Amazon Sponsored Products Ads: A Seller’s Guide [2023]

The Skinny: Amazon Sponsored Products are pay-per-click ads that promote individual listings within Amazon’s search results and product pages to drive discoverability and incremental sales. By utilizing a mix of automatic targeting for keyword harvesting and granular manual targeting for bid control, sellers can effectively scale new products and protect their brand space. Successful optimization involves segmenting campaigns at the SKU level, utilizing negative keywords to reduce waste, and managing bids against specific ACoS goals.

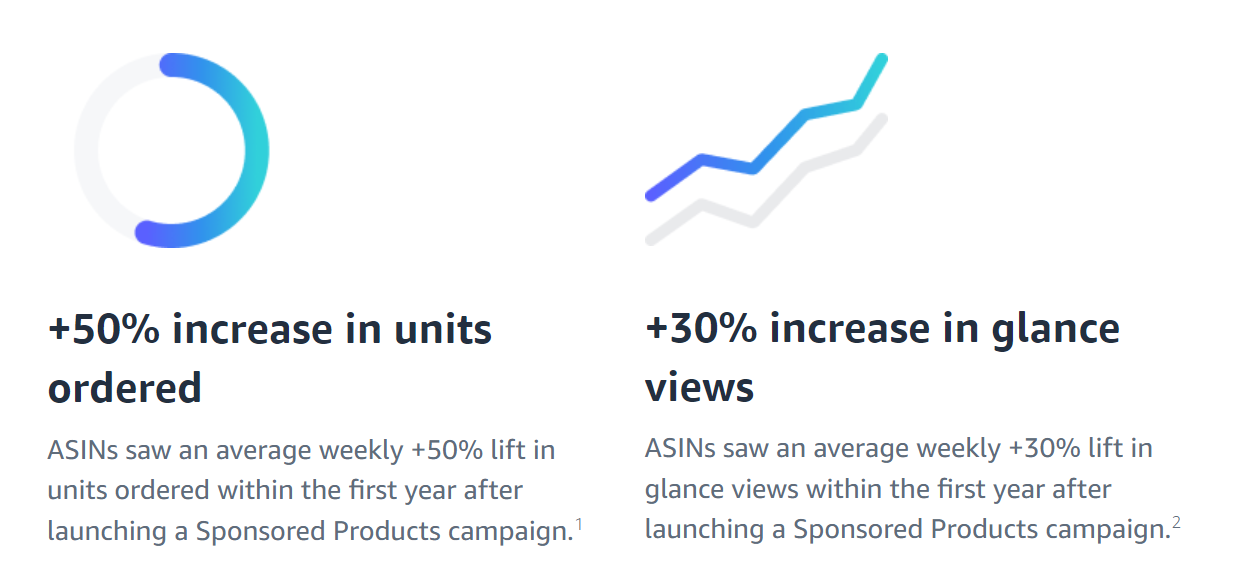

For brands selling and growing on Amazon’s marketplace, Amazon Sponsored Products ads are—and will continue to be—one of the most powerful tools for driving discoverability and incremental sales for any catalog.

The “cost to play” on Amazon’s marketplace has increased as more Amazon sellers flood the Marketplace increasing demand in the bidding auction. In response, sellers have to rely on sophisticated paid marketing campaigns and strategies to outsmart their competitors.

Below, you’ll get a deep dive into the Amazon Sponsored Products marketing techniques every seller should be leveraging, including campaign structure, data segmentation, keyword harvesting, and refined product targeting to maximize your paid advertising conversion rate.

Amazon Sponsored Products are pay-per-click ads based on keywords (and product targeting) that drive traffic to a desired product detail page within the Amazon platform.

These search ads are Amazon’s flagship ad format and are a key investment for brands across all categories for driving awareness and conversions on Amazon’s marketplace.

