How Buy Now, Pay Later Options Work for Retailers: Q&A with Klarna

With the ability to increase impulse buys and drive additional ecommerce sales, it’s no wonder Buy now, pay later (BNPL) is the biggest payment trend in the online retail world.

BNPL allows shoppers to make a purchase without providing cash at the time of purchase. One case study found that average order values increased by 33% solely due to the addition of a buy now, pay later option.

We spoke with Klarna, one of the most popular BNPL payment platforms on the market to learn more about what they offer, how BNPL options benefit consumers as well as brands, and what we can expect to see from BNPL platforms in the future.

Seamlessly. With Klarna, shoppers have an alternative way of paying for their purchases—giving them more time and flexibility—while retailers get paid upfront and in full. Plus, Klarna integrates with almost every e-commerce and payment platform, enabling retailers to start using Klarna in mere minutes.

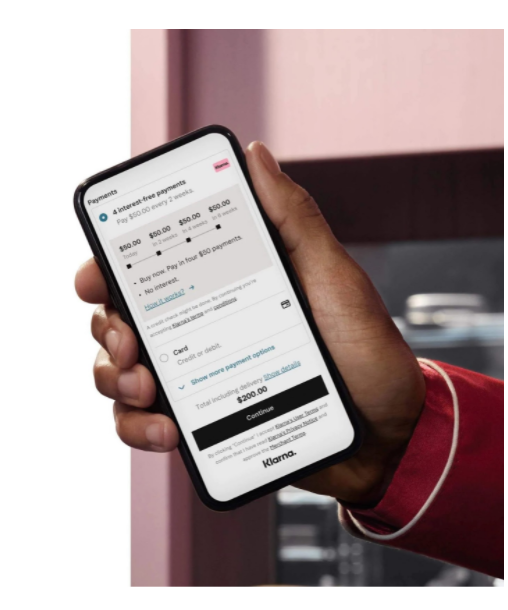

Klarna’s most popular service in the US is Pay in 4, where shoppers split their total purchase amount into 4 payments, without any interest, over 6 weeks. Our second most popular payment method in the US is Financing, where shoppers can choose to pay over 6-36 months, which may include interest depending on the plan they choose.

Our retail partners can offer Klarna online, in-store, and through their own mobile apps. Regardless of which product shoppers choose, retailers always receive full payment up-front. More flexibility for the shopper and more sales for the retailer—talk about win-win!

There are over 9,500 US retailers, with 250,000 globally, and Klarna is the partner of choice for 24 of the US top 100 retailers. Shoppers can see which stores are integrated with Klarna on our website.

With the Klarna app, shoppers can use Klarna at any retailer whether they offer Klarna on their site or not. When shoppers browse, wishlist, and buy directly through the app, we get insights into their preferences and future purchase intent. We utilize these insights to target, inspire and engage shoppers to make their next purchase with our Klarna retail partners.

Klarna’s availability can be customized to the retailer’s choosing based on what their ultimate goals are as a partner. This includes making certain products available at certain pricing thresholds or to certain shoppers. With over 1,400 engineers, Klarna can customize our products to fit the needs of the retailers we partner with.

Klarna is available on almost every platform retailers are using today. Adobe Commerce, BigCommerce, SAP, Salesforce, Shopify, and WooCommerce are a few of our partners. We also integrate with payment services providers like Stripe, Adyen, and Cybersource.

Klarna pricing varies depending on what country your customers are shopping from. Similar to a credit card or other forms of alternative payments, retailers only pay a single processing fee when a shopper uses Klarna, while consistently seeing higher AOVs, conversion rates, and new customers.

We make it incredibly simple to also add Klarna into retail locations. In fact, Klarna is now live with over 80,000 physical stores in the US.

Digital Cards allow shoppers to create single-use temporary credit cards through the Klarna app. Shoppers simply add the card to their Apple or Google wallets and tap to pay. In order to support this, no integration is required for the retailer; Klarna simply enables digital cards for any retailer who would like to go live in stores.

