Amazon Prime Day Results: Analysis & Key Insights for 2022

[This post was authored by Emily Sullivan and Shannon Mullery, Content Specialists at Tinuiti]

What began as a one-day Amazon event in 2015 has grown to become a major shopping holiday for Amazon and their competitors. And as Amazon shoppers have come to expect in recent years, the retailer kicked off their now (officially) 2-day sales extravaganza a little early.

Shoppers visiting Amazon.com on July 11, 2022 were greeted with Early Prime Day Deals they could nab right away, ranging from Certified Refurbished discounts, to steep savings on devices with Alexa.

These prominently placed deals remind us that Prime Day isn’t only a major event for Amazon the retailer, and the brands and sellers on the platform—it’s also a major event for the many arms of Amazon that produce goods and services.

Enhanced offerings that encourage subscriptions—like the two-additional-months-free Audible (an Amazon subsidiary) deal, shown below—also showcase how reaching a wide audience during one of the biggest shopping events of the year can help you realize recurring revenue benefits for months or years to come.

Our 2022 Amazon Prime Day Study of 1,000 Prime members found that 88% planned to shop on Prime Day in 2022; 40% noted they were more excited to shop Amazon during Prime Day this year than in 2021.

Did the sales number reflect that excitement? Let’s find out…

Now that Prime Day has come and gone, let’s dive into additional stats from two of the biggest shopping days of the year.

Managing advertising for clients across a wide range of industries presents us with an abundance of high-level, category-specific, and brand-specific insights on Prime Day performance, and the wins this year included some of the usual suspects, and some pleasant surprises!

Here, we explore a few of the successes our clients saw this Prime Day…

Though folks have long had an interest in their genetic profile and family history, scientific advances and the Internet have made the testing, researching, and connecting side of things much easier.

Genealogy sites have gained substantial popularity over the years, connecting people with their past, and present family members they didn’t know how to reach—or didn’t even know existed. More recently, at-home DNA test kits have also skyrocketed in popularity, giving people a convenient, cost-effective testing solution that only requires a trip to the mailbox instead of a doctor’s office.

Ancestry, a Tinuiti client operating in this space, saw tremendous success during Prime Day 2022, driving over 2.3M in top line sales on Prime Day (day one)—a 391% YoY increase from day 1 of Prime Day 2021.

Ancestry’s Prime Day Search strategy leveraged conversion and consideration tactics through keyword targeting, product targeting, custom images and video creative. Their Display strategy utilized on-Amazon contextual placements to drive customers through the purchase phase. Our team implemented a broad-reaching consideration campaign to bring new shoppers to Ancestry’s product detail pages (PDPs). We also targeted new-to-category audiences with a goal of attracting new Amazon shoppers to Ancestry’s products.

“We are thrilled with the Prime Day results which are a testament to our strong partnership with Tinuiti,” said Benjamin Huppertz, Director of Onsite Marketing at Ancestry. “We look forward to building on these insights to help even more people discover, craft and connect around their family story.”

Animal lovers were opening their canvas wallets this Prime Day, with record-breaking sales for a number of Tinuiti clients who offer cruelty-free products, including:

As more folks shift to a dairy-free diet for a variety of reasons, conveniently packaged plant-based protein sources have been taking the CPG industry by storm. One Tinuiti client, No Cow—whose business focuses on vegan protein bars—saw their highest ecommerce sales day in the history of their company on Tuesday. No whey? Yes, way!

“Thanks to solid preparation and teamwork on both the Search and DSP side, we smashed another company record with Tinuiti. We look forward to taking these learnings and doing it all over again in 2023.”

— Joey Saad, Digital Marketing Manager, No Cow

Vegan Cosmetics

Another Tinuiti client saw their all-time highest sales day the first official day of the Prime Day event, as well. This cruelty-free, vegan cosmetics brand hit their average total daily sales by noon, helped along by a single ASIN selling 2300+ units. And on day two of Prime Day, they broke their record again.

“We prioritized inventory management in the first half of the year, and the diligence in restocking heroes paid off this Prime Day. We partnered with the brand’s Social Media team and our Tinuiti Paid Media team to drive external traffic to our Amazon brand store. We saw the visitors to the brand store jump 60% with this collaboration. This was a team effort.”

— Megan King, Sr. Account Manager, Retail Operations at Tinuiti

While there’s always a buzz of excitement around Prime Day, some merchants were concerned recent inflation spikes and supply chain woes would impact overall sales. The annual inflation rate in the United States has increased by 9.1% (as of June 2022), which is the largest annual increase since 1981. And while many sellers built up additional stock for Prime Day demands, a massive surge in sales could also impact supply chain and distribution efforts.

