Amazon vs. Google: Who Will Win the Most Voice-First Shoppers?

Remember The Clapper?

The plug-in device flipped on and off your household lights with a double clap of your hands.

The Clapper blew everyone’s minds in the 80s and 90s–until they discovered it frequently mistook a dog bark or knock for clapping.

A few weeks ago, Google Homes across the country went rogue, flipping light switches and blasting music in sync to a Google Home commercial.

Every new piece of technology has glitches. But apparently, as long as they make our lives easier, our wallets are out.

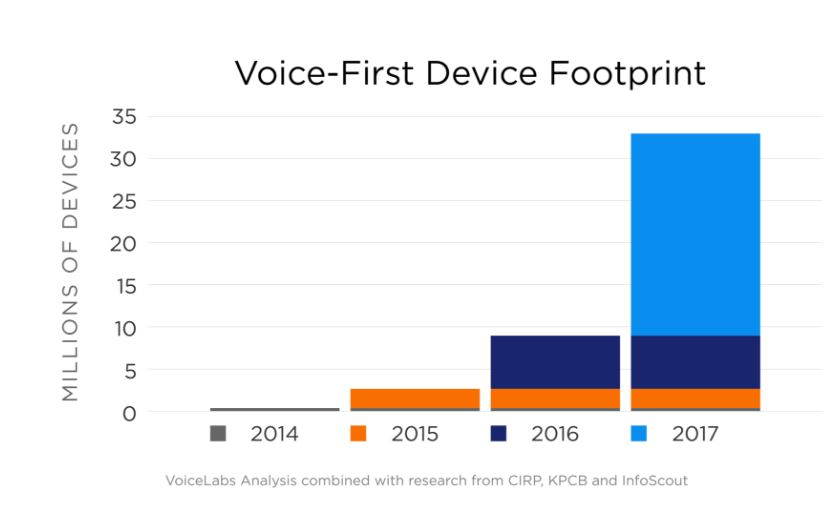

That’s why, by the end of 2017, experts predict there will be over 30 million voice first device assistants in US households.

Voice-first devices (unlike sadly limited Clapper) could easily be the next smartphone.

And right now, Google and Amazon are the biggest players in the voice-first game.

As a performance ad agency, we’re already thinking about what advertising will look like on voice-first devices–and more importantly, who will get there first. Here’s what we’ll cover:

Since launch, Google has sold between 400,000 and 500,000 Google Home devices.

Users had the capability to do things like play music, get calendar events, or adjust smart thermostats.

Unlike Amazon’s Echo, shopping wasn’t an option.

However, Google just announced they now allow voice shopping.

And it’s free–meaning no membership or service fees–through April 30, 2017.

Users simply add their payment info to the Google home app and set a default credit card and delivery address. From there, they can shop at Google Express retail partners such as Nine West, Orchard Supply Hardware, and Costco.

As far as user adoption goes, Amazon blows Google out of the water.

The Amazon Echo and Echo Dot have infiltrated 8.2 million US homes.

In fact, the Echo and Echo Dot were the best-selling items on Amazon from Thanksgiving through Cyber Monday last year–sales were up 9x since 2015.

And unlike Google’s device, Echo owners don’t just use their device to look up cookie recipes or to listen to Adele.

They’re Prime members, which means they already spend more than the average Amazon shopper, and they can order everything but the following:

Data shows that Echo owners actually increase their Amazon spending by about 10% after buying the device.

