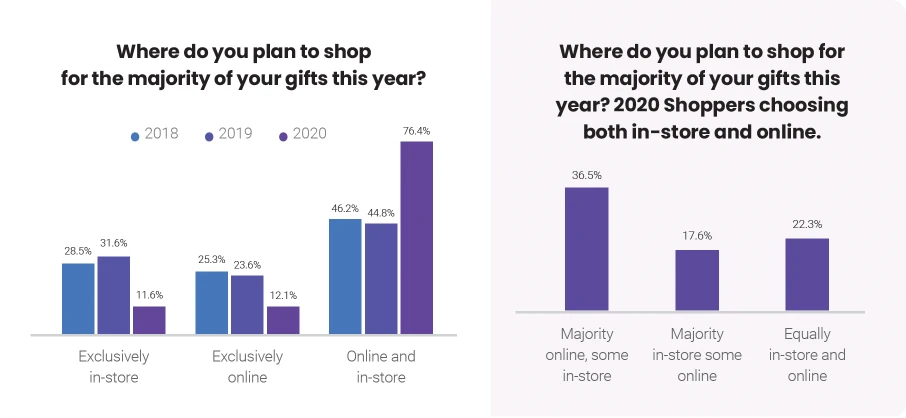

More than three-quarters of survey respondents, 76.4%, plan to shop both online and in-store this holiday season—a 70.5% increase compared with 2019*. The coronavirus pandemic has completely reversed the uptick in-store usage reported in 2019 when 3 in 10 said they’d rely on stores for their gift shopping; this year, just 11.6% of respondents plan to do so—a 63.3% drop.

Among those who will shop both online and offline, the majority plan to primarily use the web—47.7% of omnichannel shoppers, representing 36.5% of all survey participants. By contrast, just 23.1% of omnichannel shoppers (17.6% of all respondents) will shop mostly in stores, with the remainder predicting they’ll use stores and the web in equal measure.

Even factoring in those who plan to shop in stores to some degree, the web remains the likely dominant shopping channel of the season. Just under 3 in 10 respondents (29.2%) will shop mostly or exclusively in stores, compared with 48.5% who will buy predominantly online— a difference of 66.3%.

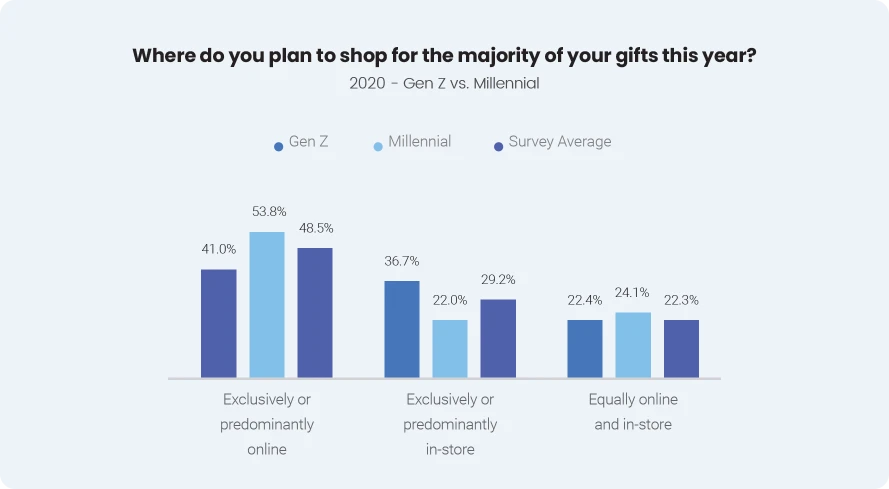

The shift to online shopping in response to the pandemic is especially dramatic for younger shoppers; 54% of Gen Z respondents ages 18 to 23 say COVID-19 has driven them to shop more online, 19% higher than average.

Overall, however, Gen Z continues to show a fondness for in-store shopping, with more than a third, 36.7%, planning to shop mostly or only in stores this holiday season—25% higher than average. Of those shoppers, 14% plan to find gifts in-store only, 20% higher than average. This finding aligns with results showing that Gen Z spurred the renewal of stores’ popularity in 2019 when the percentage of 18-24-year-olds planning to shop primarily in-store rose 15%.

By contrast, Millennials are more decidedly committed to the web, perhaps reflecting a need for convenience as rising professionals juggle domestic, work, and school life from home during the pandemic. More than half of those ages 24 to 39, 53.8%, plan to shop predominantly or only online—nearly 11% higher than average.

Super Spenders are likewise dedicated web shoppers. More than half (51.4%) said they plan to shop exclusively or mostly online, while fewer than 1 in 4 will buy mostly or only in stores.

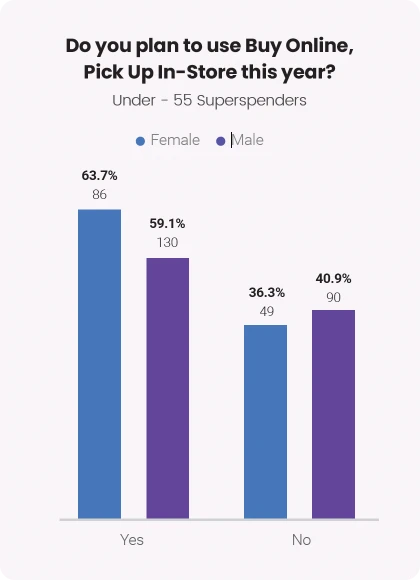

Use of blended online/offline shopping services have surged due to the global pandemic, and the majority of respondents, 51.7%, plan to buy items online for store pickup during the holidays—a 20.8% increase compared with 2019.

Those under 55 are more likely to use store pickup services than Boomers and seniors ages 75 and up 56.8% of Gen Z shoppers, 57.7% of Millennial shoppers, and 56.2% of Gen X shoppers ages 40-55 will take advantage of store pickup opportunities.

Super Spenders will also use store pickup more than average, with 55.3% predicting they’ll do so. More specifically, nearly two-thirds (63.7%) of women shoppers under 55 who will spend more than $500 on gifts plan to use store pickup—higher than men in the same cohort, at 59.1%, and 23% higher than the overall survey average.

These findings suggest that retailers continuing to invest in their online/offline fulfillment operations can earn sales this holiday season by promoting their offerings and can earn loyalty by delivering seamless, convenient experiences, especially with younger shoppers and top spenders—both categories with potential to deliver long-term customer value. For example, setting aside VIP parking spots or dedicated in-store counters for pickup service could help burnish store reputations with top spenders.

