PPC Scope's Brian Johnson Shares Expert Advice on Amazon Sponsored Products

Whether you’re just starting out in the world of Amazon PPC or you’ve been in it since the early days–there’s always more to learn.

That’s why we connected with Brian Johnson, Amazon Ads coach and founder of PPC Scope, a PPC measurement and optimization tool for Amazon sellers.

Johnson originally started his ecommerce career on eBay, but quickly switched over to Amazon and became passionate about the ad side of Amazon.

Read on to glean some of Johnson’s expert knowledge on the metrics, myths, and future of Amazon Sponsored Ads.

A. Originally, the PPC Scope software was primarily focused on Amazon’s ACoS [or Advertising Cost of Sales] metric–but then just through practice, you learn which metrics actually make a difference that you can control.

A. Originally, the PPC Scope software was primarily focused on Amazon’s ACoS [or Advertising Cost of Sales] metric–but then just through practice, you learn which metrics actually make a difference that you can control.

ACoS…mainly tells you how well you’re giving Amazon money in exchange for selling your product in general.

The two I really focus on now are the CTR and Conversion rate on the front and back end of the sales funnel.

It may seem counterintuitive because Amazon continues to push ad spend, AcoS, and some of these other metrics, but I look at it from a sales funnel standpoint.

[PPC Scope] focuses on profit margins so users can see the profit off their advertising, not just ad spend to sales ratio.

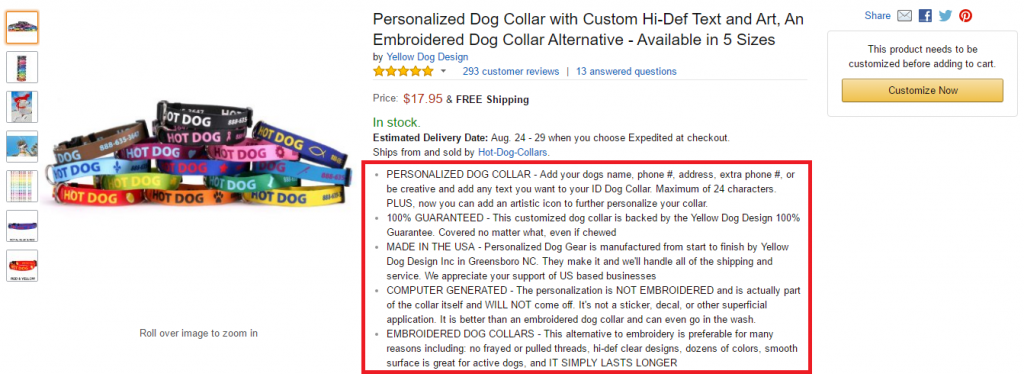

A. With CTR, our first challenge is to get the shopper in the door to our product listing. The CTR signals how well we’re attracting potential buyers via our ad.

A low CTR–below 0.2%–signals a mismatch or disconnect with the shopper. That’s a problem because Amazon notices when your ads are missing the target, and they’re going to be less compelled to show your ad if it’s continually a mismatch.

[CTR is negatively affected] when shoppers dismiss our product based on what they see in the ad–a shortened title, a very small image, or perhaps they’re comparing the price to other listings on page one.

Any one of those [factors] can prevent or create doubt in a shopper and prevent them from visiting the listing.

The first thing a seller should do is look at the search terms they think should be targeting, but then see where their ads aren’t lining up with what the shopper is looking for.

Most of the time, it’s because the search term is too broad or general for that specific product.

[A shopper] may search for a term, but they may be thinking about something totally different than what you’re selling.

Conversion rate refers more to the backend. So your customer is [on your listing] and you want them to see your product is the one they’re looking for–that your product solves their problem or fulfills their desire.

If a shopper [is confused or in doubt] they probably won’t buy your product.

Any element of your content–whether it’s an image, price, review, description–that introduces doubt or confusion–leads a shopper to consider other alternatives.

So similar to what we would do with figuring out why shoppers aren’t clicking on our ad in the first place, a high CTR and low conversion rate could mean we convinced them at one point, then lost them in our listing.

For those search terms with a high CTR and low conversion rate, you’ll want to walk through your listings and find out where you’re losing them.

It could be the “similar products” on your page are superior in some way, but it’s usually because [the shopper] is looking around because they’re not seeing what they’re expecting on the listing.

A. Now in the sense of search terms, there are seasonal terms that will change throughout the year–for instance, searches for “garden hoses” will be huge during spring and the early summer, and not as much during the winter–but also shoppers are distracted seasonally.