Klarna also supports integration directly with a retailer’s existing point-of-sale (POS) system and can create tokens available in the retailers’ own app, meaning retailers can add our payment methods into all their channels, wherever a shopper wants to pay.

There are many differentiators, both for retailers and for shoppers. For retailers, our brand, products, and ubiquity set us apart.

Klarna’s brand campaigns and partnerships, like our Superbowl ad and A$AP Rocky collab, see stunning shopper engagement. This grows our shopper network and ultimately drives more people to our retail partners.

Our payment methods help consumers at each stage of the shopping journey. From Klarna messaging in marketing channels, to multiple payment options, to a rich post-purchase experience, our products drive results before, during, and after checkout. If the shopper enjoys an exceptional experience, they’ll buy more, shop more often, and tell their friends. Klarna for Business’s services also go far beyond payments, with marketing solutions driving new customer acquisition, turning our 20 million shoppers into your loyal customers.

Finally, we’re everywhere. With our global presence, Klarna reaches the greatest audience in 20 markets across North America, Europe, and Australia. We also work with 24 of the top 100 internet retailers, more than any other flexible payment provider. AKA the big players choose us.

For shoppers:

With over 250,000 different retail partners across the globe, you’re likely to come across Klarna wherever you shop.

We’ve seen impressive adoption with verticals like fashion, home, beauty, footwear, electronics, outdoors, digital goods, and even subscriptions.

For retailers, Klarna removes all the risk as we immediately pay our partners in full, while we take on the risk of any potential fraud, chargebacks, and collecting the remaining balance from our shoppers.

With nearly 20 million shoppers in the US, and over 250,000 retailers globally, retailers usually find we have a solution and product to fit whatever their needs are.

If you have questions about Klarna, talk to someone on our team!

Klarna’s 90M global users are some of the most engaged, active shoppers around. On average, Klarna users shop more often (68%) than other shoppers, have a higher purchase frequency (36%), and their average order values (AOV) are 45% larger than non-Klarna users.

Most importantly, Klarna regularly helps drive new customers to our retailers. Klarna’s network in the US has nearly 20 million engaged shoppers; we work hand-in-hand with our retailers to identify the most relevant shoppers to promote their brand, both through Klarna and external channels, ensuring we’re a top customer acquisition tool. Some retailers have seen 40% of Klarna sales are new to their store.

rue21, implemented Klarna and saw:

In rue21’s words, “We saw a big lift in sales and AOV once we introduced Klarna as an option at checkout. Our younger audience, in particular, is really responding to it, which has helped us with both customer satisfaction and retention. We’re looking forward to growing our audience together with Klarna as a partner.”

Plus, Klarna’s unique post-purchase experience helped rue21 drive repeat purchases at a much higher rate than the competition. Klarna customers are more likely than non-Klarna customers to shop more than once per year. Read more on rue21 here.

We make money from the retailer through a transaction fee on Klarna orders, similar to credit card companies. No additional costs to consumers!

Klarna’s nearly 20 million users in the US are largely made up of Gen Z and Millennials, who prefer using debit cards over credit cards. In fact, half of those shoppers are no longer using credit cards today.

Statistics show during the pandemic there was a 40% reduction in credit card applications, a 50% drop in credit card spending, and $100 billion in credit card debt paid off during this time.

That said, in just the beginning months of 2021, usage of Klarna increased 215% compared to the previous year. Klarna’s flexible payment options are wildly popular with shoppers who look to use Klarna for all their transactions because of the easy and smooth experience.

Any threshold or spending limit for our partners can all be configured to be retailer-dependent, depending on our retailer’s preference.

So we can ensure a customer spends within their limits, every shopper has a different total spending limit based on their unique paying history that builds over time the more they use Klarna.

Our focus is on expanding Klarna’s services and offerings to create a smoother shopping experience for retail partners and shoppers around the country. We just acquired HERO, enabling shoppable content produced directly from physical retail stores for our 250,000 retail partners. Moving beyond the transaction to the whole end-to-end experience, we want to engage, inform, and empower consumers.

To learn more about Klarna, visit our website at https://www.klarna.com/us/business/.