It’s been nine months since Snapchat rolled out their Ads API and went public.

So how are things going? It’s probably not a good time to ask.

Snap’s fighting flack from former employees who have accused them of “inflating user numbers” ahead of their IPO, and there’s been a steep dive in Snapchat app downloads.

Now, presumably due to low advertiser involvement and competition from Facebook, Snapchat is offering Pixel tracking and retargeting options–a practice CEO Evan Spiegel once condemned as “creepy.”

However, Spiegel doesn’t regret taking the company public. And according to some sources, Snap has a head start on augmented reality, which is becoming a hot topic for advertisers.

So is it worth investing in this ad platform, or will Snapchat go the way of its iconic ghost? Here’s what we think.

Snapchat’s New Ads Strategy

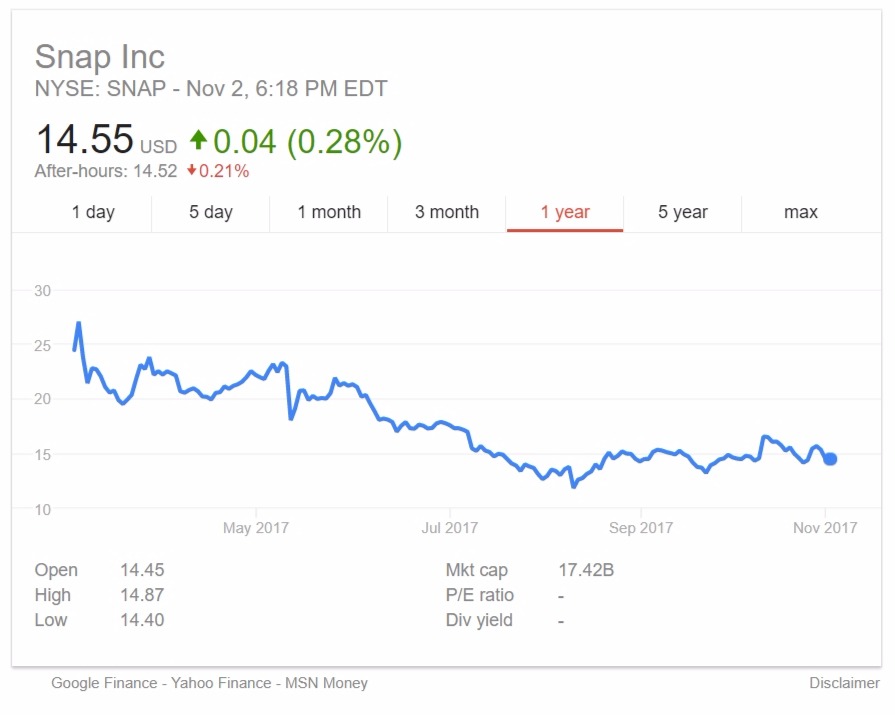

The writing seems written on the Wall (Street)–Snap’s current market value is at about half of its all time high, points out Tien Nguyen, Director of Technology at CPC Strategy.

Several months ago, our COO and Co-Founder, Nii Ahene, spoke about the biggest drawback of Snap’s shiny new advertising API–weak audience retargeting.

“If we look back at what’s been effective for Facebook, big-brand demographic media buys aren’t effective,” says Ahene. “It’s being able to use your 1st party data to see who matches against that data on that platform. I see the potential for Snapchat to be a place to re-engage consumers who have interacted with your brand in the past.”

Right now, Facebook has the edge on sophisticated ad targeting, and Instagram is cornering the market on Snap’s user base.

Will Snapchat’s pixel retargeting capabilities be enough to compete?

Snapchat’s Challenges

It’s not fair that Facebook essentially copied Snapchat’s features within Instagram and Facebook, the main value props being “stories”.

But it was smart.

While users have been sloth-level slow to adopt the stories feature in Facebook, Instagram stories took off. (Somewhat related: In September, to give Facebook stories a much-needed boost, Zuckerberg decided to allow Instagram users to double post Instagram stories to Facebook. The Verge’s headline pretty much summed it up: “No one is using Facebook stories, so Facebook is borrowing Instagram’s”.)

Snapchat may be working on new advertising features and augmented reality, but that’s not the real problem. The real problem is a shrinking user base.