Seasonality could refer to times when shoppers are distracted by family plans during the holidays or weather-related seasonality fluctuations, and that affects CTR and Conversion metrics.

[For instance,] [w]e recently had a typhoon on the West Coast and a hurricane on the East Coast at the same time–and a lot of sellers were wondering why their sales were dropping from ads.

The CTR rate was high, but shoppers weren’t committing to a sale. They were more willing to window shop.

You’ll see this in January after the holidays, too. People in January are willing to window shop more than anything, but they may be dealing with distractions at home because [it may have been too icy to take the kids to school].

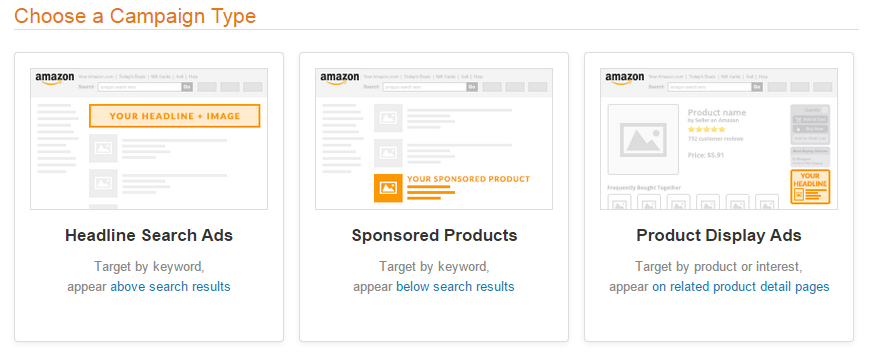

AMS has gone through a number of changes, but it’s still clunky in reporting.

For those [sellers] who have been ungated and qualified to use AMS, there are additional advantages as far as advertising–for instance, banner advertising for multiple products, the ability to target individual competitor listings to show your ad, or showing your ad in specific target subcategories.

Personally, I don’t typically use the AMS version of Sponsored Ads because the reporting is poor.

I prefer the traditional Sponsored Products platform for that. AMS keeps adding in new features–keywords, bid adjustments–but reporting–well, I really hope they’re working on that.

A. First of all, sellers rely too much on advertising to solve a sales problem.

They think they can turn on Amazon advertising and it’s going to propel their product to page one–well it’s a nice lofty goal, the reality is it comes back to if they have a product nobody wants and zero social proof, the chances of the product selling is low.

Advertising can show you who’s attracted to a product or looking for a product based on search terms, but it can’t fix a bad product.

A lot of sellers want to take shortcuts and copy their competitors. They do their keyword research with a tool like Jungle Scout to figure out [the keywords that are converting], but you can’t predicate your whole business on one keyword because you were too lazy to understand what the audience is.

The second mistake is not narrowing down your audience. Most of the private label sellers I see on Amazon didn’t come in with a passion. They’re not a manufacturer of a product they’ve been working on 10 years and have been selling on other channels.

Most of them have been trained to just look for the next business opportunity–which isn’t a terrible thing, and it works sometimes–but there’s too much competition on Amazon to get away with that now.

Traditional marketing will tell those sellers to create buyer personas, but they’re going to get frustrated because it’s going to take six months to get it right (or hire someone to get it right), and that seller is focused on what’s going to happen next week.

The third problem I see a lot is a poor campaign structure based on outdated information. [Sellers] make the mistake of putting everything in one campaign.

Typically I’ll target my campaigns by targeted audience, but then subset ad groups by product variation and SKU, which makes my reporting more definitive and my ability to optimize my campaign and ad group that much easier.

If you bundle it all together, you don’t have that visibility or control you need to do anything with it.

A. All of Amazon’s changes have been either proactive or reactive. From a proactive standpoint, they recently updated the campaign manager user interface and there’s a new data API.

They also add or remove available data fields or reports. Generally, they have good intentions, but their departments are very siloed and don’t communicate well. You’ll see instances where one department will take something away that the other department actually needed.

Amazon changes almost on a monthly basis–continuing to tweak the advertising algorithm.

It used to be that we could just throw in individual words to content, title, backend, and Amazon would show our ad because of a loose match.

But this year, they tested a Sponsored Products algorithm shift and put more emphasis on phrase matching, more so than broad or exact–meaning the keyword phrase had to be in your listing content.

Amazon was looking for a specific phrase more than just a loose connection of words.

Now, Amazon’s ad algorithm is focused on relevance between what the buyer is searching for, what keywords we’re advertising as sellers, the category of our product, and what’s in our product listing content.

If you don’t get all of those lined up, Amazon is less likely to show your ad.