Advertisers See Major Sales Spike Amid Consumer Spending Surge

Great news for advertisers: accounts across many verticals saw a major lift in conversions and sales last week, with some brands reporting record activity levels that rival even Black Friday and Cyber Monday.

While there are multiple variables at play (such as stimulus checks and payday), one thing is clear: consumers are engaging in retail therapy for the first time since lockdowns began — and the brands that continue to engage consumers are receiving big lifts as a result.

Here’s a look at the data and expert insights on the advertiser spikes in revenue and conversions across Amazon, Google, Social, and more.

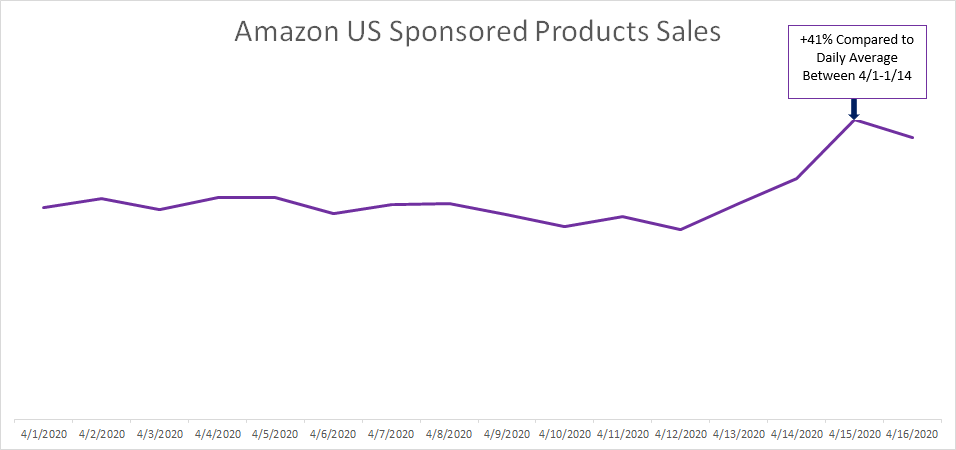

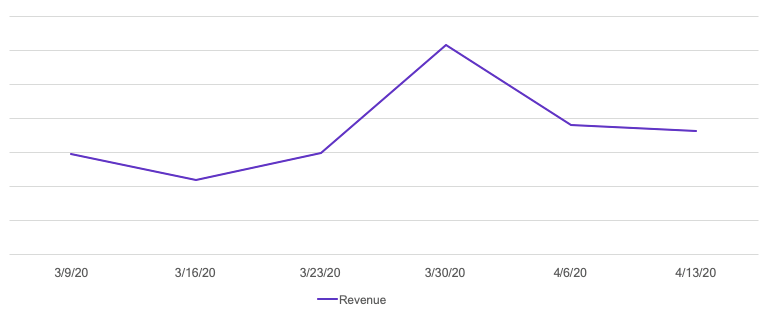

1. Sponsored Products Sales Spike for Amazon Advertisers

“Across a collection of more than 150 long-standing Amazon advertisers that remained active throughout April, sales attributed to Sponsored Products on April 15 spiked 41% compared to the daily average of the first two weeks of the month, with more than half of the clients studied seeing a jump of at least 20%,” says Andy Taylor, Director of Research at Tinuiti.

“Sales remained elevated on April 16, coming in at 33% higher than the daily average of the first two weeks of April. This surge in performance seems directly tied to the timing of stimulus payments reaching American consumers in mid-April.”

“Many Amazon sellers and vendors have lived in a state of flux for the last several weeks, and while marketers search for signs of what the ‘new normal’ is, the fact is that conditions are changing too rapidly to assign such a moniker to snapshots of performance at any one time.”

“This is a prime example of how quickly the Amazon advertising opportunity can shift, and marketers should understand that lulls in performance or updates to systems like FBA can often change abruptly.”

“As always, brands should be ready to adjust strategy rapidly, and should make every effort to be available to customers as they too find their way in this ever-evolving ecosystem,” explains Taylor.

There can be many factors at play that contribute to spikes in Amazon performance beginning last week, but what’s more interesting is that the lift for many accounts appears to be somewhatsustained; lasting longer than a week even.