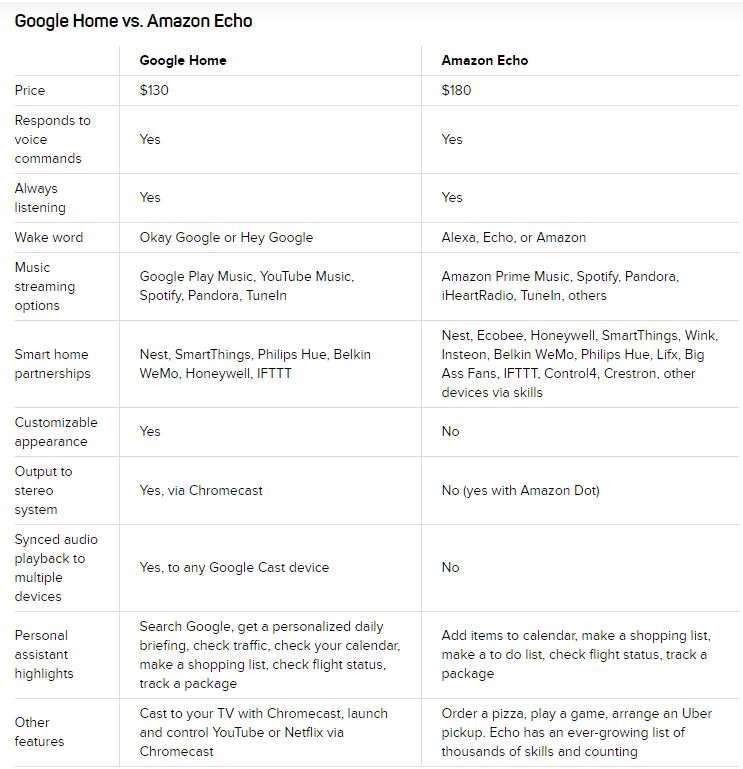

In case you’re wondering about specs, here’s an awesome breakdown from Cnet’s review of both devices:

So now that we’ve seen both devices, are there any other voice-first devices–not counting the voices on your phone–that might enter the playing field?

Back in 2016, we heard a lot about Mark Zuckerberg toying with an AI named “Jarvis“, voiced by Morgan Freeman.

Although it’s unlikely Facebook will enter the voice-first hardware wars with their own physical device, there’s a distinct possibility they could supply the software to run these devices, says Nii Ahene, COO and Co-Founder of CPC Strategy:

“Facebook may create a voice search operating system and open it up in the same way that Android created an operating system and sold it to different phone manufacturers. It would be smarter for them to do that rather than competing with Amazon and Google on a one-to-one basis.”

Now to answer the first big question.

To understand what voice-first device ads look like (sound like?), we need understand how users currently use them.

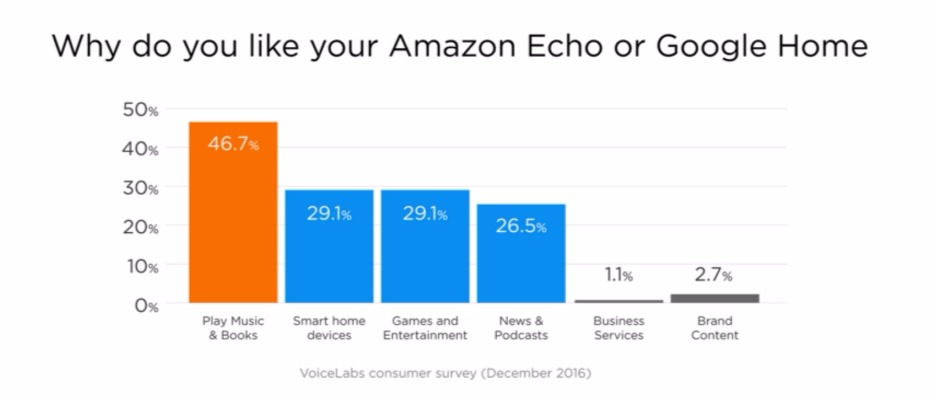

Here’s the breakdown of how people use voice-first devices, according to The 2017 Voice Report by VoiceLabs:

That’s right–about 75% voice-device owners use their Echos or Homes for recreational purposes–including music, books, games, and entertainment.

Because of this, many advertisers assume that these ads will sound like radio ads.

There’s one key problem with that idea.

While radio or even podcast ads interrupt continuous airplay, a voice-first device could go several hours without playing either music or an audiobook. Meaning inventory for ads will be far more limited.

With this in mind, here are a few directions these ads can go.