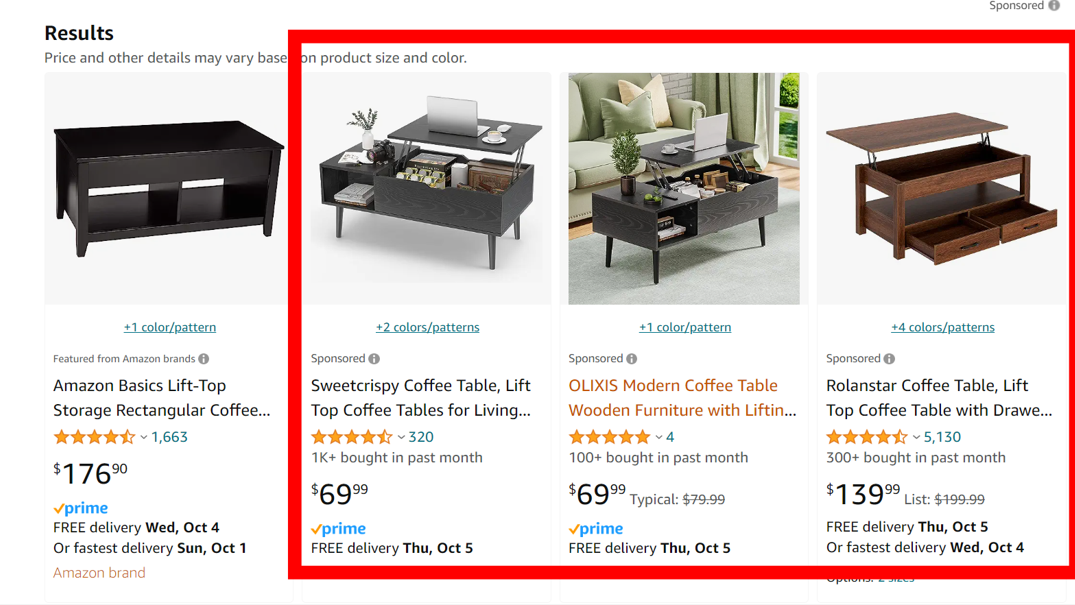

Amazon Sponsored Products ads appear in a variety of locations. They can appear at the top and bottom of the search results pages, within organic results, and more. Let’s take a look at each:

Search Results Page: Sponsored Products can appear prominently on the search results page when a user enters a relevant keyword or phrase in the Amazon search bar. They appear at the top of, and throughout the search results, and are marked as “Sponsored.” These ads are delivered across desktop and mobile devices, including within the Amazon mobile app. Amazon now also buckets Sponsored Product ads into groups like “highly rated” or “more results” seemingly as a way to break up the SERP and draw attention to sponsored listings in a user-friendly manner.

Product Detail Pages: Sponsored Products can also appear on the product detail pages of other related products. For example, if you’re looking at the detail page of one product, you may see Sponsored Product listings under a section like “Customers who bought this also bought” or “Sponsored Products related to this item.” These ads are also delivered across desktop and mobile devices, including within the Amazon mobile app.

Sponsored Products ads are important for building catalog awareness, driving conversions, as well as protecting and expanding your brand space.

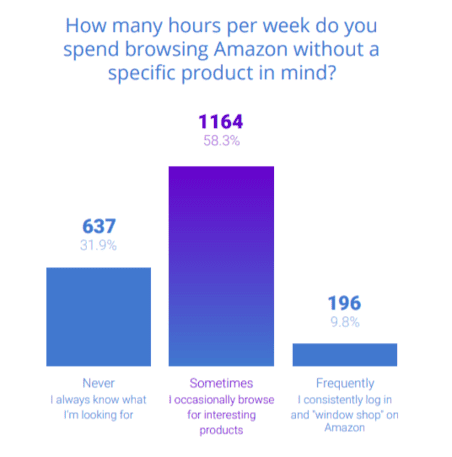

A staggering 68% of Amazon Shoppers “Window Shop” on Amazon, according to our Amazon Consumer Study and the number of consumers using Amazon as a way to discover new brands is on the rise.

In 2019, Amazon introduced advanced tools to help advertisers engage with new customers using Sponsored Product Ads product targeting. With product targeting, it’s easier to reach shoppers as they browse detail pages and filter search results for specific products similar to yours.

Sponsored Products impact your brand’s overall Amazon marketplace presence by:

As we briefly covered, Amazon Sponsored Products is a pay-per-click (PPC) advertising program that allows sellers and vendors to promote their products within Amazon’s marketplace. These ads work by allowing advertisers to bid on specific keywords or product placements to boost the visibility of their products to potential customers.

During this process, advertisers choose keywords or products to target, set bids, and create campaigns. Ads are displayed when relevant searches occur, and advertisers pay when a shopper clicks on their ad. Ad performance can be monitored, and adjustments can be made to optimize campaign performance.