Our 2022 Prime Day Study showed that many consumers indicated economic concerns would affect their purchase decisions this year. 63% of respondents said that product price inflation will likely discourage them from making some purchases this Prime Day, and that figure is 79% for those respondents who are less excited for Prime Day this year than in 2021.

On the flip side, our study also showed that 88% of those surveyed said they planned to shop on Prime Day this year. So, how did Amazon do when it comes to sales? Despite inflation concerns, Amazon reported that “Prime members purchased more than 300 million items worldwide during Prime Day 2022, making this year’s event the biggest Prime Day event in Amazon’s history.”

With Prime Day seeing so much success over the years, other major retailers have naturally taken notice. Three to watch each Prime Day are Target, Walmart, and Best Buy, who aim to even the playing field for themselves a bit with showstopping deals of their own.

Similar to Amazon, Target also got a headstart on sale pricing, kicking off their 3-day Deal Days event on July 11, 2022, complete with an animated banner featuring Bullseye the Bull Terrier on guitar.

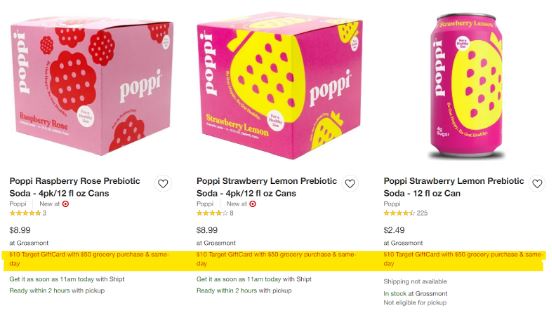

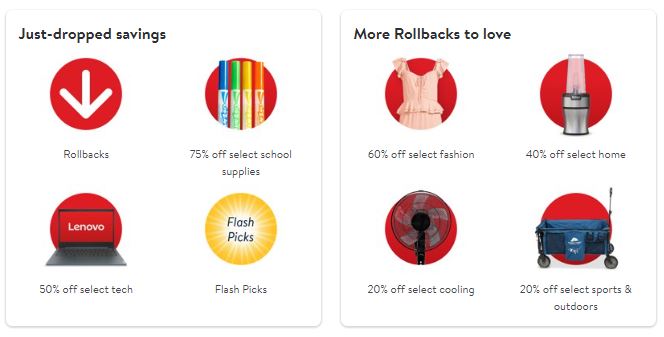

Target offered something for the whole family in their Deal Days, with some of their hottest category-level savings including:

Target also ran their own category-specific deal for grocery items, with shoppers earning a free $10 Target gift card with a $50 food and beverage purchase. Even if brands within this larger category didn’t run their own promotions, their listings still stood out, with Target’s promotional banner running below qualifying items, letting shoppers know if products would count toward that $50.

Walmart ran their own Deals for Days event in early June—instead of aligning their event with Prime Day, as they typically do—but there were still some great deals to be had Prime week as well.

The promotional banners and language on Walmart’s website weren’t as directly event-focused as Amazon, Target, or Best Buy; we didn’t see any countdown timers or clear end dates for lowered prices. Instead, the focus was on prices having been recently lowered, with a general encouragement for shoppers to act fast.

In our Prime Day 2022 Study, 57% of Prime Day shoppers shared they planned to shop Walmart’s site as well. The next most popular stop on their deal journey was expected to be Target.com. 50% of those surveyed said they’d be checking other retailers for price comparison purposes, with 28% saying they’d be stopping by other sites to check out the deals.

With electronics being a heavy focus for Prime Day, it makes sense that Best Buy gets in on the action, as well. This year, they called their sales event Black Friday in July, with sale prices running through Wednesday, July 13, 2022.

Respondents to our 2022 Prime Day Study noted Best Buy would be the third most common retail site (outside Amazon) that they were planning to visit during Prime Day, trailing only Walmart and Target.

Some of Best Buy’s hottest Black Friday in July deals included:

From ecommerce competition and inflation struggles, to agility driving impressive sales performance, our experts are sharing their hot takes and key insights from Prime Day 2022.

Prime Day is inarguably one of the best sales events to score great prices on electronics, small kitchen appliances, bedding, clothing, home goods, and more.

But what about Prime Members who don’t need any of those things, or simply don’t have the disposable income to spend on them in today’s economic climate?

