Holiday Trends to Know for Amazon Ads

The holiday shopping season is once again upon us, and with it the opportunity to reach consumers during the most important sales period of the year for many businesses. Our 2019 Holiday Shopping Predictions & Behaviors report showed that 82% of survey respondents planned to shop on Amazon in some capacity this holiday season, and the ecommerce giant will play an important role for brands over the coming weeks.

With the influx of demand, Amazon advertisers should be prepared for some key shifts in purchase behavior throughout the season. Here are just a few of the holiday insights we uncovered from last year using long-standing Tinuiti client data.

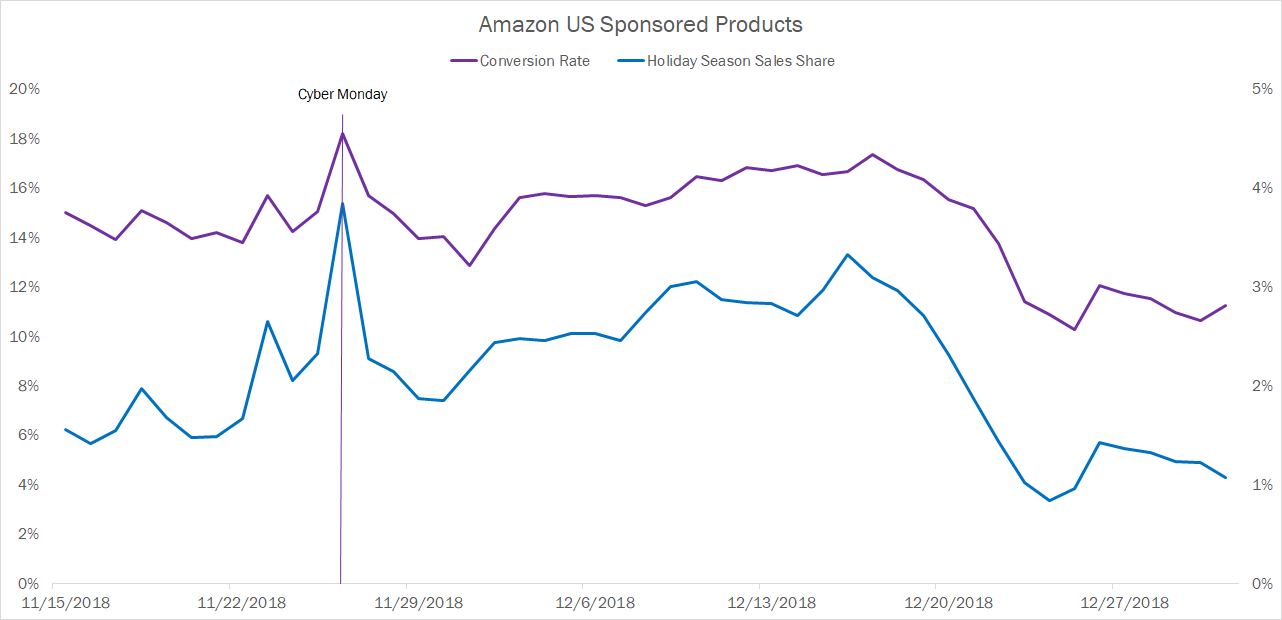

Looking at the share of sales attributed to Sponsored Products between November 15 and December 31 last year, mapped in this chart to the secondary axis on the right, Cyber Monday was the biggest day of the holiday shopping season.

Not only did Cyber Monday account for the most sales, but conversion rate was also at its absolute highest on Cyber Monday. Both conversion rate and sales share climbed through the first half of December, and the next most important day for sales volume occurred December 16.

Last-minute holiday sales will likely be even more important this year than in 2018 owing to the shorter holiday season. With Thanksgiving falling on November 28, the period between Thanksgiving and Christmas will be six days shorter than last year, meaning shoppers will be more crunched for time than in any year since 2013.

However, there will always be early shoppers who start their research well ahead of Christmas Day, and it’s important to incorporate the expected value of latent orders into bid and budget management.

A key consideration for Amazon advertisers should be the fact that orders and sales roll up to the date of the ad click as they occur. That means that the total sales and orders attributed to a particular day will grow over time using longer attribution windows, and that advertisers won’t know the full value of ad clicks from a particular day in real time. As such, brands should look to historical performance in order to inform bids and budgets throughout the holiday season.

