In the U.S. alone, Amazon.com lists over 560 million products and counting, providing the consumer with an endless product selection from some of the world’s most renowned brands, to start-ups, and private labelers (including Amazon).

Although the “endless digital aisle” contains an infinite amount of product space, the reality is the majority of shoppers won’t search for products beyond the first page.

This enormous amount of consumer choice can sometimes leave brands scratching their heads thinking – “How do we get shoppers to find our products?

A big part of this conversation is whether or not to increase Amazon ad spend.

In 2017, Amazon Q4 drove a whopping $60.5 billion in revenue (up from $43.7 billion the year prior).

We know today brands are spending more on advertising than ever before – but is it working?

In the following article, we decided to take a closer look at why brands are spending more on advertising this year vs. last year and how to get your products to the very front of Amazon’s seemingly endless digital shelf.

Why are brands spending more on Amazon advertising?

According to Courtney Manual, Marketing Manager at Guthy-Renker, one of the world’s largest and most respected direct marketing companies – 3 major factors played a role in the significant jump in spend.

FREE WEBINAR: “Amazon’s Endless Aisle + Digital Shelf Revolution“

Reason 1. There’s an increasing number of sellers.

It’s common sense – the more sellers on the Marketplace, the more competition. This increase in competition means there’s an increase in the number of businesses going after the same keywords & ad space.

“Even if you didn’t expand your holiday plans and essentially ran the same deals as last year – that same ad, with the same ad grouping & ad placement cost you a lot more in 2017 than it did in 2016,” Manual said.

Reason 2. Marketplace saturation within a confined platform.

If you think of a traditional brick and mortar, there’s only a given amount of shelf space available in-store. As new products enter the market, stores will gradually retire older products and replace them with new products on their shelf.

But because Amazon is a function of the internet, hundreds of new sellers can join the site without having to kick off any older sellers. This leaves the impression that there is endless shelf space, which is theoretically true.

The problem is consumer browse behavior hasn’t changed much. So while there’s a 1,000 additional pages of products to choose from, when you search for a keyword like “anti-aging serum” the majority of shoppers still won’t search for products beyond the first page.

“In fact, almost 100% of all sales are garnered within the first 3 pages. This would be like a brick and mortar adding 50 floors of products to their current structure, without building an elevator for consumers to reach them. Nobody is going to climb up 50 flights of stairs to look at your product, when there’s a comparable product on the first floor,” Manual said.

3. Increased Marketplace-specific consumers.

There are now over 100 million Amazon Prime members. Prime Members are incredibly savvy, and they know how to compare value propositions across products at a high level. As a result, Marketers have to create robust campaigns and spend more ad dollars – just to get noticed.

“[As a test] at Guthy-Renker we ran the same deals in 2017 that we ran in 2016. The result? Performance was poorer (if not flat) compared to the newly introduced deals that we launched on the platform that year. Without a doubt, consumers expect more out of your deals, because they can comparatively shop in one click,” Manual said.

What does the data tell us?