With omnichannel shopping on the rise, consumers are also omni-device—relying on both desktop and mobile devices to shop. More than 1 in 2 survey respondents (57.7%) will shop for gifts on their desktop or laptop computer, while more than 4 in 10, 43.3%, will use their phones. One in five shoppers (22.4%) plan to use tablets for gift shopping and just over 5% browse via voice devices using intelligent agents like Alexa or Siri.

Phones are catching up to desktop in popularity, with the percentage-point gap between the two form factors dropping from 17 to 14. Not surprisingly, the change is being driven by those under 40, for whom phones are the most popular choice: 65.6% of Millennials and 60.4% of Gen Z will use their phones to find gifts.

However, consumers overall reported usage of all devices dropped this year, while the percentage of those saying they don’t plan to shop online at all more than doubled, for a total of 12.9% of respondents—slightly higher than the percentage saying they plan to shop exclusively in stores (11.6%), but still lower than in 2018, when around 1 in 5 shoppers said they wouldn’t go online for gifts. Store-loving Gen Z shoppers and Boomers ages 56-74 are predominantly responsible for the increase: 14.9% of Gen Z respondents claim they won’t use any devices to shop for gifts, slightly trailing Boomers at 15.6%.

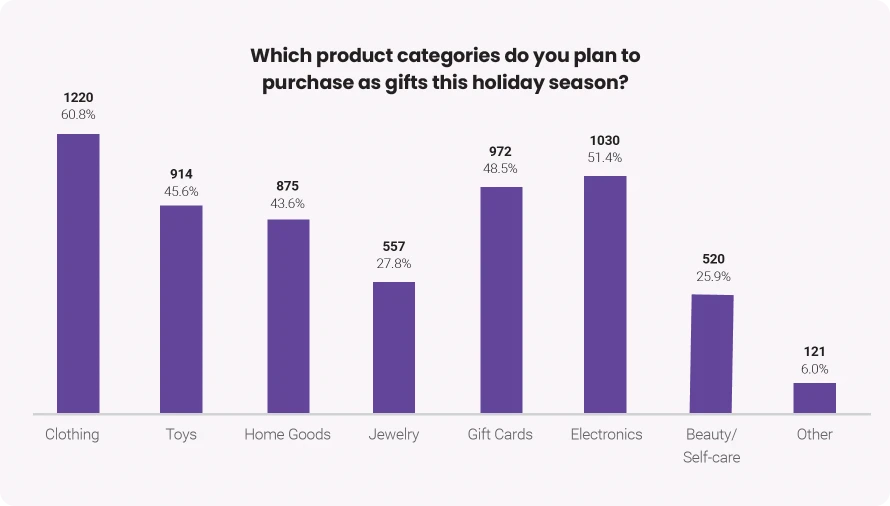

While the global pandemic is poised to transform how consumers shop during the holidays, what they put in their shopping carts will vary less dramatically—the top five product categories remain the same as 2019.

With social distancing policies limiting opportunities to show off new outfits, apparel remains in the lead overall, with 60.8% of respondents saying they’ll give clothing gifts this year. The pandemic may be more of a contributing factor for the second-most-popular choice: Electronics (51.4%) have overtaken gift cards (48.5%) in the number two spot, suggesting home entertainment is top-of-mind for shoppers. Strong showings for toys and home goods, at 45.6% and 43.6% respectively, similarly point to the need for at-home diversion for all ages.

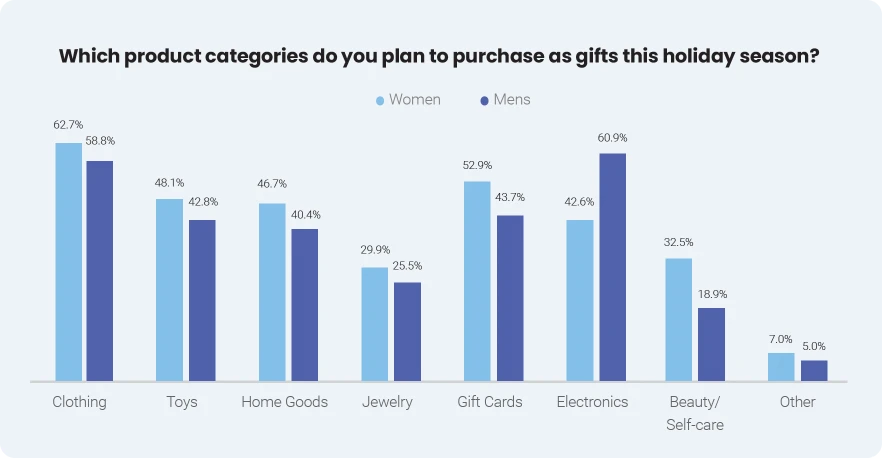

Women overall prefer apparel and gift cards most frequently, followed by toys, home goods, and electronics, while men favor electronics first and foremost, followed by clothing, with gift cards, toys, and home goods trailing further behind.

Men are nearly as likely as women to say they’ll buy apparel gifts—and for both Gen Z and Boomer men, clothing is the most popular category. Two-thirds of Gen Z men (66.4%) will buy apparel gifts this holiday season, nearly as high a percentage as Gen Z women, at 68.9%; 54.5% of Boomer men will buy clothing gifts, compared with 56.9% of Boomer women.

Women’s number two picks are more varied. Gen Z women ages 18 to 23 are most likely to select beauty and self-care items as gifts, with 59.6% saying they would do so—83% higher than women overall. By contrast, the number two pick for women 55 and older is gift cards, at 54% for Boomer women, and 47.5% for Senior women.

Electronics top the list of gift categories for men, with 60.9% planning to buy gifts in the category— 43% more than women. The percentages are still higher for men under 55, with nearly 7 in 10 Millennial men (69.1%) saying electronics will be among their gift purchases, along with 64.4% of Gen X men and 64.3% of Gen Z men.

Male electronics buyers are more likely to have bigger gift budgets than average: 37.8% will spend at least $500 on gifts (known as Super Spenders), compared with 30.8% of the survey population overall. Perhaps not surprisingly given the product category, these men are more likely than average to use their phones to shop, with 55% saying they’ll do so during the holiday season—26% higher than average; 7.3% will use voice-enabled devices to shop for gifts, 40% higher than average.