There are two ways to build & manage your campaigns within Sponsored Products:

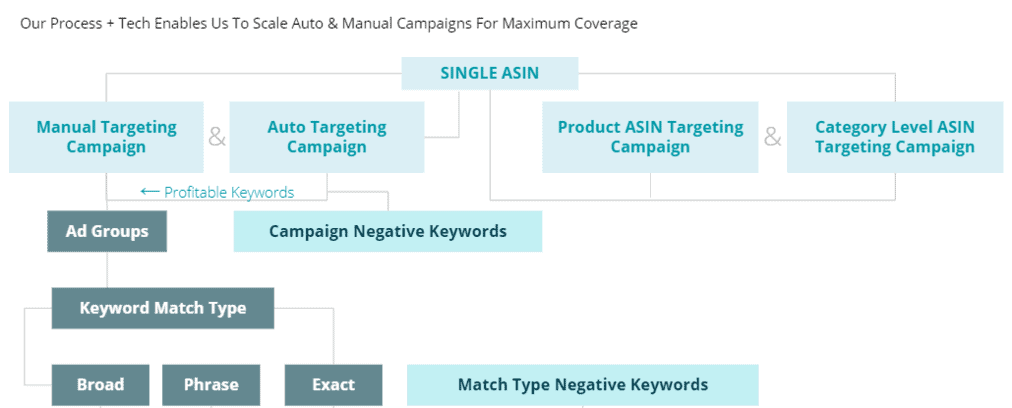

We believe a great Amazon Sponsored Products strategy involves both Manual and Automatic Targeting. Let’s dive into each a bit deeper…

Automatic Targeting allows you to skip the process of selecting keywords. However, it also removes the higher level of control associated with Manual Targeting. This is a more hands-off approach where Amazon’s algorithms automatically determine which keywords and products to target for your ads.

Advertisers provide a list of relevant products or categories, and Amazon’s system automatically identifies and targets keywords and search queries that it deems relevant to those products. The bids for keywords in Automatic Targeting are set by Amazon’s algorithms based on your daily budget and campaign goals. It’s a good option for advertisers who may not have extensive knowledge of keyword research or who want to quickly launch campaigns without manual keyword selection and it also helps source ASINs to target (from a competitive standpoint).

Manual Targeting allows you to explicitly identify the keywords and products for searches your ads are surfacing for. This targeting option provides more control over ad visibility and keyword relevance but requires ongoing keyword optimization and management.

When using manual targeting, you can choose to target broad, phrase, or exact match types for selected keywords. We’ll cover each of those a bit later in this post.

Lastly, negative targeting allows you to prevent your ads from appearing alongside unwanted keywords, products, or brands. This optimization technique enhances your campaign’s efficiency and cost-effectiveness and can be applied in both automatic and manual advertising campaigns. For example, if your brand sells deck furniture you would not want your products to appear when shoppers search for “deck of cards”. You can use the negative keyword functionality to ensure that your products do not appear for any searches including the keyword “cards”.

You can create Sponsored Products Ad Campaigns via Amazon’s Ad Console dashboard. Let’s break down the steps…

Navigate to the Campaign Manager in Amazon Seller Central:

Hit the “Create Campaign” Button:

Select Your Product(s):

Continue with Campaign Setup:

Set Your Campaign Name, Budget, and Duration:

Review and Launch:

Below is an example of what a well-built Sponsored Products campaign structure should look like:

Once you’ve launched your campaign, now’s the perfect time to consider how you need to optimize your Sponsored Products campaigns in the future. Take a look at these steps to learn more about optimizing your Sponsored Products.

Running Automatic Campaigns and harvesting data is a critical first step in your Sponsored Products’ advertising strategy. Automatic campaigns select the keywords to target based on the ASIN(s) that the advertiser has selected. It’s important to keep in mind that the top performing keywords may not be intuitive, and automatic campaigns are a great way to quickly obtain data to understand keywords that work best for your promoted products.

You can create automatic campaigns in Seller Central under Advertising > Campaign Manager> Create Campaigns.

With Automatic campaigns, Amazon will target your ads to all relevant customer searches based on your product information.

Since Amazon customers tend to have a higher intent to purchase, selecting the best keyword for your products is a vital component of your marketing strategy.

Bidding on the right keywords for your products can improve your page sales rank and organic listings, and will ultimately influence your product sales.

You should analyze their customer search term data to make strategic decisions on which products and keywords to bid higher or lower on.

This is why we recommend that advertisers utilize the Search Terms Report for Sponsored Products located within the Ad Console as their main source of keyword harvesting.

To start, we recommend building your campaign structure with only 1 SKU per ad group.

As an agency managing a wide variety of clients using Amazon Sponsored Products, we’ve found that segmenting SKUs by Ad Group greatly increases the precision and granularity of bid adjustments and keyword harvests.

