Google Shopping Actions: 9 Ways to Optimize Performance in 2020

In September, Google’s not-widely-known Google Express marketplace website was replaced as Google Shopping.

Yes, it’s confusing because Google Shopping already exists. But when you dig more into it, it makes sense from a branding and a customer perspective.

Like many companies, Google has found success adding enhanced features to existing properties that are already popular versus trying to create a new property that demands a more robust marketing reach to educate and acquire new customers.

Google struggled with marketing their Google Express property because it was confusing to explain.

Was it supposed to be Google’s version of Amazon? Was it just for local deliveries? Or was it supposed to be the culmination of their “Buy Button” that they released in 2015?

It never got less confusing.

It’s understandable that instead of trying to continue promoting their marketplace website Google Express, Google said: “Why don’t we just add the best parts of Google Express into YouTube, Search, Images, and Assistant and call it the New Google Shopping experience?”

Consumers and merchants already like Google Shopping and we can build on the success we’ve already had with that property by enhancing its functionality.

In this guide, you will learn how Google’s New Shopping Actions works and nine ways you can improve the performance of your Shopping Actions program in 2020.

Instead of trying to create a new marketplace, the “New Google Shopping experience” is distributing marketplace functionality across existing Google properties through what they are calling “Actions units.”

These actions units make up the Google Shopping Actions program and let customers checkout directly from Google without leaving to go to a merchant website.

Retailers can also appreciate that Google handles all aspects of customer service, support, and returns.

This is a big win for Actions because merchants can feel safer testing it out–knowing that there won’t be more strain added to existing customer service teams.

Shopping Actions are organic units that will show up when Google gets a signal that a consumer has a high intent to purchase in the short term.

You can’t pay to get more impressions on Shopping Actions. Google chooses when to show these units in addition to or instead of showing ad units.

To date, there aren’t a lot of details surrounding how Google’s algorithm works here. Since Google only gets paid when a sale happens and Actions units can take away from clicks (where Google always gets paid), we expect them to continue testing things out.

Google commonly provides the example of Actions helping a user with:

This tells us that there is at least some part of the algorithm that centers the Actions program around retargeting.