The COVID-19 pandemic isn’t the only external force influencing consumers’ attitudes toward the holiday shopping season. The community impact of economic shutdowns and the mass protests in the wake of mass protests during the Black Lives Matter movement are propelling a significant minority to spend their dollars in alignment with their beliefs—even as most shoppers prioritize the convenience and savings that mass brands offer.

For purchasing the majority of their gifts overall—whether online or offline—55.4% of respondents will head to “large retailers (Target, Walmart, Amazon)”—pointing to the continued dominance of “big box” stores and the Amazon juggernaut. Online, that dominance is even more pronounced. Amazon and Walmart’s leads as top picks have slipped—continuing a downward trend since 2018—but they remain heavy favorites, with more than 3 in 4 shoppers saying they’ll buy from Amazon and nearly half saying they’ll purchase gifts at Walmart online.

Target’s share of web shopping has grown by less than a percentage point to 33%, edging out the individual retailer and brand sites for third place. That shift is fueled by men, 32% of whom will shop at Target for gifts this year—a 53% increase over 2019. Women, by contrast, continue to prefer individual retailer and brand websites as their third favorite pick, as in 2019.

Just over 3 in 10 (31.7%) of respondents will buy holiday gifts at brand and retailer websites, a drop of nearly 11%. The shift may reflect Walmart and Target’s deep investments in—and promotion of—discounts and services to compete with Amazon, such as free priority shipping and same-day store pickup. Those same offerings also happen to position mass merchants well in the COVID-19 era, setting the bar high for smaller retailers and brands.

Both eBay and Google continue to lose importance as holiday shopping resources. eBay saw the steepest year-over-year drop, 27%, with 17.7% of shoppers planning to buy gifts on the platform, while just over 1 in 5 shoppers will use the search giant for holiday shopping, down 16% year over year—a reflection of the marked shift toward Amazon as the web’s premier product research destination.

By contrast, interest in artisan marketplace Etsy is nearly steady at 12% of shoppers, suggesting that consumers aren’t averse in principle to smaller sellers. Gen Z and Millennial respondents, as well as women overall, are more likely than average to use Etsy, with 16% of shoppers in each cohort saying they would shop there for gifts.

Even as individual retailers slipped in the online rankings, respondents consider them the next best alternative to mass merchants. A quarter of survey participants (25.4%) will shop small or shop locally for the majority of their holiday purchases, outranking department stores, stores at 11.2% and member warehouses such as Costco at 4.1%.

This finding aligns with the 22.1% of shoppers pledging to shop more locally and at small retailers specifically in response to the COVID-19 pandemic, half of whom (49.8%, or 11% of respondents overall) plan to buy the majority of their gifts there.

Younger shoppers express especially strong intentions to spend predominantly at small or local outlets: 29.1% of Gen Z shoppers and 27% of Millennials say that’s where they plan to buy the majority of their gifts. Not surprisingly, the cohort prioritizing small and local businesses is more likely to shop offline: 37.4% said they’ll shop predominantly or exclusively in stores—28% higher than average, and in alignment with Gen Z’s fondness for face to face shopping encounters.

The national reckoning with race touched off by The Black Lives Matter Movement will impact more than 1 in 5 shoppers (21%) spend their holiday gifting dollars. More than 1 in 10 respondents (11.1%) plan to shop more at black-owned businesses, and another 3.5% said they’ll shop only at those businesses. More than 6% said they will choose brands that have pledged support for the Black Lives Matter movement.

Younger shoppers are more likely to use their shopping dollars in support of BLM: close to 4 in 10 respondents ages 18 to 23 say their spending will reflect their support for racial equality. Specifically, nearly 28% of Gen Z shoppers will shop more or exclusively at black-owned businesses for the holidays—more than double the other generations combined.

In addition to being younger than the survey average, those who plan to support BLM through holiday purchases are predominantly women, at 54%. They’re also more likely than average to shop small and local businesses for the majority of their gift purchases, at nearly 4 in 10 (39.8%), suggesting boutique and niche retailers with strong diversity practices should showcase them as a means of differentiating their brands.