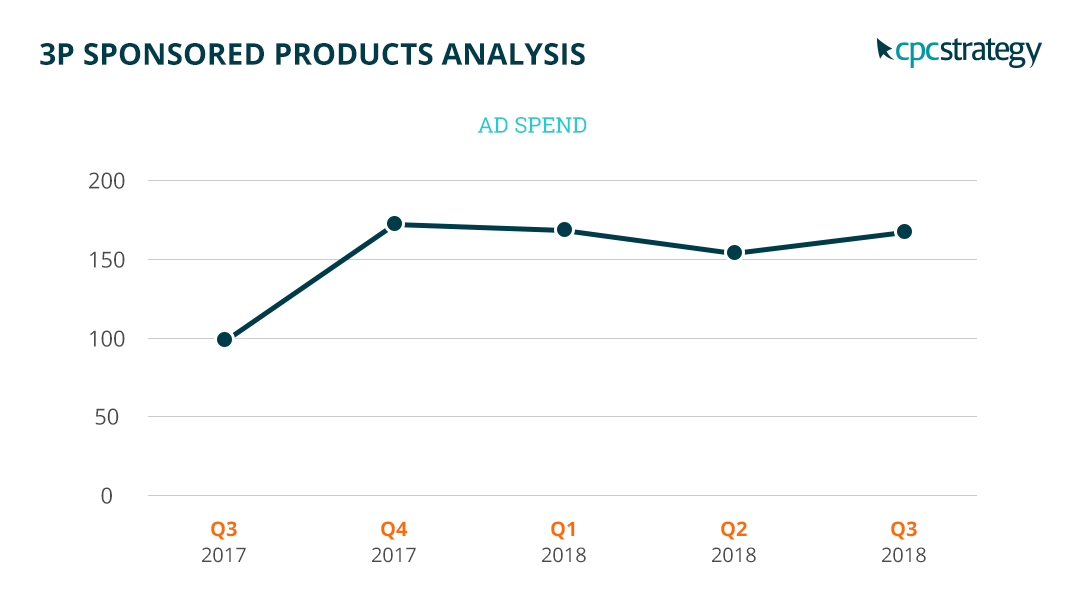

To better understand the trends occurring within Amazon’s Sponsored Products program, CPC Strategy conducted an analysis of our Sponsored Products data for all of our own same store clients from Q3 2017 to Q3 2018.

The data we gathered is from Vendors & Third Party Sellers leveraging Sponsored Products.

CPC Strategy collected the following metrics* including:

- Spend

- Revenue

- Clicks

*Please note all data (with the exception of CPC) is normalized for confidentiality. The baseline marker for Q3 2017 is represented by 100 on each graph below.

CPC Strategy’s 3P Sponsored Products Analysis

The analysis below includes data from 59 same-stores U.S. Amazon sellers.

Ad Spend:

We saw a +66.51% increase in spend from Q3 2017 to Q3 2018.

This increase indicates that sellers are absolutely investing more marketing dollars into Amazon advertising than ever before.

It also indicates that sellers view Amazon Sponsored Products as an effective use of their budget to help drive sales and increase revenue.

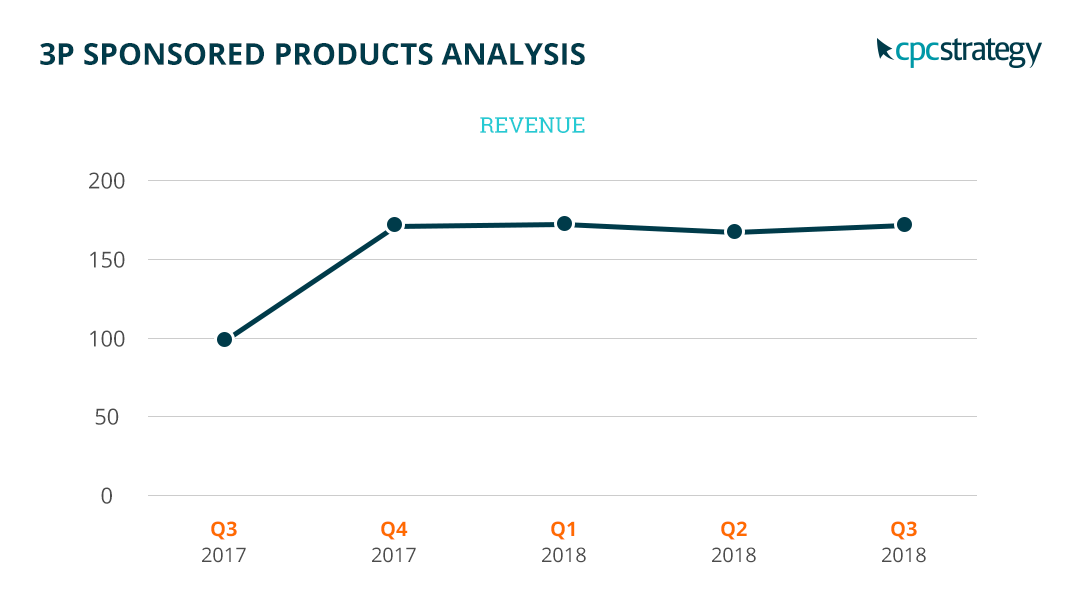

Revenue:

We also saw a lift of +68.26% in ad revenue from Q3 2017 to Q3 2018.

The data above indicates revenue lift is outpacing spend lift which means:

1) Ads are performing better in terms of efficiency, which is likely due to sophisticated targeting techniques and implementation.