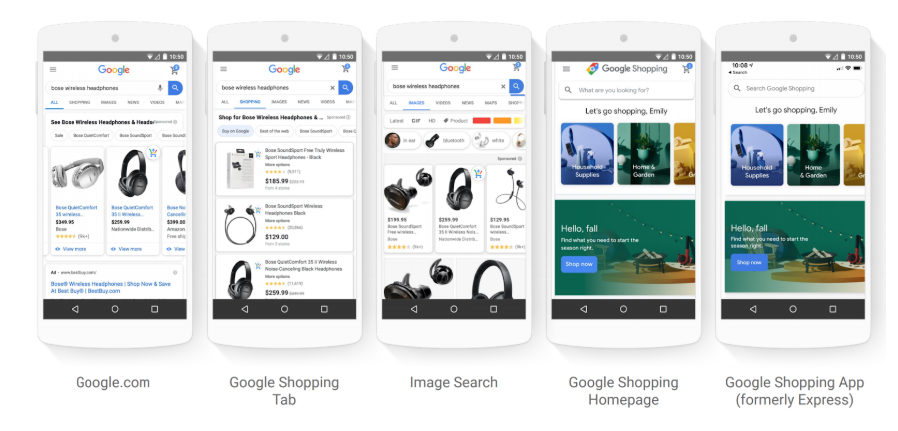

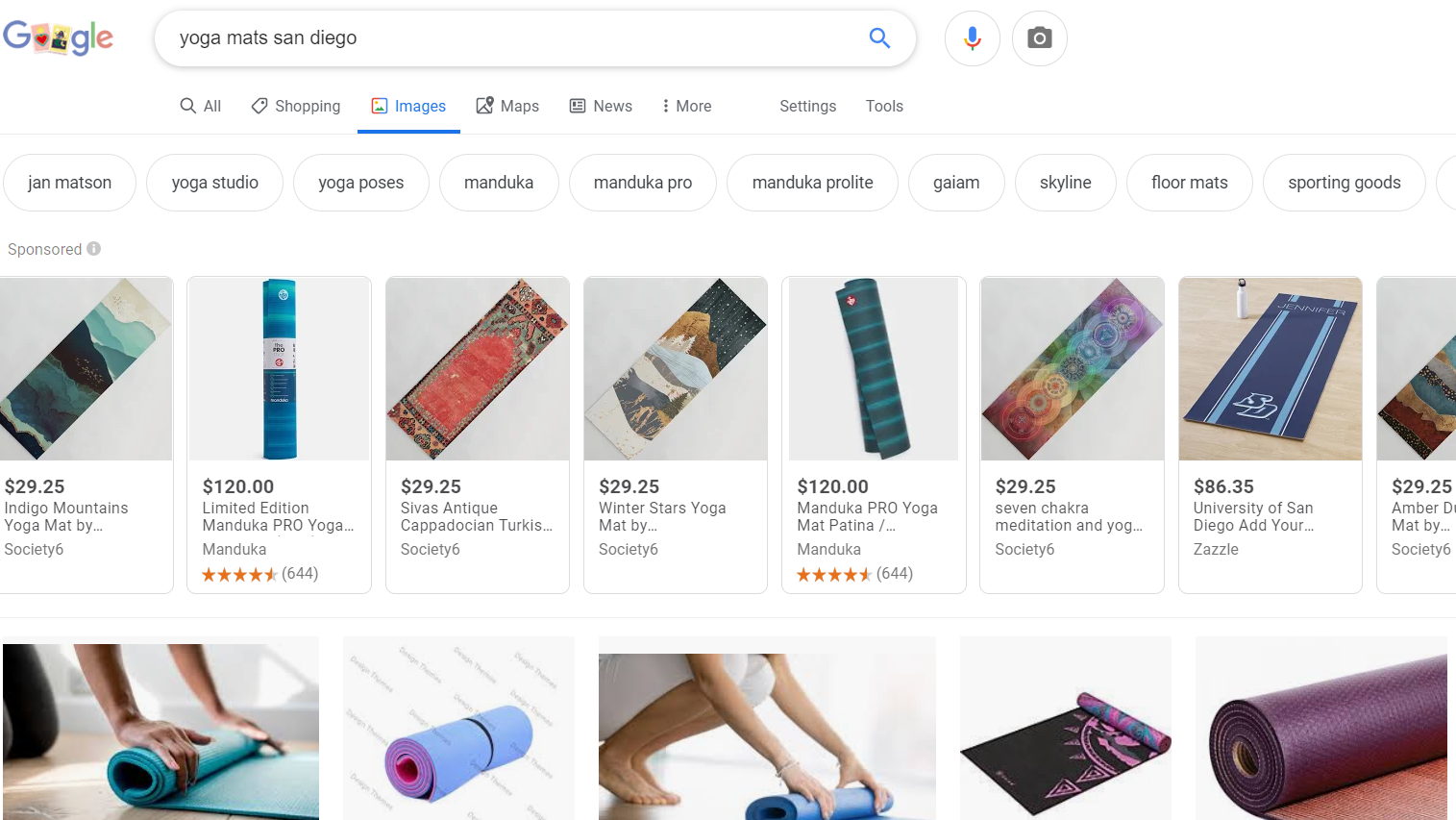

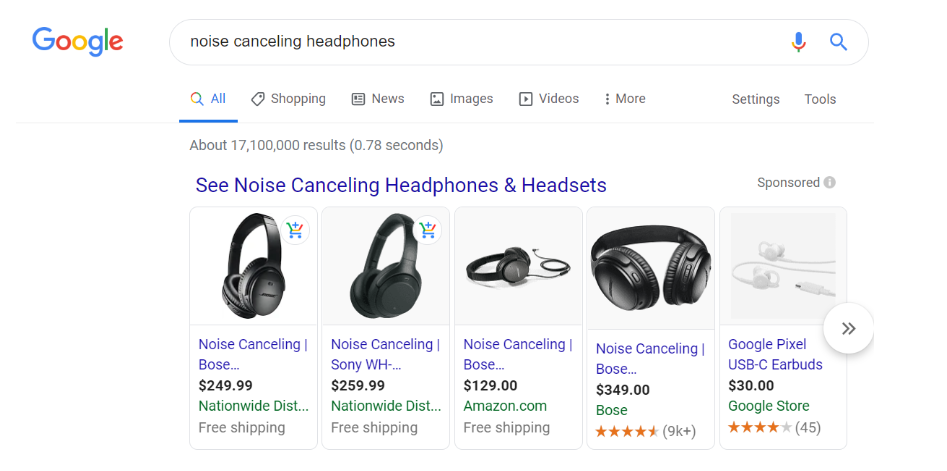

Actions units will be denoted by a blue cart icon across Google properties like the search engine results page, the new personalized Google Shopping website (https://shopping.google.com), Google Images, YouTube, and Google Discover feeds.

The most underrated aspect of the program is a new universal cart that will follow customers around these different Google properties.

Google built out new sections in its existing Google Merchant Center property to set up and manage the Actions program.