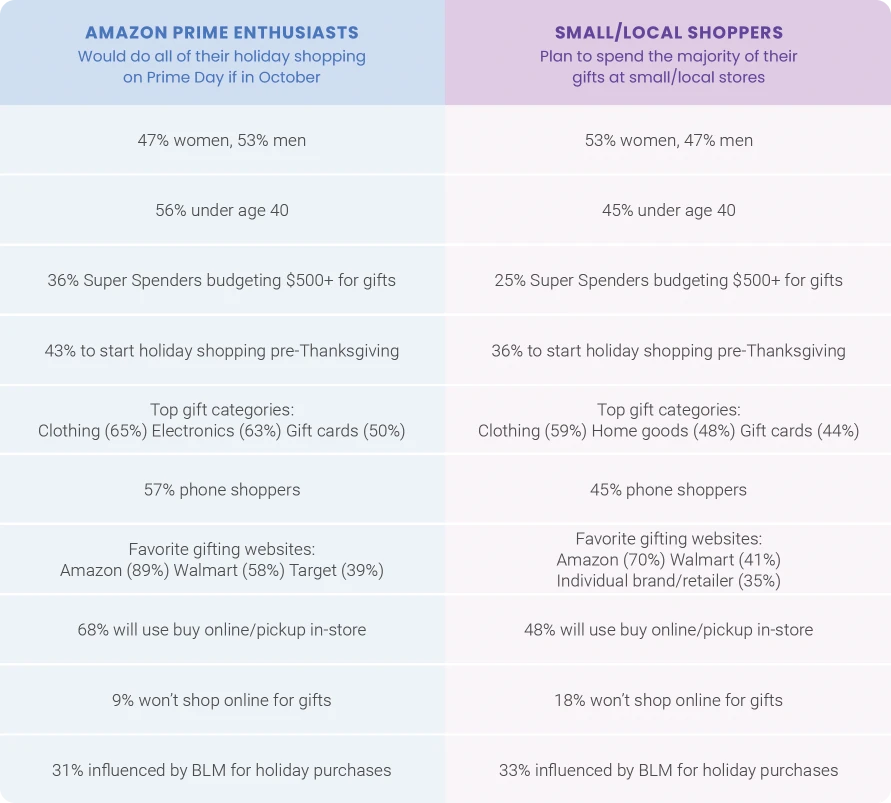

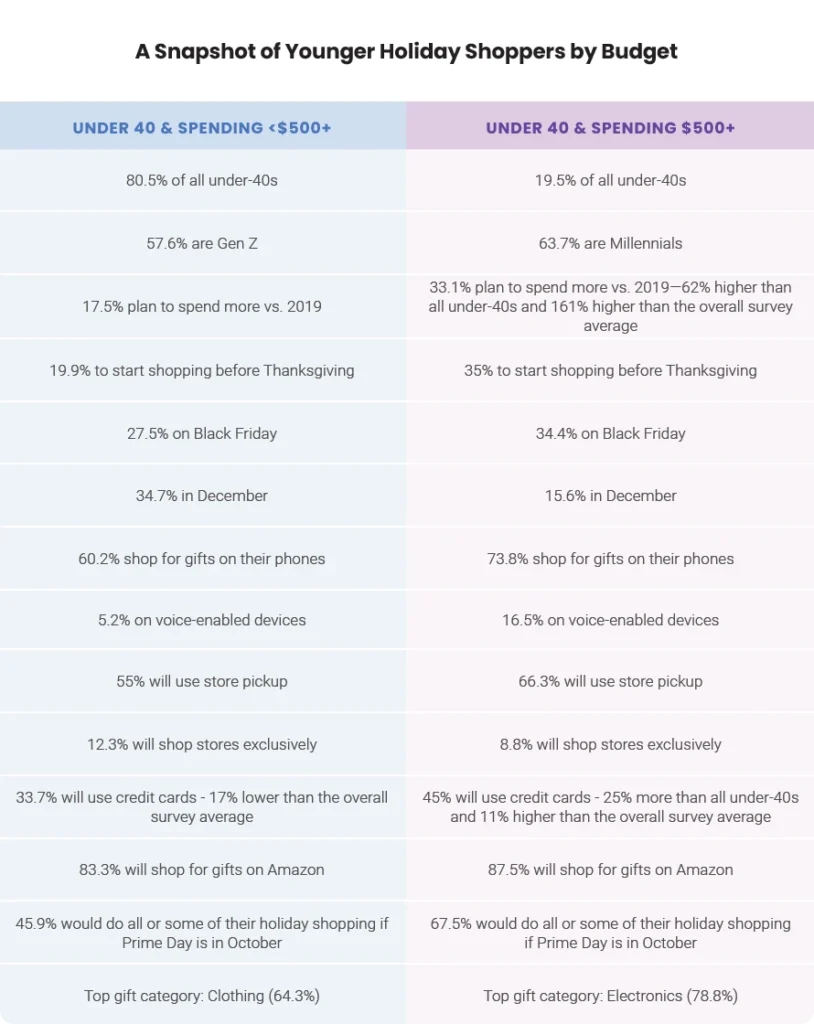

While shoppers under 40 comprise a sizeable percentage both of those who are among Amazon’s biggest fans and those who plan to buy the majority of their gifts from small or local stores, their planned gift-buying behaviors vary significantly—suggesting that brands must understand their target customers’ priorities on an individual level and target promotions accordingly, rather than taking the simplistic route of segmenting by age or channel preference.

Given that the economy is in turmoil and work and school routines have been upended, it would be understandable if consumers planned on spending less this holiday season. But on the contrary, the vast majority of survey respondents are planning to spend the same or more on gifts, and the percentage of top spenders has grown by double digits year over year.

Nonetheless, the uncertainty of the era is manifesting itself in subtler but pervasive ways. Across age groups and spending brackets, shoppers are prioritizing discounts and savings, with the timing of their holiday purchases depending on when deals can be found. To make the most of the season amidst constantly-changing conditions, retailers should streamline their marketing operations for maximum agility, so that campaigns and discounts can be extended or updated according to the needs of the moment.

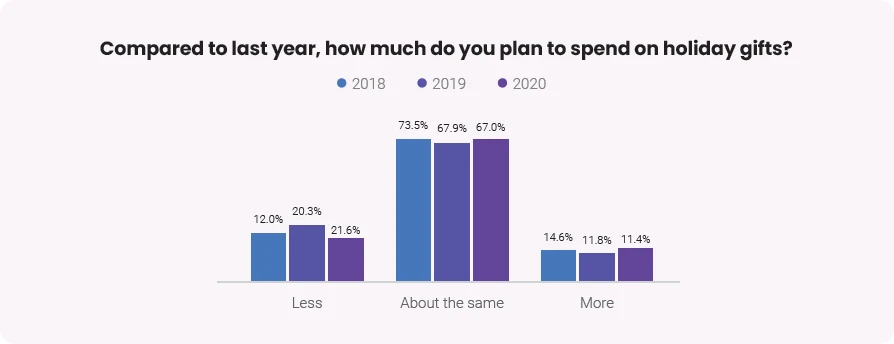

More than 8 in 10 consumers (81.3%) plan to spend about the same or more on holiday gifts— the highest level in the past three years. The percentage of those estimating they’ll spend less fell to under 1 in 5, dropping by 13.4% year over year to 18.3%.

The percentage of shoppers planning to spend less tracks with 18.6% of respondents who say they plan to cut back on gifts in response to COVID-19. However, of the shoppers predicting the pandemic would rein in their holiday gifting, just over half (53.4%, or 9.9% of all respondents) say they’ll spend less, with the remainder predicting they would spend the same or more. Even those reducing the number of gifts may still be willing to splurge on those that remain on their list—or the split results may simply mean that consumers are still uncertain as to how exactly the pandemic will affect their holiday planning and shopping.

Among the 18.3% of shoppers will spend less, 6 in 10 are women, and 4 in 10 are over the age of 55 (41.3%), 21% higher than the survey population overall. Due to the older age demographic, this cohort is also 24% less likely to attend holiday gatherings due to COVID-19.

They’re also 9.7% less likely than average to shift spending online in response to the pandemic. But that may be because they’re heavy online shoppers already: 52% say they plan to shop exclusively or mostly online for gifts, and more than 1 in 5 (21.9%) say they’ll do their gift shopping entirely online—81% higher than average. By contrast, 59.1% of those who plan to spend more on gifts this year are men, and two-thirds are younger than 40 (66.2%). Gen Z men lead the way: 25% will increase their spending this year, along with 20.5% of Millennial men.