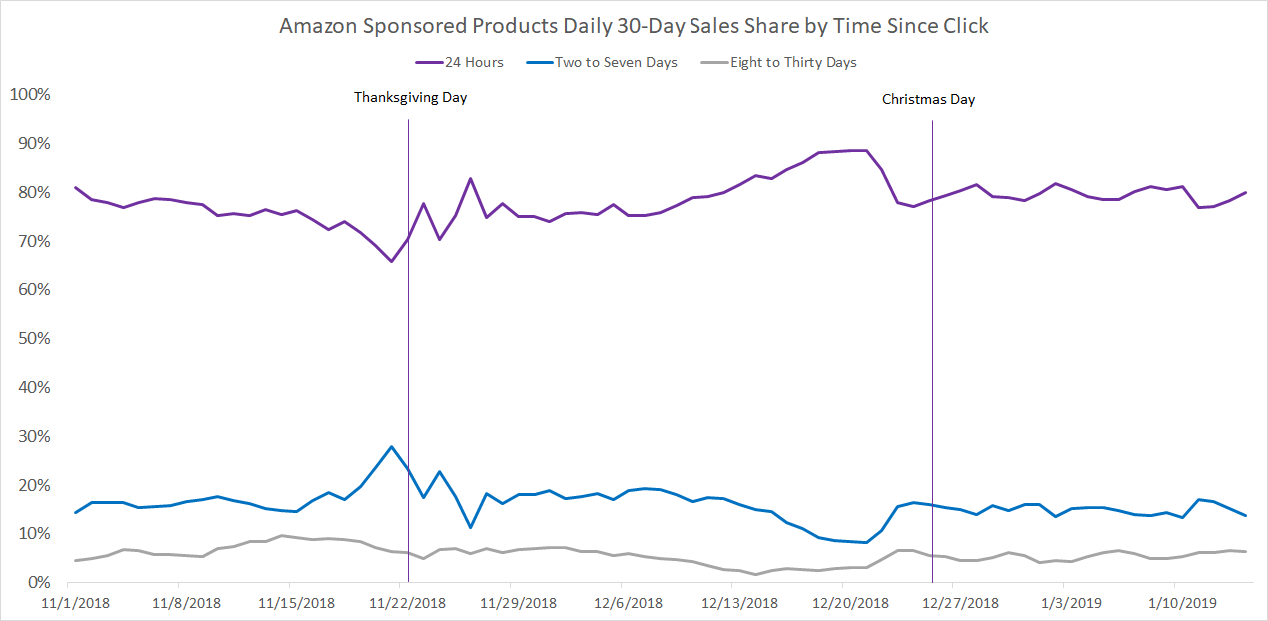

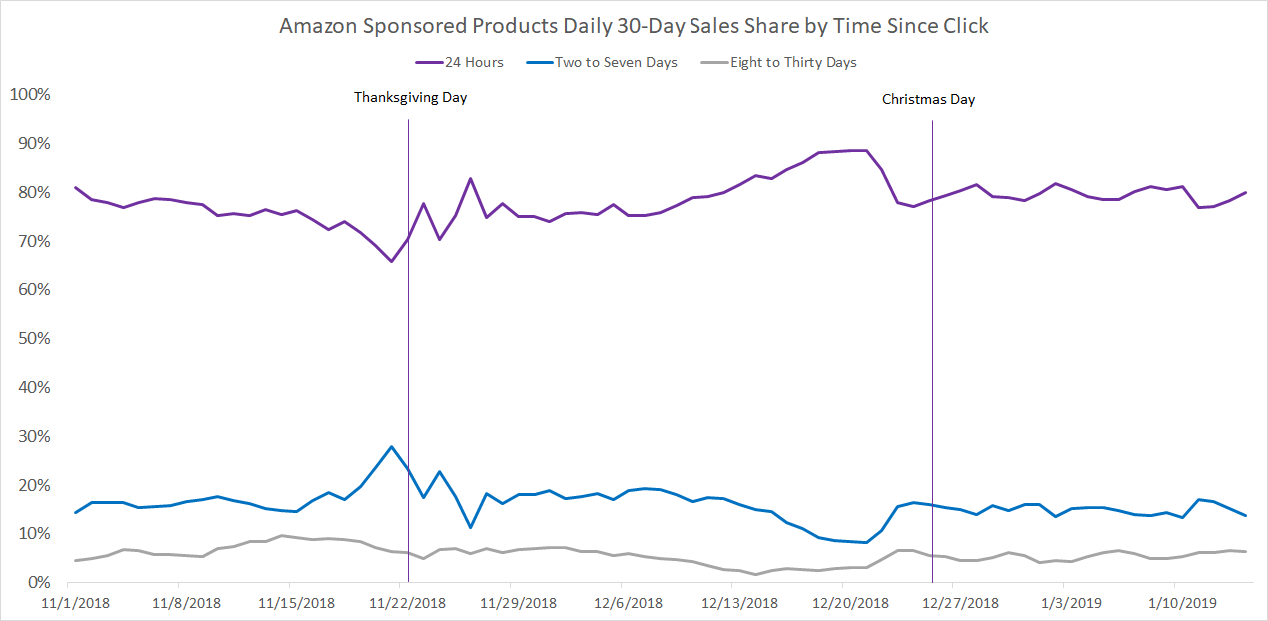

The chart below shows the share of sales attributed to ad clicks within 30 days, broken down by if the sales occurred within 24 hours of the click, between two and seven days of the click, or between eight and 30 days of the click.

As you can see, the share of sales that occur within 24 hours of the initial click rises throughout the holiday season as the urgency to quickly place orders grows