It’s also where you can view inventory data, tax/shipping settings and download invoices for commission payouts to Google.

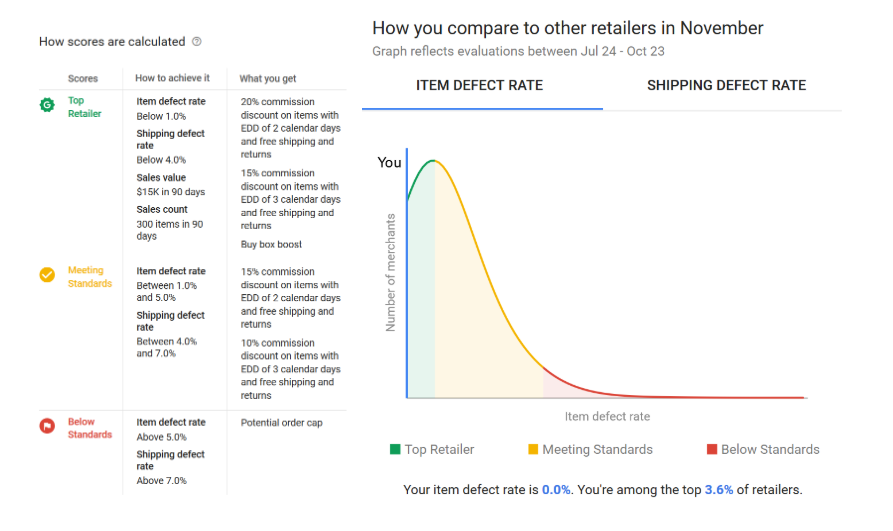

Retailers can also view their Retailer Standards rating in Merchant Center. This is a monthly benchmark/rating system for Google to reward or penalize participants in the program.

If you are selling items that are out of stock, seeing lots of order cancellations, or shipping items late, you can get a poor rating and Google might impose an order cap on your account.

Conversely, Google can grant a commission discount of 10-20% for orders that meet the criteria (shipped within 2-3 calendar days, includes free shipping/free returns).