We’re in the age of ad-skipping, and riots may happen if there’s not a way out.

That’s why, however the ads appear, our experts believe you may be able to buy your way out of them–or at least get something in return for your patience.

“I don’t see a world where the device plays an ad without someone using it,” says Ahene. “I don’t think Amazon or Google are looking to disrupt the user experience that much. I also don’t see consumers paying for a device only to be subjected to ads–unless it’s to support premium content.”

There are two potential ways this could appear.

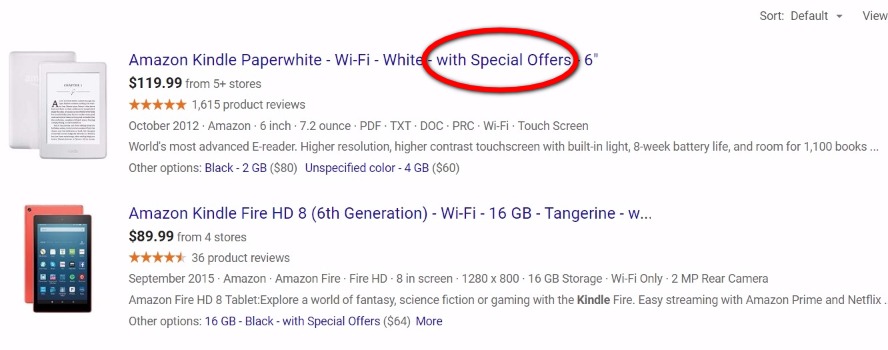

If you can opt out of ads with a Kindle Fire, why shouldn’t you be able to do that with your voice first device?

It’s possible that more content (think audiobooks) could be “featured” by a specific brand.

Farther down the shopping funnel, there could be preferred providers when users are voice shopping for products for Google Home.

This is currently happening with Amazon’s Echo device, which features Prime products and places orders based on:

“Let’s say I want to go to the movies,” says Ahene. “There are many places I could buy that ticket–Fandango, for instance. In that case, Fandango could actually pay Amazon to be the default provider on a voice search.”

As long as there’s not a monetary difference for the consumer, this could work–because we know at least Amazon shoppers are very price conscious.

This is probably the most practical way we could see voice first devices interacting with PPC ads.

“Voice first devices can gather user data to create a richer profile for advertisers to leverage downstream,” says LaBroi Walton, Retail Search Manager at CPC Strategy. “For example: If I ask my Google Home to purchase a particular branded product, I may be retargeted by that brand with ads on a different device–mobile or desktop–later on.”

There’s no company that knows data better than Facebook. Yet another reason, points out Ahene, why Facebook may invest in voice ads differently:

“Facebook is the most logical player to get in on this voice first device monetization–they already understand those richer user profiles, and how they fit into ad targeting.”

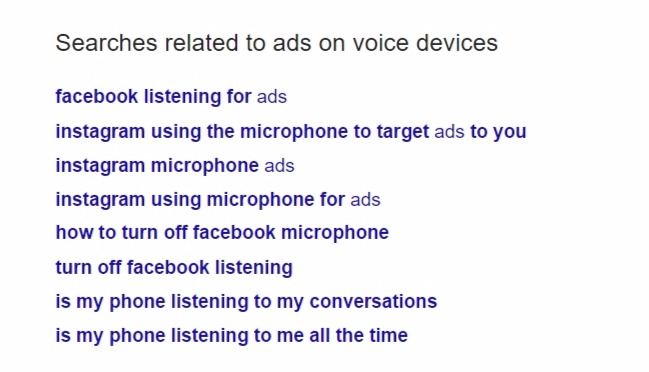

Many of us are already wary of our devices listening to us (check out the suggested Google searches below):

For now, we know devices listen 24/7, but only to respond to your initial commands and subsequent words. This could become a privacy issue in the future, but for now, Google and Amazon are playing it very safe–even when evidence-hunting police get involved.

Local businesses could really benefit if ads were geo-targetable.

