Scaling Your Amazon Business for Acquisition: Q&A with Thrasio

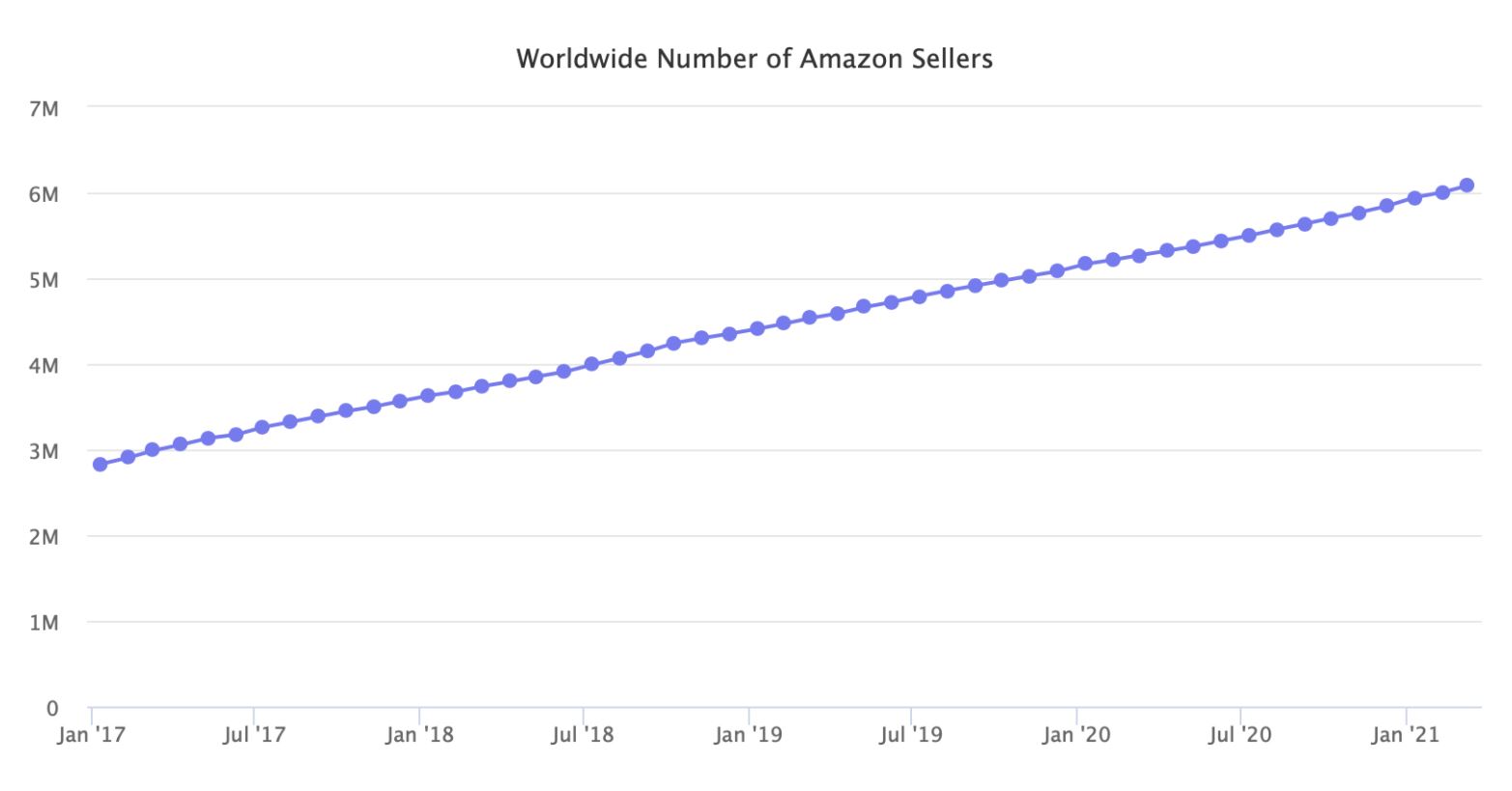

The world population currently sits at ~7.9 billion people. Of those ~7.9 billion people, a staggering six million are third-party sellers on Amazon.