More than half of these online natives are planning to shop more online for the holidays due to COVID-19 (54.3%), 20% higher than the survey average. Phones are the predominant online form factor, with 62.6% of those planning to spend more using them to shop for gifts. The relative youth of those planning to spend more makes them outliers in their age group in terms of holiday spending, with two-thirds (66.6%) budgeting more than $250 for gifts—17.5% higher than average and 74% higher than under-40s altogether.

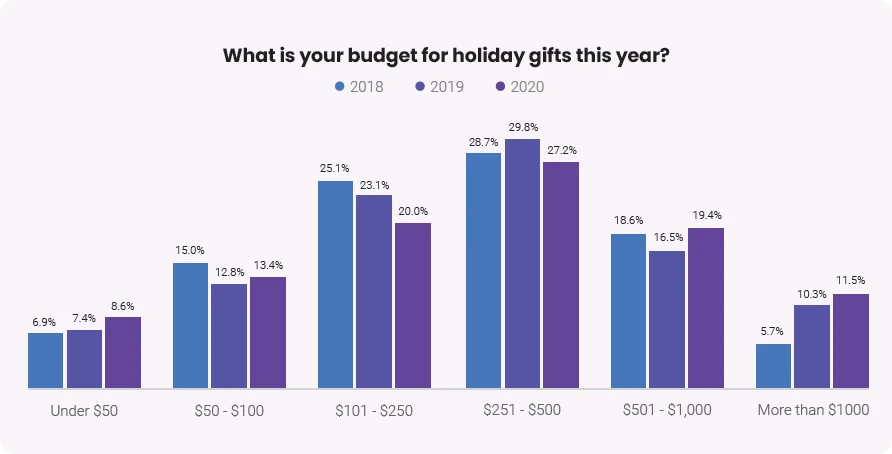

Predicted gift budgets shifted upwards incrementally, with 58.1% of survey respondents saying they plan to spend more than $250, compared with 56.7% in 2019.

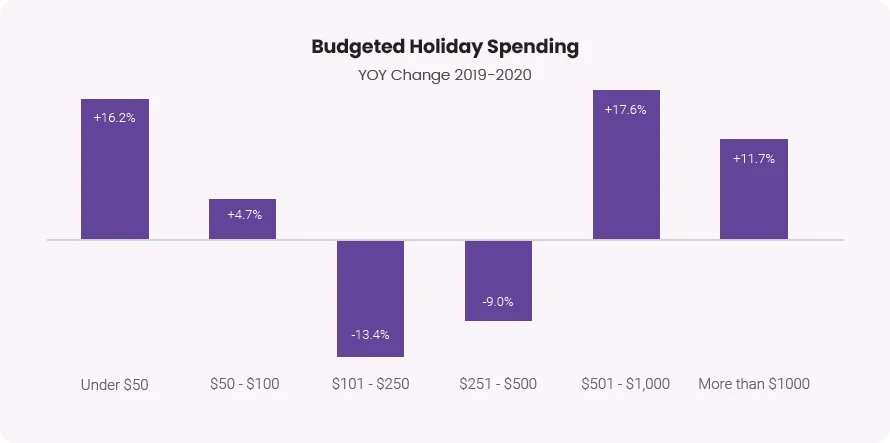

Super Spenders account for more than 3 in 10 respondents (30.9%), a 15.3% increase from 2019. Notably, this year Super Spenders are equally women and men, compared with 2019, when men were in the majority, 53% to 47%. The spending bracket of $501-$1,000 has grown most overall, with 19.4% of 2020 respondents estimating their gift buying total would fall within that range, up 17.3% from 2019.

However, the spending range taking second place for year-over-year growth is the Under-$50 category, selected by 8.6%—an increase of 16.2%. The total percentage of those predicting they’ll spend less than $100 grew by 8.9% to 22% of all respondents.

This decline of the middle spending tiers from $101 to $500 and the growth of the lowest and highest brackets mirrors the widening gulf between haves and have-nots in the economy as a whole and suggests that retailers adopting a tiered strategy can most effectively deliver the holiday offers and product selection matching shoppers’ budgets.

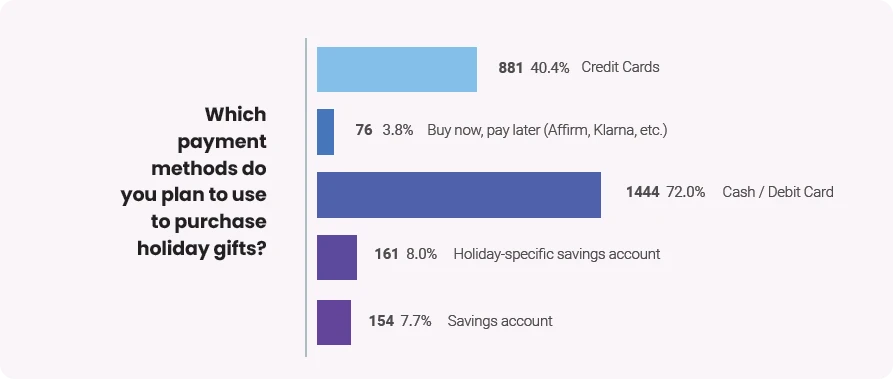

Given the uncertainties of the economy, it’s no surprise that survey respondents are planning to use primarily cash or debit cards this holiday season, limiting their purchases to funds already on hand. More than 7 in 10 (72%) will use those payment methods, compared with the 40.4% who will use credit cards. While users of debit cards and cash are so numerous as to be evenly represented across age demographics, credit card users skew older: 63.8% of those planning to use them for holiday gifts are over the age of 40, while that age group makes up 59.1% of respondents overall.

Some 15% of shoppers also plan to use savings accounts to pay for gifts; 8% have holiday-specific savings they will deploy, while 7.7% report dipping into regular savings to fund holiday spending. A smaller percentage still, 3.8%, will use a financing option such as Affirm or Klarna to defer and spread out payments on installment plans. The majority of these shoppers (55%) are under 40, and 57.7% plan to spend at least $250 in gifts, making the payment method an attractive option for merchants selling higher-priced items to this target audience.