“If the ads do turn out to be radio-like ad spots, we’d most certainly be able to target by income, demographics, location, interests, and more,” says Josh Brisco, Manager of Retail Search Operations at CPC Strategy.

This could also benefit users looking for a nearby mechanic, or other goods or services. Because these devices are solely used hands-free, they’re even easier to use than a phone, if a little less portable.

Why does it matter who gets there first?

Well, because once a device gets purchased, it’s highly unlikely the owner would go out and purchase another one.

The same VoiceLabs report showed that–whether it’s a Google Home or Amazon Dot–only 11% of voice-first device owners would consider adding another device.

In other words, a Dot owner probably would never be exposed to Google ads, and a Google Home owner would probably never hear Amazon ads.

“I can see why that would happen,” says Tien Nguyen, Director of Technology at CPC Strategy. “I think people are more likely to commit to one device because there would be no reason to change. It’s not like an iPhone where you would buy the latest hardware–especially because all smart devices integrate with the voice-first devices.”

This could change as voice-first devices start to differentiate more from each other, and perhaps if smart devices form more alliances with just one voice-first brand–but right now, that’s the hard truth.

At face value, Amazon’s closer than Google to coming up with an ad solution.

Amazon is the first place people go when they’re looking to make a purchase online.

However, we need to keep in mind that voice queries aren’t just about bottom-of-the-funnel sales, which is Amazon’s strength.

Voice search queries also encompass a wide range of other uses, some which are top-of-the-funnel.

Which brings us to Google’s first advantage: Full-funnel advertising.

Ahene explains:

Because voice first devices are primarily used for entertainment right now, the most logical advertisers would be companies looking to drive brand awareness or customer activation. Between news reports and songs, they can tap into the user base with audio ads. In that sense, Google has the advantage. They have the advertiser base, they have more advertisers in retail, and they also have Youtube. They’re closer to advertisers who are looking to raise brand awareness than Amazon, which is more at the bottom of the funnel.

If ads do resemble radio ads, Google also has more experience in that arena.

Remember back in 2006 when Google acquired dMarc Broadcasting? Us either.

Google moved out of that space because it was too early for its time. However, it’s now a prime time (no pun intended) to start exploring potential audio ads.

Finally, Google devices in other forms have already infiltrated many US households–and cars, for that matter.

“Google also has connected devices in cars–and since people are using them for music, it would be logical for them to extend their advertising to those in-home devices,” says Ahene.

At the end of the day, it’s plausible that while Google and Amazon will both fight over audience share, advertisers will both benefit from voice first devices.

Walton explains:

So many people start their search off on Amazon–but they still shop on Google. Google has so many opportunities in terms of understanding people and understanding their intent from what they say to devices–but so does Amazon. It’s like comparing the difference between Android and Apple–they’re completely different environments, and people act different within them to achieve similar goals.

Now for the doom-and-gloom portion of our story.

In the race of Google vs. Amazon, it doesn’t seem that Google knows they’re racing.

Considering they just introduced Shopping for Google Home–they don’t seem to be overly concerned about rushing the process.

This may be because Sundar Pichai, the CEO of Google, has openly said he doesn’t believe voice-first devices will replace search on desktop and mobile. Instead, he believes voice search will simply be an additional avenue for users to interact with Google.

“The sum total of all of this: It expanded the pie,” Pichai told investors recently.

CPC Strategy experts disagree.

“That’s shortsighted,” argues Ahene. “Sure–in the near to medium term, the search query pie will grow. But as devices increase and machine learning becomes more accurate, opportunities to leverage voice search instead of desktop or mobile search will increase. The timeline is to be determined, but I can’t see us typing things to find them instead of saying them out loud in 20 years.”

On the other hand, Google is very aware that paid search as we know it will change.

Sridhar Ramaswamy, Senior Vice president of advertising and commerce at Google, has said that”the days of the top three text ads followed by ten organic results is a thing of the past.”

And that’s probably true.

Many retailers are still struggling to survive the mobile overhaul–only the advanced will survive a leap to voice.