In the 25+ years since its launch, Amazon.com has grown to become the virtual mall of the world. Once a site dedicated to purchasing books online, Amazon was soon a trusted go-to shop for electronics, clothing, video games, home goods, sports equipment, pet supplies, and…well, as you know, the list goes on!

So how did one company manage to grow this much, in this many directions, this fast? A big part of that ‘how’ goes back to those six million sellers, and the billions of items they bring to the Amazon marketplace.

But what happens when a seller wants to take a step back from the everyday efforts that go into running a successful Amazon store, but they don’t want to simply close up shop on all their hard work? For many, the answer is selling their Amazon business to a company like Thrasio.

Thrasio is the largest acquirer of Amazon companies, and among the top 25 FBA operators. They estimate that a product from their portfolio has been delivered to 1 in nearly 10 US households.

We recently sat down for a virtual chat with Jenna Craig and other members of the Thrasio team to learn more about what their Amazon store acquisition strategy looks like, and important things to consider if you’re currently planning to sell your Amazon business, or might be in the future.

— Jenna Craig, Content Marketing Manager, Thrasio

— Jenna Craig, Content Marketing Manager, Thrasio

Thrasio: There are three primary factors we consider when evaluating an Amazon business for acquisition—R3: Reviews, Ratings, and Rank.

Reviews: We are most interested in products or brands that have hero ASINs with a minimum of 500 predominantly positive, organically acquired reviews—not incentivized reviews, or purchased reviews. These honest, authentic reviews serve as social proof that the product is a leader in its category.

Ratings: We look for ratings above 4 stars as they speak to the overall quality of the product, as well as the brand’s ability to sustain their position over time.

Rank: We also consider the product’s current ranking for the most popularly searched, high volume keywords. When a seller has been able to secure a high ranking within a competitive category, we often find it’s a strong indicator that they’re doing other things well. This can include strategically investing in marketing, and optimizing their listings for success.

However, high-ranking products aren’t our only interest. We also regularly evaluate niche products whose performance we believe we can enhance after our playbook is applied.

What we’re not as excited about are large seller accounts with a vast portfolio of moderately successful ASINs. Unlike some Amazon store buyers, we are very interested in wildly successful ASINs that drive $3M in revenue. We’re able to acquire these brands because we can spread the risk (e.g. black hat competitors, suspensions, etc.) across our wider portfolio of 130+ brands.

For all elements of the R3—reviews, ratings, and rank—we are only interested in growth that has been fueled organically, and doesn’t violate any of Amazon’s Terms of Service.

Thrasio: Current market rates across the industry for FBA business acquisitions are 2 – 4x the Trailing Twelve-month Earnings/Profit for that business. This will often be written as TTM EBITDA (trailing twelve-month earnings, earnings before interest, taxes, depreciation, or amortization) or TTM SDE (trailing twelve-month earnings, seller discretionary earnings).

Any operating expenses your business incurs that aren’t directly tied to its success are typically considered “add-backs.” We add those back to your profit, resulting in a higher up-front payment for the seller.

Common add-backs include the store owner’s salary, and/or office rent, but some expenses vary on a seller-by-seller basis. For example, we once worked with a pet product owner who was running her dog’s food through her business. Because we would no longer be running that expense through the business once we acquired it, we don’t ‘count’ that as an operating expense.

We see a large volume of the available transactions in this industry in the US today, and these are the rates at which most buyers and sellers are transacting. There are certain factors that play into getting a valuation closer to the 4x than the 2x, including:

If you would like to calculate a rough estimate of what your FBA business might be worth to a buyer, you can multiply your SDE (your trailing twelve-months net profit + your owner expenses) by 3 or 4.

An example of how this would work is:

TTM Net Profit = $1,000,000

Operating Expenses = $200,000

TTM EBITDA/ SDE = $800,000

Multiply by 2.5x

Expect an upfront payment of $2,000,000 for your business + Performance Payments + Inventory at Landed Costs

Thrasio: We don’t think the COVID bump in Amazon/ecommerce shoppers is going to revert back to pre-pandemic market share ratios.