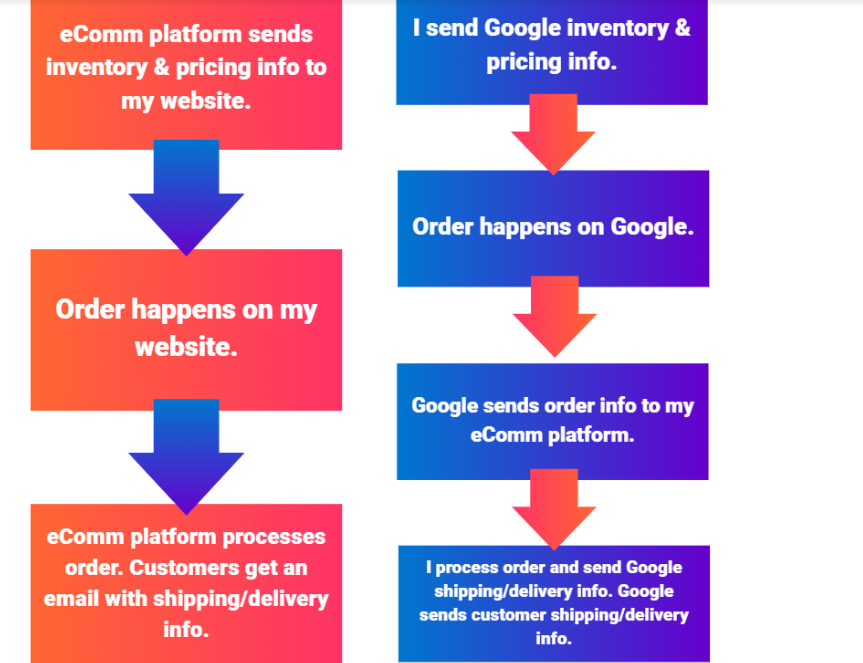

Most retailers have order management set up through their website. So when an order happens, there are a series of backend systems and workflows set up to get the order fulfilled and get the customer a confirmation email letting them know when the item(s) will be shipped.

Since the purchase for Google Shopping Actions happens on Google–not the retailer website–retailers need to set up a way to connect their current order management process to Google’s Orders API.

1. Fulfill orders manually through Google Merchant Center. This requires a lot of manual work to log in every day and go through each order to update the customer with a tracking number for their order.

2. Work with a third party order management platform that will serve as a go-between the Google API and the retailer/brand’s eCommerce/order management platform.

3. Have an internal dev team build out an API connection between the Google Orders API and a brand’s eCommerce platform/current order management solution.

Great order management is a complex, fast-moving workflow that will determine success or failure in any marketplace.

That’s why Tinuiti has developed a close relationship with our technology partner Feedonomics as our go-to recommendation for initiatives like this.

Having an internal dev team devote resources to this new marketplace functionality without any assurance that there will be a lot of volume could be a risky, expensive and time-consuming project.

It is an easier path to invest in a technology provider that has worked out the kinks and built a way to translate and deliver order information and shipping/tracking information back and forth.

In many ways, Google’s marketplace is very different from Amazon’s. Google’s ranking system ignores sales velocity and sales volume.

The goal is to get more people to click on links with more relevant content. Merchants are encouraged to make better landing pages to get organic traffic and bid higher to get more ad clicks.

Amazon rarely sends traffic away from Amazon to merchant websites. Amazon’s Ad Rank prioritizes sales velocity and sales volume in addition to clickthrough rate/content relevance for both organic and ad units. Merchants are encouraged to above all make more sales.

However, since Amazon is the largest US eCommerce marketplace, it’s the bellwether to compare against any new marketplace program.

While Actions is still new (and lower volume), both Google and Amazon now have an advertising component and a cost-per-action component for merchants to explore and figure out.

Recommendation: If your teams that manage Google and Amazon are siloed, discuss where you think it might make sense to work more closely together in 2020. You might find operational projects and time-saving opportunities that spring from this discussion.

Customers may find lower prices for some items on Google Shopping Actions. At least partially, this might be due to the fact that retailers often set rules to give Amazon higher prices than the prices offered on their own website.

For a long time, this was against Amazon’s policy. Retailers weren’t required to let Amazon crawl the pricing info on their websites though. So it was a difficult policy for Amazon to enforce. If they catch you now, they won’t suspend your products but your listing won’t be listed in the Buy Box as a “featured item.”

Google Merchant Center (and thus Shopping Actions) requires retailers to let Google crawl their website to check on pricing and availability info. So a pricing policy is much easier for Google to enforce. If you try to give Google a higher price, the crawler will see that and disapprove the product from showing up in Ads or Actions.

There is a big marketplace of repricing tools and software for Amazon. Clients can set rules to manipulate a product’s price to set the lowest still-profitable price that will win them the “Buy Box”–the holy grail on Amazon where at least 80% of sales happen. It’s a controversial but useful lever for some merchants.