Decreased Daily Users and App Downloads

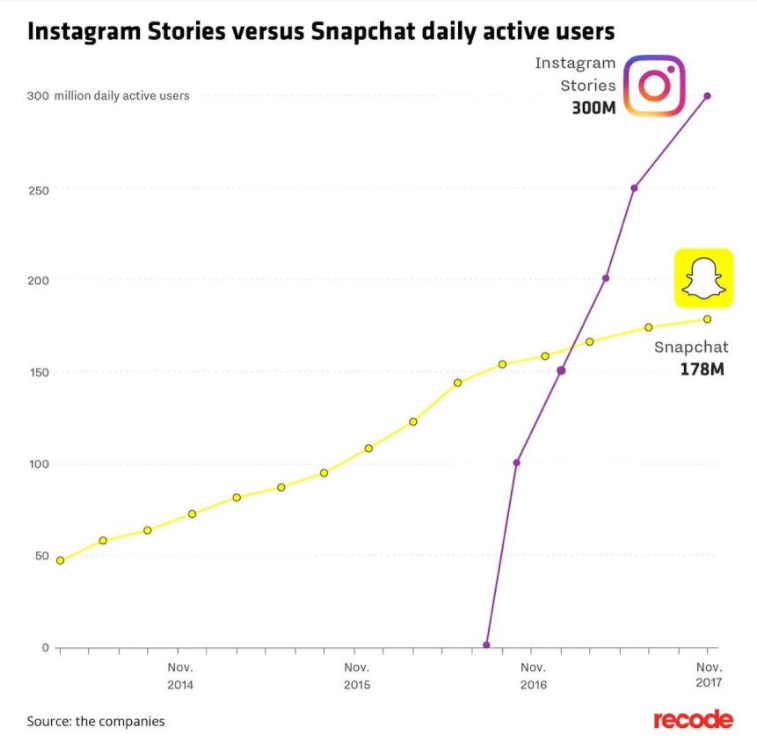

On November 1, 2017, Facebook CEO Mark Zuckerberg announced that Instagram Stories and WhatsApp Status​​ both now have 300 million daily active users (DAU), according to TechCrunch.

Instagram has grown by 50 million users in just five months (from 250 million DAU in June this year).

Snapchat’s app only sees 173 million DAU.

The decreased user base is a problem not just for Snapchat, but also for advertisers.

Ahene expands:

The things that make a media channel valuable are one, reach, and two, influence. Snapchat’s reach has been dulled by Facebook, which took their features and incorporated those into their own platforms. Snapchat’s influence is limited because their market is primarily focused on [Gen Z], a demographic with limited buying power and a limited propensity to take action after seeing an ad.

Another problem? While they’re ahead in augmented reality, Snapchat’s light years behind Facebook in terms of ad targeting.

Weak Ad Targeting

Snapchat’s current ad platform isn’t just limited by user base, it’s also limited in targeting capabilities. Facebook allows advertisers to build audiences based on everything from gender to affinities–and Snapchat’s far behind.

“Facebook only started to drive true value for advertisers when they introduced strong performance-based marketing opportunities beyond geographic targeting,” says Ahene. “For Snapchat to be a true player in the ad space–even for a sub-millennial market–they’ll need to mirror Facebook’s capability to target and set up Lookalike Audiences.”

That–and as Ahene points out, it’s a mobile-only platform, which means advertisers won’t get a full picture of aggregated data across different types of devices.

In an age where advertisers are finally connecting the dots and getting stronger attribution modeling in place, that’s not great.

Snapchat’s Edge

While it’s true that Gen X doesn’t quite have the buying power of their older siblings, Millennials, they still frequent Snapchat more than any other social platform.

Over half of respondents were on Snapchat at least 11 times a day, and when asked about which brands they believe “effectively employ Snapchat,” they pointed to Buzzfeed, Cosmo, and the Kardashians (yes, they’re a brand).

Considering another study showed 80% of Gen Z purchases are influenced by social media, retailers do have a unique opportunity to influence a large segment of future shoppers via the platform.

Novel Ad Formats

While Facebook offers native-looking ads that are powerful and highly relevant to users, they aren’t really “fun” to engage with.

Canvas and 360 degree ads were a thing, but when’s the last time you actually played with one?

Snapchat takes it a step further and makes ads skippable and fun to engage with, integrating them into popular features such as geofilters.

Here are some other advantages:

- 60% of Snap Ads are watched with audio on (compared to 15% of Facebook ads)

- Ads carefully placed to reduce negative interactions for users

- Actionable full-screen Snap ad videos (enable online conversions)

- Augmented reality experiences (3D lenses)

As we’ve stated before, the Snapchat team is focused on reducing ad friction, which is why you won’t find pre-roll, or fixed ads. It’s one of the few ad platforms that strives to put users first. (That is, until they started tracking them via Pixels.)

Augmented Reality & Geo Targeting

Augmented reality is probably Snapchat’s biggest advantage over competitors.

Snapchat just built a new augmented reality art platform featuring respected artists such as Jeff Koons, and the new Sponsored World Lens ads are also pretty impressive.

This geo-lens capability could be a huge draw for more than just retailers. AJ Swamy, Client Services Manager at CPC Strategy, explains:

Digital marketing is skewed towards physical products right now, but there’s a lot of opportunity for digital marketing to span across multiple industries. There’s a huge need for this type of geo-targeted advertising in the restaurant, hospitality, and tourism industries. I see a lot of opportunity there.

Unfortunately, that might not be enough for advertisers (or investors) who want to see a more consistent return right now. Swamy acknowledges this:

“If Snapchat doesn’t get advertisers to buy into [augmented reality] within five years, they’ll probably be finished.”

The Bottom Line

Augmented reality and new pixels aside, Snapchat’s ad success is based on whether or not they can grow their audience and influence them to buy.

And as the numbers above show, that’s not happening.

“There’s a fair chance that the introduction of pixels will only confirm the lack of effectiveness of Snapchat as an ad medium,” says Ahene.

To be clear, we’re not anti-Snapchat–we’re just finding it hard to believe with their current focus that this underdog will find a way to make a comeback. And a dancing hotdog just doesn’t cut it.

You Might Be Interested In