What Happened on Amazon Prime Day 2020? [The Ultimate Recap for Brands and Advertisers]

The 48-hour event, exclusively for Amazon Prime members, is usually held in July but, with the ongoing coronavirus pandemic, this year Prime Day was pushed to October 13th and 14th.

Prime Day is Amazon’s biggest event of the year, with hundreds of deals on products across categories including home goods, electronics, toys, and personal care.

In 2015, Amazon launched Prime Day to celebrate their 20th anniversary. The first Amazon Prime Day was a one-day retail holiday for Prime members. Since then, Prime Day has overtaken Black Friday and Cyber Monday as the biggest annual sales event on Amazon, with better deals on more products resulting in increased sales (and Prime memberships).

This year, due to an increase in competition from Walmart, Target, and Best Buy, it was absolutely vital for retail brands to have a sophisticated Prime Day advertising strategy heading into the self-made holiday. And for those who did – the payout was big.

According to reports, small and midsize businesses (that sell on the Amazon Marketplace) made more than $3.5 billion during Prime Day, which is a 60% increase from last year’s sales.

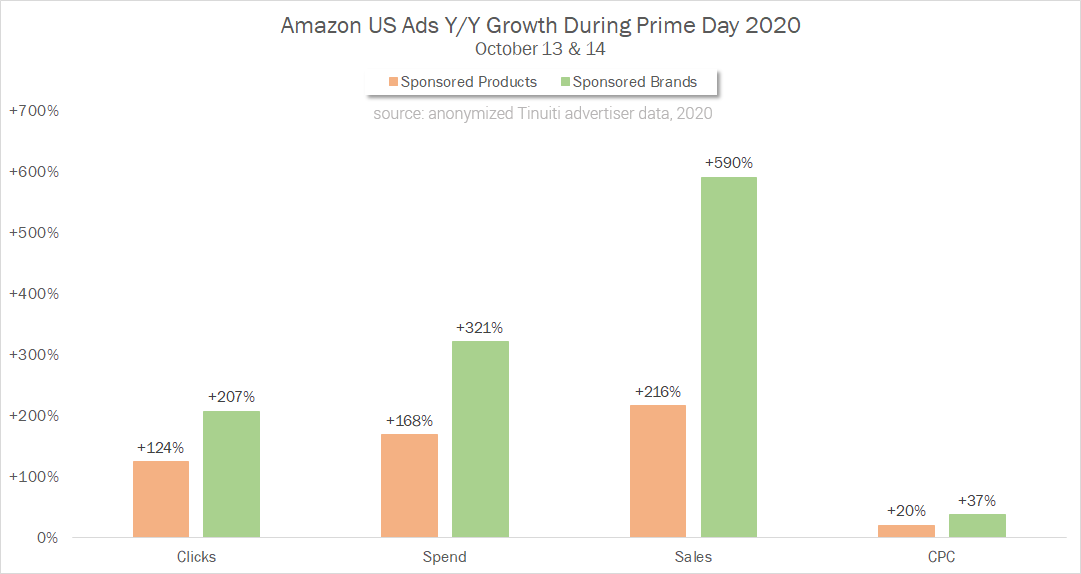

According to Tinuiti’s client data (see below), sales attributed to Sponsored Brands increased nearly 600% year over year during Prime Day 2020, and Sponsored Brands video ads played a key role, driving nearly 20% of all Sponsored Brands Prime Day sales for advertisers deploying video.

“Cost per click (CPC) rose significantly year over year across both Sponsored Products and Sponsored Brands during Prime Day, and the Q4 holiday shopping season promises to be competitive for Amazon advertisers looking to make the most of the last quarter of the year,” Andy Taylor, Head of Research at Tinuiti said.

Overall, sales attributed to ads soared year over year across Google and Facebook in addition to Amazon during Amazon’s Prime Day event, and sales growth outpaced spend growth across all three platforms (Amazon, Google, and Facebook) as consumers found strong deals and converted quickly.