the closer it gets to Christmas. Last year this share peaked on December 21 at 89% of sales across the advertisers studied.

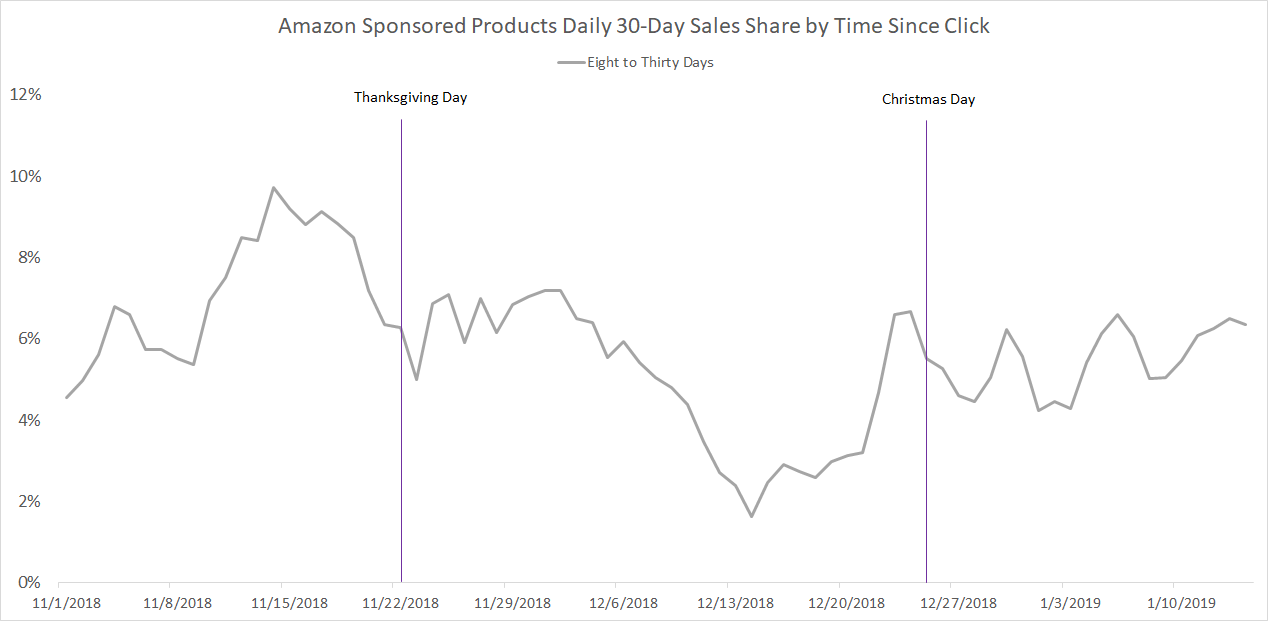

Another important takeaway from these trends is how important latent orders are to properly valuing clicks that occur outside of the core weeks between Thanksgiving and Christmas. Zooming in on just the share of sales occurring between eight and 30 days of the ad click, this share peaked on November 14 last year.