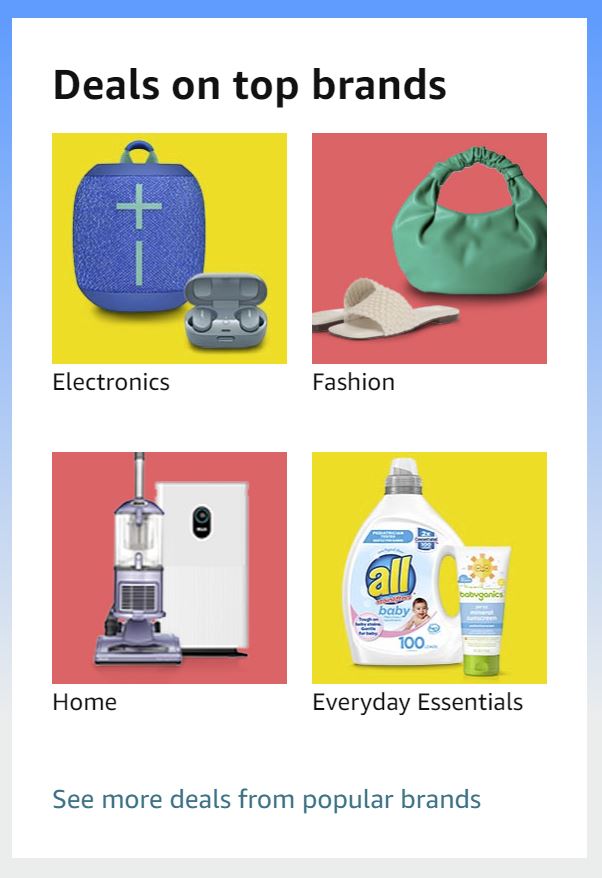

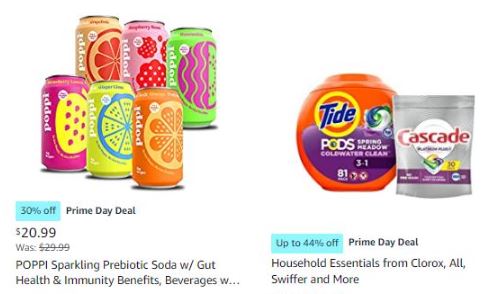

Prime Day also offered an abundance of deals to suit all Members’ needs and budgets, with deep discounts on everyday essentials likely already on most folks’ regular shopping list, from soap to soda.

Some examples of these included:

As reported by CNBC:

“This year, shoppers appeared to reach for necessities over indulgences, with products such as Frito-Lay snack packs landing among the top purchased items, according to Numerator, which tracked Prime Day spending.”

Numerator’s Prime Day purchase study of more than 21K households also found that ~58% of orders placed were for items less than $20.

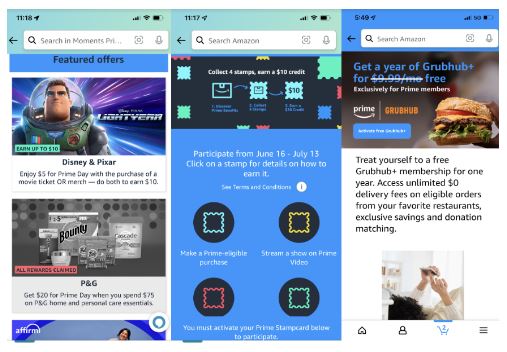

As we covered, inflation was top-of-mind for many shoppers during this year’s Prime Day. Amazon tried a variety of creative ways to draw more consumers to their site during the two-day event with fun incentives for shoppers.

“Seeing inflation at a record high and discretionary income being tightened for most Americans, Amazon did what they could to incentivize users to purchase during Prime Day and in the lead up by offering actions subscribers could take to earn Prime Day credits and gamify the experience. Amazon rewarded customers for actions they might already take with spending money for Prime Day in case they didn’t have any. Amazon also offered a free year to Grubhub+ for all prime members, this was announced days before Prime Day, giving any prospective shopper another perk to sign up for Prime in the days before Prime Day.”

— Christian Lopez, Team Strategist, Marketplaces at Tinuiti

“This year’s Prime Day brought even more competitive and steep deals, likely due to sellers wanting to lure budget-conscious consumers in the midst of inflation. Therefore, competitive deals and discounts were more vital this year for sellers and vendors without strong brand recognition. Those clients tended to generate low conversion and sales as the SERP was littered with competitors offering strong incentives (many 25-50% off discounts). For sellers & vendors with large and loyal customer bases, steep discounts were not as essential in competing.”

— Lauren Wood, Team Strategist, Marketplaces at Tinuiti

Prime Day rakes in billions of dollars each year, so it’s no surprise that other retailers are coming up with saving events of their own during Amazon’s two-day event. This year, the competition was fierce between Walmart, Target, Best Buy and more, but Amazon continues to lead the charge.