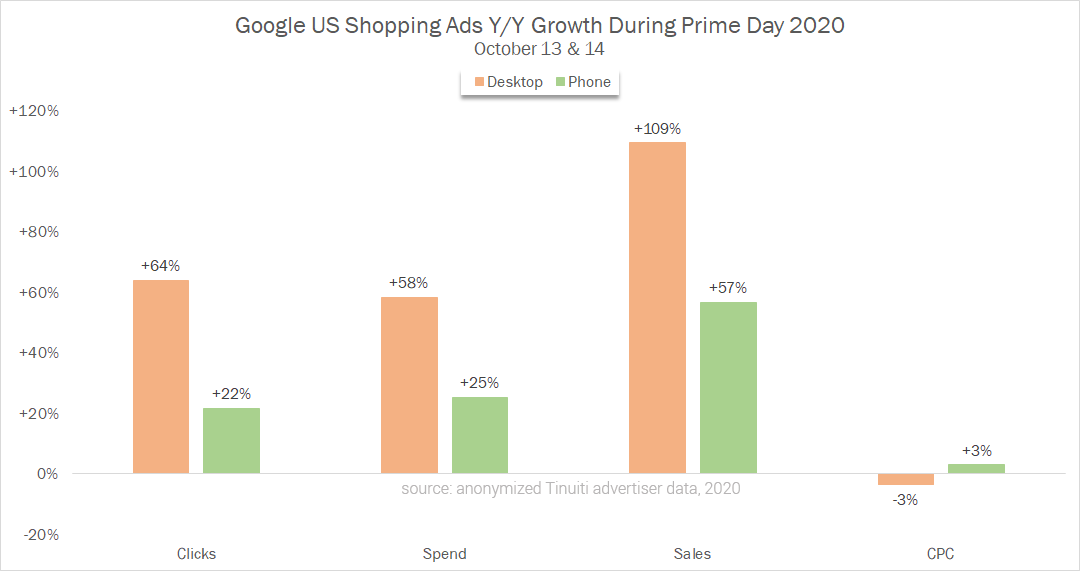

Sales attributed to Google Shopping ads more than doubled year-over-year on desktop and increased 57% on phones during Prime Day, as retailers offered concurrent discounts and online shoppers spilled over onto platforms other than Amazon on Prime Day to search for deals.

According to Tinuiti’s data, much of the increase in demand came in the form of desktop searches, with clicks on these devices rising 64% compared to 22% growth on phones. Average desktop cost per click went from an 8% year-over-year decline in Q3 to a 3% decline during Prime Day, while on phones CPC went from declining 6% in Q3 to increasing 3% year-over-year during Prime Day.

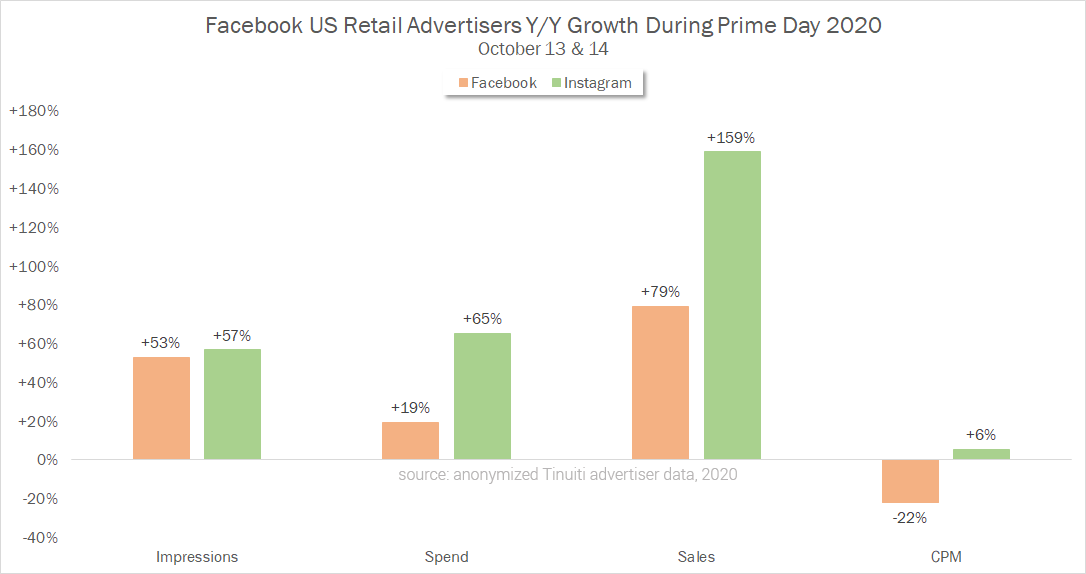

Retailers also saw a surge in sales attributed to Facebook ads, with a 79% increase on Facebook proper and 159% increase on Instagram(yeah, you read that correctly – a 159% increase on Instagram!)