Recommendation: As a merchant, you can’t just copy over the repricing rules you use for Amazon to give Google higher prices than your website. Google will disapprove your products.

If you do want to test repricing to see if it will get you more volume through Google’s marketplace, there’s not an easy way to do this without having to change the price on your website for all customers.

If you really want a workaround, you could make special product pages with different prices than the normal product pages on your website and then submit these pages in your Google product feed for Google to crawl. This would promote special pricing for both Google Shopping Ads and Google Shopping Actions.

While Google Actions might offer better pricing sometimes vs. Amazon, it’s difficult to imagine Google offering quicker shipping.

Amazon Prime’s 0-2 day shipping is popular for a reason. Through the years, Amazon has amassed a gigantic advantage as one of the best logistics companies to ever exist. Google will have a tough time here because they are not asking merchants to ship products to a Google warehouse for a Google version of Prime. They are not subsidizing free shipping either or charging for a Prime membership.

With the recent Amazon push for one day or same-day shipping even for small orders, many retailers like Target, Best Buy, and Walmart have upped their operational capacity to offer similarly competitive delivery times and pickup options.

If you are going to expend the time and effort to test out the Shopping Actions program, you need to provide consistent and competitive shipping lead times across your website and the Shopping Actions marketplace.

Rand Fishkin, one of the leading SEO industry experts and the co-founder of SEO empire Moz.com, wrote an article in August titled “Less than Half of Google Searches Now Result in a Click.”

The article highlights how Google is becoming more of a “walled-garden” and sending less traffic away from Google to other websites.

In many ways, this is one of the big contradictions hovering around big tech in 2019. The big companies want brands and businesses to buy into the value these big companies can offer them as a publisher.

But these big companies are optimized to keep users on their own platforms as much as possible–at the expense of sending away traffic to a business’s website where that business could then find ways to develop and engage users outside of Google, Facebook, etc.

Instead of brands trying to build content for their own website, they are more frequently building content that will be specific for each platform (ie short videos for Instagram).

Google’s gambit with Shopping Actions is that it could be good for businesses to sacrifice some of their website traffic to Google.

Here’s what I think their two main selling points are:

Neither are crazy assumptions. eCommerce websites are notoriously slow. Especially on mobile, cart abandonment rates and bounce rates can be difficult challenges for brands to overcome.

One of Amazon’s foundational pillars is conversion rate optimization. As a consumer, it’s amazingly easy to go through the purchase funnel. Amazon has been able to get better and better at this is because they have a gigantic amount of traffic to A/B test out ways to improve conversion rates.

While Google Actions has a smaller volume now, Google still has A LOT of data to work with so they can test ways to improve conversion rate too.

Recommendation: The hard part about this is that Google doesn’t give merchants click data for Shopping Actions. So you can’t divide conversions by clicks and get your conversion rate.

As a merchant, currently, you have to take Google’s word that Actions will convert at a higher rate than Shopping Ads or general traffic that lands on your website.

If you know you have a poor conversion rate on mobile for instance, you might still want to test this program out with the assumption that Google will probably get you a higher CVR than your mobile eCommerce site.

Google has been very clear that it is promoting Actions as a retailer-friendly program with early adopters like Target, Best Buy and Fry’s.

Unlike some other marketplaces, brands can retain customer data post-purchase if a customer opts in to give their information. Google has partnered with some retailers like ULTA Beauty to help get their loyalty program integrated with Google Shopping Actions as well.

This is a big win for retailers. It’s one thing to lose out on getting website traffic. But it’s a much larger thing to lose out on getting any customer data at all.

For years, merchants on Amazon have been critical of Amazon’s decision to own customer data. For every purchase that happens on Amazon, there is no option to opt-in for promotional materials from the retailer or manufacturer. Amazon sends through customer names and addresses but merchants are prohibited from adding customers to CRM lists or email marketing audiences.