For example: If you have a catalog of 1,000 SKUs, you should have 1,000 campaigns or ad groups.

We’ve developed several unique campaign structures to better manage large (300+ products), medium (30-300 products) and small catalogs (1-30 products).

In the past, Sponsored Products campaign creation was a manual and tedious process where campaigns had to be created one at a time and products added individually. This was fine for sellers with smaller catalogs, but difficult for sellers with larger ones.

Now, you have access to “Bulk Operations for Sponsored Products” which allows you to manage your campaigns through excel documents.

By segmenting the campaign, this solution directly impacts the bidding strategy and the overall success of the campaign. In simple terms, more granular campaigns means more control over your products & their advertising strategy.

The Search Term Report includes a variety of metrics (per SKU if you segmented your report as mentioned above) but the most telling data will be found in:

Once you’ve identified your top keywords, it’s time to build out your Manual Campaigns by adding the SKU(s) to bid on each keyword.

Even if your keyword fails, you can always trace it back to the data. Keep in mind there is always a possibility of shifts in the market, including seasonality or unexpected trends—that’s why keyword harvesting is a continuous process.

When creating a keyword in Campaign Manager or using bulk uploads, you must specify a match type.

Keyword match types give you the opportunity to fine-tune which search terms your ads appear on. You can choose from three types of keywords: broad match, phrase match, and exact match.

IMPORTANT: You can’t change the match type of an existing keyword, but you can add multiple match types for one keyword. You can also select match types for Negative Keywords.

Once you’ve selected the keywords you believe are most lucrative, it’s time to implement. There are three keys to successful bid management, and you’ll need to use all three continuously as long as your campaigns are running:

You can measure the success of your bidding strategy by looking at the Advertising Cost of Sale (ACoS). Here’s how you calculate ACoS:

ACoS = 100 ( [total ad spend] ÷ [ad sales] )

For example: If you spend $50 on advertising and it resulted in a single sale of $100, your ACoS would be 100 (50/100) = 50%.

A low ACoS is profitable and efficient, but what you determine as low will vary by product. Another metric you should reference in your search terms report is the average CPC for each keyword term. This number, combined with ACoS, can help you reduce ad spend and focus more time and dollars on lucrative keywords.

For example, if the average CPC for the keyword term “black eyeliner” is 75 cents with an ACoS of 40%, you might want to lower your bid to get a little closer to that ACoS sweet spot of 20% to 25%.

As important as it is to identify popular keywords for your products, it is equally as important to locate which keywords are having a negative impact and draining your campaign ad spend.

Negative keywords allow sellers to refine and sculpt their target audience to improve the performance of their Sponsored Products campaigns.

One of the reasons we’re really excited about the Negative Keyword functionality is because it gives Sellers an opportunity to get more efficient. When you optimize your campaigns with negative keywords, you’ll see a greater impact for each and every advertising dollar.

Keep in mind, you can also identify negative keywords through the Amazon Sponsored Products Search Terms Report.

There’s no doubt that Amazon Sponsored Products is one of the most lucrative advertising tools that Amazon offers. These advertising campaigns offer a range of benefits that can significantly impact your bottom line including precise targeting, increased visibility, customization, and so much more.

Interested in learning more about Amazon’s advertising opportunities? Drop us a line, we’d love to hear from you.

Download our Digital Ads Benchmark Report for a deep-dive on data across Google, Meta, Amazon, and more.

The products you advertise with Sponsored Products must be eligible for the Buy Box and you must be able to ship to all US addresses.

Sponsored Products ads can appear in the following Amazon categories:

Amazon Sponsored Brand Ads are a form of pay-per-click advertising that allows sellers and vendors to promote their brand and multiple products in a single ad. These ads prominently feature the brand logo, a customizable headline, and a selection of products. Sponsored Brand Ads are distinct from Sponsored Product Ads, which focus on individual product promotions. Sponsored Brand Ads are ideal for building brand awareness, showcasing a broader product range, and driving shoppers to your Amazon Store to highlight your brand and offerings. In contrast, Sponsored Product Ads direct customers to a specific product’s detail page.

Amazon Sponsored Display Ads are a type of advertising within Amazon’s platform that enables sellers and vendors to reach a broader audience. These ads appear both on and off Amazon, targeting shoppers who have shown interest in related products or categories. Sponsored Display ads are a great way to extend your campaign reach outside of Amazon. They’re designed to re-engage past visitors, cross-sell or upsell products, and increase brand exposure.