“It’s clear that Prime Day is an event that even brands that don’t sell on Amazon should be preparing for, and a strong cross-channel advertising strategy can help make the most of the surge in demand. Heading into Q4, cross-channel pricing trends during Prime Day indicate a competitive ad landscape in which many advertisers will be vying to get in front of Q4 shoppers,” Taylor said.

Successful Prime Day tactics from the experts

There’s a fine balance between keeping enough inventory in stock to meet demand without overstocking. The equation gets even more complex when you factor in advertising. Stockouts during Prime Day are an Amazon seller’s worst nightmare – which is why we encouraged our clients to focus on inventory levels prior to Prime Day.

Pro-tip: You can generally expect Prime Day numbers to fall in line with Black Friday and Cyber Monday, so if you have data from those sales events, use it to determine your inventory strategy for the remainder of Q4. Keep in mind that the ecommerce landscape and consumer preferences look different this year — and that Prime Day is no longer tied to back-to-school but rather a ramp-up period for holiday sales.

According to our experts, in addition to product detail page optimizations, every brand should evaluate its overall operating processes; ensuring a sufficient amount of available inventory to the projected demand, clean up of warehouse inefficiencies, and actively manage your catalog listings.

Know that there’s a balance between keeping enough inventory in stock to meet demand and overstocking, especially with Amazon running low on warehouse space – we saw many brands defer to Amazon’s Direct Fulfillment program for Prime Day 2020 and leading into Q4.

Our data shows that the consideration period for shoppers in the Health and Personal Care category is 6 to 10 days on average. Based on this information, we know shoppers started researching products a week (or more) in advance, that they later purchased on Prime Day.

We typically recommend brands increase their budgets and bids during the week leading up to Prime Day to ensure they are building consideration for products as consumers conduct their research and save items to cart.

We also saw success with brands who dedicated a Prime Day landing page in their Store to feature Prime Day deals and discounts. By creating a subcategory page on their “Store” page, many brands were able to point users to a specific landing page makes it easier for them to convert into customers. Some brands were also able to can use their subcategory page as a landing page for ads off Amazon, like Google or Facebook (supporting the cross-channel selling strategy we mentioned earlier).

With the rise of new ad video formats, we also encouraged brands and advertisers to place a heavier emphasis on Sponsored Brands and Sponsored Brands and Video campaigns (as these have been shown to help differentiate brands during these key shopping events, like Prime Day).

“I specifically recommended building out video in Sponsored Brands. We have found that, on average, we are seeing quadruple the click-through rate (CTR) for our clients versus the original Sponsored Brands ads. It’s a great way to stand out while taking advantage of the opportunity to showcase how to use a product and send traffic back to a storefront to tie everything together.”

– Meghan Andrade, Director of Business Development, Amazon & Marketplaces at Tinuiti

You can learn more about video advertising strategies on Amazon here.

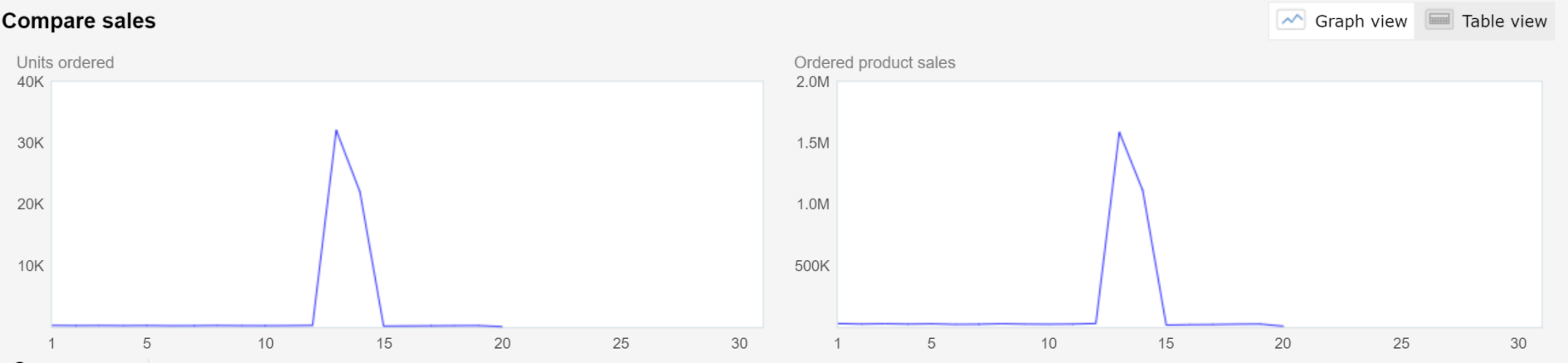

One client, a household food storage brand, sold more than 10x sales the second day of Prime Day (compared to their average daily sales). According to our experts, much of the success was due to Lightning Deals coupled with coupons for additional SKUs in the catalog.