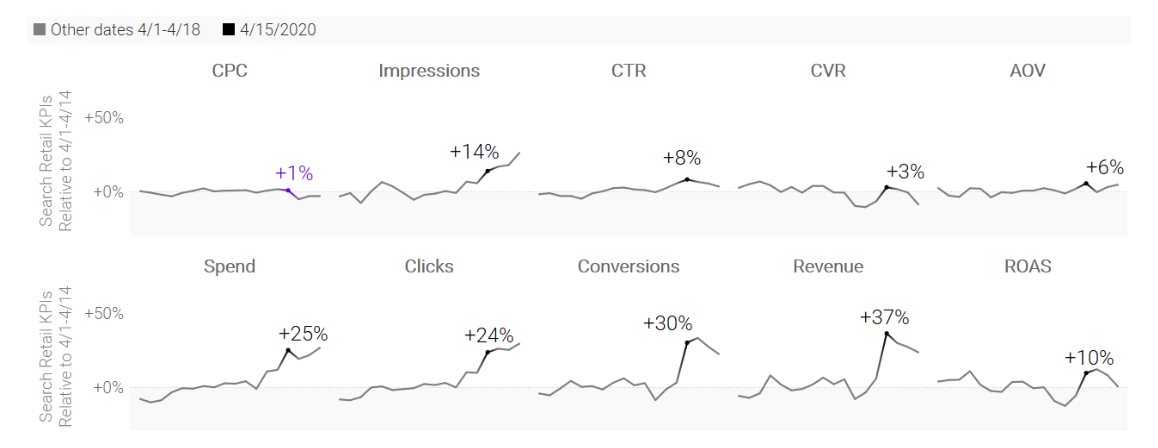

“The increase in spend and impression started on April 14th and continued for 6 days straight. If it was stimulus check-related, then it shouldn’t have been as sustained. People aren’t receiving a check every week.”

— Jeff Coleman, VP of Marketplace Channels at Tinuiti

“Part of the sales bump can be attributed to Amazon reallowing products back into their Fulfillment Centers. getting those products back into inventory should be a top priority for Amazon sellers right now.”

“If you missed out on this bump, then you should know that you can expect more in the future. Sellers that don’t go dark on Amazon advertising will be best positioned to take advantage of future upswings in consumer activity.”

— Pat Petriello, Director of Amazon Strategy at Tinuiti

“You should be checking your reports in Seller and Vendor Central on a daily basis to monitor performance and pivot accordingly,” explains Petriello.

“We are in an unprecedented period of consumer behavior. We are seeing the accelerated adoption of online spending. There is a unique opportunity to gather new audiences for the long-term.”

The spike was not exclusive to Amazon either, with many advertisers seeing sales increases on their ecommerce sites.