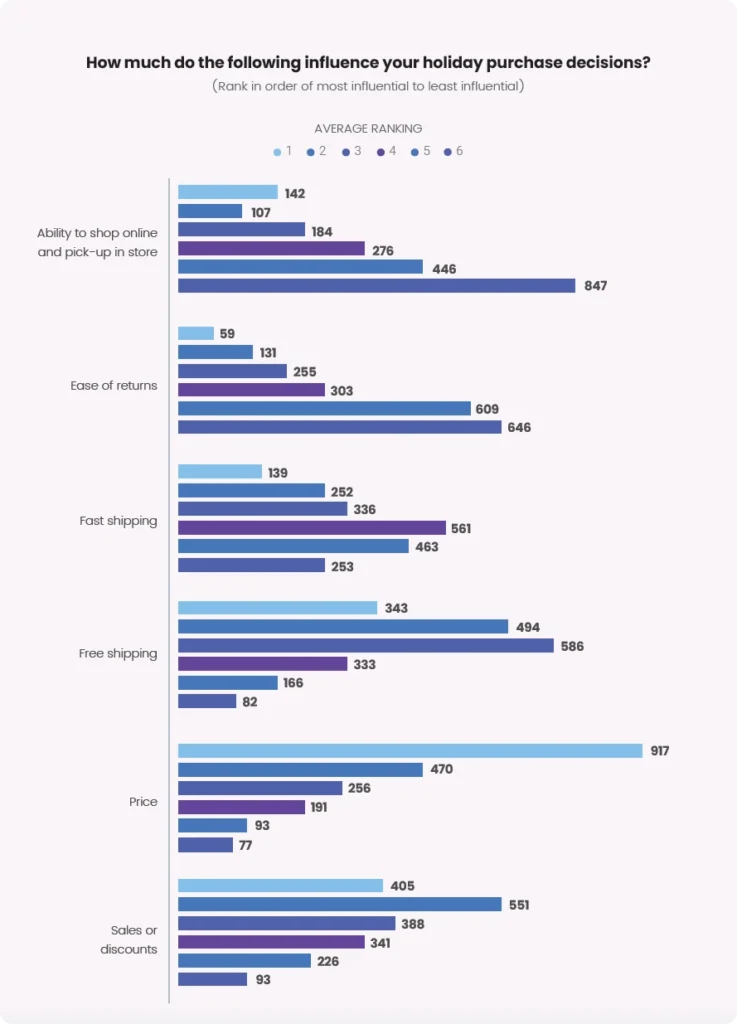

Despite rising holiday spending, price is invariably the most influential factor when making purchase decisions. Survey respondents of all ages, spending levels, preferred buying channels, favorite websites, and store types rank product price number one among incentives or offerings.

In addition to price, sales or discounts and free shipping universally round out the top three ranking factors, with variations between second and third place often determined by one or two-tenths of a point. Fast shipping ranks fourth overall, while customer service-oriented features such as availability of store pickup and ease of returns are at the bottom of the list.

These results aren’t exactly surprising. After all, low prices—and the ease of comparison shopping to find them—have always been one of the chief reasons to buy online, and free shipping is perennially the top discount web shoppers seek. Still, the survey findings signal that however rosy the spending outlook, shoppers aren’t feeling optimistic enough to let go of the reins and abandon total order cost as the primary factor driving purchase decisions.

Additionally, the lower rankings for store pickup and easy returns suggest that however dramatic the impact of COVID-19, shoppers aren’t willing to pay more for service—a challenging prospect for small- to mid-sized merchants without the economies of scale that make discounting less painful. Finally, with store pickup being increasingly ubiquitous, many shoppers may feel it is now table stakes, and no longer enough of a differentiating factor to drive purchase decisions (unless, of course, it’s executed poorly).

Even with Amazon Prime setting the bar high with two- or even next-day delivery for its 110-plus million U.S. members, consumers still rank “free” above “fast” in importance as a purchase factor.

For some respondents, free shipping even outranks sales or discounts as a purchase factor, though often just barely. Among Boomers, for example, free shipping ranks 2.71 to take second place, while sales/discounts rank 2.72—virtually a dead heat—and among Super Spenders, free shipping ranks 2.76, while sales/discounts rank 2.82—a gap of just 0.06 points.

The strongest showing overall is among Seniors ages 75 and up, who rank free shipping at 2.64, just 0.04 points out of first place. Free shipping ranks lowest among offline shoppers—although it’s still in the top three: those who plan to exclusively visit stores to find gifts rank free shipping 0.81 points behind sales/discounts in third place.

While it never breaks into the top three, the ease of returns ranks number four for offline shoppers, overtaking fast shipping. For the majority of respondents, easy returns rank number 5 of 6, just ahead of the availability of store pickup services.

The exception is for consumers 55 and under; members of Gen Z, Millennials, and Gen X all value store pickup over easy returns, suggesting that streamlining processes for speed and adding convenience boosters such as curbside pickup can help meet younger shoppers’ expectations for service.

Not surprisingly given shoppers’ obsession with costs and discounts, their predictions around the timing of holiday purchases are highly dependent on deals. More than 1 in 3 survey respondents, 37.5% more than in 2019, plan to take advantage of “Cyber Five” sales events (Thanksgiving through Cyber Monday).

Shoppers may also shop early or late, depending on the savings offered. Thanks to the short holiday calendar, most survey respondents plan to kick off gift shopping before Thanksgiving—but depending on the deals, consumers are willing to get started early: 4 in 10 would do some or all of their gift shopping if Amazon holds its Prime Day sale event in October.

At the same time, the percentage of holdouts for December rose 30% year over year, to 28.1%, suggesting that a sizable portion of shoppers will hold off on gift purchases until as late as possible in the season, possibly due to economic uncertainty or simply the desire for last-minute deals.

More than 1 in 3 shoppers (34.3%) will start looking for holiday gifts at some point during the “Cyber Five” period from Thanksgiving to Cyber Monday, demonstrating rebounding interest in the sales event after a decline from 2018 to 2019.17 Gen Z respondents are far and away the most committed to kicking off the peak shopping season at some point during the holiday weekend, with 52.2% saying they’d do so—a 26.7% increase over 2019.

Of the three peak sales days during the event, Thanksgiving Day will see the steepest growth as the start date for holiday shopping: nearly 1 in 10 (9.7%) respondents said they wouldn’t wait until Friday, a 115.6% increase from 2019. Gen Z leads among age cohorts, at 13.5%, more than double the 2019 total.