The food storage brand was also featured on Amazon’s Instagram (on the first day of Prime Day) and featured on Amazon Live (highlighted for being a sustainable and female-owned company).

Pro-tip: Amazon Live is Amazon’s online, interactive version of QVC or HSN. Hosts demonstrate and discuss Amazon products, from grocery items to consumer electronics. To create a livestream on Amazon Live, you need to download the Amazon Live Creator mobile app. Once you download the app, you can log in with the email address tied to your Amazon Seller Central account. You can learn more about Amazon Live here.

“Outside of just typical branded/non-branded efforts, we expanded our category to draw like-minded customers in the green, ecofriendly, sustainability mindset through Amazon Search as well as DSP. As a brand in an increasingly competitive space, they were incredibly excited to see such a strong day coming into Q4 (where we see a majority of our yearly sales) and more than double what we did for Prime Day last year.”

– Zak Semitka, Specialist, Marketplace Search at Tinuiti

Another brand (selling in the Health and Personal Care category) surpassed goals by 12x by combining deep discounts with tactics across Search and Amazon Display.

In addition to promoting their top-selling product(s), we also pushed a massive Amazon DSP blast leading up to the event and increased non branded spend aggressively.

Pro-tip: Using Search and Display together to form your Prime Day tactics allows you to not only capture the demand of those who are actively searching on Amazon but also to generate demand by layering in mid and upper-funnel strategies such as competitor conquesting and In-Market or Lifestyle audience targeting on top of Amazon Search ad units.

“As we approach the holidays, retargeting through DSP or Sponsored Display is a great opportunity to capitalize on the growth of your audience (from Prime Day), while simultaneously building velocity heading into Holiday to maximize organic rank & sales volume in Q4.”

– Jeff Coleman, Group VP, Marketplace Channels at Tinuiti

There are still a number of ways to put your own Prime Day data to good use in Q4. Here’s how we recommend using your Prime Day data to prep for Black Friday, Cyber Monday and overall holiday sales (just around the corner):

Analyze data: The first thing you want to do is analyze what worked and what did not. Take a look at your data to identify strong and weak performing items including products, campaigns, ad groups, specific keywords, and bids. That way you can see what performed efficiently and use this data moving forward to make optimizations in Q4.

Review returns: It’s possible you experienced a successful Prime Day but now you’re noticing an influx of returns with negative feedback flooding in. Although nobody enjoys reading through painful feedback, this is another learning lesson: Optimize your product copy/images and take a closer look to determine where content is not clear.

Inventory prep: Post-Prime Day is also a good time to figure out how effective your inventory launch process is and if it needs refinement or sophistication. For example, did you overstock, and now you’re facing those unwanted long-term FBA storage fees? Or maybe you ran out of inventory too quickly? Either way, these are signals that you need to advance your inventory planning strategy prior to the holiday shopping season.

Keep in mind, now is not the time to take your foot off the gas as we head into the holiday shopping season. Following Prime Day, many major retailers including Walmart and Best Buy are rolling out Black Friday-like deals (well ahead of the traditional holiday shopping season).

According to reports, here’s a look at some of the deals already out there:

Tinuiti’s Holiday Shopping Trends Report shows that despite the economic hardships and uncertainties surrounding the pandemic, the overwhelming majority (81.3%) of consumers said that they plan to spend about the same or more on holiday gifts compared to 2019—the highest level in the past three years.

“Over the last year, the increase in spending can be heavily attributed to the growth of Super Spenders or consumers with a budget of over $500 for holiday shopping,” said Dalton Dorné, chief marketing officer, Tinuiti said in a recent interview.

“More than 30 percent of the respondents fall into this segment which is up by 15.3 percent from 2019. With an October Prime Day also in the mix, targeting this group early and often in Q4 can be the key to unlocking growth and ending on a high note this year.”

To learn more, be sure to check out Tinuiti’s 2020 Holiday Shopper Study as businesses prepare for a jam-packed Q4.