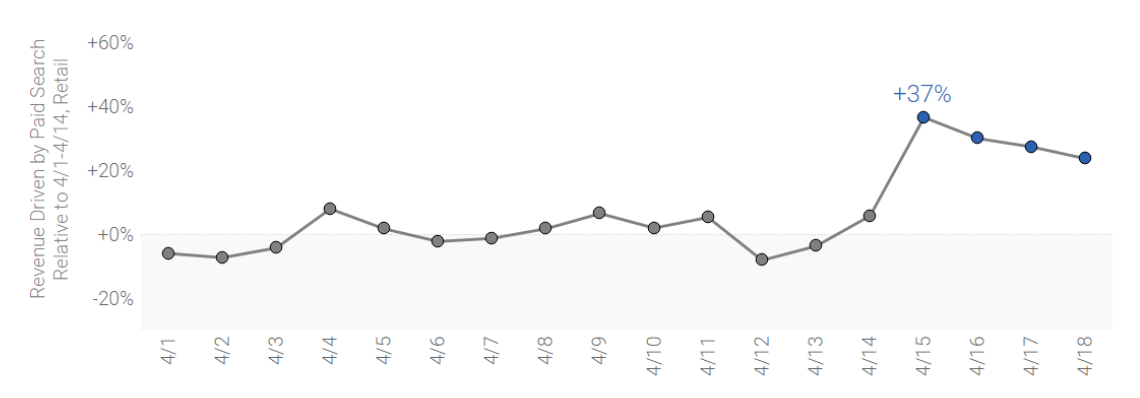

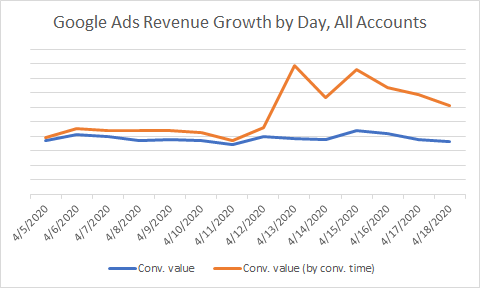

“Across 63 retail advertisers that remained active through April, revenue driven by Paid Search spiked by an average of +37% on 4/15 relative to the daily average of the first two weeks of the month.”

— Andrew Richardson, VP of Analytics and Marketing Science at Tinuiti

“Revenue levels gradually decreased the next few days but still remained at elevated levels (at +24% on 4/18),” explains Richardson.

“The revenue spike on 4/15 was driven mostly by higher impression volume, but higher engagement and basket sizes drove the increase as well. Cost per click was stable despite the volatility in other metrics.”

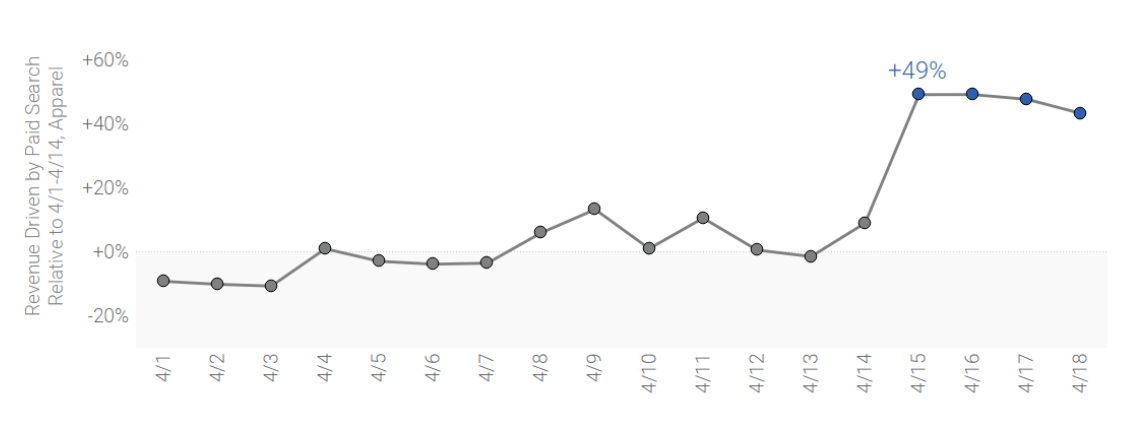

“Advertisers in the Apparel and Accessories vertical saw an especially sharp increase, with revenue driven by Paid Search spiking by +49% on 4/15 relative to the daily average of the first two weeks of the month. Revenue levels remained elevated the next few days (still at +43% on 4/18).”

Many Google Shopping advertisers also saw positive shifts in revenue beginning last week, with some accounts receiving increases similar to Q4 shopping periods.

“We’re seeing very positive gains with Shopping clients, particularly those that invest heavily in the channel. April month-to-date, Shopping client revenue from Google Ads is +25% YoY.”

“In March, we were at +13% to last year. This is in the range of growth percentages we saw during Q4. We’ve been seeing very solid YoY growth since the end of March,” explains Wojciechowski.