Latent order share can be much higher for some advertisers, owing to higher price points or other variables which produce a longer consideration cycle. Several brands studied saw 30-day sales share from orders placed at least eight days after the click peak at 25% or more.

With all that value trickling in more than a week removed from ad clicks, advertisers should be using performance from last year to assess the total value of ad clicks occurring right now, since real-time reporting simply isn’t telling the full story.

Aside from Sponsored Products, it’s also important for advertisers to stay on top of managing Sponsored Brands, which played a key role last holiday season.

Last year, the median Sponsored Brands advertiser saw 13% of total Amazon search ad clicks come from the format between November 15 and December 31, with the rest attributed to Sponsored Products. While Sponsored Products will continue to account for the lion’s share of ad clicks and sales this holiday season, it’s clear Sponsored Brands play an important role in maximizing the impact of Amazon advertising during the holidays.

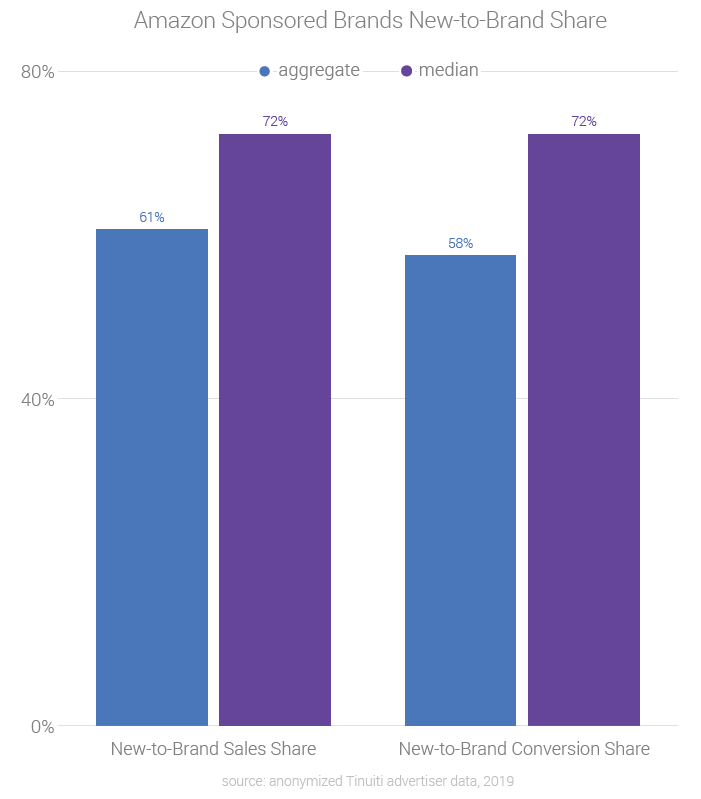

Advertisers will have new insight this year into the value these ads are producing thanks to new-to-brand metrics rolled out in January 2019. These metrics segment the sales attributed to Sponsored Brands based on whether the customer has purchased from the brand on Amazon in the last twelve months, thus giving advertisers a better sense for the incremental value these ads produce in getting in front of new customers.

As we reported in the latest Amazon Ads Benchmark Report, new-to-brand customers accounted for more than 60% of sales attributed to Tinuiti advertisers in Q3 2019.

New-to-band share can vary significantly from advertiser to advertiser, owing to disparities in variables such as market share and how long an advertiser has been active on Amazon. As such, advertisers should make sure to assess their own new-to-brand share in making performance evaluations and optimization decisions.

Given these ads tend to have a lower overall conversion rate than Sponsored Products for many advertisers, it’s important to bake the brand-building potential of Sponsored Brands into the expected value of these ads.

This holiday season might see some meaningful departures from last year’s trends given the significantly shorter holiday season. Still, last year is helpful in giving advertisers directional insights into trends like the importance of Cyber Monday and the latent order value of ad clicks earlier in the shopping season. As such, marketers should have a strong understanding of how performance shifted over the course of the holidays last year and look to incorporate these insights into this year’s optimizations.