“Emerging Marketplaces’ deal days show their reliance on Amazon’s model — until each marketplace can discover its own unique way to deliver a marketwide sale (such as Walmart’s Summer Savings event), Prime Day will continue to hold the spotlight as the premier online sales day.”

— Brody Leonard, Associate, Retail Media at Tinuiti

“As more retailers follow and create their own Prime/Deal Days in the summer, consumers will have to do their research more diligently to find the best deals from their favorite retailer or brand.”

— Isaac Lee, Specialist, Retail Media Search at Tinuiti

“We seem to be seeing a much larger push by AMZ to drive increased traffic to the site for Prime Day this year as compared to the past Prime Days. It seems like the “organic” lift of Prime Day has lessened over time, and as competition (Target Deal Days, etc.) has increased.”

— Stuart Dooley, Sr. Manager, Marketplaces at Tinuiti

For brands and advertisers operating in the thick of Prime Day, it can feel like the Shopping Olympics. Traffic, sales, and interest are high, and many decisions have to be made quickly based on what’s happening in real-time, no matter how well you prepared.

Ken Magner, Sr. Specialist on the Marketplaces team at Tinuiti, shared his experience in how ‘staying the course’ led to winning the race for one of his clients this Prime Day:

“Being agile on the day of an event based on competitor presence/deals is an important element. One of my client’s core competitors had a strong presence, particularly on Sponsored Brands (SB) placements early in the day yesterday. By 6pm EST, the competition appeared to disappear from showing in SB placements.

The client agreed to add more SB budget for the evening to really own that placement to close the day. ACOS on the account was 32% at 10pm EST, and down to 15% the morning of Day 2. This drop was largely impacted by sales data delay/lag, but the heavy push to own SB at the end of the day when competition was lesser, and CPCs were cheaper, certainly helped.”

2022 Prime Day has come to a close, but that doesn’t mean it’s time to put the event in the rear view mirror just yet. Let’s take a look at a few quick tips so you can apply Prime Day learnings to your Amazon Business in the future.

As with any campaign or event, it’s critical to take the time to reflect on your data. After Prime Day, it’s important to analyze what worked and what could be improved upon so you can optimize your results for next year. Take some time to examine your top and low performing products, ad campaigns, keywords, and more to facilitate future growth.

“Sales attribution is especially slow on tentpole event days due to the influx of traffic, so it’s difficult to make data-driven decisions in real time. Because we don’t have real-time data to work with, it can be scary to increase the budget on campaigns that appear to have shot up in ACOS, but taking risks on Prime Day is essential if your client’s primary goal is boosting revenue and/or growing awareness. If you see a campaign that has performed efficiently in the past, which also contains ASINs on best deals, you should feel comfortable bumping the budget substantially (3x-5x) even if you see a temporary spike in ACOS.”

— Kevin Wellis, Strategist, Marketplaces at Tinuiti

After you’ve taken a look at your Prime Day data, it’s time to set up a game plan for next year. Prepping early is one of the keys to success and will give you ample time to…

While Amazon’s Prime Day event is leading the charge when it comes to sales, don’t count other competitors out. As we covered, Target, Walmart, Best Buy, and other retailers have stepped up to the plate with their own savings events to compete with Prime Day. If you’ve considered adding emerging marketplaces to your strategy, now might be a good time to explore those options before next year’s sales events ramp up (and Tinuiti can help!).

Nine out of ten customers read reviews before buying a product so it’s incredibly important to check out your Amazon reviews before the next Prime Day. Have you received negative feedback after an influx of orders? Take a look at any factors that could be contributing to negative reviews and look for opportunities to correct them. Are your descriptions misleading? Do your photos misrepresent your product? Take quick action so you can build up strong reviews as consumers are shopping on these high-traffic days.

“Regardless of anyone’s feelings on Prime Day’s place amongst the competition of newly minted holidays, it’s impossible to deny the impact the event has within the marketplace. Prime Day can still be a kingmaker for a product able to effectively leverage deals. In searching across the marketplace, I saw one retailer with a solid product and well-known brand name rise 9K spots in BSR (Best Sellers Rank) in part due to offering a 10% off coupon.”

— Justin McCurdy, Team Strategist, Marketplaces at Tinuiti

If you’re interested in learning more about Tinuiti’s Amazon Services, or if you’d like to learn more about emerging marketplaces, contact us today. Also be sure to sign up for our upcoming webinar where we’ll take a deeper dive into all things Prime Day 2022—and keep an eye out for our Prime Day Data Recap coming soon.