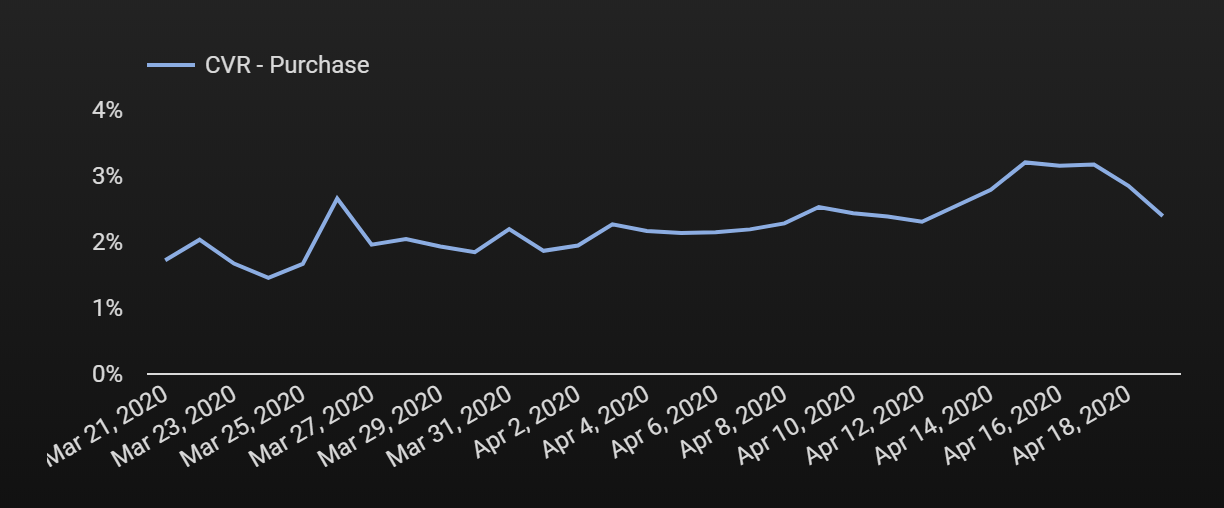

Conversions also began lifting on April 14th across many paid social accounts.

“Conversions and outbound clicks for Tinuiti paid social clients have slowly been trending up since the initial dip we saw at the beginning of the pandemic.”

— Katy Lucey, Director of Paid Social at Tinuiti

“We did see a spike last week around April 14th and 15th, but they are trending back down, but in line with what we’ve been seeing on average.”

Small-to-midsize business advertisers also posted significant gains across Google Ads (Search and Shopping).

Note on the Two Conversion Value Metrics Provided:

“It’s important to use conversion value (by time) because it tracks the date of actual purchase and so shows the spike correlate to last week’s stimulus checks hitting. The conversion time lens shows that people were researching products before clicking and purchasing at a later date.”

— Nick Manessis, Senior Manager of Growth Media at Tinuiti

Last Week (4/12 – 4/18) vs Previous Week (4/5 – 4/11), Google Ads Data:

Client A:

Industry – Apparel (Shoes Specifically)

Shopping – 156% Increase Conversion Value (by conv time), 120% Increase Conversion Value

Search – 64% Increase Conversion Value (by conv time), 1.81% Increase Conversion Value

Client B:

Industry – Baby (Carriers Specifically)

Shopping – 63% Increase Conversion Value (by conv time), 16% Increase Conversion Value

Search -109% Increase Conversion Value (by conv time), 67% Increase Conversion Value

Client C:

Industry – Electronics Peripherals

“A few clients (mainly retail vertical) did see a spike in sales last week. One client, in particular, saw a 79% increase in ROAS, a 120% increase in revenue, and a 60% decrease in CPA.”

— Jess Reikowsky, Senior Manager at Tinuiti

The spikes in brand performance last week paint a positive picture for the future: remaining active and present can have a major impact on consumer decisions.

In fact, research shows that consumers don’t want radio silence during the current crisis. They want the opposite: they want brands to help them retain a sense of control in their daily lives.

“Do people want to listen to brands right now? Do they want advertising to come through? The answer is a resounding yes. Research from Kantar shows that 78% of consumers believe brands should help them in their daily lives and 75% of them want to be informed on what the brand is doing during the pandemic.”

— Tom Olivieri, VP of Creative at Tinuiti

“People are losing their sense of normalcy. In a time of isolation, they want communication, not darkness,” explains Olivieri.

While many advertisers did enjoy this temporary bump, there will be more opportunities down the road for brands that dial in and pivot their marketing to engage their audiences in times of need.

With the possibility of more stimulus checks on the way and traditional holidays like Mother’s Day looming, it’s very possible that this sales spike is not an isolated incident.

For more information on marketing strategy during COVID-19, check out Marketing During Coronavirus: Your Top Questions Answered.