The following day, Black Friday, remains the most popular sales event of the Cyber Five period; with 19.3% planning to start the hunt for gifts then—a 10.9% increase over 2019, but not quite rebounding to 2018 levels. Fully a third of Gen Z shoppers, 33.4%, will start gift shopping on Black Friday, 73.1% higher than the overall average.

Finally, 5.2% of respondents will wait to begin shopping until Cyber Monday, historically the largest online shopping day of the year.

The largest percentage of shoppers, 37.8%, will begin their holiday shopping before Thanksgiving— the same percentage as in 2019, which had a similarly short peak season. Women are most likely to shop early, at 45.5%, as are Super Spenders, 44.4% of whom plan to get started before Thanksgiving—18% higher than average. They also tend to be older: 46% are over the age of 55, 35% higher than average.

By contrast, the growing cohort of shoppers who will wait to start buying gifts until December are predominantly men, at 52.5%. These later shoppers are more likely to be reliant on stores: 35.7% plan to exclusively or mostly shop in physical outlets, 22% higher than average. COVID-19 is less of a factor for these shoppers: just under 4 in 10 (39%) will shop more online in direct response to the pandemic, 16% lower than average, and 24.3% predicted no impact on their holidays at all.

Both groups are united in their focus on price as the top purchase influencer, with sales or discounts the second-most important factor and free shipping coming in third—again proving that cost-consciousness will rule the season from start to finish.

With so many deal-hungry survey respondents already pledging to kick off their holiday spending before Thanksgiving, it’s no surprise that they would take advantage of a time-shifted Amazon Prime Day to score savings on gifts. If the event occurs in October, more than 4 in 10 (43.8%) shoppers would take care of at least some of their holiday shopping, with 17.5% saying they would finish their lists.

Younger consumers and Super Spenders are most enthusiastic at the prospect: 51.1% of respondents under 40 and 48.8% of those planning to spend $500 or more on gifts would get at least some of their holiday shopping done during an October Prime Day event.

A further 35% of consumers overall say their participation would depend on what deals are available—another indication that spending is of chief concern and shoppers are keeping their options open during this fluid and chaotic year.

Just over 1 in 5 shoppers (20.3%) reject the idea of Prime Day as a holiday shopping opportunity, with 10.6% saying October is too early to start buying gifts and 9.7% avoiding shopping on Amazon altogether. While 49.1% of these Prime Day skeptics plan to shop on Amazon at some point during the season, they are predominantly offline shoppers: 45% shop mostly or only in stores, and 1 in 4 (25.3%) shop exclusively in physical locations—more than double the survey average.

Despite the oft-repeated platitude “We’re all in this together,” the confluence of the pandemic and social upheaval in 2020 has not affected the young and the old in the same way—leading to starkly different predictions about year-end spending.

Although they’re at higher risk for contracting COVID-19, older shoppers are largely proceeding with “business as usual,” while those under 40 report greater impacts in terms of their economic spending power and their desire to enact social change through consumer choices. Layered atop these singular current conditions are young consumers’ digital-native shopping habits, leading to two very different buying personas for sellers to accommodate during the holiday season.

Gen Z and Millennial shoppers are hardly monolithic when it comes to spending habits, but they share in common a smaller cash reserve than Gen X members, Boomers, or Seniors. More than 1 in 5 shoppers under 40 (20.5%) will spend more this holiday season compared with last year— but their budgets overall are smaller, with 41.8% planning to spend more than $250, 40% lower than older shoppers.

Just 7.2% of shoppers over 40 plan to spend more this year compared with 2019, and nearly 70% of them are planning to spend over $250. Nearly 75% of Super Spenders (budgeting $500 and up) are over the age of 40, whereas roughly 63% of Budget Buyers (spending less than $100 on gifts) are under 40.

With more spending power at their command, it’s no surprise that a higher percentage of over-40s, 43.6%, plan to pay for holiday gifts with credit cards than under-40s, at 35.9%.

Instead, under-40s will rely more heavily on “buy now, pay later” services such as Klarna, with 5.1% saying they’ll use them to pay for gifts—and pay the extra costs associated with installment plans. Just 2.9% of shoppers over 40 report using such financing for gift purchases.

Under-40s also report dipping into savings at more than double the rate of older shoppers, 11.4% compared to 5.1%. And while both generations will rely primarily on cash or debit cards to pay for gifts, a higher percentage of under-40s will do so, 75.7%, compared with 69.5% of over-40s.

It’s both the best of times and the worst of times for Gen Z and Millennial shoppers. While they have less disposable income for holiday spending, under-40 consumers also represent 26% of Super Spenders budgeting $500 and up for the holidays. This segment, which represents nearly

20% of under-40 shoppers, has different holiday shopping plans than other consumers their age.

By a significant margin, shoppers under 40 are more likely to use their holiday shopping dollars to support causes that matter to them—a finding consistent with earlier research showing that young consumers have led the push for brands to demonstrate corporate, social, and environmental sustainability.

Over 30% of Gen Z and Millennial shoppers plan to change their gift shopping habits to support Black Lives Matter—163% higher than over-40 survey respondents. By contrast, shoppers over 40 are less apt to view their shopping dollars as agents for social or economic change. Just 12.6% say their gift purchases will be influenced by the Black Lives Matter movement.

A solid percentage of under-40 shoppers, 28.1%, intend to buy the majority of their gifts at small or local businesses, an apparent win for “shop local” campaigns promoting mom-and-pop storefronts that have been devastated by the COVID-19 pandemic. But it’s unclear whether this preference is motivated by a drive for economic sustainability.

Just 17.5% of under-40 shoppers say shopping small or local is specifically in response to COVID-19 —31% lower than over-40s. Indeed, the percentage of Gen Z and Millennial shoppers buying the majority of their gifts from big-box retailers and Amazon is on a par with older shoppers; support for small and local retailers comes at the expense of member warehouses like Costco and “other”, not Amazon and the mass merchants.

In fact, with 50.1% of Gen Z and Millennial shoppers saying the global pandemic will cause them to do more of their holiday shopping online, they’ll likely give more dollars than ever to Amazon, which is the most popular holiday shopping site for under-40 shoppers.

More than 8 in 10 Gen Z and Millennial shoppers (84.1%) say they’ll buy gifts from Amazon, while individual retailer or brand sites ranked behind Walmart and Target in fourth place, at 30.9%. Similarly, more than half of Gen Z and Millennial shoppers will do some or all of their gift purchasing if Prime Day was held in October; just 6.2% don’t shop on Amazon, 49% lower than over-40 survey respondents.