We’ve raised over 1.8B+ in capital, and analyzed thousands of businesses. Many people sell because they’ve started a secondary brand, and are capital constrained. Amazon is also getting more and more competitive, and sellers can experience burnout.

Many sellers we work with have scaled their Amazon business, and are at a decision point: do they seek capital to take it to the next level, or put it in the hands of someone who already has an expert team plus the money to build out product lines, expand internationally, etc.?

We’re seeing a large number of sellers with strong performance—high valuation at TTM (trailing twelve-month earnings); businesses are comping at their COVID bump—think workout gear, crafts, and other highly sought after products people were desperate for during lockdown. More capital groups are looking at these businesses. It’s a richer market with more players, and more experienced players on both sides of the table.

Thrasio: A lot of sellers find success doing retail arbitrage, but we don’t buy those businesses; we also don’t buy resellers. Our sweet spot is in everyday hard goods selling on a private label—everything from kitchen utensils to pet supplies.

We stay away from trendy items like apparel, tech products that will be obsolete within a few years, and food/grocery. We go for items that are likely to be found in every household, office, or car.

Thrasio: I think trying to find the “right time” to sell your business is like asking when it’s the right time to start a family, or get married, or any big life decision—there is no one “right time.”

There are a lot of sellers who try to sell “too early” in the sense that they don’t have a good financial grasp on their business, which makes it harder for a buyer to create a valuation. But we can work with people in that position to help them understand where their business stands financially. We often end up building a Profit & Loss statement for sellers, which really is an easy thing for us to do.

Many businesses that don’t have a long enough timeline of sales—or too small of sales—can also be difficult to value. You’ll generally want at least 12 months of solid sales data before looking to sell.

Some sellers wait too long to reach out to an acquirer or investor. They might be running on a thin line of inventory and frequent stockouts stunt their sales velocity. They might be someone who has some serious issues running the business from an administrative capacity, but put off hiring.

On the other hand, we see sellers who spend too much on outsourcing, aren’t getting a decent ROI, and are unprofitable. Whether you need an influx of capital, product improvements, or more warm bodies to help scale your brand, don’t be the seller who waits to hit your optimal peak before selling, and tanks their business when it becomes more than they can manage.

My best advice would be to connect with a potential buyer when you feel like you have grown your business to the best of your ability, but getting to the “next level” is either something you can’t do (due to resources), or are not interested in pursuing. The latter includes sellers who want to start a new business, spend more time with family, or are simply tired of running an ecommerce business.

Not only do we acquire businesses like this, but we also share in the upside of growth with sellers. We do the work in taking your business to the next level, and you still get to participate financially in the upside.

Thrasio: Most businesses we acquire are 3-5 years old. In many of our larger acquisitions, those businesses have been closer to 10 years old.

Thrasio: The majority of sellers we deal with—and have closed transactions on—often just have one store; I’d estimate that ~80-85% fall into that category, with the remaining percentage being a seller with another store.

However, a lot of sellers we buy FBA businesses from intend to use the capital they’ve acquired from the transaction to launch a new store on Amazon, with the ultimate goal of building another successful Amazon FBA business.

Thrasio: What is appealing are brands that have covered most of their bases, but not yet ventured into new channels, which allows our teams to get creative and really explore new opportunities for growth with the brand.

If brands have yet to venture into SBV (sponsored brand videos), DSP (demand-side platform), or external traffic, it’s an appealing business because we are confident we can drive growth and added value for the seller post-sale in the terms of earn-outs.

If a business is fully optimized with every single advertising channel running it’s still a great business, but means we need to be more creative and tackle things like product expansion and market expansion sooner.

Thrasio: Most brands should be spending ~10% or more TACoS (total advertising cost of sale) on PPC (pay-per-click), SBV (sponsored brand videos), SB (sponsored brands) and SD (sponsored display) inside Amazon at a minimum. You can do more or less depending on what category you are in.