2) Sellers are willing to spend more because they are seeing a strong return on their incremental investment in Sponsored Products.

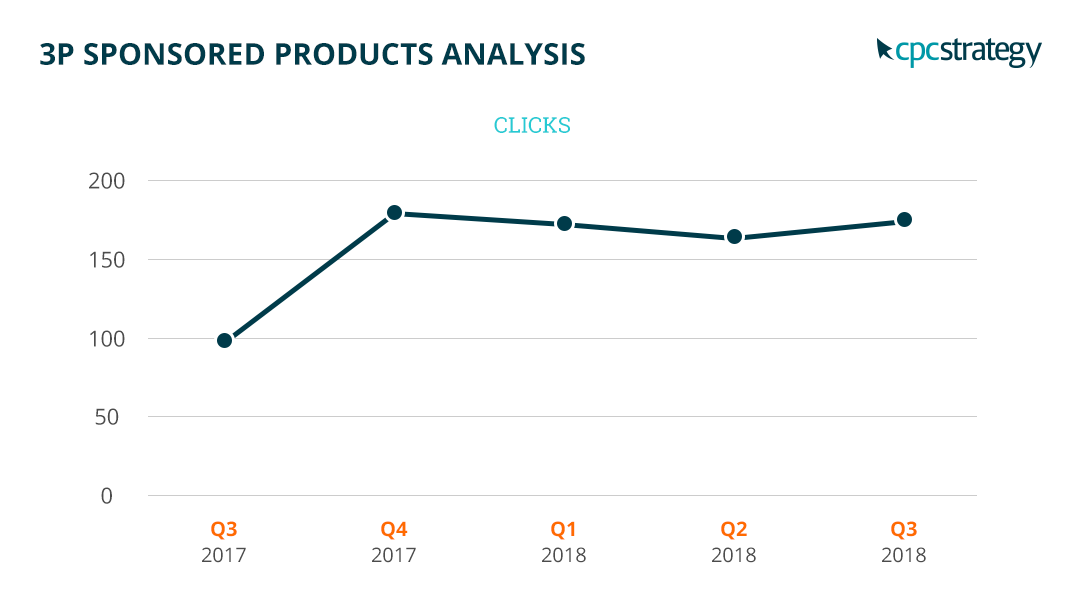

Clicks:

In Q3, we also saw a +68.29% increase in clicks. This indicates that the increase in spend is also driving a similar increase in clicks and traffic to seller detail page(s).

Note: Typically, when we significantly increase ad spend (coinciding with a lift in traffic) there is an expected decrease on return. Why? Because you are expanding your reach and targeting shoppers located much higher up the sales funnel, who typically have a lower purchase intent.

Note: We also conducted the same analysis for all 75 same-store US Amazon Vendors (within our CAPx AMS platform). You can view those results here.

The Main Takeaway:

Judging by our own study, (combined with the national data) – we can say with confidence that brands are spending more ad dollars on Amazon advertising than ever before.

The good news is – sellers are willing to spend more because they are also experiencing a strong return on their incremental investment in Sponsored Products.

But increasing ad spend is not the only tactic to succeed on the Marketplace.

Last year, Amazon tightened up their standards for sellers on the platform–and the marketplace is only going to get more competitive in 2018 and beyond.

The “cost to play” aka “how to get your products to the first page of the search results” will continue to increase as more Amazon sellers flood the Marketplace increasing demand in the bidding auction.

According to Pat Petriello, Head of Marketplace at CPC Strategy:

“We expect click volume and click-through rates to increase for Sponsored Product ads as they become less discernible from organic listings, meaning winning these auctions will be more important than ever.”

In response, sellers will have to rely on sophisticated paid marketing campaigns and strategies to outsmart their competitors.

“Because Amazon has levelled the playing field for brands of all sizes to compete for a share of the digital shelf, it is forcing brands to adopt a comprehensive & holistic Amazon strategy that can scale across various product lines to drive sales growth + profitability on the marketplace.”

– Nick Cotter, Manager, Demand Generation at CPC Strategy

In search of new ways to stay ahead of your competitors this holiday season?

Be sure to check out our holiday prep tips from our Amazon Expert panel.

You Might Be Interested In