By contrast, more than a quarter of shoppers over 40 intend to shore up local or small businesses in response to COVID-19, and even as a lower percentage, 23.6%, will buy the majority of their gifts there. And while Amazon is the favorite gift-buying site for older shoppers just as it is for Gen Z and Millennials, its grip isn’t so strong, at 73.9%—while individual brand or retailer sites enjoy more support, ranking third at 32.9%. Just under 4 in 10 older shoppers (39.5%) would take advantage of an October Prime Day to do some or all of their holiday shopping, 21% lower than under-40s.

While Amazon’s third-party Marketplace platform gives small businesses unprecedented visibility, the site’s dominance has led to recent calls from some quarters to “break up” the company. Shoppers under 40 entered adulthood with Amazon already established as a major online retailer—and their holiday shopping plans suggest they have no interest in consumer activism that would check its continued growth.

While both older and younger respondents will shop for gifts online to the same degree, those under 40 are more likely to avoid tethering to a single touchpoint, using phones and voice commands as well as store pickup services to a larger extent than older consumers.

More than 6 in 10 Gen Z and Millennial shoppers (62.8%) will use their phones to shop for gifts, more than double the percentage of older shoppers, at 30.2%. Fewer than 1 in 2 shoppers under 40 will shop on a desktop or laptop computer, compared with 63.4% of those over 40.

While only small percentages of both age groups will use voice-enabled devices to shop for gifts, twice as many shoppers under 40 will do so, at 7.5%, compared with 3.7% of those over 40.

A solid majority of Gen Z and Millennial buyers, 57.2%, will use store pickup this holiday season— 19% higher than those over 40, at 47.9%. The availability of pickup services is also a stronger purchase influencer for younger shoppers, who rank it above easy returns in importance, while over-40 shoppers rated returns as more of a factor in gift-buying decisions.

Retailers should reflect these priorities in their customer service promotions, tailoring messages to emphasize seamless and convenient online/offline experiences for Gen Z and Millennials, while spotlighting easy (and free, if available) returns for older shoppers.

Generation X shoppers ages 40 to 55 straddle both worlds. Their fluency with online shopping aligns with younger shoppers, while their spending power and habits track more closely with Boomers and Seniors.

More than half of Gen X shoppers (50.8%) will shop mostly or exclusively online for gifts, 8% ahead of younger respondents. But like older shoppers, they favor desktop and laptop browsing over phones, 60.2% to 43.4%, and use voice-enabled devices at a lower rate than survey respondents overall, 4.6%. Gen X is nearly as likely as shoppers under 40 to use store pickup, at 56.2%, a single percentage point behind younger shoppers. They also rank the availability of store pickup ahead of easy returns as a purchase factor.

Unlike younger cohorts, Gen X marries this omnichannel fluency with peak spending power. 70% of Gen X shoppers plan to spend more than $250 on gifts— the highest of any age cohort, 67% more than shoppers under 40, and 19% higher than the survey average.

Gen X buyers are less likely to lend those dollars in support of a cause. In alignment with older shoppers, just 14.8% say Black Lives Matter will impact their holiday spending. Additionally, more than 1 in 5 (21.4%) say COVID-19 won’t change their holiday spending or other plans, 20% more than those under 40. Gen X shoppers are also less likely to say they’ll purchase the majority of their gifts at small or local businesses, at 21%—25% less than Gen Z and Millennial shoppers.

With the majority of consumers blending offline and online experiences to varying degrees, retailers that can deliver consistent and unified service, as well as promotional offers that take into account past brand interactions across touchpoints, will be well-positioned to compete this holiday season. Messages highlighting safety measures and contactless options during the COVID-19 pandemic, with special attention to store and curbside pickup options, will further convey the flexibility shoppers seek as they adapt their holiday shopping plans to local conditions and their perceptions of safety.

Given the stratification of gift budgets, sellers should tailor their promotions and pricing strategies to cater to bargain hunters and top spenders alike. With total order cost a crucial purchase influencer, shipping deals can help convey perceived savings without reducing product prices; merchants should get creative to avoid eroding margins, such as by offering a discount for those choosing slow or consolidated shipping options early in the season, or free upgrades to expedited shipping as a VIP perk for loyal top spenders.

Under-40s and over-40s shop differently, so retailers should understand their audience and test strategies with members of the relevant age cohort. As one example, sellers catering to Gen Z and Millennials should envision customer journeys centered on phone-to-store interactions and store pickup services.

While alignment with social movements such as Black Lives Matter is potentially beneficial, “cause marketing” can backfire if it’s not tied to concrete actions. Merchants can start by promoting their internal policies, from extra safety measures for workers during the pandemic to living wage standards to equity hiring policies and even support for personnel juggling work and domestic life on lockdown. Charitable partnerships and donations can help demonstrate support for local communities.

Given the outsized enthusiasm for shopping on Thanksgiving and Black Friday among Gen Z and Millennials, retailers should court these younger shoppers in the runup to the holiday weekend, engaging on relevant social channels and through mobile campaigns.

Whether sellers are planning to sell and advertise on the Amazon platform or offer competing standalone holiday sales, it’s key to have a marketing plan that works around Prime Day.

Tinuiti surveyed 2,092 online respondents ages 18 and older on August 3, 2021, via the Pure Spectrum Insights platform. All respondents were screened with the question, “Will you shop for holiday gifts?” and those who do not plan to shop for holiday gifts did not participate.

This survey was commissioned by Tinuiti and conducted by Pure Spectrum, which uses

PureCore, proprietary technology for gathering quality responses. Consumers receive no

monetary payment for their participation. More information on Pure Spectrum’s methodology

can be found at https://www.purespectrum.com/insights/.

* The 2020 survey gave respondents more nuanced options for omnichannel shopping, which have been grouped together for year-over-year comparison. In 2019, the options were “In-store,” “Online,” “Both in-store and online”; in 2020, the options were “Exclusively in-store,” “Exclusively Online,” “Majority online, some in-store,” “Majority in-store, some online,” and “Equally in-store and online”. For year-over-year comparison purposes, “Exclusively in-store” from 2020 was compared with “In-store” from 2019, “Exclusively online” was compared with “Online”, and the remainder of the 2020 responses were compared with “Both in-store and online” from 2019.

Check out our most recent Holiday Shopping Trends Report for more exclusive insights.