The next step is to start using DSP (demand-side platform) for retargeting, only to pick up extra sales at a high ROAS. Once you have done that, you should move to external channels and utilize Google first using Amazon attribution; this is the next most qualified traffic.

Beyond that, brands should start getting creative with influencers, Facebook, affiliates, and other forms of outside traffic. Once you are super scaled you can start thinking about big picture things like DRTV (direct response television). But at a bare minimum, brands should be using all the tools inside Amazon with special attention on Sponsored Brand Video and other forms of video advertising.

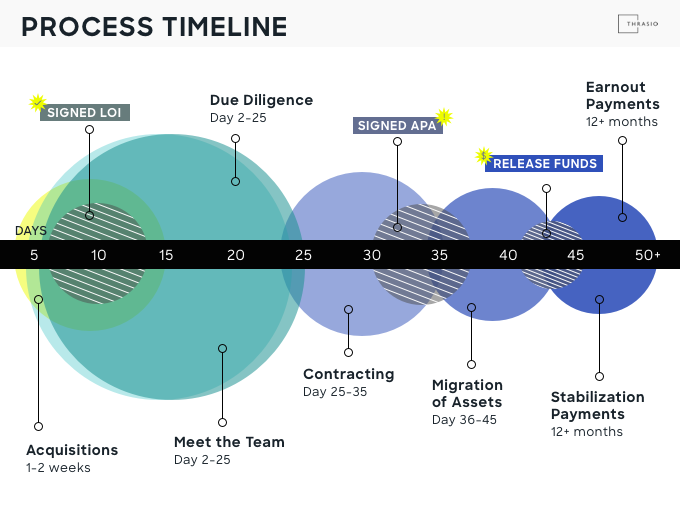

Thrasio: Full migration of all assets throughout the transaction typically takes approximately 30-40 days (as illustrated in the above graphic).

Letter of Intent (LOI)

Once we have had an opportunity to chat with the prospective Amazon store seller a few times, and it’s been determined we’re mutually a good fit, we move through negotiations and sign a letter of intent. This isn’t a step we take lightly; more than 95% of the time that we sign an LOI, we complete the transaction, so there’s a lot of diligence that goes into analyzing the business before this step.

That said, a letter of intent is not a legally binding document, outside of the exclusivity period as we diligently work under the NDA. It’s a common misconception that once the diligence period is complete, buyers will try to negotiate a lower price—Thrasio doesn’t do that.

Due Diligence

Once the letter of intent has been signed, our diligence team begins working through the Seller Central accounts—and other platforms—to validate the costs of goods sold. In this stage we’ll review the seller’s IP (intellectual property) and legal agreements, and recreate their P&L (profit and loss statement).

When it comes to what those financial records look like, we aren’t easily scared off. We have purchased companies in the past whose records included handwritten notes on paper. We understand that not all business owners are working with the latest software.

We’ll have you walk through what you do have, meeting you where you are.

In the due diligence stage, sellers meet with teams from different Thrasio departments so they can gain further insights on how to help your business reach its highest potential. These will include meetings with our internal marketing team, creative team, and brand management and supply chain teams.

Migration & Payments

US-based companies will then finalize any negotiations in the Asset Purchase Agreement, and we deposit payment for the acquired business in an escrow account, with asset migration taking around one to two weeks. Once migration is complete, we release the funds from escrow, and the seller receives their first payment.

Depending on how the deal is structured, sellers will receive additional stabilization and earnout payments. These are payments made based on certain conditions being met. Stabilization payments, which are typically issued 12 months after closing, are provided to sellers whose business continued to operate at the same net revenue performance level as it was when we purchased it. Earnout payments are provided to sellers whose brands we have grown. When the latter conditions are met, sellers truly get to enjoy the fruits of their labor and our labor, even after they no longer own the business.

Want to learn more? Watch our recent webinar with Thrasio: Scaling Your Amazon 3P Business to be Acquisition-Ready: The Top Signals Buyers Look For.