Recommendation: While it’s good that Google is including an opt-in during checkout, merchants should still check to see how often customers are opting in. If it’s a low rate, this could mean that you have fewer customers in a retargeting pool for display, social, email marketing, etc.

It could be interesting to send surveys to customers post-purchase to find out why they bought your product–Was it the price point? Did you have a lot of good reviews? Did they already know about your brand?

Getting answers to these questions can help you pinpoint your strengths in the Actions marketplace.

My team exclusively works on Shopping ads–most of which appear on Google. Many of us have been working with Shopping ads for a long time and can remember when the ads were free (RIP Froogle).

We are the third-highest spender in the industry and we have been a leader in the space as one of the only agencies with a dedicated team of Shopping & Feed experts. Our account managers manage both the technical aspects of product feed management and the strategic aspects of campaign planning, reporting, and execution.

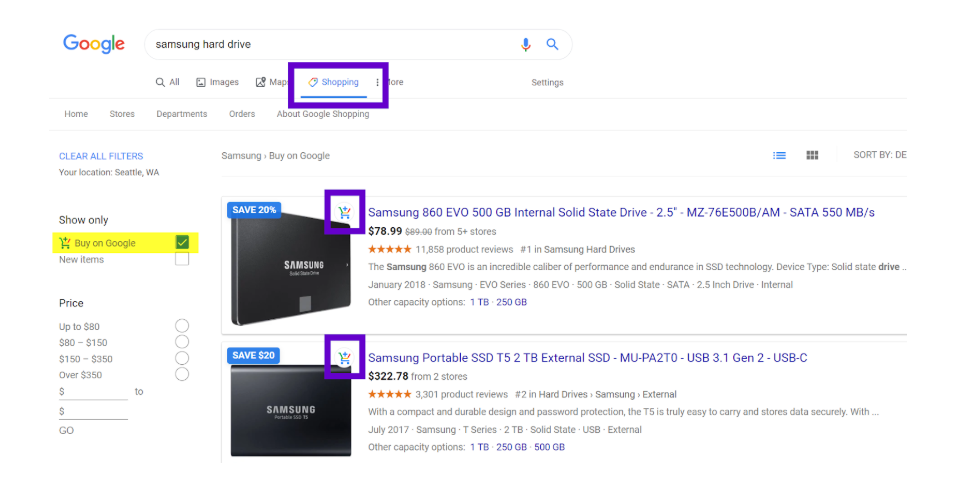

I say all this because one of the harder truths to tell about Shopping Actions is that it overlaps with Shopping ads in messy ways.

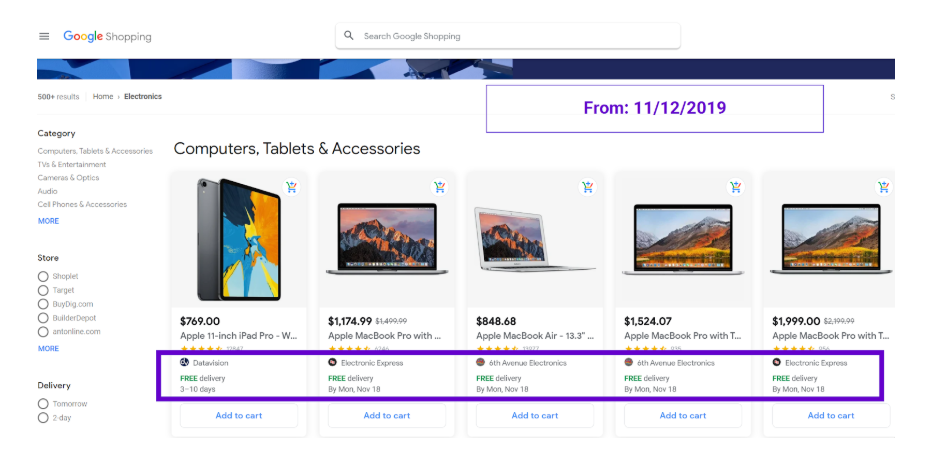

Previously, Google separated “Buy on Google” Shopping Actions units into their own auction. Now, as shown above, Google is experimenting with putting Shopping Actions/Buy on Google units in in the same space as paid Shopping ads.

This makes tracking holistic performance for Google Shopping extremely challenging. A common way to know whether you can get more volume via Google Shopping Ads is to look at impression share.

If Google is placing organic Actions units into the same space as a paid Shopping Ads auction though, how does that change the way we are supposed to view impression share and clickthrough rate?

Google doesn’t give impression or click data for the organic Shopping Actions units. So even if our clients are running the program, we can’t accurately add both programs together to get a holistic view of performance.

You can’t tell whether Shopping Actions units are cannibalizing impressions or clicks that would have went to your Shopping Ads.

Also, since orders and revenue for Actions units only show up in Google Merchant Center–not in Google Ads or Google Analytics–you have to stitch together separate reports just to look at revenue trends.

If you depend on Google Analytics (or you have paid for the premium version Google Analytics 360) it’s difficult to understand why Google hasn’t built out the infrastructure to host reporting for their Actions program there.

Recommendation: Having to pull reports from separate places with incomplete data can make it very difficult to tell where you are trending up or down for certain products or product categories.

If you have a large Google Shopping ads presence and want to join the Shopping Actions program, you need to acknowledge that there will be some data loss for reporting.

Looking at frontend data like impressions, clicks, and cost for year-over-year performance might be difficult and you will have to make some assumptions (or bug Google for their secret internal reports) around why performance is trending up or down.

You can calculate your ROI for Shopping Actions.

Even though the program doesn’t have ad spend, you can use the commission rate for a product category to calculate your cost.

You can also add in additional operational costs like paying a technology vendor for order management or expending more people hours internally to maintain the program.

For merchants that sell high price point products, it could be less profitable to give 10-15% of each sale to Google as a commission–even if Google does have some stipulations about taking a lower commission rate for orders over a certain dollar threshold.

For merchants that sell lower price point items, it could potentially be a more profitable avenue for sales.

| Cost | Revenue | ROI |

| $20,000 (monthly ad spend) | $60,000 | 3 |

| $7,200 (12% commission on sales) + $3,000 (monthly technology costs) | $60,000 | 5.9 |

Recommendation: The big caveat here is that, with Shopping ads, you have a lot of levers to increase traffic. You can’t do a whole lot to get more volume via Shopping Actions.

For small retailers or brands that don’t have huge marketing budgets, the targeting capabilities of Google Shopping ads give them a chance to get visibility. They may not be able to compete with Amazon or Target or Walmart on all searches for “women’s jackets” but they can target searches for “women’s jackets” within the radius of their stores for people who have previously been to their website.

That said, for smaller retailers and brands that don’t have huge marketing budgets, it can also be very appealing to join an organic program where they only get charged when a sale happens. At the very least, it could be interesting to test out and see what happens.

The coexistence of Google Shopping Ads and Google Shopping Actions units will be very interesting to watch over the coming holiday and year ahead.

Will Google subsidize shipping? Will Google add a “sponsored paid listing” option for Actions so brands will have more levers to win the Google “buy box” or generally increase their volume? Will more brands opt into the marketplace?

At the end of the day, if brands can still build awareness and engagement through more upper-funnel formats, will they care that they are sending some of their traffic to checkout on Google (with what is likely to be a better CVR than their website)?

Ultimately merchants need to weigh the pros and cons for Actions and decide if it’s worth being an early adopter.

If you do decide that you want to participate, it’s crucial to invest in a good partner that you can trust. Google, Amazon, and Facebook are blurring the lines between paid and organic, publisher and platform.

You need a partner that has the deep knowledge and experience required to see through some of these changes and help you stay one step ahead of your competitors.

Want to learn more?

How Tinuiti & Feedonomics Boosted Beauty Brand Revenue By 44% and ROAS By 69%

New Google Shopping Actions Program To Replace Purchases on Google

The Complete Google Shopping Ads Guide For 2019

Advertising Insights and Learnings from the Cyber Five Across Google, Facebook, and Amazon